The global White Inorganic Pigments Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Aluminium Silicate, Calcium Silicate, Calcium Carbonate, Silica, Titanium Dioxide, Zinc Oxide, Others), By Application (Paints & Coatings, Adhesives & Sealants, Plastics, Cosmetics, Paper, Inks, Others).

White inorganic pigments are essential components in coatings, paints, plastics, ceramics, and construction materials, providing opacity, brightness, and UV resistance in 2024. These pigments are derived from minerals such as titanium dioxide, zinc oxide, and various types of white clays, each offering unique properties and performance characteristics. White inorganic pigments are used to impart whiteness, opacity, and color stability to a wide range of products, from architectural paints and automotive coatings to cosmetics and food packaging. Titanium dioxide (TiO2) is the most widely used white pigment due to its excellent hiding power, brightness, and weather resistance, making it a staple in exterior paints, plastics, and industrial coatings. Zinc oxide (ZnO) is valued for its UV-blocking properties and is commonly used in sunscreens, cosmetics, and polymer applications to provide protection against UV radiation and photo-degradation. White clays such as kaolin and calcium carbonate are used as extenders and fillers in paints, plastics, and paper to improve opacity, texture, and rheological properties. With increasing focus on sustainability and regulatory compliance, manufacturers are developing eco-friendly and low-VOC formulations using white inorganic pigments, driving innovation and adoption in various industries seeking high-performance and environmentally responsible solutions for their products and applications.

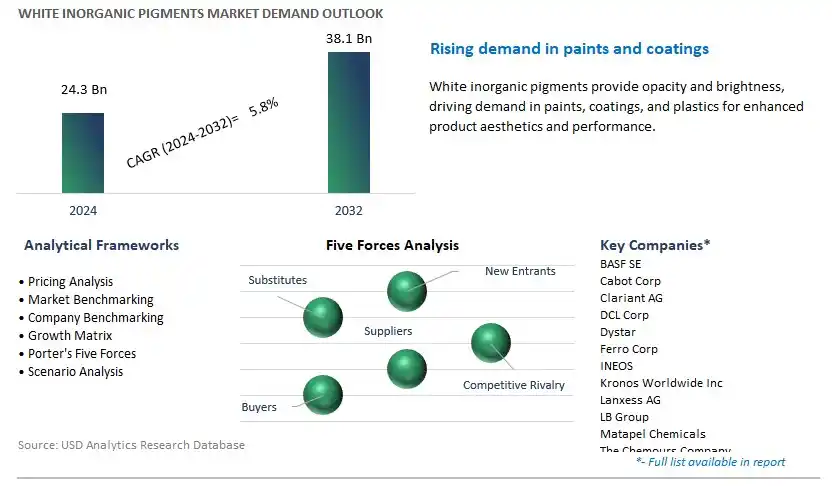

The market report analyses the leading companies in the industry including BASF SE, Cabot Corp, Clariant AG, DCL Corp, Dystar, Ferro Corp, INEOS, Kronos Worldwide Inc, Lanxess AG, LB Group, Matapel Chemicals, The Chemours Company, Tronox Holdings Plc, Valhi Inc, Venator Materials Plc, and others.

A significant market trend in the white inorganic pigments industry is the shift towards sustainable and high-performance formulations. With increasing awareness of environmental issues and regulations governing chemical usage, there is a growing demand for white pigments that offer both superior performance and reduced environmental impact. This trend is driven by factors such as stricter regulatory standards, consumer preferences for eco-friendly products, and advancements in pigment technology. White inorganic pigments that provide excellent opacity, brightness, and color stability while minimizing heavy metal content and emissions are witnessing higher demand as industries seek sustainable alternatives for various applications including paints, coatings, plastics, and ceramics. As manufacturers prioritize sustainability and performance in their product offerings, the market for white inorganic pigments is experiencing growth and innovation to meet evolving industry requirements and market trends.

The driver behind the growth of the white inorganic pigments market is the expansion in construction and infrastructure projects. With ongoing urbanization, population growth, and infrastructure development worldwide, there is a significant demand for white pigments used in architectural paints, coatings, and construction materials. This driver is fueled by factors such as government investments in infrastructure projects, housing market trends, and commercial development initiatives. White inorganic pigments play a crucial role in providing durability, weatherability, and aesthetic appeal to architectural coatings and construction materials such as concrete, plaster, and mortar. As construction activities continue to expand, particularly in emerging markets, the demand for white inorganic pigments for use in exterior and interior applications is expected to rise, driving market growth and opportunities for pigment manufacturers and suppliers.

An opportunity for growth and differentiation in the white inorganic pigments market lies in the development of specialty grades for high-value applications. While white pigments are commonly used in architectural coatings and construction materials, there is potential for penetration into new sectors with specialized requirements for pigment performance and functionality. By developing specialty grades tailored to meet the demands of specific industries and applications such as automotive coatings, cosmetic formulations, and electronic ceramics, pigment manufacturers can address emerging market needs and capture additional market share. For example, high-purity titanium dioxide pigments are sought after in the cosmetics industry for their brightness and color consistency, while specialty grades of zinc oxide are used in niche applications such as sunscreens and pharmaceuticals. By focusing on innovation and customization to meet the unique requirements of high-value applications, white inorganic pigment producers can expand their product portfolios, enter new markets, and drive revenue growth in the competitive pigment industry.

Within the White Inorganic Pigments market, the Titanium Dioxide segment is the largest segment. Titanium Dioxide (TiO2) is the most widely used white pigment in various industries, including paints and coatings, plastics, paper, cosmetics, and ceramics, due to its exceptional opacity, brightness, and whiteness. TiO2 offers superior hiding power, allowing for excellent coverage and color consistency in coatings and formulations. Moreover, titanium dioxide is chemically inert, stable, and resistant to UV radiation, making it suitable for outdoor applications where durability and weather resistance are essential. Additionally, the growing construction and infrastructure development activities worldwide contribute to the demand for titanium dioxide in architectural coatings and construction materials. Furthermore, advancements in TiO2 manufacturing technologies, such as the development of rutile and Nano-sized particles, enhance its performance and application versatility, further solidifying its position as the largest segment in the White Inorganic Pigments market.

Within the White Inorganic Pigments market, the Plastics segment is experiencing rapid growth. White inorganic pigments are widely used in the plastics industry to impart color, opacity, and brightness to various plastic products, including packaging materials, consumer goods, automotive components, and construction materials. The increasing demand for white pigments in plastics can be attributed to the growing consumer preference for aesthetically appealing and high-quality plastic products. Additionally, stringent regulations and consumer awareness regarding the use of safe and non-toxic materials in plastic products drive the demand for white inorganic pigments, which are known for their stability, inertness, and compliance with regulatory standards. Moreover, the rising trend towards lightweighting and sustainability in the plastics industry further boosts the demand for white pigments, as they enable the production of durable and visually appealing plastics with reduced environmental impact. As a result, the Plastics segment is the fastest-growing segment within the White Inorganic Pigments market, propelled by the expanding applications and increasing demand for white pigments in the plastics industry.

By Product

Aluminium Silicate

Calcium Silicate

Calcium Carbonate

Silica

Titanium Dioxide

Zinc Oxide

Others

By Application

Paints & Coatings

Adhesives & Sealants

Plastics

Cosmetics

Paper

Inks

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

BASF SE

Cabot Corp

Clariant AG

DCL Corp

Dystar

Ferro Corp

INEOS

Kronos Worldwide Inc

Lanxess AG

LB Group

Matapel Chemicals

The Chemours Company

Tronox Holdings Plc

Valhi Inc

Venator Materials Plc

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 White Inorganic Pigments Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global White Inorganic Pigments Market Size Outlook, $ Million, 2021 to 2032

3.2 White Inorganic Pigments Market Outlook by Type, $ Million, 2021 to 2032

3.3 White Inorganic Pigments Market Outlook by Product, $ Million, 2021 to 2032

3.4 White Inorganic Pigments Market Outlook by Application, $ Million, 2021 to 2032

3.5 White Inorganic Pigments Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of White Inorganic Pigments Industry

4.2 Key Market Trends in White Inorganic Pigments Industry

4.3 Potential Opportunities in White Inorganic Pigments Industry

4.4 Key Challenges in White Inorganic Pigments Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global White Inorganic Pigments Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global White Inorganic Pigments Market Outlook by Segments

7.1 White Inorganic Pigments Market Outlook by Segments, $ Million, 2021- 2032

By Product

Aluminium Silicate

Calcium Silicate

Calcium Carbonate

Silica

Titanium Dioxide

Zinc Oxide

Others

By Application

Paints & Coatings

Adhesives & Sealants

Plastics

Cosmetics

Paper

Inks

Others

8 North America White Inorganic Pigments Market Analysis and Outlook To 2032

8.1 Introduction to North America White Inorganic Pigments Markets in 2024

8.2 North America White Inorganic Pigments Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America White Inorganic Pigments Market size Outlook by Segments, 2021-2032

By Product

Aluminium Silicate

Calcium Silicate

Calcium Carbonate

Silica

Titanium Dioxide

Zinc Oxide

Others

By Application

Paints & Coatings

Adhesives & Sealants

Plastics

Cosmetics

Paper

Inks

Others

9 Europe White Inorganic Pigments Market Analysis and Outlook To 2032

9.1 Introduction to Europe White Inorganic Pigments Markets in 2024

9.2 Europe White Inorganic Pigments Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe White Inorganic Pigments Market Size Outlook by Segments, 2021-2032

By Product

Aluminium Silicate

Calcium Silicate

Calcium Carbonate

Silica

Titanium Dioxide

Zinc Oxide

Others

By Application

Paints & Coatings

Adhesives & Sealants

Plastics

Cosmetics

Paper

Inks

Others

10 Asia Pacific White Inorganic Pigments Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific White Inorganic Pigments Markets in 2024

10.2 Asia Pacific White Inorganic Pigments Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific White Inorganic Pigments Market size Outlook by Segments, 2021-2032

By Product

Aluminium Silicate

Calcium Silicate

Calcium Carbonate

Silica

Titanium Dioxide

Zinc Oxide

Others

By Application

Paints & Coatings

Adhesives & Sealants

Plastics

Cosmetics

Paper

Inks

Others

11 South America White Inorganic Pigments Market Analysis and Outlook To 2032

11.1 Introduction to South America White Inorganic Pigments Markets in 2024

11.2 South America White Inorganic Pigments Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America White Inorganic Pigments Market size Outlook by Segments, 2021-2032

By Product

Aluminium Silicate

Calcium Silicate

Calcium Carbonate

Silica

Titanium Dioxide

Zinc Oxide

Others

By Application

Paints & Coatings

Adhesives & Sealants

Plastics

Cosmetics

Paper

Inks

Others

12 Middle East and Africa White Inorganic Pigments Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa White Inorganic Pigments Markets in 2024

12.2 Middle East and Africa White Inorganic Pigments Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa White Inorganic Pigments Market size Outlook by Segments, 2021-2032

By Product

Aluminium Silicate

Calcium Silicate

Calcium Carbonate

Silica

Titanium Dioxide

Zinc Oxide

Others

By Application

Paints & Coatings

Adhesives & Sealants

Plastics

Cosmetics

Paper

Inks

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

BASF SE

Cabot Corp

Clariant AG

DCL Corp

Dystar

Ferro Corp

INEOS

Kronos Worldwide Inc

Lanxess AG

LB Group

Matapel Chemicals

The Chemours Company

Tronox Holdings Plc

Valhi Inc

Venator Materials Plc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Aluminium Silicate

Calcium Silicate

Calcium Carbonate

Silica

Titanium Dioxide

Zinc Oxide

Others

By Application

Paints & Coatings

Adhesives & Sealants

Plastics

Cosmetics

Paper

Inks

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global White Inorganic Pigments Market Size is valued at $24.3 Billion in 2024 and is forecast to register a growth rate (CAGR) of 5.8% to reach $38.1 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

BASF SE, Cabot Corp, Clariant AG, DCL Corp, Dystar, Ferro Corp, INEOS, Kronos Worldwide Inc, Lanxess AG, LB Group, Matapel Chemicals, The Chemours Company, Tronox Holdings Plc, Valhi Inc, Venator Materials Plc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume