The global Xanthates Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Sodium Ethyl Xanthate, Sodium Isopropyl Xanthate, Sodium Isobutyl Xanthate, Potassium Amyl Xanthate, Others), By Application (Mining, Rubber Processing, Agrochemicals, Others).

Xanthates are a class of organosulfur compounds widely used as reagents in mineral processing, rubber vulcanization, and chemical synthesis due to their ability to form stable metal complexes and facilitate reactions such as flotation and precipitation. Derived from carbon disulfide and alkali metal hydroxides or alkoxides, xanthates exhibit strong affinity for metal ions, making them effective collectors and frothers in ore flotation processes for extracting minerals such as copper, lead, and zinc from ores. Additionally, xanthates serve as intermediates in the production of pesticides, pharmaceuticals, and specialty chemicals, where they undergo transformations to yield diverse functional groups and structures. As the mining industry seeks to optimize recovery rates and minimize environmental impact, xanthate manufacturers focus on developing high-performance formulations and sustainable production processes, driving advancements in mineral processing technologies.

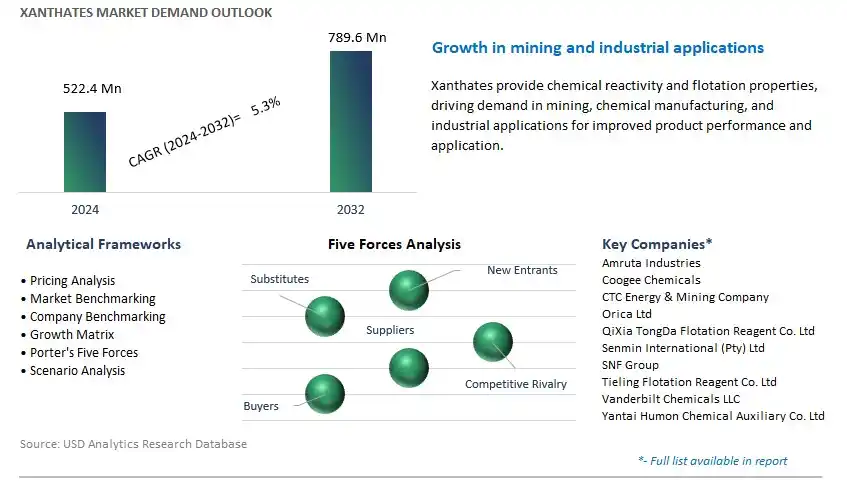

The market report analyses the leading companies in the industry including Amruta Industries, Coogee Chemicals, CTC Energy & Mining Company, Orica Ltd, QiXia TongDa Flotation Reagent Co. Ltd, Senmin International (Pty) Ltd, SNF Group, Tieling Flotation Reagent Co. Ltd, Vanderbilt Chemicals LLC, Yantai Humon Chemical Auxiliary Co. Ltd, and others.

A prominent trend in the Xanthates market is the growing demand in mining and mineral processing applications. Xanthates, a type of chemical reagent, are widely used as flotation agents in the mining industry for the extraction of metals such as copper, lead, zinc, and nickel from ore deposits. With the increasing global demand for metals and minerals, particularly in emerging economies and infrastructure development projects, there's a corresponding rise in the consumption of xanthates to facilitate the flotation process. This trend is driving the expansion of xanthate production capacity and the development of new formulations to meet the specific requirements of different mineral processing operations.

A key driver in the Xanthates market is the continuous advancements in mining technologies and processes, which require effective chemical reagents to optimize mineral recovery and processing efficiency. As mining operations strive for higher productivity, lower costs, and improved environmental performance, there's a growing need for specialized reagents like xanthates that can selectively enhance the flotation of target minerals while minimizing the consumption of water and energy. Furthermore, the depletion of high-grade ore deposits and the increasing complexity of ore bodies necessitate the use of advanced flotation reagents to extract valuable metals from lower-grade and more challenging ores, thereby driving the demand for xanthates in the mining industry.

Amidst the evolving market dynamics, there exists a significant opportunity for Xanthates manufacturers to diversify into other chemical applications beyond mining. Xanthates possess properties such as solubility, frothability, and surface activity that make them suitable for various industrial processes such as rubber production, chemical synthesis, and wastewater treatment. By leveraging their expertise in xanthate chemistry and process engineering, companies can explore new markets and applications where xanthates can offer value-added solutions. Additionally, investing in research and development to optimize xanthate formulations for specific applications and collaborating with downstream users can unlock opportunities for growth and market expansion beyond the mining sector.

The Sodium Ethyl Xanthate segment is the largest within the Xanthates Market, primarily due to its widespread applications and established usage in various industries. Sodium Ethyl Xanthate is extensively utilized as a flotation agent in the mining industry for the extraction of minerals such as copper, lead, and zinc from ore. Its effectiveness in selectively separating valuable minerals from gangue materials, coupled with its relatively low cost and ease of handling, has made it the preferred xanthate reagent for mineral processing operations globally. Additionally, Sodium Ethyl Xanthate finds applications in the production of rubber chemicals, pesticides, and pharmaceuticals, further contributing to its market dominance. With the continuous expansion of the mining sector, driven by growing demand for metals and minerals across industries, the Sodium Ethyl Xanthate segment is expected to maintain its position as the largest segment in the Xanthates Market.

The Agrochemicals segment is the fastest-growing segment within the Xanthates Market. Xanthates, particularly Sodium Ethyl Xanthate and Sodium Isopropyl Xanthate, are widely utilized in the production of pesticides and herbicides in the agrochemical industry. These xanthates serve as essential intermediates in the synthesis of various agrochemical compounds, imparting crucial properties such as stability, solubility, and effectiveness in pest and weed control formulations. With the increasing global population and shrinking arable land, there is a pressing need to enhance agricultural productivity and mitigate crop losses due to pests and diseases. As a result, the demand for agrochemicals continues to rise, propelling the growth of the Agrochemicals segment in the Xanthates Market. Additionally, advancements in agricultural practices, such as integrated pest management and precision agriculture, further drive the adoption of xanthate-based agrochemicals, contributing to the segment's rapid expansion. With agriculture playing a critical role in food security and economic development, the Agrochemicals segment is poised for sustained growth, solidifying its position as a key driver in the Xanthates Market.

By Product

Sodium Ethyl Xanthate

Sodium Isopropyl Xanthate

Sodium Isobutyl Xanthate

Potassium Amyl Xanthate

Others

By Application

Mining

Rubber Processing

Agrochemicals

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Amruta Industries

Coogee Chemicals

CTC Energy & Mining Company

Orica Ltd

QiXia TongDa Flotation Reagent Co. Ltd

Senmin International (Pty) Ltd

SNF Group

Tieling Flotation Reagent Co. Ltd

Vanderbilt Chemicals LLC

Yantai Humon Chemical Auxiliary Co. Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Xanthates Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Xanthates Market Size Outlook, $ Million, 2021 to 2032

3.2 Xanthates Market Outlook by Type, $ Million, 2021 to 2032

3.3 Xanthates Market Outlook by Product, $ Million, 2021 to 2032

3.4 Xanthates Market Outlook by Application, $ Million, 2021 to 2032

3.5 Xanthates Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Xanthates Industry

4.2 Key Market Trends in Xanthates Industry

4.3 Potential Opportunities in Xanthates Industry

4.4 Key Challenges in Xanthates Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Xanthates Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Xanthates Market Outlook by Segments

7.1 Xanthates Market Outlook by Segments, $ Million, 2021- 2032

By Product

Sodium Ethyl Xanthate

Sodium Isopropyl Xanthate

Sodium Isobutyl Xanthate

Potassium Amyl Xanthate

Others

By Application

Mining

Rubber Processing

Agrochemicals

Others

8 North America Xanthates Market Analysis and Outlook To 2032

8.1 Introduction to North America Xanthates Markets in 2024

8.2 North America Xanthates Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Xanthates Market size Outlook by Segments, 2021-2032

By Product

Sodium Ethyl Xanthate

Sodium Isopropyl Xanthate

Sodium Isobutyl Xanthate

Potassium Amyl Xanthate

Others

By Application

Mining

Rubber Processing

Agrochemicals

Others

9 Europe Xanthates Market Analysis and Outlook To 2032

9.1 Introduction to Europe Xanthates Markets in 2024

9.2 Europe Xanthates Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Xanthates Market Size Outlook by Segments, 2021-2032

By Product

Sodium Ethyl Xanthate

Sodium Isopropyl Xanthate

Sodium Isobutyl Xanthate

Potassium Amyl Xanthate

Others

By Application

Mining

Rubber Processing

Agrochemicals

Others

10 Asia Pacific Xanthates Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Xanthates Markets in 2024

10.2 Asia Pacific Xanthates Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Xanthates Market size Outlook by Segments, 2021-2032

By Product

Sodium Ethyl Xanthate

Sodium Isopropyl Xanthate

Sodium Isobutyl Xanthate

Potassium Amyl Xanthate

Others

By Application

Mining

Rubber Processing

Agrochemicals

Others

11 South America Xanthates Market Analysis and Outlook To 2032

11.1 Introduction to South America Xanthates Markets in 2024

11.2 South America Xanthates Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Xanthates Market size Outlook by Segments, 2021-2032

By Product

Sodium Ethyl Xanthate

Sodium Isopropyl Xanthate

Sodium Isobutyl Xanthate

Potassium Amyl Xanthate

Others

By Application

Mining

Rubber Processing

Agrochemicals

Others

12 Middle East and Africa Xanthates Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Xanthates Markets in 2024

12.2 Middle East and Africa Xanthates Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Xanthates Market size Outlook by Segments, 2021-2032

By Product

Sodium Ethyl Xanthate

Sodium Isopropyl Xanthate

Sodium Isobutyl Xanthate

Potassium Amyl Xanthate

Others

By Application

Mining

Rubber Processing

Agrochemicals

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Amruta Industries

Coogee Chemicals

CTC Energy & Mining Company

Orica Ltd

QiXia TongDa Flotation Reagent Co. Ltd

Senmin International (Pty) Ltd

SNF Group

Tieling Flotation Reagent Co. Ltd

Vanderbilt Chemicals LLC

Yantai Humon Chemical Auxiliary Co. Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Sodium Ethyl Xanthate

Sodium Isopropyl Xanthate

Sodium Isobutyl Xanthate

Potassium Amyl Xanthate

Others

By Application

Mining

Rubber Processing

Agrochemicals

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Xanthates Market Size is valued at $522.4 Million in 2024 and is forecast to register a growth rate (CAGR) of 5.3% to reach $789.6 Million by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Amruta Industries, Coogee Chemicals, CTC Energy & Mining Company, Orica Ltd, QiXia TongDa Flotation Reagent Co. Ltd, Senmin International (Pty) Ltd, SNF Group, Tieling Flotation Reagent Co. Ltd, Vanderbilt Chemicals LLC, Yantai Humon Chemical Auxiliary Co. Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume