The global Waterproof Tapes Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Resin (Acrylic, Butyl, Silicone, Others), By Substrate (Plastic, Metal, Rubber, Others), By End-User (Electrical & Electronics, Automotive, Building & Construction, Healthcare, Packaging, Others).

Waterproof tapes are indispensable tools for sealing and repairing leaks, cracks, and joints in various applications in 2024, offering quick and reliable waterproofing solutions. These tapes are typically made from flexible and durable materials such as rubber, butyl rubber, silicone, or polymer films, coated with pressure-sensitive adhesives that adhere to a wide range of surfaces, including metal, plastic, concrete, and fabric. Waterproof tapes find applications in construction, plumbing, automotive, marine, and outdoor activities, where moisture resistance and weatherproofing are essential. In construction and building maintenance, waterproof tapes are used for sealing roof seams, flashing, windows, and doors to prevent water intrusion and air leakage. Similarly, in automotive repair and maintenance, waterproof tapes are employed for sealing automotive seams, hoses, and electrical connections to prevent water ingress and corrosion. With their ease of use, versatility, and durability, waterproof tapes provide effective and cost-efficient solutions for addressing waterproofing challenges in various industries and environments, ensuring protection against water damage and extending the lifespan of structures and products.

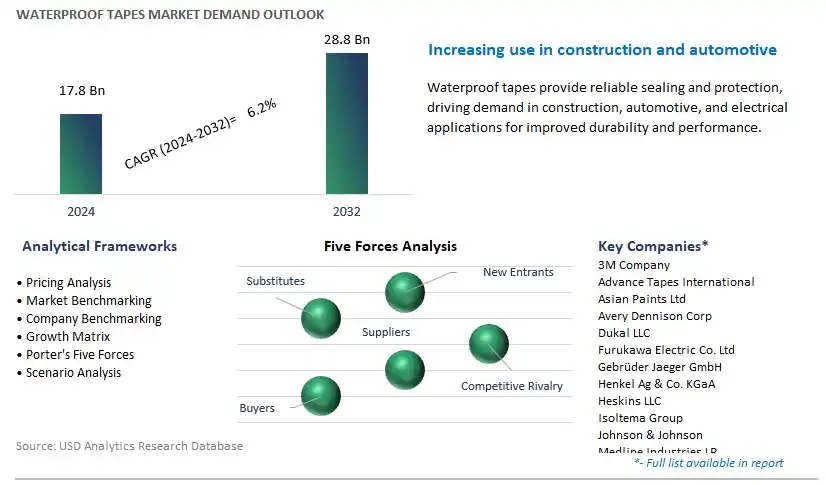

The market report analyses the leading companies in the industry including 3M Company, Advance Tapes International, Asian Paints Ltd, Avery Dennison Corp, Dukal LLC, Furukawa Electric Co. Ltd, Gebrüder Jaeger GmbH, Henkel Ag & Co. KGaA, Heskins LLC, Isoltema Group, Johnson & Johnson, Medline Industries LP, Nitto Denko Corp, Scapa Group Plc, Teraoka Seisakusho Co. Ltd, Tesa SE, and others.

A significant market trend in the waterproof tapes industry is the increasing demand for water-resistant packaging solutions. With the rise of e-commerce and online shopping, there is a growing need for packaging materials that can withstand various environmental conditions, including moisture and water exposure during storage and transportation. This trend is driven by factors such as consumer expectations for product protection, regulatory requirements for packaging integrity, and the need to prevent damage to goods during shipment. Waterproof tapes, which provide secure sealing and protection against water ingress, are witnessing higher demand in industries such as logistics, electronics, and food packaging. As companies prioritize product safety and integrity in their packaging strategies, the market for waterproof tapes is experiencing growth and greater adoption as essential components of water-resistant packaging solutions.

The driver behind the growth of the waterproof tapes market is the rapid expansion of e-commerce and online retail. With the convenience of online shopping and the increasing preference for doorstep delivery, there has been a significant surge in e-commerce sales worldwide. This growth in online retail has led to higher demand for packaging materials that can withstand the rigors of shipping and handling, including exposure to moisture and water during transit. Waterproof tapes play a crucial role in ensuring the integrity of packages and protecting goods from damage caused by water ingress. As e-commerce continues to expand and reshape the retail landscape, the demand for waterproof tapes driven by the growth of online shopping remains strong, shaping the market towards greater innovation and adoption of water-resistant packaging solutions.

An opportunity for growth and diversification in the waterproof tapes market lies in expanding into specialty applications and industries. While waterproof tapes are commonly used in packaging and shipping, there is potential for penetration into new sectors with specialized requirements for water resistance, adhesion, and durability. In industries such as construction, automotive, and marine, where exposure to moisture and water is common, there is growing demand for waterproof tapes for applications such as sealing seams, repairing leaks, and protecting surfaces from water damage. By developing specialized formulations and tailored solutions for these niche markets, waterproof tape manufacturers can expand their product offerings, address specific industry needs, and capitalize on opportunities for growth and market diversification beyond traditional packaging applications. Additionally, targeting emerging sectors such as healthcare, outdoor recreation, and aerospace with innovative waterproofing solutions can further broaden market reach and drive revenue growth in the waterproof tapes industry.

The Silicone segment within the Waterproof Tapes market stands out as the largest segment, primarily due to its versatile properties and wide-ranging applications across various industries. Silicone-based waterproof tapes offer exceptional durability, flexibility, and resistance to extreme temperatures, UV radiation, moisture, and chemicals, making them highly sought after in demanding environments such as construction, automotive, aerospace, and electrical industries. These tapes provide excellent adhesion to a variety of substrates including metal, glass, plastics, and ceramics, ensuring reliable sealing and bonding solutions for both indoor and outdoor applications. Moreover, silicone tapes are favored for their ease of use, as they can be applied quickly and adhere well even to irregular surfaces. With the growing emphasis on sustainability and eco-friendliness, silicone tapes are also preferred for their non-toxic and environmentally friendly characteristics. As a result, the Silicone segment dominates the Waterproof Tapes market, capturing a significant share due to its widespread adoption across diverse industries and its ability to meet stringent performance requirements.

The Rubber segment within the Waterproof Tapes market is experiencing rapid growth owing to its unique properties and expanding applications across various industries. Rubber-based waterproof tapes offer exceptional flexibility, elasticity, and resistance to moisture, chemicals, and abrasion, making them ideal for sealing and bonding applications in challenging environments. In industries such as automotive, construction, and marine, where exposure to harsh conditions is common, rubber tapes are increasingly being used for sealing joints, repairing leaks, and protecting surfaces from water ingress. Additionally, the versatility of rubber tapes allows them to adhere well to a wide range of substrates including plastic, metal, and rubber itself, further enhancing their utility and driving their adoption across diverse applications. Furthermore, the growing emphasis on preventive maintenance and infrastructure development projects is boosting the demand for waterproof tapes, particularly those with rubber substrates, as they offer cost-effective solutions for addressing water-related issues and extending the lifespan of structures and equipment. As a result, the Rubber segment is the fastest-growing segment within the Waterproof Tapes market, propelled by its superior performance characteristics and expanding application scope.

The Building & Construction segment within the Waterproof Tapes market is the largest segment. In particular, the construction industry's substantial demand for waterproofing solutions to protect structures from water damage, leakage, and mold growth fuels the significant uptake of waterproof tapes. These tapes play a crucial role in sealing joints, seams, and gaps in building envelopes, roofs, windows, and doors, ensuring the integrity and durability of the construction against moisture intrusion. Moreover, with the increasing focus on sustainable construction practices and regulations mandating the use of waterproofing materials to enhance building longevity and energy efficiency, the demand for waterproof tapes in the building and construction sector is further amplified. Additionally, the rising trend of urbanization, infrastructure development projects, and renovation activities worldwide contribute to the robust growth of the Building & Construction segment within the Waterproof Tapes market. Consequently, this segment commands a considerable share of the market due to its indispensable role in ensuring the longevity and performance of structures in the construction industry.

By Resin

Acrylic

Butyl

Silicone

Others

By Substrate

Plastic

Metal

Rubber

Others

By End-User

Electrical & Electronics

Automotive

Building & Construction

Healthcare

Packaging

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

3M Company

Advance Tapes International

Asian Paints Ltd

Avery Dennison Corp

Dukal LLC

Furukawa Electric Co. Ltd

Gebrüder Jaeger GmbH

Henkel Ag & Co. KGaA

Heskins LLC

Isoltema Group

Johnson & Johnson

Medline Industries LP

Nitto Denko Corp

Scapa Group Plc

Teraoka Seisakusho Co. Ltd

Tesa SE

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Waterproof Tapes Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Waterproof Tapes Market Size Outlook, $ Million, 2021 to 2032

3.2 Waterproof Tapes Market Outlook by Type, $ Million, 2021 to 2032

3.3 Waterproof Tapes Market Outlook by Product, $ Million, 2021 to 2032

3.4 Waterproof Tapes Market Outlook by Application, $ Million, 2021 to 2032

3.5 Waterproof Tapes Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Waterproof Tapes Industry

4.2 Key Market Trends in Waterproof Tapes Industry

4.3 Potential Opportunities in Waterproof Tapes Industry

4.4 Key Challenges in Waterproof Tapes Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Waterproof Tapes Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Waterproof Tapes Market Outlook by Segments

7.1 Waterproof Tapes Market Outlook by Segments, $ Million, 2021- 2032

By Resin

Acrylic

Butyl

Silicone

Others

By Substrate

Plastic

Metal

Rubber

Others

By End-User

Electrical & Electronics

Automotive

Building & Construction

Healthcare

Packaging

Others

8 North America Waterproof Tapes Market Analysis and Outlook To 2032

8.1 Introduction to North America Waterproof Tapes Markets in 2024

8.2 North America Waterproof Tapes Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Waterproof Tapes Market size Outlook by Segments, 2021-2032

By Resin

Acrylic

Butyl

Silicone

Others

By Substrate

Plastic

Metal

Rubber

Others

By End-User

Electrical & Electronics

Automotive

Building & Construction

Healthcare

Packaging

Others

9 Europe Waterproof Tapes Market Analysis and Outlook To 2032

9.1 Introduction to Europe Waterproof Tapes Markets in 2024

9.2 Europe Waterproof Tapes Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Waterproof Tapes Market Size Outlook by Segments, 2021-2032

By Resin

Acrylic

Butyl

Silicone

Others

By Substrate

Plastic

Metal

Rubber

Others

By End-User

Electrical & Electronics

Automotive

Building & Construction

Healthcare

Packaging

Others

10 Asia Pacific Waterproof Tapes Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Waterproof Tapes Markets in 2024

10.2 Asia Pacific Waterproof Tapes Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Waterproof Tapes Market size Outlook by Segments, 2021-2032

By Resin

Acrylic

Butyl

Silicone

Others

By Substrate

Plastic

Metal

Rubber

Others

By End-User

Electrical & Electronics

Automotive

Building & Construction

Healthcare

Packaging

Others

11 South America Waterproof Tapes Market Analysis and Outlook To 2032

11.1 Introduction to South America Waterproof Tapes Markets in 2024

11.2 South America Waterproof Tapes Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Waterproof Tapes Market size Outlook by Segments, 2021-2032

By Resin

Acrylic

Butyl

Silicone

Others

By Substrate

Plastic

Metal

Rubber

Others

By End-User

Electrical & Electronics

Automotive

Building & Construction

Healthcare

Packaging

Others

12 Middle East and Africa Waterproof Tapes Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Waterproof Tapes Markets in 2024

12.2 Middle East and Africa Waterproof Tapes Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Waterproof Tapes Market size Outlook by Segments, 2021-2032

By Resin

Acrylic

Butyl

Silicone

Others

By Substrate

Plastic

Metal

Rubber

Others

By End-User

Electrical & Electronics

Automotive

Building & Construction

Healthcare

Packaging

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

3M Company

Advance Tapes International

Asian Paints Ltd

Avery Dennison Corp

Dukal LLC

Furukawa Electric Co. Ltd

Gebrüder Jaeger GmbH

Henkel Ag & Co. KGaA

Heskins LLC

Isoltema Group

Johnson & Johnson

Medline Industries LP

Nitto Denko Corp

Scapa Group Plc

Teraoka Seisakusho Co. Ltd

Tesa SE

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Resin

Acrylic

Butyl

Silicone

Others

By Substrate

Plastic

Metal

Rubber

Others

By End-User

Electrical & Electronics

Automotive

Building & Construction

Healthcare

Packaging

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Waterproof Tapes Market Size is valued at $17.8 Billion in 2024 and is forecast to register a growth rate (CAGR) of 6.2% to reach $28.8 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

3M Company, Advance Tapes International, Asian Paints Ltd, Avery Dennison Corp, Dukal LLC, Furukawa Electric Co. Ltd, Gebrüder Jaeger GmbH, Henkel Ag & Co. KGaA, Heskins LLC, Isoltema Group, Johnson & Johnson, Medline Industries LP, Nitto Denko Corp, Scapa Group Plc, Teraoka Seisakusho Co. Ltd, Tesa SE

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume