The global Zeolites Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Natural, Synthetic), By Application (Catalysts, Adsorbents, Detergent Builders, Cement, Animal Feed, Others).

Zeolites are versatile minerals with unique properties and applications in various industries, including petrochemicals, environmental remediation, agriculture, and healthcare in 2024. These crystalline aluminosilicate minerals have a porous structure with uniform pore sizes, high surface areas, and cation exchange capacity, making them valuable for adsorption, catalysis, ion exchange, and molecular sieving. Zeolites find applications as catalysts and adsorbents in petrochemical refining and gas separation processes, where they enhance reaction rates, selectivity, and purity of products. In environmental remediation, zeolites are used for water and air purification, heavy metal removal, and radioactive waste management, providing effective and sustainable solutions for pollution control and remediation. In agriculture, zeolites are employed as soil amendments and nutrient carriers to improve soil fertility, water retention, and crop yield, promoting sustainable agriculture practices and reducing environmental impact. With their ability to selectively adsorb gases, liquids, and ions, zeolites also find applications in gas separation, water softening, and medical applications such as drug delivery and wound healing. As the demand for sustainable and eco-friendly solutions grows, zeolites to be valued for their versatility, efficiency, and environmental benefits across diverse industries, driving innovation and advancements in zeolite technology and applications worldwide.

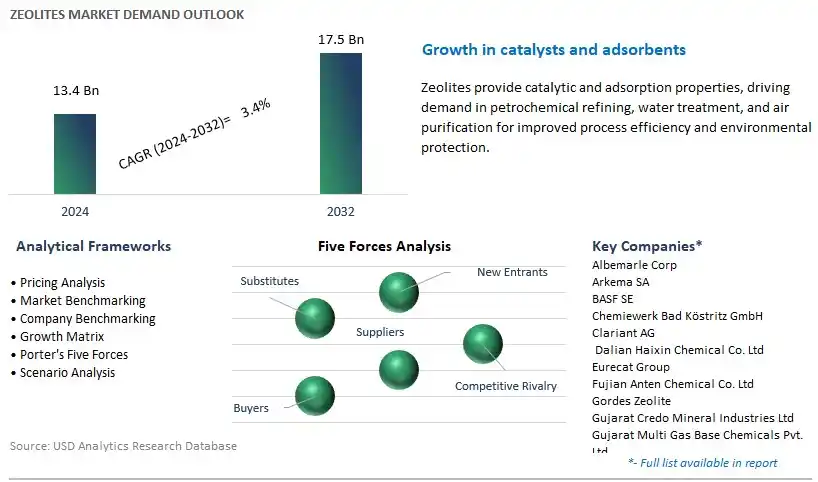

The market report analyses the leading companies in the industry including Albemarle Corp, Arkema SA, BASF SE, Chemiewerk Bad Köstritz GmbH, Clariant AG, Dalian Haixin Chemical Co. Ltd, Eurecat Group, Fujian Anten Chemical Co. Ltd, Gordes Zeolite, Gujarat Credo Mineral Industries Ltd, Gujarat Multi Gas Base Chemicals Pvt. Ltd, Honeywell International Inc, Huiying Chemical Industry Co. Ltd, IQE Group, KNT Group, Manek Minerals, NALCO India, Ningbo Jiahe New Materials Technology Co. Ltd, Sorbead India, TOSOH Corp, Union Showa KK, W.R. Grace & Co., Zeochem AG, Zeolyst International, and others.

A significant market trend in the zeolites industry is the increasing demand for environmental remediation and water purification applications. Zeolites, with their unique porous structure and ion-exchange properties, are increasingly being utilized in various environmental applications such as soil remediation, water filtration, and air purification. This trend is driven by factors such as growing concerns over water and soil pollution, tightening environmental regulations, and the need for sustainable solutions to address environmental challenges. Zeolites offer effective adsorption and filtration capabilities, making them valuable materials for removing contaminants and pollutants from water and soil. As industries and governments prioritize environmental protection and sustainability initiatives, the demand for zeolites for use in environmental remediation and water purification applications is experiencing growth and innovation to meet evolving environmental requirements and market demands.

The driver behind the growth of the zeolites market is the expansion in industrial and municipal water treatment activities. With increasing industrialization, urbanization, and population growth, there is a growing need for effective water treatment solutions to ensure access to clean and safe drinking water. This driver is fueled by factors such as rapid industrial development, aging water infrastructure, and concerns over water quality and scarcity. Zeolites are widely used in water treatment processes such as ion exchange, adsorption, and catalysis, offering efficient removal of heavy metals, ammonia, and other pollutants from water sources. As industries and municipalities invest in upgrading water treatment facilities and implementing advanced treatment technologies, the demand for zeolites as key components in water treatment systems is expected to rise, driving market growth and opportunities for zeolite producers and suppliers.

An opportunity for growth and differentiation in the zeolites market lies in innovation in zeolite-based specialty products. While conventional zeolites are commonly used in water treatment and environmental applications, there is potential for innovation in developing specialty zeolite products tailored to specific industrial and consumer needs. By investing in research and development, zeolite manufacturers can develop novel formulations and surface modifications that enhance the performance and versatility of zeolites for targeted applications such as gas separation, catalysis, and chemical synthesis. Additionally, there is an opportunity to explore new markets and applications for zeolite-based materials, such as energy storage, pharmaceuticals, and agricultural products. By collaborating with industry partners and leveraging advancements in zeolite science and engineering, zeolite companies can capitalize on opportunities to provide innovative solutions that address unmet needs, expand market reach, and drive growth in the zeolites industry.

Within the Zeolites market, the Synthetic segment is the largest segment. Synthetic zeolites are artificially manufactured materials that mimic the structure and properties of natural zeolites but offer potential advantages in terms of purity, uniformity, and tailored properties. These synthetic variants are engineered to possess specific pore sizes, surface areas, and ion-exchange capacities, making them highly versatile for various industrial applications. Additionally, synthetic zeolites can be produced in large quantities and with consistent quality, ensuring reliable supply chains and meeting the growing demand across industries such as petrochemicals, detergents, water treatment, and catalysis. Moreover, advancements in synthesis techniques and catalyst formulations have led to the development of novel synthetic zeolites with enhanced performance characteristics, further driving their adoption in niche applications. Furthermore, the cost-effectiveness and versatility of synthetic zeolites make them a preferred choice for manufacturers seeking tailored solutions for specific process requirements. As a result, the Synthetic segment commands a significant share of the Zeolites market, reflecting its dominance in industrial applications and the continuous innovation in synthetic zeolite technology.

Within the Zeolites market, the Catalysts segment is experiencing rapid growth. Zeolite-based catalysts play a crucial role in various chemical processes, including petroleum refining, petrochemical production, and environmental remediation. The unique structure and properties of zeolites, such as high surface area, uniform pore size distribution, and ion-exchange capacity, make them highly effective catalysts for catalytic cracking, hydrocracking, isomerization, and other reactions. Additionally, the increasing demand for cleaner fuels, stricter environmental regulations, and the need to optimize process efficiency drive the adoption of zeolite catalysts in the refining and petrochemical industries. Moreover, ongoing research and development efforts aimed at enhancing the catalytic performance and stability of zeolite catalysts further contribute to their growth in applications such as emission control and renewable energy production. Furthermore, the versatility of zeolite-based catalysts extends to emerging sectors such as biomass conversion and carbon capture, offering opportunities for market expansion and innovation. As a result, the Catalysts segment is the fastest-growing segment in the Zeolites market, propelled by the increasing demand for efficient and sustainable catalytic solutions across industries.

By Product

Natural

Synthetic

By Application

Catalysts

Adsorbents

Detergent Builders

Cement

Animal Feed

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Albemarle Corp

Arkema SA

BASF SE

Chemiewerk Bad Köstritz GmbH

Clariant AG

Dalian Haixin Chemical Co. Ltd

Eurecat Group

Fujian Anten Chemical Co. Ltd

Gordes Zeolite

Gujarat Credo Mineral Industries Ltd

Gujarat Multi Gas Base Chemicals Pvt. Ltd

Honeywell International Inc

Huiying Chemical Industry Co. Ltd

IQE Group

KNT Group

Manek Minerals

NALCO India

Ningbo Jiahe New Materials Technology Co. Ltd

Sorbead India

TOSOH Corp

Union Showa KK

W.R. Grace & Co.

Zeochem AG

Zeolyst International

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Zeolites Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Zeolites Market Size Outlook, $ Million, 2021 to 2032

3.2 Zeolites Market Outlook by Type, $ Million, 2021 to 2032

3.3 Zeolites Market Outlook by Product, $ Million, 2021 to 2032

3.4 Zeolites Market Outlook by Application, $ Million, 2021 to 2032

3.5 Zeolites Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Zeolites Industry

4.2 Key Market Trends in Zeolites Industry

4.3 Potential Opportunities in Zeolites Industry

4.4 Key Challenges in Zeolites Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Zeolites Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Zeolites Market Outlook by Segments

7.1 Zeolites Market Outlook by Segments, $ Million, 2021- 2032

By Product

Natural

Synthetic

By Application

Catalysts

Adsorbents

Detergent Builders

Cement

Animal Feed

Others

8 North America Zeolites Market Analysis and Outlook To 2032

8.1 Introduction to North America Zeolites Markets in 2024

8.2 North America Zeolites Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Zeolites Market size Outlook by Segments, 2021-2032

By Product

Natural

Synthetic

By Application

Catalysts

Adsorbents

Detergent Builders

Cement

Animal Feed

Others

9 Europe Zeolites Market Analysis and Outlook To 2032

9.1 Introduction to Europe Zeolites Markets in 2024

9.2 Europe Zeolites Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Zeolites Market Size Outlook by Segments, 2021-2032

By Product

Natural

Synthetic

By Application

Catalysts

Adsorbents

Detergent Builders

Cement

Animal Feed

Others

10 Asia Pacific Zeolites Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Zeolites Markets in 2024

10.2 Asia Pacific Zeolites Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Zeolites Market size Outlook by Segments, 2021-2032

By Product

Natural

Synthetic

By Application

Catalysts

Adsorbents

Detergent Builders

Cement

Animal Feed

Others

11 South America Zeolites Market Analysis and Outlook To 2032

11.1 Introduction to South America Zeolites Markets in 2024

11.2 South America Zeolites Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Zeolites Market size Outlook by Segments, 2021-2032

By Product

Natural

Synthetic

By Application

Catalysts

Adsorbents

Detergent Builders

Cement

Animal Feed

Others

12 Middle East and Africa Zeolites Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Zeolites Markets in 2024

12.2 Middle East and Africa Zeolites Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Zeolites Market size Outlook by Segments, 2021-2032

By Product

Natural

Synthetic

By Application

Catalysts

Adsorbents

Detergent Builders

Cement

Animal Feed

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Albemarle Corp

Arkema SA

BASF SE

Chemiewerk Bad Köstritz GmbH

Clariant AG

Dalian Haixin Chemical Co. Ltd

Eurecat Group

Fujian Anten Chemical Co. Ltd

Gordes Zeolite

Gujarat Credo Mineral Industries Ltd

Gujarat Multi Gas Base Chemicals Pvt. Ltd

Honeywell International Inc

Huiying Chemical Industry Co. Ltd

IQE Group

KNT Group

Manek Minerals

NALCO India

Ningbo Jiahe New Materials Technology Co. Ltd

Sorbead India

TOSOH Corp

Union Showa KK

W.R. Grace & Co.

Zeochem AG

Zeolyst International

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Natural

Synthetic

By Application

Catalysts

Adsorbents

Detergent Builders

Cement

Animal Feed

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Zeolites Market Size is valued at $13.4 Billion in 2024 and is forecast to register a growth rate (CAGR) of 3.4% to reach $17.5 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Albemarle Corp, Arkema SA, BASF SE, Chemiewerk Bad Köstritz GmbH, Clariant AG, Dalian Haixin Chemical Co. Ltd, Eurecat Group, Fujian Anten Chemical Co. Ltd, Gordes Zeolite, Gujarat Credo Mineral Industries Ltd, Gujarat Multi Gas Base Chemicals Pvt. Ltd, Honeywell International Inc, Huiying Chemical Industry Co. Ltd, IQE Group, KNT Group, Manek Minerals, NALCO India, Ningbo Jiahe New Materials Technology Co. Ltd, Sorbead India, TOSOH Corp, Union Showa KK, W.R. Grace & Co., Zeochem AG, Zeolyst International

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume