The global Wood Adhesives Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Urea-Formaldehyde (UF), Melamine urea-formaldehyde (MUF), Phenol-formaldehyde (PF), Isocyanates, Polyurethane, Polyvinyl acetate (PVA), Soy-based, Others), By Application (Flooring, Furniture, Doors & windows, Housing components, Others), By Substrate (Solid wood, Oriented Strand Board (OSB), Plywood, Particle Board (PB), Medium-Density fiberboard (MDF), High-Density fiberboard (HDF), Others).

Wood adhesives play a crucial role in bonding wood components and assemblies in various industries, including furniture manufacturing, construction, cabinetry, and woodworking in 2024. These adhesives are formulated to provide strong and durable bonds between wood substrates, offering resistance to moisture, heat, and environmental stresses. Wood adhesives come in various types, including polyvinyl acetate (PVA) adhesives, urea-formaldehyde (UF) adhesives, phenol-formaldehyde (PF) adhesives, epoxy resins, and polyurethane adhesives, each tailored to specific applications and performance requirements. In furniture manufacturing, wood adhesives are used for edge gluing, veneering, laminating, and assembling furniture components such as tabletops, cabinets, and chairs. In construction, wood adhesives are employed for bonding structural components such as beams, trusses, and panels, enhancing structural integrity and load-bearing capacity. With advancements in adhesive technology, environmentally friendly formulations, and automation in manufacturing processes, wood adhesives to evolve to meet the demands for efficiency, sustainability, and performance in wood bonding applications, driving innovation and progress in the woodworking industry worldwide.

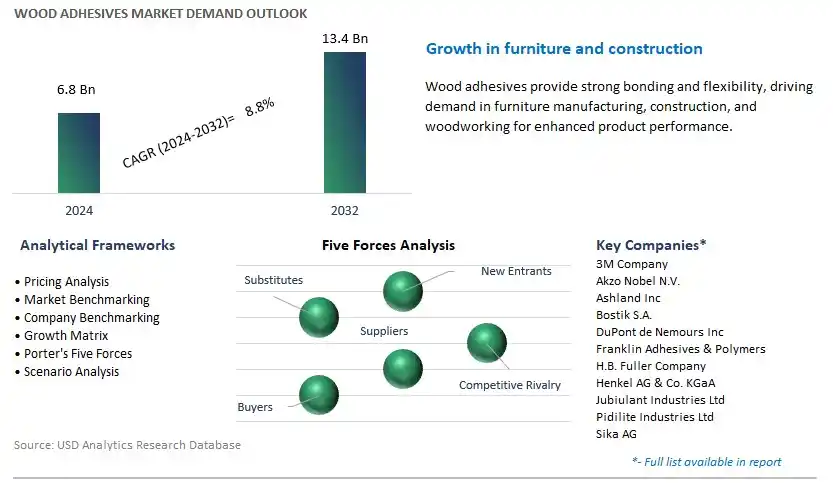

The market report analyses the leading companies in the industry including 3M Company, Akzo Nobel N.V., Ashland Inc, Bostik S.A., DuPont de Nemours Inc, Franklin Adhesives & Polymers, H.B. Fuller Company, Henkel AG & Co. KGaA, Jubiulant Industries Ltd, Pidilite Industries Ltd, Sika AG, and others.

A significant market trend in the wood adhesives industry is the shift towards sustainable and bio-based formulations. With increasing environmental concerns and regulations on chemical usage, there is a growing demand for wood adhesives that offer reduced environmental impact and are derived from renewable sources. This trend is driven by factors such as consumer preferences for eco-friendly products, corporate sustainability initiatives, and government regulations promoting green chemistry. Wood adhesives formulated with bio-based polymers, such as soy, starch, or lignin-based adhesives, are witnessing higher demand as manufacturers seek to align with sustainability goals and reduce reliance on fossil fuel-derived raw materials. As industries prioritize the adoption of environmentally friendly adhesives for wood bonding applications, the market for sustainable wood adhesives is experiencing growth and innovation to meet evolving industry requirements and market trends.

The driver behind the growth of the wood adhesives market is the expansion in construction and furniture industries. With increasing urbanization, population growth, and housing demand worldwide, there is a significant demand for wood adhesives used in various applications such as engineered wood products, furniture manufacturing, and construction of residential and commercial buildings. This driver is fueled by factors such as infrastructure development projects, housing market trends, and the growing preference for wood-based products in interior design and furniture. Wood adhesives play a crucial role in bonding wood substrates together to create structural components and finished products with high strength and durability. As construction activities and furniture production continue to expand, particularly in emerging markets, the demand for wood adhesives for use in wood bonding applications is expected to rise, driving market growth and opportunities for adhesive manufacturers and suppliers.

An opportunity for growth and differentiation in the wood adhesives market lies in the development of high-performance and specialty adhesive solutions. While conventional wood adhesives offer adequate bonding strength and durability for standard applications, there is potential for innovation in adhesive formulations tailored to meet the specific needs of niche markets and high-value applications. By investing in research and development, adhesive manufacturers can develop specialty adhesives with enhanced properties such as water resistance, heat resistance, and adhesion to difficult-to-bond substrates. Additionally, there is an opportunity to innovate in adhesive technologies that enable faster curing times, improved application properties, and compatibility with automated manufacturing processes. By collaborating with wood product manufacturers and understanding their unique bonding requirements, adhesive suppliers can capitalize on opportunities to provide innovative solutions that address unmet needs, enhance product performance, and differentiate themselves in the competitive wood adhesives market.

Within the Wood Adhesives market, the Urea-Formaldehyde (UF) segment is the largest segment. UF adhesives have been extensively used in the wood industry for decades due to their cost-effectiveness, versatility, and strong bonding properties. UF resins are widely employed in various woodworking applications, including furniture manufacturing, cabinetry, flooring, and plywood production. These adhesives offer excellent bonding strength, fast curing times, and compatibility with a wide range of wood substrates, making them suitable for both interior and exterior wood bonding applications. Additionally, UF adhesives provide good heat and moisture resistance, ensuring durable and long-lasting bonds even in challenging environmental conditions. Moreover, the established manufacturing infrastructure and widespread availability of UF resins contribute to their dominance in the wood adhesives market. As a result, the Urea-Formaldehyde (UF) segment commands a significant share of the market, reflecting its established reputation and widespread use in the wood industry.

Within the Wood Adhesives market, the Housing Components segment is experiencing rapid growth. The construction industry, particularly the residential housing sector, is witnessing a surge in demand for wood-based building components such as structural beams, panels, trusses, and prefabricated housing elements. Wood adhesives play a crucial role in bonding these components together to create strong and durable structures. The increasing adoption of wood-based construction methods, driven by factors such as sustainability, cost-effectiveness, and ease of construction, is fuelling the demand for wood adhesives in housing component applications. Additionally, the growing trend towards modular and off-site construction techniques further amplifies the need for reliable and high-performance wood adhesives that can withstand transportation, handling, and assembly processes. Moreover, government initiatives promoting green building practices and energy-efficient construction methods contribute to the growth of the Housing Components segment, as wood-based construction is often preferred for its environmental benefits. As a result, the Housing Components segment is the fastest-growing segment within the Wood Adhesives market, propelled by the expanding adoption of wood-based construction solutions in the housing sector.

Within the Wood Adhesives market, the Particle Board (PB) segment is the largest segment. Particle board, also known as chipboard, is a widely used substrate in various woodworking applications due to its affordability, versatility, and ease of use. PB consists of wood particles or chips bonded together with adhesive resins, making it an ideal substrate for furniture manufacturing, cabinetry, shelving, and interior panelling. The demand for particle board continues to grow, particularly in residential and commercial construction projects, where it is used for wall panels, flooring underlayment, and furniture components. Additionally, advancements in adhesive technologies have led to the development of specialized wood adhesives tailored specifically for bonding particle board substrates, ensuring strong and durable joints. Moreover, the availability of raw materials and the cost-effectiveness of particle board production contribute to its dominance as the largest segment in the Wood Adhesives market. As a result, the Particle Board (PB) segment commands a significant share of the market, reflecting its widespread use and popularity in the woodworking industry.

By Product

Urea-Formaldehyde (UF)

Melamine urea-formaldehyde (MUF)

Phenol-formaldehyde (PF)

Isocyanates

Polyurethane

Polyvinyl acetate (PVA)

Soy-based

Others

By Application

Flooring

Furniture

Doors & windows

Housing components

Others

By Substrate

Solid wood

Oriented Strand Board (OSB)

Plywood

Particle Board (PB)

Medium-Density fiberboard (MDF)

High-Density fiberboard (HDF)

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

3M Company

Akzo Nobel N.V.

Ashland Inc

Bostik S.A.

DuPont de Nemours Inc

Franklin Adhesives & Polymers

H.B. Fuller Company

Henkel AG & Co. KGaA

Jubiulant Industries Ltd

Pidilite Industries Ltd

Sika AG

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Wood Adhesives Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Wood Adhesives Market Size Outlook, $ Million, 2021 to 2032

3.2 Wood Adhesives Market Outlook by Type, $ Million, 2021 to 2032

3.3 Wood Adhesives Market Outlook by Product, $ Million, 2021 to 2032

3.4 Wood Adhesives Market Outlook by Application, $ Million, 2021 to 2032

3.5 Wood Adhesives Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Wood Adhesives Industry

4.2 Key Market Trends in Wood Adhesives Industry

4.3 Potential Opportunities in Wood Adhesives Industry

4.4 Key Challenges in Wood Adhesives Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Wood Adhesives Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Wood Adhesives Market Outlook by Segments

7.1 Wood Adhesives Market Outlook by Segments, $ Million, 2021- 2032

By Product

Urea-Formaldehyde (UF)

Melamine urea-formaldehyde (MUF)

Phenol-formaldehyde (PF)

Isocyanates

Polyurethane

Polyvinyl acetate (PVA)

Soy-based

Others

By Application

Flooring

Furniture

Doors & windows

Housing components

Others

By Substrate

Solid wood

Oriented Strand Board (OSB)

Plywood

Particle Board (PB)

Medium-Density fiberboard (MDF)

High-Density fiberboard (HDF)

Others

8 North America Wood Adhesives Market Analysis and Outlook To 2032

8.1 Introduction to North America Wood Adhesives Markets in 2024

8.2 North America Wood Adhesives Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Wood Adhesives Market size Outlook by Segments, 2021-2032

By Product

Urea-Formaldehyde (UF)

Melamine urea-formaldehyde (MUF)

Phenol-formaldehyde (PF)

Isocyanates

Polyurethane

Polyvinyl acetate (PVA)

Soy-based

Others

By Application

Flooring

Furniture

Doors & windows

Housing components

Others

By Substrate

Solid wood

Oriented Strand Board (OSB)

Plywood

Particle Board (PB)

Medium-Density fiberboard (MDF)

High-Density fiberboard (HDF)

Others

9 Europe Wood Adhesives Market Analysis and Outlook To 2032

9.1 Introduction to Europe Wood Adhesives Markets in 2024

9.2 Europe Wood Adhesives Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Wood Adhesives Market Size Outlook by Segments, 2021-2032

By Product

Urea-Formaldehyde (UF)

Melamine urea-formaldehyde (MUF)

Phenol-formaldehyde (PF)

Isocyanates

Polyurethane

Polyvinyl acetate (PVA)

Soy-based

Others

By Application

Flooring

Furniture

Doors & windows

Housing components

Others

By Substrate

Solid wood

Oriented Strand Board (OSB)

Plywood

Particle Board (PB)

Medium-Density fiberboard (MDF)

High-Density fiberboard (HDF)

Others

10 Asia Pacific Wood Adhesives Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Wood Adhesives Markets in 2024

10.2 Asia Pacific Wood Adhesives Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Wood Adhesives Market size Outlook by Segments, 2021-2032

By Product

Urea-Formaldehyde (UF)

Melamine urea-formaldehyde (MUF)

Phenol-formaldehyde (PF)

Isocyanates

Polyurethane

Polyvinyl acetate (PVA)

Soy-based

Others

By Application

Flooring

Furniture

Doors & windows

Housing components

Others

By Substrate

Solid wood

Oriented Strand Board (OSB)

Plywood

Particle Board (PB)

Medium-Density fiberboard (MDF)

High-Density fiberboard (HDF)

Others

11 South America Wood Adhesives Market Analysis and Outlook To 2032

11.1 Introduction to South America Wood Adhesives Markets in 2024

11.2 South America Wood Adhesives Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Wood Adhesives Market size Outlook by Segments, 2021-2032

By Product

Urea-Formaldehyde (UF)

Melamine urea-formaldehyde (MUF)

Phenol-formaldehyde (PF)

Isocyanates

Polyurethane

Polyvinyl acetate (PVA)

Soy-based

Others

By Application

Flooring

Furniture

Doors & windows

Housing components

Others

By Substrate

Solid wood

Oriented Strand Board (OSB)

Plywood

Particle Board (PB)

Medium-Density fiberboard (MDF)

High-Density fiberboard (HDF)

Others

12 Middle East and Africa Wood Adhesives Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Wood Adhesives Markets in 2024

12.2 Middle East and Africa Wood Adhesives Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Wood Adhesives Market size Outlook by Segments, 2021-2032

By Product

Urea-Formaldehyde (UF)

Melamine urea-formaldehyde (MUF)

Phenol-formaldehyde (PF)

Isocyanates

Polyurethane

Polyvinyl acetate (PVA)

Soy-based

Others

By Application

Flooring

Furniture

Doors & windows

Housing components

Others

By Substrate

Solid wood

Oriented Strand Board (OSB)

Plywood

Particle Board (PB)

Medium-Density fiberboard (MDF)

High-Density fiberboard (HDF)

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

3M Company

Akzo Nobel N.V.

Ashland Inc

Bostik S.A.

DuPont de Nemours Inc

Franklin Adhesives & Polymers

H.B. Fuller Company

Henkel AG & Co. KGaA

Jubiulant Industries Ltd

Pidilite Industries Ltd

Sika AG

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Urea-Formaldehyde (UF)

Melamine urea-formaldehyde (MUF)

Phenol-formaldehyde (PF)

Isocyanates

Polyurethane

Polyvinyl acetate (PVA)

Soy-based

Others

By Application

Flooring

Furniture

Doors & windows

Housing components

Others

By Substrate

Solid wood

Oriented Strand Board (OSB)

Plywood

Particle Board (PB)

Medium-Density fiberboard (MDF)

High-Density fiberboard (HDF)

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Wood Adhesives Market Size is valued at $6.8 Billion in 2024 and is forecast to register a growth rate (CAGR) of 8.8% to reach $13.4 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

3M Company, Akzo Nobel N.V., Ashland Inc, Bostik S.A., DuPont de Nemours Inc, Franklin Adhesives & Polymers, H.B. Fuller Company, Henkel AG & Co. KGaA, Jubiulant Industries Ltd, Pidilite Industries Ltd, Sika AG

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume