The global Zero Liquid Discharge Systems Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By System (Hybrid, Conventional), By Process (Pre-treatment, Filtration, Evaporation/Crystallization), By Technology (Reverse Osmosis, Ultrafiltration, Evaporation/Crystallization), By End-User (Energy & Power, Chemicals & Petrochemicals, Food & Beverage, Textile, Pharmaceuticals, Electronics & Semiconductors, Others).

Zero liquid discharge (ZLD) systems are advanced wastewater treatment technologies designed to eliminate liquid waste discharge and minimize environmental impact in industrial and municipal applications in 2024. These systems utilize a combination of physical, chemical, and biological processes to treat wastewater and recover valuable resources such as water, salts, and solids, achieving near-total elimination of liquid effluent. ZLD systems typically consist of multiple treatment stages, including pretreatment, membrane filtration, evaporation, crystallization, and dewatering, tailored to the specific characteristics and contaminants present in the wastewater stream. In industrial sectors such as power generation, chemical manufacturing, and mining, ZLD systems are used to treat process wastewater containing high concentrations of pollutants, heavy metals, and dissolved solids, ensuring compliance with environmental regulations and reducing freshwater consumption and wastewater disposal costs. In municipal wastewater treatment plants, ZLD systems are employed to treat sewage and industrial effluents, producing high-quality effluent for reuse in irrigation, industrial processes, or potable water supply. With increasing water scarcity, regulatory pressures, and sustainability goals, ZLD systems to gain traction as viable solutions for managing wastewater streams and minimizing environmental footprint, driving innovation and adoption of advanced water treatment technologies worldwide.

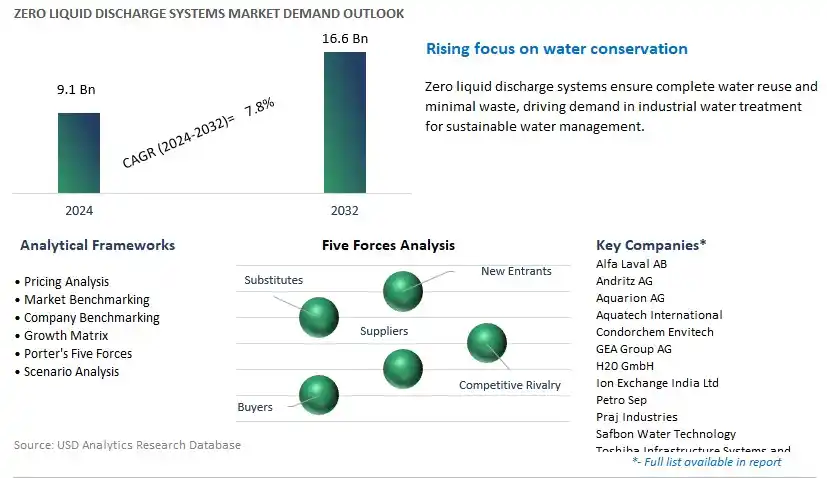

The market report analyses the leading companies in the industry including Alfa Laval AB, Andritz AG, Aquarion AG, Aquatech International, Condorchem Envitech, GEA Group AG, H20 GmbH, Ion Exchange India Ltd, Petro Sep, Praj Industries, Safbon Water Technology, Toshiba Infrastructure Systems and Solutions Corp, Veolia Environnement SA, and others.

A significant market trend in the zero liquid discharge systems industry is the increasing adoption of ZLD practices by industries worldwide. With growing concerns over water scarcity, pollution, and regulatory pressures, industries are turning to ZLD systems as a sustainable solution to minimize water usage and discharge. This trend is driven by factors such as stringent environmental regulations, corporate sustainability initiatives, and rising awareness of the importance of water conservation. ZLD systems allow industries to treat and recycle wastewater streams, achieving near-complete recovery of water and minimizing the discharge of liquid waste into the environment. As industries across sectors such as power generation, chemicals, and textiles seek to enhance their environmental performance and comply with regulatory requirements, the demand for ZLD systems is experiencing growth and innovation to meet evolving industry needs and sustainability goals.

The driver behind the growth of the zero liquid discharge systems market is the focus on water conservation and environmental compliance. With increasing pressure to conserve water resources and reduce pollution, industries are investing in advanced wastewater treatment technologies to achieve zero liquid discharge goals. This driver is fueled by factors such as water scarcity in regions with limited freshwater availability, concerns over water pollution and ecosystem degradation, and the need to meet regulatory standards for wastewater discharge. ZLD systems offer industries a sustainable approach to wastewater management by recovering valuable resources from wastewater streams and minimizing environmental impact. As governments enact stricter regulations on wastewater discharge and industries face penalties for non-compliance, the demand for ZLD systems as an effective solution for water conservation and environmental stewardship is expected to rise, driving market growth and opportunities for ZLD system providers and solution integrators.

An opportunity for growth and expansion in the zero liquid discharge systems market lies in entering emerging markets and industries with evolving wastewater treatment needs. While ZLD systems have traditionally been adopted by industries such as power plants, refineries, and chemical manufacturing facilities, there is potential to explore new market segments and geographic regions with growing demand for advanced wastewater treatment solutions. By targeting emerging markets such as food and beverage, pharmaceuticals, and mining, ZLD system providers can capitalize on opportunities to address evolving industry needs and regulatory requirements for wastewater management. Additionally, there is an opportunity to offer customized ZLD solutions tailored to the specific challenges and constraints of different industries and applications. By leveraging expertise in water treatment technologies and collaborating with local partners, ZLD system providers can expand their market presence, drive adoption of ZLD practices, and contribute to sustainable water management efforts globally.

Within the Zero Liquid Discharge Systems market, the Hybrid segment is the largest segment. Hybrid zero liquid discharge (ZLD) systems combine multiple treatment technologies to achieve maximum water recovery and minimal waste generation. These systems typically integrate membrane-based processes such as reverse osmosis (RO) or ultrafiltration (UF) with thermal processes like evaporation and crystallization. The hybrid approach allows for the efficient removal of dissolved solids, organic contaminants, and other pollutants from wastewater streams, ensuring compliance with stringent environmental regulations and sustainability goals. Additionally, hybrid ZLD systems offer flexibility in treatment capacity and process optimization, making them suitable for a wide range of industrial applications, including power generation, chemical manufacturing, and textile production. Moreover, the growing emphasis on water conservation, resource recovery, and circular economy principles drives the adoption of hybrid ZLD systems as a sustainable solution for wastewater management. Furthermore, advancements in membrane technology, energy efficiency, and system integration further enhance the performance and reliability of hybrid ZLD systems, solidifying their position as the largest segment in the Zero Liquid Discharge Systems market.

Within the Zero Liquid Discharge Systems market, the Evaporation/Crystallization segment is experiencing rapid growth. Evaporation and crystallization processes are integral components of zero liquid discharge (ZLD) systems, where they play a crucial role in concentrating wastewater streams and recovering valuable resources. These processes involve the removal of water from the wastewater through evaporation, followed by the crystallization of dissolved solids to produce solid salts or crystals for disposal or reuse. The increasing regulatory pressure to minimize liquid discharge and the need for sustainable wastewater management solutions drive the adoption of evaporation and crystallization technologies in industries such as power generation, chemical manufacturing, and mining. Moreover, advancements in process efficiency, energy recovery, and thermal management contribute to the growth of the Evaporation/Crystallization segment, making it a preferred choice for achieving high water recovery rates and reducing environmental impact. Additionally, the versatility of evaporation and crystallization systems allows for the treatment of diverse wastewater streams, including highly saline or complex effluents, further fuelling their demand in ZLD applications. As a result, the Evaporation/Crystallization segment is the fastest-growing segment in the Zero Liquid Discharge Systems market, driven by the increasing need for sustainable water management solutions and technological advancements in evaporation and crystallization processes.

Within the Zero Liquid Discharge Systems market, the Reverse Osmosis (RO) segment is the largest segment. Reverse osmosis technology is widely recognized for its effectiveness in removing dissolved solids, contaminants, and impurities from wastewater streams, making it a cornerstone of zero liquid discharge (ZLD) systems. RO systems utilize semi-permeable membranes to separate water molecules from dissolved solids and pollutants, producing a high-quality permeate stream while concentrating the rejected contaminants for further treatment or disposal. The versatility, efficiency, and reliability of RO technology make it a preferred choice for industries seeking sustainable solutions for water reuse, resource recovery, and environmental compliance. Additionally, advancements in membrane materials, module design, and system integration have improved the performance and cost-effectiveness of RO systems, further driving their adoption across various industrial sectors such as power generation, pharmaceuticals, and food & beverage. Moreover, the scalability and adaptability of RO technology enable its application in treating diverse wastewater sources, including brackish water, seawater, and industrial effluents, catering to the specific requirements of different industries and applications. As a result, the Reverse Osmosis segment commands a significant share of the Zero Liquid Discharge Systems market, reflecting its widespread use and established reputation for providing efficient and reliable water treatment solutions.

Within the Zero Liquid Discharge Systems market, the Electronics & Semiconductors segment is experiencing rapid growth. The electronics and semiconductor industry require stringent water treatment solutions to maintain high levels of purity in manufacturing processes and to comply with strict environmental regulations. Zero liquid discharge (ZLD) systems play a crucial role in treating the wastewater generated from semiconductor fabrication facilities, which contains various contaminants such as heavy metals, chemicals, and organic compounds. The increasing demand for electronic devices, rapid technological advancements, and the expansion of semiconductor manufacturing facilities worldwide drive the adoption of ZLD systems in the electronics and semiconductor sector. Additionally, the growing focus on sustainability and water conservation practices within the electronics industry further accelerates the deployment of ZLD systems to minimize water consumption, reduce wastewater discharge, and enhance resource recovery. Moreover, advancements in ZLD technology, such as improved membrane materials, energy-efficient processes, and modular system designs, cater to the specific needs and challenges of electronics and semiconductor manufacturers, contributing to the segment's fast growth. As a result, the Electronics & Semiconductors segment is the fastest-growing segment in the Zero Liquid Discharge Systems market, propelled by the increasing demand for water treatment solutions to support the production of electronic components and devices.

By System

Hybrid

Conventional

By Process

Pre-treatment

Filtration

Evaporation/Crystallization

By Technology

Reverse Osmosis

Ultrafiltration

Evaporation/Crystallization

By End-User

Energy & Power

Chemicals & Petrochemicals

Food & Beverage

Textile

Pharmaceuticals

Electronics & Semiconductors

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Alfa Laval AB

Andritz AG

Aquarion AG

Aquatech International

Condorchem Envitech

GEA Group AG

H20 GmbH

Ion Exchange India Ltd

Petro Sep

Praj Industries

Safbon Water Technology

Toshiba Infrastructure Systems and Solutions Corp

Veolia Environnement SA

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Zero Liquid Discharge Systems Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Zero Liquid Discharge Systems Market Size Outlook, $ Million, 2021 to 2032

3.2 Zero Liquid Discharge Systems Market Outlook by Type, $ Million, 2021 to 2032

3.3 Zero Liquid Discharge Systems Market Outlook by Product, $ Million, 2021 to 2032

3.4 Zero Liquid Discharge Systems Market Outlook by Application, $ Million, 2021 to 2032

3.5 Zero Liquid Discharge Systems Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Zero Liquid Discharge Systems Industry

4.2 Key Market Trends in Zero Liquid Discharge Systems Industry

4.3 Potential Opportunities in Zero Liquid Discharge Systems Industry

4.4 Key Challenges in Zero Liquid Discharge Systems Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Zero Liquid Discharge Systems Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Zero Liquid Discharge Systems Market Outlook by Segments

7.1 Zero Liquid Discharge Systems Market Outlook by Segments, $ Million, 2021- 2032

By System

Hybrid

Conventional

By Process

Pre-treatment

Filtration

Evaporation/Crystallization

By Technology

Reverse Osmosis

Ultrafiltration

Evaporation/Crystallization

By End-User

Energy & Power

Chemicals & Petrochemicals

Food & Beverage

Textile

Pharmaceuticals

Electronics & Semiconductors

Others

8 North America Zero Liquid Discharge Systems Market Analysis and Outlook To 2032

8.1 Introduction to North America Zero Liquid Discharge Systems Markets in 2024

8.2 North America Zero Liquid Discharge Systems Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Zero Liquid Discharge Systems Market size Outlook by Segments, 2021-2032

By System

Hybrid

Conventional

By Process

Pre-treatment

Filtration

Evaporation/Crystallization

By Technology

Reverse Osmosis

Ultrafiltration

Evaporation/Crystallization

By End-User

Energy & Power

Chemicals & Petrochemicals

Food & Beverage

Textile

Pharmaceuticals

Electronics & Semiconductors

Others

9 Europe Zero Liquid Discharge Systems Market Analysis and Outlook To 2032

9.1 Introduction to Europe Zero Liquid Discharge Systems Markets in 2024

9.2 Europe Zero Liquid Discharge Systems Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Zero Liquid Discharge Systems Market Size Outlook by Segments, 2021-2032

By System

Hybrid

Conventional

By Process

Pre-treatment

Filtration

Evaporation/Crystallization

By Technology

Reverse Osmosis

Ultrafiltration

Evaporation/Crystallization

By End-User

Energy & Power

Chemicals & Petrochemicals

Food & Beverage

Textile

Pharmaceuticals

Electronics & Semiconductors

Others

10 Asia Pacific Zero Liquid Discharge Systems Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Zero Liquid Discharge Systems Markets in 2024

10.2 Asia Pacific Zero Liquid Discharge Systems Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Zero Liquid Discharge Systems Market size Outlook by Segments, 2021-2032

By System

Hybrid

Conventional

By Process

Pre-treatment

Filtration

Evaporation/Crystallization

By Technology

Reverse Osmosis

Ultrafiltration

Evaporation/Crystallization

By End-User

Energy & Power

Chemicals & Petrochemicals

Food & Beverage

Textile

Pharmaceuticals

Electronics & Semiconductors

Others

11 South America Zero Liquid Discharge Systems Market Analysis and Outlook To 2032

11.1 Introduction to South America Zero Liquid Discharge Systems Markets in 2024

11.2 South America Zero Liquid Discharge Systems Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Zero Liquid Discharge Systems Market size Outlook by Segments, 2021-2032

By System

Hybrid

Conventional

By Process

Pre-treatment

Filtration

Evaporation/Crystallization

By Technology

Reverse Osmosis

Ultrafiltration

Evaporation/Crystallization

By End-User

Energy & Power

Chemicals & Petrochemicals

Food & Beverage

Textile

Pharmaceuticals

Electronics & Semiconductors

Others

12 Middle East and Africa Zero Liquid Discharge Systems Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Zero Liquid Discharge Systems Markets in 2024

12.2 Middle East and Africa Zero Liquid Discharge Systems Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Zero Liquid Discharge Systems Market size Outlook by Segments, 2021-2032

By System

Hybrid

Conventional

By Process

Pre-treatment

Filtration

Evaporation/Crystallization

By Technology

Reverse Osmosis

Ultrafiltration

Evaporation/Crystallization

By End-User

Energy & Power

Chemicals & Petrochemicals

Food & Beverage

Textile

Pharmaceuticals

Electronics & Semiconductors

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Alfa Laval AB

Andritz AG

Aquarion AG

Aquatech International

Condorchem Envitech

GEA Group AG

H20 GmbH

Ion Exchange India Ltd

Petro Sep

Praj Industries

Safbon Water Technology

Toshiba Infrastructure Systems and Solutions Corp

Veolia Environnement SA

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By System

Hybrid

Conventional

By Process

Pre-treatment

Filtration

Evaporation/Crystallization

By Technology

Reverse Osmosis

Ultrafiltration

Evaporation/Crystallization

By End-User

Energy & Power

Chemicals & Petrochemicals

Food & Beverage

Textile

Pharmaceuticals

Electronics & Semiconductors

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Zero Liquid Discharge Systems Market Size is valued at $9.1 Billion in 2024 and is forecast to register a growth rate (CAGR) of 7.8% to reach $16.6 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Alfa Laval AB, Andritz AG, Aquarion AG, Aquatech International, Condorchem Envitech, GEA Group AG, H20 GmbH, Ion Exchange India Ltd, Petro Sep, Praj Industries, Safbon Water Technology, Toshiba Infrastructure Systems and Solutions Corp, Veolia Environnement SA

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume