The global Windows and Doors Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Material (Metal, Wood, Plastic, Others), By End-User (Residential, Commercial).

The windows and doors market is witnessing dynamic growth fueled by urbanization, construction activities, and the renovation and remodeling sector. Windows and doors are essential components of residential, commercial, and industrial buildings, impacting both aesthetics and functionality. Key trends shaping the future of the windows and doors industry include the adoption of energy-efficient designs and materials to comply with building codes and energy performance standards, integration of smart technologies for enhanced security, automation, and convenience, and customization options to meet diverse architectural styles and customer preferences. Moreover, with the growing focus on sustainability and green building practices, there is a rising demand for windows and doors made from recycled materials, certified wood, and eco-friendly composites, as well as products designed for easy disassembly and recycling at the end of their service life. Additionally, advancements in manufacturing processes such as 3D printing and digital fabrication are enabling faster prototyping, customization, and cost-effective production of windows and doors tailored to specific project requirements.

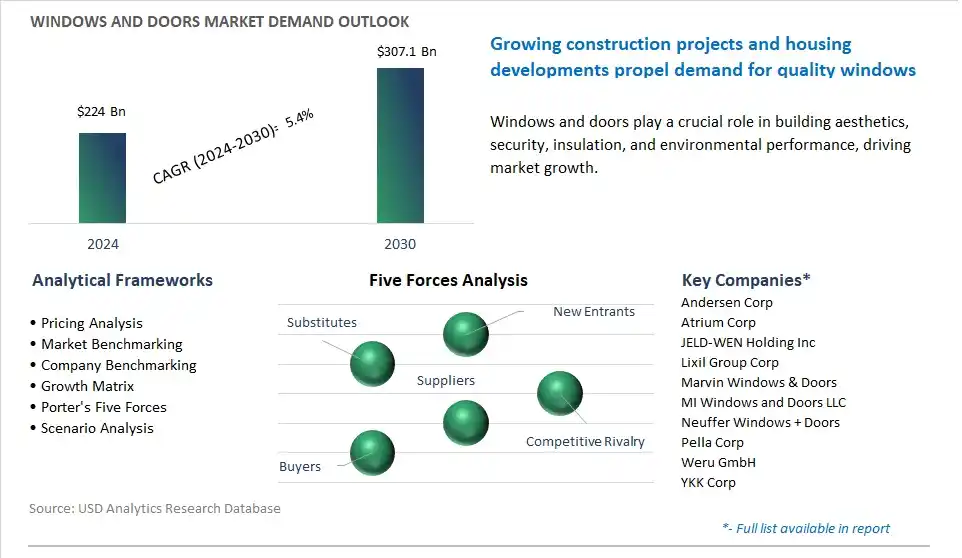

The market report analyses the leading companies in the industry including Andersen Corp, Atrium Corp, JELD-WEN Holding Inc, Lixil Group Corp, Marvin Windows & Doors, MI Windows and Doors LLC, Neuffer Windows + Doors, Pella Corp, Weru GmbH, YKK Corp.

A prominent trend in the windows and doors market is the increasing emphasis on energy efficiency and sustainability. With rising awareness of environmental issues and energy consumption, consumers and building developers are prioritizing the installation of windows and doors that offer superior insulation, thermal performance, and sustainability credentials. Energy-efficient windows and doors, equipped with features such as low-emissivity coatings, double or triple glazing, and insulated frames, help to reduce heat loss, minimize air leakage, and lower heating and cooling costs. Additionally, there is a growing demand for sustainable materials and manufacturing processes in the construction industry, driving the adoption of eco-friendly windows and doors made from recycled materials or sourced from sustainable forests.

The primary driver for the windows and doors market is the growth in residential and commercial construction activities. As populations grow, urbanization continues, and infrastructure development expands, there is a steady demand for new buildings and renovation projects worldwide. Windows and doors are essential components of building construction, providing natural light, ventilation, security, and aesthetic appeal. Factors such as population growth, changing lifestyle preferences, and urbanization drive the need for new housing developments, commercial buildings, and infrastructure projects, fueling demand for windows and doors across residential, commercial, and institutional sectors. The construction of energy-efficient and sustainable buildings further amplifies the demand for high-performance windows and doors that meet regulatory standards and green building certifications.

An opportunity for market advancement in the windows and doors segment lies in the integration of smart and connected technologies. With the proliferation of the Internet of Things (IoT) and smart home automation systems, there is potential to develop windows and doors equipped with sensors, actuators, and connectivity features that enable remote monitoring, control, and automation of building environments. Smart windows and doors can adjust their operation based on environmental conditions, occupancy status, and user preferences, enhancing comfort, security, and energy efficiency. By offering integrated smart building solutions that optimize indoor environments and enhance user experience, manufacturers can capitalize on the growing demand for connected homes and buildings and differentiate themselves in the competitive windows and doors market. Collaboration with technology partners, building automation firms, and smart home integrators can facilitate the development and deployment of smart window and door solutions, unlocking new opportunities for revenue growth and market leadership in the windows and doors industry.

The largest segment in the Windows and Doors Market is the Plastic category. Plastic, particularly uPVC (unplasticized polyvinyl chloride), has become increasingly popular in the construction industry for windows and doors due to potential advantages it offers. uPVC is highly durable and resistant to rot, corrosion, and decay, making it suitable for use in various climates and environments. Unlike wood, uPVC does not require regular maintenance such as painting or sealing, reducing long-term upkeep costs for homeowners and building managers. Additionally, uPVC windows and doors provide excellent thermal insulation, helping to improve energy efficiency and reduce heating and cooling costs. They also offer good sound insulation, enhancing comfort and privacy indoors. Further, uPVC is a versatile material that can be easily molded into different shapes and styles to suit various architectural designs and preferences. Furthermore, uPVC is relatively cost-effective compared to other materials like wood or metal, making it accessible to a wide range of consumers. Over the forecast period, these factors contribute to the widespread adoption of plastic, particularly uPVC, making it the largest segment in the Windows and Doors Market.

The fastest-growing segment in the Windows and Doors Market is the Residential category. Diverse factors contribute to the rapid growth of residential windows and doors compared to commercial applications. There has been a surge in residential construction and renovation projects driven by population growth, urbanization, and low mortgage rates. As more people seek to own homes or upgrade their existing residences, the demand for windows and doors in the residential sector increases. Additionally, homeowners are increasingly investing in energy-efficient and aesthetically pleasing windows and doors to enhance the comfort, appearance, and value of their homes. Energy-efficient windows and doors help reduce heating and cooling costs, making them an attractive option for homeowners looking to improve energy efficiency and lower utility bills. Further, advancements in window and door technology, such as improved insulation and soundproofing, further contribute to the appeal of residential products. As homeowners prioritize comfort, energy savings, and aesthetics, the demand for residential windows and doors is expected to continue growing rapidly, making it the fastest-growing segment in the Windows and Doors Market.

By Material

Metal

Wood

Plastic

Others

By End-User

Residential

Commercial

Regions Included

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Andersen Corp

Atrium Corp

JELD-WEN Holding Inc

Lixil Group Corp

Marvin Windows & Doors

MI Windows and Doors LLC

Neuffer Windows + Doors

Pella Corp

Weru GmbH

YKK Corp

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Windows and Doors Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Windows and Doors Market Size Outlook, $ Million, 2021 to 2030

3.2 Windows and Doors Market Outlook by Type, $ Million, 2021 to 2030

3.3 Windows and Doors Market Outlook by Product, $ Million, 2021 to 2030

3.4 Windows and Doors Market Outlook by Application, $ Million, 2021 to 2030

3.5 Windows and Doors Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Windows and Doors Industry

4.2 Key Market Trends in Windows and Doors Industry

4.3 Potential Opportunities in Windows and Doors Industry

4.4 Key Challenges in Windows and Doors Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Windows and Doors Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Windows and Doors Market Outlook by Segments

7.1 Windows and Doors Market Outlook by Segments, $ Million, 2021- 2030

By Material

Metal

Wood

Plastic

Others

By End-User

Residential

Commercial

8 North America Windows and Doors Market Analysis and Outlook To 2030

8.1 Introduction to North America Windows and Doors Markets in 2024

8.2 North America Windows and Doors Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Windows and Doors Market size Outlook by Segments, 2021-2030

By Material

Metal

Wood

Plastic

Others

By End-User

Residential

Commercial

9 Europe Windows and Doors Market Analysis and Outlook To 2030

9.1 Introduction to Europe Windows and Doors Markets in 2024

9.2 Europe Windows and Doors Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Windows and Doors Market Size Outlook by Segments, 2021-2030

By Material

Metal

Wood

Plastic

Others

By End-User

Residential

Commercial

10 Asia Pacific Windows and Doors Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Windows and Doors Markets in 2024

10.2 Asia Pacific Windows and Doors Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Windows and Doors Market size Outlook by Segments, 2021-2030

By Material

Metal

Wood

Plastic

Others

By End-User

Residential

Commercial

11 South America Windows and Doors Market Analysis and Outlook To 2030

11.1 Introduction to South America Windows and Doors Markets in 2024

11.2 South America Windows and Doors Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Windows and Doors Market size Outlook by Segments, 2021-2030

By Material

Metal

Wood

Plastic

Others

By End-User

Residential

Commercial

12 Middle East and Africa Windows and Doors Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Windows and Doors Markets in 2024

12.2 Middle East and Africa Windows and Doors Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Windows and Doors Market size Outlook by Segments, 2021-2030

By Material

Metal

Wood

Plastic

Others

By End-User

Residential

Commercial

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Andersen Corp

Atrium Corp

JELD-WEN Holding Inc

Lixil Group Corp

Marvin Windows & Doors

MI Windows and Doors LLC

Neuffer Windows + Doors

Pella Corp

Weru GmbH

YKK Corp

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Material

Metal

Wood

Plastic

Others

By End-User

Residential

Commercial

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Windows and Doors is forecast to reach $307.1 Billion in 2030 from $224 Billion in 2024, registering a CAGR of 5.4%

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Andersen Corp, Atrium Corp, JELD-WEN Holding Inc, Lixil Group Corp, Marvin Windows & Doors, MI Windows and Doors LLC, Neuffer Windows + Doors, Pella Corp, Weru GmbH, YKK Corp

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume