The global Waterproofing Admixtures Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Pore Blocking Admixtures, Crystalline Admixtures, Densifier), By Application (Residential, Commercial, Infrastructure).

Waterproofing admixtures are essential components in concrete and mortar formulations, providing integral waterproofing properties to structures and construction materials in 2024. These admixtures are added to concrete or mortar mixes during the mixing process to improve the water resistance, durability, and performance of the finished product. Waterproofing admixtures work by reducing the porosity of concrete or mortar, blocking capillary pores, and enhancing the hydration process to create a denser and more impermeable matrix. They find applications in residential, commercial, industrial, and infrastructure projects such as basements, foundations, tunnels, bridges, and swimming pools, where protection against water penetration and moisture damage is crucial. By incorporating waterproofing admixtures into concrete and mortar mixes, builders and contractors can mitigate the risk of water ingress, cracks, and deterioration, ensuring the longevity and structural integrity of construction projects. With increasing focus on sustainable and resilient construction practices, waterproofing admixtures to be preferred solutions for enhancing the performance and durability of concrete structures in various applications, contributing to the longevity and sustainability of the built environment.

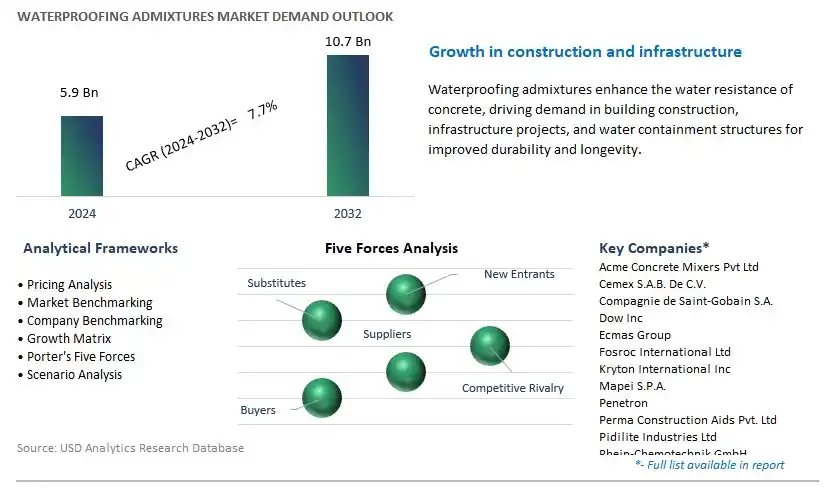

The market report analyses the leading companies in the industry including Acme Concrete Mixers Pvt Ltd, Cemex S.A.B. De C.V., Compagnie de Saint-Gobain S.A., Dow Inc, Ecmas Group, Fosroc International Ltd, Kryton International Inc, Mapei S.P.A., Penetron, Perma Construction Aids Pvt. Ltd, Pidilite Industries Ltd, Rhein-Chemotechnik GmbH, RPM International Inc, Sika AG, Tripolarcon Pvt Ltd, Wacker Chemie AG, Xypex Chemical Corp, and others.

A significant market trend in the waterproofing admixtures industry is the growing focus on infrastructure resilience. With the increasing frequency of extreme weather events and the need to mitigate risks associated with water damage, there is a heightened emphasis on enhancing the durability and longevity of concrete structures. This trend is driven by factors such as urbanization, aging infrastructure, and climate change, which pose challenges to the performance and lifespan of buildings, bridges, tunnels, and other infrastructure assets. Waterproofing admixtures, which are added to concrete mixes to improve water resistance and reduce permeability, are witnessing higher demand as they offer proactive protection against moisture intrusion, cracking, and deterioration. As governments, engineers, and developers prioritize infrastructure resilience and invest in waterproofing solutions, the market for waterproofing admixtures is experiencing growth and greater adoption as essential components of durable and sustainable construction practices.

The driver behind the growth of the waterproofing admixtures market is regulatory mandates and quality standards. Governments worldwide impose strict regulations and building codes to ensure the safety, durability, and performance of constructed facilities, including requirements for waterproofing and moisture control in concrete structures. Additionally, industry organizations and standards bodies establish guidelines and specifications for the use of waterproofing admixtures to meet performance criteria and quality assurance standards. Compliance with regulatory mandates and adherence to quality standards drive the adoption of waterproofing admixtures as essential components of construction projects, particularly in infrastructure applications such as transportation, utilities, and water management. As regulations evolve and quality requirements become more stringent, the demand for waterproofing admixtures driven by regulatory compliance continues to rise, shaping the market towards greater innovation and adoption of advanced waterproofing technologies.

An opportunity for growth and diversification in the waterproofing admixtures market lies in expansion into emerging markets and specialty applications. While waterproofing admixtures are commonly used in building construction, civil engineering, and infrastructure projects, there is potential for penetration into new sectors with specialized requirements for waterproofing performance and durability. In emerging markets such as Asia-Pacific, Latin America, and the Middle East, where rapid urbanization and infrastructure development are driving construction activities, there is growing demand for waterproofing solutions to address water-related challenges and ensure long-term durability of structures. By developing tailored formulations and solutions for specific regional needs and construction practices, waterproofing admixture manufacturers can capitalize on opportunities for growth and market expansion beyond traditional applications. Additionally, targeting specialty applications such as underground structures, marine environments, and industrial facilities with innovative waterproofing solutions can further diversify market reach and drive revenue growth in the waterproofing admixtures industry.

Within the Waterproofing Admixtures market, the Crystalline Admixtures segment is the largest segment, driven by its unique properties and versatile applications in the construction industry. Crystalline admixtures work by forming insoluble crystals within the capillary pores and hairline cracks of concrete structures, effectively blocking the passage of water and providing long-lasting waterproofing solutions. This segment's dominance can be attributed to the growing demand for durable and cost-effective waterproofing solutions in infrastructure projects, residential buildings, commercial complexes, and industrial facilities worldwide. Furthermore, crystalline admixtures offer potential advantages such as enhanced concrete strength, resistance to chemical attack, and self-healing properties, making them highly desirable for use in various construction applications. As sustainability and environmental concerns gain prominence, the eco-friendly nature of crystalline admixtures, which reduce the need for additional membrane systems and prolong the lifespan of structures, further drives their adoption in the construction industry. Thus, the Crystalline Admixtures segment commands a significant share of the Waterproofing Admixtures market due to its effectiveness, durability, and widespread application across diverse construction projects.

The Infrastructure segment within the Waterproofing Admixtures market is experiencing rapid growth. In particular, the increasing investments in infrastructure projects globally, including transportation networks, water treatment facilities, and energy infrastructure, are driving the demand for waterproofing solutions to enhance the longevity and durability of these structures. Waterproofing admixtures play a crucial role in mitigating water ingress and damage, protecting critical infrastructure assets from deterioration caused by moisture, chloride ions, and other deleterious substances. Additionally, the growing urbanization, population expansion, and climate change-related concerns necessitate the development of resilient infrastructure that can withstand extreme weather events and environmental challenges. As a result, there is a rising need for advanced waterproofing technologies, including admixtures, to ensure the structural integrity and functionality of infrastructure projects over their lifecycle. Moreover, government initiatives and regulations mandating the use of waterproofing measures in public infrastructure projects further fuel the demand for waterproofing admixtures in the infrastructure sector. Thus, the Infrastructure segment is the fastest-growing segment within the Waterproofing Admixtures market, propelled by the increasing focus on infrastructure resilience, sustainability, and longevity.

By Type

Pore Blocking Admixtures

-Fatty Acids

-Silanes/ Siloxanes

-Waxes

Crystalline Admixtures

-Calcium Hydroxide-based

-Others

-Clay-based Admixtures

Densifier

-Silicates

-Others

By Application

Residential

Commercial

InfrastructureCountries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Acme Concrete Mixers Pvt Ltd

Cemex S.A.B. De C.V.

Compagnie de Saint-Gobain S.A.

Dow Inc

Ecmas Group

Fosroc International Ltd

Kryton International Inc

Mapei S.P.A.

Penetron

Perma Construction Aids Pvt. Ltd

Pidilite Industries Ltd

Rhein-Chemotechnik GmbH

RPM International Inc

Sika AG

Tripolarcon Pvt Ltd

Wacker Chemie AG

Xypex Chemical Corp

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Waterproofing Admixtures Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Waterproofing Admixtures Market Size Outlook, $ Million, 2021 to 2032

3.2 Waterproofing Admixtures Market Outlook by Type, $ Million, 2021 to 2032

3.3 Waterproofing Admixtures Market Outlook by Product, $ Million, 2021 to 2032

3.4 Waterproofing Admixtures Market Outlook by Application, $ Million, 2021 to 2032

3.5 Waterproofing Admixtures Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Waterproofing Admixtures Industry

4.2 Key Market Trends in Waterproofing Admixtures Industry

4.3 Potential Opportunities in Waterproofing Admixtures Industry

4.4 Key Challenges in Waterproofing Admixtures Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Waterproofing Admixtures Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Waterproofing Admixtures Market Outlook by Segments

7.1 Waterproofing Admixtures Market Outlook by Segments, $ Million, 2021- 2032

By Type

Pore Blocking Admixtures

-Fatty Acids

-Silanes/ Siloxanes

-Waxes

Crystalline Admixtures

-Calcium Hydroxide-based

-Others

-Clay-based Admixtures

Densifier

-Silicates

-Others

By Application

Residential

Commercial

Infrastructure

8 North America Waterproofing Admixtures Market Analysis and Outlook To 2032

8.1 Introduction to North America Waterproofing Admixtures Markets in 2024

8.2 North America Waterproofing Admixtures Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Waterproofing Admixtures Market size Outlook by Segments, 2021-2032

By Type

Pore Blocking Admixtures

-Fatty Acids

-Silanes/ Siloxanes

-Waxes

Crystalline Admixtures

-Calcium Hydroxide-based

-Others

-Clay-based Admixtures

Densifier

-Silicates

-Others

By Application

Residential

Commercial

Infrastructure

9 Europe Waterproofing Admixtures Market Analysis and Outlook To 2032

9.1 Introduction to Europe Waterproofing Admixtures Markets in 2024

9.2 Europe Waterproofing Admixtures Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Waterproofing Admixtures Market Size Outlook by Segments, 2021-2032

By Type

Pore Blocking Admixtures

-Fatty Acids

-Silanes/ Siloxanes

-Waxes

Crystalline Admixtures

-Calcium Hydroxide-based

-Others

-Clay-based Admixtures

Densifier

-Silicates

-Others

By Application

Residential

Commercial

Infrastructure

10 Asia Pacific Waterproofing Admixtures Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Waterproofing Admixtures Markets in 2024

10.2 Asia Pacific Waterproofing Admixtures Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Waterproofing Admixtures Market size Outlook by Segments, 2021-2032

By Type

Pore Blocking Admixtures

-Fatty Acids

-Silanes/ Siloxanes

-Waxes

Crystalline Admixtures

-Calcium Hydroxide-based

-Others

-Clay-based Admixtures

Densifier

-Silicates

-Others

By Application

Residential

Commercial

Infrastructure

11 South America Waterproofing Admixtures Market Analysis and Outlook To 2032

11.1 Introduction to South America Waterproofing Admixtures Markets in 2024

11.2 South America Waterproofing Admixtures Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Waterproofing Admixtures Market size Outlook by Segments, 2021-2032

By Type

Pore Blocking Admixtures

-Fatty Acids

-Silanes/ Siloxanes

-Waxes

Crystalline Admixtures

-Calcium Hydroxide-based

-Others

-Clay-based Admixtures

Densifier

-Silicates

-Others

By Application

Residential

Commercial

Infrastructure

12 Middle East and Africa Waterproofing Admixtures Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Waterproofing Admixtures Markets in 2024

12.2 Middle East and Africa Waterproofing Admixtures Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Waterproofing Admixtures Market size Outlook by Segments, 2021-2032

By Type

Pore Blocking Admixtures

-Fatty Acids

-Silanes/ Siloxanes

-Waxes

Crystalline Admixtures

-Calcium Hydroxide-based

-Others

-Clay-based Admixtures

Densifier

-Silicates

-Others

By Application

Residential

Commercial

Infrastructure

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Acme Concrete Mixers Pvt Ltd

Cemex S.A.B. De C.V.

Compagnie de Saint-Gobain S.A.

Dow Inc

Ecmas Group

Fosroc International Ltd

Kryton International Inc

Mapei S.P.A.

Penetron

Perma Construction Aids Pvt. Ltd

Pidilite Industries Ltd

Rhein-Chemotechnik GmbH

RPM International Inc

Sika AG

Tripolarcon Pvt Ltd

Wacker Chemie AG

Xypex Chemical Corp

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Pore Blocking Admixtures

-Fatty Acids

-Silanes/ Siloxanes

-Waxes

Crystalline Admixtures

-Calcium Hydroxide-based

-Others

-Clay-based Admixtures

Densifier

-Silicates

-Others

By Application

Residential

Commercial

Infrastructure

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Waterproofing Admixtures Market Size is valued at $5.9 Billion in 2024 and is forecast to register a growth rate (CAGR) of 7.7% to reach $10.7 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Acme Concrete Mixers Pvt Ltd, Cemex S.A.B. De C.V., Compagnie de Saint-Gobain S.A., Dow Inc, Ecmas Group, Fosroc International Ltd, Kryton International Inc, Mapei S.P.A., Penetron, Perma Construction Aids Pvt. Ltd, Pidilite Industries Ltd, Rhein-Chemotechnik GmbH, RPM International Inc, Sika AG, Tripolarcon Pvt Ltd, Wacker Chemie AG, Xypex Chemical Corp

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume