The global Welding Materials Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Electrodes & Filler Materials, Fluxes & Wires, Gases), By Technology (Arc Welding, Resistance Welding, Oxy-Fuel Welding, Others), By End-User (Transportation, Building & Construction, Heavy Industries, Others).

Welding materials play a crucial role in joining metals and alloys in various industries, including construction, automotive, aerospace, and manufacturing, in 2024. These materials include welding electrodes, filler metals, fluxes, shielding gases, and welding consumables, each designed to meet specific welding requirements and applications. Welding electrodes and filler metals provide the necessary material for creating strong and durable welds, while fluxes and shielding gases protect the weld pool from atmospheric contamination and oxidation during the welding process. Welding materials come in various forms, including solid wires, flux-cored wires, stick electrodes, and welding powders, offering versatility and compatibility with different welding techniques and equipment. In construction and fabrication, welding materials are used for joining structural steel, pipelines, and sheet metal components, providing structural integrity and reliability in buildings, bridges, and infrastructure projects. Similarly, in automotive and aerospace manufacturing, welding materials are employed for assembling vehicle frames, aircraft structures, and engine components, ensuring strength, safety, and performance in demanding operating conditions. With advancements in welding technology, materials science, and automation, welding materials to evolve to meet the increasing demands for efficiency, quality, and innovation in welding processes across industries, driving progress and advancements in manufacturing and construction sectors worldwide.

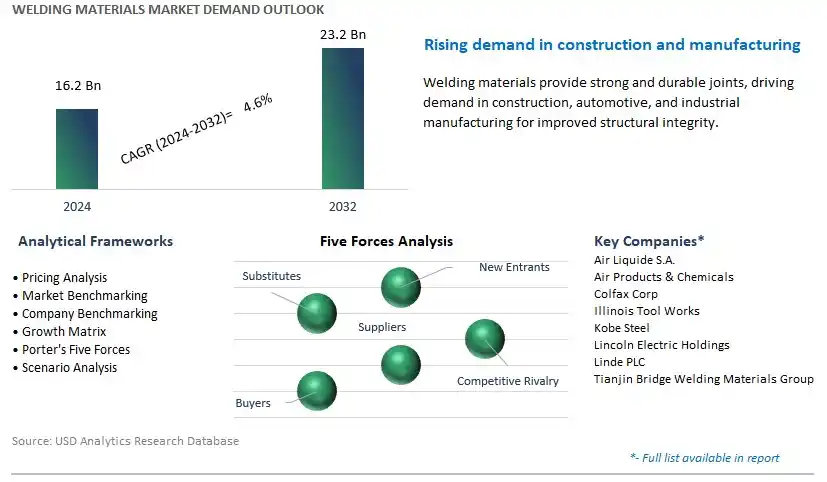

The market report analyses the leading companies in the industry including Air Liquide S.A., Air Products & Chemicals, Colfax Corp, Illinois Tool Works, Kobe Steel, Lincoln Electric Holdings, Linde PLC, Tianjin Bridge Welding Materials Group, and others.

A significant market trend in the welding materials industry is the adoption of advanced welding techniques. As industries across sectors seek to improve efficiency, productivity, and quality in welding processes, there is a growing demand for materials that can support advanced welding methods such as robotic welding, laser welding, and friction stir welding. This trend is driven by factors such as automation, digitalization, and the need for precise and consistent welds in complex manufacturing applications. Welding materials that offer compatibility with advanced welding techniques, including specialized consumables, filler metals, and shielding gases, are witnessing higher demand as manufacturers seek to optimize their welding processes for increased throughput and reduced defects. As industries embrace advanced welding technologies to stay competitive in the global market, the demand for materials tailored to meet the requirements of these techniques is experiencing growth and greater adoption.

The driver behind the growth of the welding materials market is industrial expansion and infrastructure development. With ongoing urbanization, population growth, and infrastructure upgrades worldwide, there is a significant expansion of construction, manufacturing, and infrastructure projects that require welding services. This driver is fueled by investments in sectors such as automotive, construction, energy, aerospace, and shipbuilding, which rely heavily on welding for fabrication and assembly processes. As industries expand their operations and governments invest in infrastructure modernization and construction projects, the demand for welding materials such as electrodes, wires, fluxes, and gases continues to rise. Additionally, the repair and maintenance of aging infrastructure and equipment contribute to sustained demand for welding materials, driving market growth and opportunities for manufacturers and suppliers in the welding industry.

An opportunity for growth and differentiation in the welding materials market lies in the development of high-performance consumables and alloys. While traditional welding materials focus on basic requirements such as weldability and strength, there is potential for innovation in materials that offer enhanced properties such as corrosion resistance, fatigue strength, and temperature resistance. By developing specialized consumables and alloys tailored to meet the demands of specific industries and applications, welding material manufacturers can address emerging challenges and market needs. For example, the aerospace and automotive industries demand lightweight materials with superior strength and fatigue resistance, while the oil and gas industry requires welding materials that can withstand corrosive environments and high temperatures. By collaborating with end-users and leveraging advanced material science and manufacturing technologies, welding material developers can capitalize on opportunities to provide innovative solutions that enhance welding performance, durability, and efficiency in diverse applications.

Within the Welding Materials market, the Electrodes & Filler Materials segment is the largest segment. Electrodes and filler materials are essential components in welding processes, providing the necessary material to join metals together effectively. Electrodes serve as the conductor of electricity and the source of the welding arc, while filler materials are used to fill the gap between the two metal pieces being joined, ensuring a strong and durable bond. The widespread use of electrodes and filler materials across various welding techniques, such as arc welding, MIG (Metal Inert Gas) welding, and TIG (Tungsten Inert Gas) welding, contributes to the dominance of this segment in the market. Moreover, the growing demand for welding materials in industries such as automotive, construction, manufacturing, and aerospace further drives the consumption of electrodes and filler materials. Additionally, advancements in electrode and filler material formulations, including the development of specialized alloys and coatings, enhance welding efficiency, productivity, and quality, making them indispensable in modern welding applications. Thus, the Electrodes & Filler Materials segment commands a significant share of the Welding Materials market due to its critical role in ensuring strong and reliable welds across diverse industries and applications.

Within the Welding Materials market, the Arc Welding segment is experiencing rapid growth. Arc welding is a widely used welding technology that utilizes an electric arc to melt and join metals together. The increasing adoption of arc welding techniques, such as Shielded Metal Arc Welding (SMAW), Gas Metal Arc Welding (GMAW), and Flux-Cored Arc Welding (FCAW), across various industries is driving the demand for welding materials associated with this technology. Arc welding offers potential advantages, including versatility, suitability for a wide range of metals and thicknesses, and relatively low equipment costs compared to other welding methods. Moreover, advancements in arc welding technology, such as the development of innovative power sources, welding consumables, and automation solutions, are enhancing productivity, efficiency, and weld quality, further fuelling the growth of the Arc Welding segment. Additionally, the increasing demand for arc welding in industries such as automotive, construction, shipbuilding, and infrastructure development is contributing to the segment's rapid expansion. As a result, the Arc Welding segment is the fastest-growing segment within the Welding Materials market, propelled by its versatility, technological advancements, and widespread adoption across diverse industrial applications.

Within the Welding Materials market, the Transportation segment stands out as the largest segment. The transportation industry, including automotive, aerospace, rail, and shipbuilding sectors, relies heavily on welding materials for the manufacturing, repair, and maintenance of vehicles, aircraft, vessels, and infrastructure. Welding materials are integral to the fabrication of vehicle frames, body panels, engine components, and structural elements in transportation equipment. The constant demand for lightweight materials, such as aluminum and advanced high-strength steels, in the transportation sector further boosts the consumption of welding materials, as these materials require specialized welding techniques and consumables. Additionally, the ongoing advancements in transportation technology, such as the shift towards electric vehicles, autonomous vehicles, and lightweight materials, drive the need for innovative welding materials and processes to meet evolving industry requirements. As a result, the Transportation segment commands a significant share of the Welding Materials market, reflecting the critical role of welding materials in ensuring the safety, performance, and efficiency of transportation systems and equipment.

By Type

Electrodes & Filler Materials

Fluxes & Wires

Gases

By Technology

Arc Welding

Resistance Welding

Oxy-Fuel Welding

Others

By End-User

Transportation

Building & Construction

Heavy Industries

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Air Liquide S.A.

Air Products & Chemicals

Colfax Corp

Illinois Tool Works

Kobe Steel

Lincoln Electric Holdings

Linde PLC

Tianjin Bridge Welding Materials Group

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Welding Materials Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Welding Materials Market Size Outlook, $ Million, 2021 to 2032

3.2 Welding Materials Market Outlook by Type, $ Million, 2021 to 2032

3.3 Welding Materials Market Outlook by Product, $ Million, 2021 to 2032

3.4 Welding Materials Market Outlook by Application, $ Million, 2021 to 2032

3.5 Welding Materials Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Welding Materials Industry

4.2 Key Market Trends in Welding Materials Industry

4.3 Potential Opportunities in Welding Materials Industry

4.4 Key Challenges in Welding Materials Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Welding Materials Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Welding Materials Market Outlook by Segments

7.1 Welding Materials Market Outlook by Segments, $ Million, 2021- 2032

By Type

Electrodes & Filler Materials

Fluxes & Wires

Gases

By Technology

Arc Welding

Resistance Welding

Oxy-Fuel Welding

Others

By End-User

Transportation

Building & Construction

Heavy Industries

Others

8 North America Welding Materials Market Analysis and Outlook To 2032

8.1 Introduction to North America Welding Materials Markets in 2024

8.2 North America Welding Materials Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Welding Materials Market size Outlook by Segments, 2021-2032

By Type

Electrodes & Filler Materials

Fluxes & Wires

Gases

By Technology

Arc Welding

Resistance Welding

Oxy-Fuel Welding

Others

By End-User

Transportation

Building & Construction

Heavy Industries

Others

9 Europe Welding Materials Market Analysis and Outlook To 2032

9.1 Introduction to Europe Welding Materials Markets in 2024

9.2 Europe Welding Materials Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Welding Materials Market Size Outlook by Segments, 2021-2032

By Type

Electrodes & Filler Materials

Fluxes & Wires

Gases

By Technology

Arc Welding

Resistance Welding

Oxy-Fuel Welding

Others

By End-User

Transportation

Building & Construction

Heavy Industries

Others

10 Asia Pacific Welding Materials Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Welding Materials Markets in 2024

10.2 Asia Pacific Welding Materials Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Welding Materials Market size Outlook by Segments, 2021-2032

By Type

Electrodes & Filler Materials

Fluxes & Wires

Gases

By Technology

Arc Welding

Resistance Welding

Oxy-Fuel Welding

Others

By End-User

Transportation

Building & Construction

Heavy Industries

Others

11 South America Welding Materials Market Analysis and Outlook To 2032

11.1 Introduction to South America Welding Materials Markets in 2024

11.2 South America Welding Materials Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Welding Materials Market size Outlook by Segments, 2021-2032

By Type

Electrodes & Filler Materials

Fluxes & Wires

Gases

By Technology

Arc Welding

Resistance Welding

Oxy-Fuel Welding

Others

By End-User

Transportation

Building & Construction

Heavy Industries

Others

12 Middle East and Africa Welding Materials Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Welding Materials Markets in 2024

12.2 Middle East and Africa Welding Materials Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Welding Materials Market size Outlook by Segments, 2021-2032

By Type

Electrodes & Filler Materials

Fluxes & Wires

Gases

By Technology

Arc Welding

Resistance Welding

Oxy-Fuel Welding

Others

By End-User

Transportation

Building & Construction

Heavy Industries

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Air Liquide S.A.

Air Products & Chemicals

Colfax Corp

Illinois Tool Works

Kobe Steel

Lincoln Electric Holdings

Linde PLC

Tianjin Bridge Welding Materials Group

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Electrodes & Filler Materials

Fluxes & Wires

Gases

By Technology

Arc Welding

Resistance Welding

Oxy-Fuel Welding

Others

By End-User

Transportation

Building & Construction

Heavy Industries

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Welding Materials Market Size is valued at $16.2 Billion in 2024 and is forecast to register a growth rate (CAGR) of 4.6% to reach $23.2 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Air Liquide S.A., Air Products & Chemicals, Colfax Corp, Illinois Tool Works, Kobe Steel, Lincoln Electric Holdings, Linde PLC, Tianjin Bridge Welding Materials Group

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume