The global Waterproofing Membranes Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Raw Material (Modified Bitumen, PVC, TPO, Acrylic, Polyurea, Polyurethane, Others), By Type (Liquid-applied Membranes, Sheet-based Membranes), By Usage (Refurbishment, New construction), By Application (Building Structures, Roofing, Walls, Roadways, Waste & water management, Others).

Waterproofing membranes are essential components in building envelope systems, providing effective protection against water ingress and moisture damage in 2024. These membranes are typically made from flexible materials such as bitumen, PVC, EPDM, or TPO, and are installed on roofs, walls, foundations, and below-grade structures to create a continuous barrier against water penetration. Waterproofing membranes come in various forms, including sheets, rolls, and liquid-applied coatings, offering versatility and compatibility with different substrates and construction methods. They find applications in commercial, residential, industrial, and infrastructure projects, where waterproofing is critical for preserving the integrity and longevity of buildings and structures. In roofing systems, waterproofing membranes are installed as the primary weatherproofing layer to protect against rain, snow, and UV exposure, extending the lifespan of the roof and interior spaces. Similarly, in below-grade applications such as basements and tunnels, waterproofing membranes are used to prevent groundwater intrusion and moisture seepage, preventing mold growth, structural damage, and indoor air quality issues. With advancements in membrane technology, installation techniques, and building codes, waterproofing membranes to play a vital role in ensuring durable and resilient building construction, reducing maintenance costs, and enhancing occupant comfort and safety.

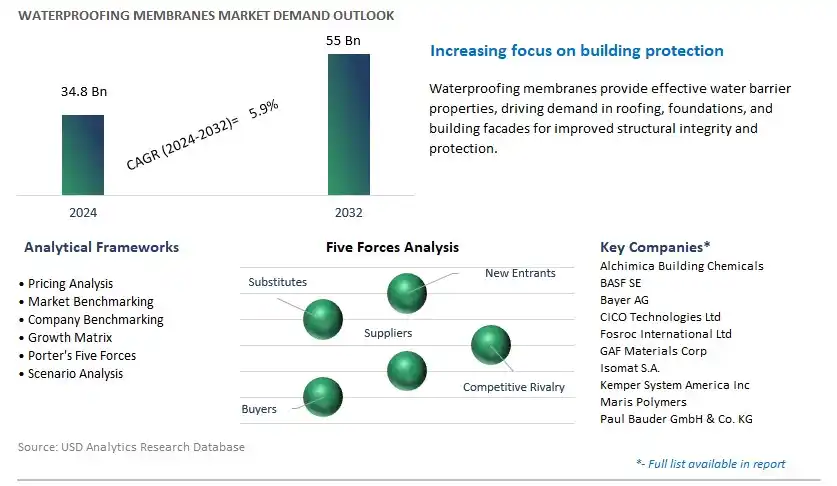

The market report analyses the leading companies in the industry including Alchimica Building Chemicals, BASF SE, Bayer AG, CICO Technologies Ltd, Fosroc International Ltd, GAF Materials Corp, Isomat S.A., Kemper System America Inc, Maris Polymers, Paul Bauder GmbH & Co. KG, and others.

A significant market trend in the waterproofing membranes industry is the increasing demand for sustainable waterproofing solutions. With growing environmental awareness and concerns over climate change, there is a rising preference for waterproofing materials that offer both effective performance and environmental sustainability. This trend is driven by factors such as regulatory mandates for green building practices, corporate sustainability initiatives, and consumer demand for eco-friendly products. Waterproofing membranes, which provide durable and reliable protection against water ingress in building structures and infrastructure, are witnessing higher demand as they offer solutions that contribute to energy efficiency, reduce carbon footprint, and promote sustainable construction practices. As industries prioritize environmental stewardship and seek to achieve green building certifications, the market for sustainable waterproofing membranes is experiencing growth and greater adoption as essential components of eco-friendly construction projects.

The driver behind the growth of the waterproofing membranes market is urbanization and infrastructure development. With rapid urbanization and population growth worldwide, there is a significant expansion of construction activities, including the construction of buildings, roads, bridges, tunnels, and other infrastructure projects. This growth in urban development creates a higher demand for waterproofing solutions to protect structures from water damage and ensure long-term durability and functionality. Additionally, investments in infrastructure projects such as transportation networks, utilities, and water management systems further drive the need for waterproofing membranes to address water-related challenges and prevent moisture intrusion. As governments and private sectors invest in building resilient and sustainable cities, the demand for waterproofing membranes driven by urbanization and infrastructure development continues to rise, shaping the market towards greater innovation and adoption of advanced waterproofing technologies.

An opportunity for growth and diversification in the waterproofing membranes market lies in expansion into high-performance applications and emerging markets. While waterproofing membranes are commonly used in building construction, roofing, and underground structures, there is potential for penetration into new sectors with specialized requirements for waterproofing performance and durability. In high-performance applications such as civil engineering, transportation infrastructure, and industrial facilities, there is growing demand for waterproofing membranes that can withstand harsh environmental conditions, including temperature fluctuations, chemical exposure, and mechanical stress. By developing advanced formulations and tailored solutions for these niche markets, waterproofing membrane manufacturers can address specific industry needs, expand their product offerings, and capitalize on opportunities for growth beyond traditional applications. Additionally, targeting emerging markets such as Asia-Pacific, Latin America, and the Middle East, where infrastructure development is accelerating, can further broaden market reach and drive revenue growth in the waterproofing membranes industry.

Within the Waterproofing Membranes market, the Modified Bitumen segment is the largest segment, owing to its widespread use and advantageous properties. Modified bitumen membranes are popular in the construction industry due to their excellent waterproofing capabilities, durability, and versatility in application. These membranes are composed of asphalt or bitumen modified with polymers such as SBS (Styrene-Butadiene-Styrene) or APP (Atactic Polypropylene), enhancing their flexibility, elongation, and resistance to temperature variations. Modified bitumen membranes are extensively utilized in various waterproofing applications, including roofing systems, underground structures, and building foundations, due to their ability to withstand harsh weather conditions, UV exposure, and mechanical stress. Moreover, the ease of installation and repair, along with the cost-effectiveness of modified bitumen membranes, make them a preferred choice for both new construction projects and renovation activities. As a result of these factors, the Modified Bitumen segment commands a significant share of the Waterproofing Membranes market, reflecting its dominance in meeting the waterproofing needs of diverse construction projects worldwide.

The Liquid-applied Membranes segment within the Waterproofing Membranes market is experiencing rapid growth. Liquid-applied membranes offer numerous advantages over traditional sheet-based membranes, driving their increasing adoption in various construction projects. In particular, liquid-applied membranes provide seamless, monolithic coverage, ensuring superior waterproofing performance without seams or joints that could potentially become weak points for water penetration. This seamless application also enables liquid membranes to conform to irregular surfaces and complex geometries, offering enhanced versatility and flexibility in waterproofing applications. Additionally, liquid membranes are typically faster and easier to apply than sheet-based membranes, reducing labor costs and project timelines. Moreover, liquid-applied membranes exhibit excellent adhesion to a wide range of substrates, including concrete, metal, wood, and even existing membranes, providing reliable waterproofing solutions for diverse construction scenarios. As sustainability and environmental concerns grow, liquid-applied membranes, which often contain low VOC (volatile organic compound) formulations and can be applied with minimal waste, are increasingly preferred by builders and developers. Thus, the Liquid-applied Membranes segment is the fastest-growing segment within the Waterproofing Membranes market, driven by their superior performance, ease of application, and growing demand across various construction applications.

Within the Waterproofing Membranes market, the New Construction segment stands out as the largest segment. New construction projects, whether residential, commercial, or industrial, typically require comprehensive waterproofing solutions to protect the structure from moisture ingress and ensure its longevity. Waterproofing membranes play a crucial role in new construction by providing a barrier against water penetration in critical areas such as foundations, basements, roofs, and wet areas like bathrooms and kitchens. Additionally, as urbanization continues to drive demand for new infrastructure and buildings worldwide, the construction industry is witnessing a surge in new construction projects across various sectors. Moreover, stringent building codes and regulations mandating waterproofing measures in new construction further bolster the demand for waterproofing membranes. With a focus on durability, sustainability, and long-term performance, builders and developers increasingly rely on waterproofing membranes to safeguard new structures from water damage and maintain their structural integrity over time. Consequently, the New Construction segment commands a significant share of the Waterproofing Membranes market, reflecting its essential role in ensuring the reliability and longevity of new buildings and infrastructure projects.

The Waste & Water Management segment within the Waterproofing Membranes market is experiencing rapid growth. As environmental concerns escalate and regulations become more stringent, there is a heightened emphasis on managing waste and water resources effectively. Waterproofing membranes play a crucial role in waste and water management infrastructure by providing impermeable barriers that prevent contamination of soil and groundwater from hazardous substances, chemicals, and leachate. In landfill construction, waterproofing membranes are essential for lining the bottom and sides of the landfill cells to contain waste and prevent leachate seepage into the surrounding environment. Additionally, in water management projects such as reservoirs, dams, and water treatment facilities, waterproofing membranes are used to prevent water loss through seepage and ensure the integrity of the structure. With increasing urbanization and industrialization, the demand for waste management facilities and water infrastructure is growing, driving the need for reliable and durable waterproofing solutions. Thus, the Waste & Water Management segment is the fastest-growing segment within the Waterproofing Membranes market, propelled by the critical role of waterproofing membranes in safeguarding the environment and ensuring the sustainability of waste and water management systems.

By Raw Material

Modified Bitumen

PVC

TPO

Acrylic

Polyurea

Polyurethane

Others

By Type

Liquid-applied Membranes

Sheet-based Membranes

By Usage

Refurbishment

New construction

By Application

Building Structures

Roofing

Walls

Roadways

Waste & water management

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Alchimica Building Chemicals

BASF SE

Bayer AG

CICO Technologies Ltd

Fosroc International Ltd

GAF Materials Corp

Isomat S.A.

Kemper System America Inc

Maris Polymers

Paul Bauder GmbH & Co. KG

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Waterproofing Membranes Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Waterproofing Membranes Market Size Outlook, $ Million, 2021 to 2032

3.2 Waterproofing Membranes Market Outlook by Type, $ Million, 2021 to 2032

3.3 Waterproofing Membranes Market Outlook by Product, $ Million, 2021 to 2032

3.4 Waterproofing Membranes Market Outlook by Application, $ Million, 2021 to 2032

3.5 Waterproofing Membranes Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Waterproofing Membranes Industry

4.2 Key Market Trends in Waterproofing Membranes Industry

4.3 Potential Opportunities in Waterproofing Membranes Industry

4.4 Key Challenges in Waterproofing Membranes Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Waterproofing Membranes Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Waterproofing Membranes Market Outlook by Segments

7.1 Waterproofing Membranes Market Outlook by Segments, $ Million, 2021- 2032

By Raw Material

Modified Bitumen

PVC

TPO

Acrylic

Polyurea

Polyurethane

Others

By Type

Liquid-applied Membranes

Sheet-based Membranes

By Usage

Refurbishment

New construction

By Application

Building Structures

Roofing

Walls

Roadways

Waste & water management

Others

8 North America Waterproofing Membranes Market Analysis and Outlook To 2032

8.1 Introduction to North America Waterproofing Membranes Markets in 2024

8.2 North America Waterproofing Membranes Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Waterproofing Membranes Market size Outlook by Segments, 2021-2032

By Raw Material

Modified Bitumen

PVC

TPO

Acrylic

Polyurea

Polyurethane

Others

By Type

Liquid-applied Membranes

Sheet-based Membranes

By Usage

Refurbishment

New construction

By Application

Building Structures

Roofing

Walls

Roadways

Waste & water management

Others

9 Europe Waterproofing Membranes Market Analysis and Outlook To 2032

9.1 Introduction to Europe Waterproofing Membranes Markets in 2024

9.2 Europe Waterproofing Membranes Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Waterproofing Membranes Market Size Outlook by Segments, 2021-2032

By Raw Material

Modified Bitumen

PVC

TPO

Acrylic

Polyurea

Polyurethane

Others

By Type

Liquid-applied Membranes

Sheet-based Membranes

By Usage

Refurbishment

New construction

By Application

Building Structures

Roofing

Walls

Roadways

Waste & water management

Others

10 Asia Pacific Waterproofing Membranes Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Waterproofing Membranes Markets in 2024

10.2 Asia Pacific Waterproofing Membranes Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Waterproofing Membranes Market size Outlook by Segments, 2021-2032

By Raw Material

Modified Bitumen

PVC

TPO

Acrylic

Polyurea

Polyurethane

Others

By Type

Liquid-applied Membranes

Sheet-based Membranes

By Usage

Refurbishment

New construction

By Application

Building Structures

Roofing

Walls

Roadways

Waste & water management

Others

11 South America Waterproofing Membranes Market Analysis and Outlook To 2032

11.1 Introduction to South America Waterproofing Membranes Markets in 2024

11.2 South America Waterproofing Membranes Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Waterproofing Membranes Market size Outlook by Segments, 2021-2032

By Raw Material

Modified Bitumen

PVC

TPO

Acrylic

Polyurea

Polyurethane

Others

By Type

Liquid-applied Membranes

Sheet-based Membranes

By Usage

Refurbishment

New construction

By Application

Building Structures

Roofing

Walls

Roadways

Waste & water management

Others

12 Middle East and Africa Waterproofing Membranes Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Waterproofing Membranes Markets in 2024

12.2 Middle East and Africa Waterproofing Membranes Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Waterproofing Membranes Market size Outlook by Segments, 2021-2032

By Raw Material

Modified Bitumen

PVC

TPO

Acrylic

Polyurea

Polyurethane

Others

By Type

Liquid-applied Membranes

Sheet-based Membranes

By Usage

Refurbishment

New construction

By Application

Building Structures

Roofing

Walls

Roadways

Waste & water management

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Alchimica Building Chemicals

BASF SE

Bayer AG

CICO Technologies Ltd

Fosroc International Ltd

GAF Materials Corp

Isomat S.A.

Kemper System America Inc

Maris Polymers

Paul Bauder GmbH & Co. KG

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Raw Material

Modified Bitumen

PVC

TPO

Acrylic

Polyurea

Polyurethane

Others

By Type

Liquid-applied Membranes

Sheet-based Membranes

By Usage

Refurbishment

New construction

By Application

Building Structures

Roofing

Walls

Roadways

Waste & water management

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Waterproofing Membranes Market Size is valued at $34.8 Billion in 2024 and is forecast to register a growth rate (CAGR) of 5.9% to reach $55 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Alchimica Building Chemicals, BASF SE, Bayer AG, CICO Technologies Ltd, Fosroc International Ltd, GAF Materials Corp, Isomat S.A., Kemper System America Inc, Maris Polymers, Paul Bauder GmbH & Co. KG

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume