The global Wood Pallets Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Wood Type (Softwood, Hardwood), By Product (Block Wooden Pallet, Stringer Wooden Pallet, Engineered Molded Wood Pallet), By End-User (Logistics & Transportation, Food & Beverages, Chemicals, Pharmaceuticals, Manufacturing, Others).

The wood pallets market is experiencing steady growth driven by the expansion of logistics, transportation, and e-commerce sectors worldwide. Wood pallets, essential for the storage and transportation of goods in supply chains, offer advantages such as strength, durability, and recyclability, making them a preferred choice for manufacturers, distributors, and retailers. Key trends shaping the future of the wood pallets industry include the adoption of sustainable forestry practices and responsible sourcing of wood materials to meet environmental regulations and customer sustainability goals. Moreover, with advancements in pallet design and manufacturing processes, there is a trend towards the development of lightweight and durable pallets optimized for automated handling systems, reducing transportation costs and improving operational efficiency. Additionally, innovations in pallet repair and recycling technologies are enabling the recovery and reuse of damaged or end-of-life pallets, minimizing waste and extending the lifecycle of wood pallets in the supply chain. Furthermore, with the increasing focus on traceability and product safety, there is a growing demand for heat-treated wood pallets compliant with international phytosanitary standards, ensuring the smooth movement of goods across borders and mitigating the risk of pest infestation.

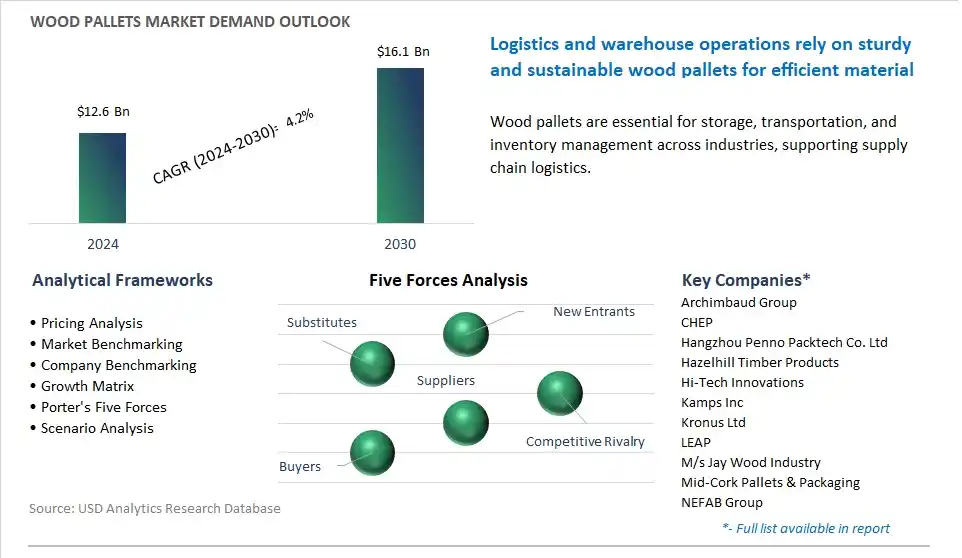

The market report analyses the leading companies in the industry including Archimbaud Group, CHEP, Hangzhou Penno Packtech Co. Ltd, Hazelhill Timber Products, Hi-Tech Innovations, Kamps Inc, Kronus Ltd, LEAP, M/s Jay Wood Industry, Mid-Cork Pallets & Packaging, NEFAB Group, Palette Deutschland, PalettenWerk, PECO Pallet, Renqiu Hongfei Wood Industry Co. Ltd, SAS GROUP, SATO Holdings Corp, The Nelson Company, Treyer Paletten GmbH, UFP Industries Inc.

A prominent trend in the wood pallets market is the increasing adoption of sustainable and recyclable packaging solutions. With growing awareness of environmental sustainability and circular economy principles, there's a rising demand for wood pallets as an eco-friendly alternative to plastic pallets and other non-biodegradable materials. Companies across various industries are prioritizing sustainability in their supply chain operations and logistics, opting for wood pallets that can be reused, repaired, and recycled. This trend is driven by regulatory pressures, consumer preferences for eco-friendly products, and corporate sustainability initiatives, stimulating the growth of the wood pallets market.

The primary driver for the wood pallets market is the expansion of global trade and logistics activities. As international trade continues to grow, there's an increasing need for efficient and cost-effective transportation and storage solutions to facilitate the movement of goods across borders. Wood pallets, known for their strength, durability, and compatibility with various handling equipment, remain the preferred choice for shipping and storing goods in warehouses, distribution centers, and transportation vehicles worldwide. Factors such as e-commerce growth, globalization of supply chains, and the need for just-in-time inventory management drive the demand for wood pallets, fueling market growth.

An opportunity for market advancement in the wood pallets segment lies in innovation in pallet design and material recycling. By leveraging advancements in manufacturing technology and materials science, manufacturers can develop innovative pallet designs that offer enhanced durability, load-bearing capacity, and customization options to meet the evolving needs of customers. Additionally, investing in pallet recycling programs and circular economy initiatives can create new revenue streams and contribute to environmental sustainability. By collaborating with stakeholders across the supply chain, including pallet users, recyclers, and waste management companies, manufacturers can optimize pallet design for disassembly and material recovery, promoting closed-loop recycling and minimizing waste generation. This not only addresses environmental concerns but also provides a competitive edge in the market by offering sustainable and cost-effective pallet solutions.

The largest segment in the Wood Pallets Market is the Softwood category. Softwood pallets are more commonly used compared to hardwood pallets. softwood, derived from coniferous trees such as pine, spruce, and fir, is abundant and readily available in many regions, making it a cost-effective choice for pallet manufacturing. Additionally, softwood pallets are lightweight yet strong and durable, offering sufficient load-bearing capacity for transporting goods and materials across various industries. Furthermore, softwood pallets are easier to work with and can be manufactured quickly and efficiently using automated production processes, reducing manufacturing costs and lead times. Further, softwood pallets are versatile and suitable for a wide range of applications, including transportation, storage, and distribution in industries such as logistics, manufacturing, retail, and agriculture. Additionally, softwood pallets are often preferred for export shipments due to international regulations requiring heat treatment for wooden packaging materials to prevent the spread of pests and diseases. Softwood is more receptive to heat treatment compared to hardwood, making softwood pallets the preferred choice for international trade. Furthermore, softwood pallets can be recycled or repurposed at the end of their lifespan, contributing to sustainability and environmental stewardship. These factors combined make softwood pallets the largest segment in the Wood Pallets Market.

The fastest-growing segment in the Wood Pallets Market is the Engineered Molded Wood Pallet category. Engineered molded wood pallets, also known as composite or pressed wood pallets, are gaining popularity due to Diverse key advantages over traditional block and stringer wooden pallets. engineered molded wood pallets are manufactured using a combination of wood fibers, resins, and additives that are compressed and molded into shape under high pressure and heat. This manufacturing process results in pallets that are lightweight yet durable, with consistent dimensions and strength characteristics. Additionally, engineered molded wood pallets are free from nails, screws, and other metal components, reducing the risk of injury to workers and damage to goods during handling and transportation. Furthermore, engineered molded wood pallets offer superior resistance to moisture, pests, and mold compared to traditional wooden pallets, making them suitable for use in a wide range of environments, including food and pharmaceutical industries where hygiene is critical. Further, engineered molded wood pallets are often designed with integrated features such as nesting capabilities, ergonomic handles, and RFID (Radio Frequency Identification) tracking systems, enhancing efficiency and traceability in supply chain operations. Additionally, engineered molded wood pallets are increasingly recognized for their sustainability benefits, as they are made from recycled wood fibers and are fully recyclable at the end of their lifespan. As businesses prioritize sustainability, efficiency, and cost-effectiveness in their logistics operations, the demand for engineered molded wood pallets is expected to continue growing rapidly, making it the fastest-growing segment in the Wood Pallets Market.

The fastest-growing segment in the Wood Pallets Market is the Food & Beverages category. Diverse factors contribute to the rapid growth of wood pallets in the food and beverages industry compared to other end-user segments. The food and beverages sector relies heavily on efficient and reliable transportation and storage solutions to maintain product quality, freshness, and safety throughout the supply chain. Wood pallets are widely used in the food and beverages industry due to their affordability, availability, and suitability for hygienic handling and storage of perishable goods. Additionally, wood pallets are naturally resistant to temperature fluctuations and moisture, making them ideal for storing and transporting food and beverage products in refrigerated or humid environments. Furthermore, wood pallets are compatible with various handling equipment such as forklifts, pallet jacks, and automated conveyor systems, facilitating seamless material handling operations in food processing plants, distribution centers, and retail stores. Further, wood pallets can be easily cleaned, sanitized, and reused multiple times, reducing the risk of cross-contamination and ensuring compliance with strict hygiene standards and food safety regulations. Additionally, the COVID-19 pandemic has accelerated the growth of e-commerce and home delivery services in the food and beverages industry, driving the demand for wood pallets to support increased order fulfillment and last-mile delivery operations. Furthermore, as consumers become more conscious of sustainable and eco-friendly packaging solutions, wood pallets are increasingly preferred over plastic and other non-biodegradable alternatives. As a result of these factors, the demand for wood pallets in the food and beverages industry is expected to continue growing rapidly, making it the fastest-growing segment in the Wood Pallets Market.

By Wood Type

Softwood

Hardwood

By Product

Block Wooden Pallet

Stringer Wooden Pallet

Engineered Molded Wood Pallet

By End-User

Logistics & Transportation

Food & Beverages

Chemicals

Pharmaceuticals

Manufacturing

Others

Regions Included

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Archimbaud Group

CHEP

Hangzhou Penno Packtech Co. Ltd

Hazelhill Timber Products

Hi-Tech Innovations

Kamps Inc

Kronus Ltd

LEAP

M/s Jay Wood Industry

Mid-Cork Pallets & Packaging

NEFAB Group

Palette Deutschland

PalettenWerk

PECO Pallet

Renqiu Hongfei Wood Industry Co. Ltd

SAS GROUP

SATO Holdings Corp

The Nelson Company

Treyer Paletten GmbH

UFP Industries Inc

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Wood Pallets Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Wood Pallets Market Size Outlook, $ Million, 2021 to 2030

3.2 Wood Pallets Market Outlook by Type, $ Million, 2021 to 2030

3.3 Wood Pallets Market Outlook by Product, $ Million, 2021 to 2030

3.4 Wood Pallets Market Outlook by Application, $ Million, 2021 to 2030

3.5 Wood Pallets Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Wood Pallets Industry

4.2 Key Market Trends in Wood Pallets Industry

4.3 Potential Opportunities in Wood Pallets Industry

4.4 Key Challenges in Wood Pallets Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Wood Pallets Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Wood Pallets Market Outlook by Segments

7.1 Wood Pallets Market Outlook by Segments, $ Million, 2021- 2030

By Wood Type

Softwood

Hardwood

By Product

Block Wooden Pallet

Stringer Wooden Pallet

Engineered Molded Wood Pallet

By End-User

Logistics & Transportation

Food & Beverages

Chemicals

Pharmaceuticals

Manufacturing

Others

8 North America Wood Pallets Market Analysis and Outlook To 2030

8.1 Introduction to North America Wood Pallets Markets in 2024

8.2 North America Wood Pallets Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Wood Pallets Market size Outlook by Segments, 2021-2030

By Wood Type

Softwood

Hardwood

By Product

Block Wooden Pallet

Stringer Wooden Pallet

Engineered Molded Wood Pallet

By End-User

Logistics & Transportation

Food & Beverages

Chemicals

Pharmaceuticals

Manufacturing

Others

9 Europe Wood Pallets Market Analysis and Outlook To 2030

9.1 Introduction to Europe Wood Pallets Markets in 2024

9.2 Europe Wood Pallets Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Wood Pallets Market Size Outlook by Segments, 2021-2030

By Wood Type

Softwood

Hardwood

By Product

Block Wooden Pallet

Stringer Wooden Pallet

Engineered Molded Wood Pallet

By End-User

Logistics & Transportation

Food & Beverages

Chemicals

Pharmaceuticals

Manufacturing

Others

10 Asia Pacific Wood Pallets Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Wood Pallets Markets in 2024

10.2 Asia Pacific Wood Pallets Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Wood Pallets Market size Outlook by Segments, 2021-2030

By Wood Type

Softwood

Hardwood

By Product

Block Wooden Pallet

Stringer Wooden Pallet

Engineered Molded Wood Pallet

By End-User

Logistics & Transportation

Food & Beverages

Chemicals

Pharmaceuticals

Manufacturing

Others

11 South America Wood Pallets Market Analysis and Outlook To 2030

11.1 Introduction to South America Wood Pallets Markets in 2024

11.2 South America Wood Pallets Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Wood Pallets Market size Outlook by Segments, 2021-2030

By Wood Type

Softwood

Hardwood

By Product

Block Wooden Pallet

Stringer Wooden Pallet

Engineered Molded Wood Pallet

By End-User

Logistics & Transportation

Food & Beverages

Chemicals

Pharmaceuticals

Manufacturing

Others

12 Middle East and Africa Wood Pallets Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Wood Pallets Markets in 2024

12.2 Middle East and Africa Wood Pallets Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Wood Pallets Market size Outlook by Segments, 2021-2030

By Wood Type

Softwood

Hardwood

By Product

Block Wooden Pallet

Stringer Wooden Pallet

Engineered Molded Wood Pallet

By End-User

Logistics & Transportation

Food & Beverages

Chemicals

Pharmaceuticals

Manufacturing

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Archimbaud Group

CHEP

Hangzhou Penno Packtech Co. Ltd

Hazelhill Timber Products

Hi-Tech Innovations

Kamps Inc

Kronus Ltd

LEAP

M/s Jay Wood Industry

Mid-Cork Pallets & Packaging

NEFAB Group

Palette Deutschland

PalettenWerk

PECO Pallet

Renqiu Hongfei Wood Industry Co. Ltd

SAS GROUP

SATO Holdings Corp

The Nelson Company

Treyer Paletten GmbH

UFP Industries Inc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Wood Type

Softwood

Hardwood

By Product

Block Wooden Pallet

Stringer Wooden Pallet

Engineered Molded Wood Pallet

By End-User

Logistics & Transportation

Food & Beverages

Chemicals

Pharmaceuticals

Manufacturing

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Wood Pallets is forecast to reach $16.1 Billion in 2030 from $12.6 Billion in 2024, registering a CAGR of 4.2%

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Archimbaud Group, CHEP, Hangzhou Penno Packtech Co. Ltd, Hazelhill Timber Products, Hi-Tech Innovations, Kamps Inc, Kronus Ltd, LEAP, M/s Jay Wood Industry, Mid-Cork Pallets & Packaging, NEFAB Group, Palette Deutschland, PalettenWerk, PECO Pallet, Renqiu Hongfei Wood Industry Co. Ltd, SAS GROUP, SATO Holdings Corp, The Nelson Company, Treyer Paletten GmbH, UFP Industries Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume