The global Waterproof Adhesives and Sealants Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Chemistry (Silicones, Polyurethanes, Acrylics, Epoxy, Polysulfide, Others), By End-User (Building & Construction, Transportation, Electrical & Electronics, Others).

Waterproof adhesives and sealants play a critical role in various industries and applications in 2024, offering reliable bonding and sealing solutions in challenging environments. These specialized formulations are designed to withstand exposure to moisture, water, chemicals, and harsh weather conditions, providing durable and long-lasting bonds and seals. Waterproof adhesives are used in construction, automotive, marine, aerospace, and electronics industries for bonding materials such as metals, plastics, glass, and composites in wet or humid conditions. Similarly, waterproof sealants are employed for sealing joints, seams, and gaps in building envelopes, automotive assemblies, and marine structures to prevent water ingress and protect against corrosion, leaks, and mold growth. With advancements in polymer chemistry, formulation technology, and application methods, waterproof adhesives and sealants to offer versatile and effective solutions for bonding and sealing applications in demanding environments, contributing to the durability, safety, and performance of various products and structures.

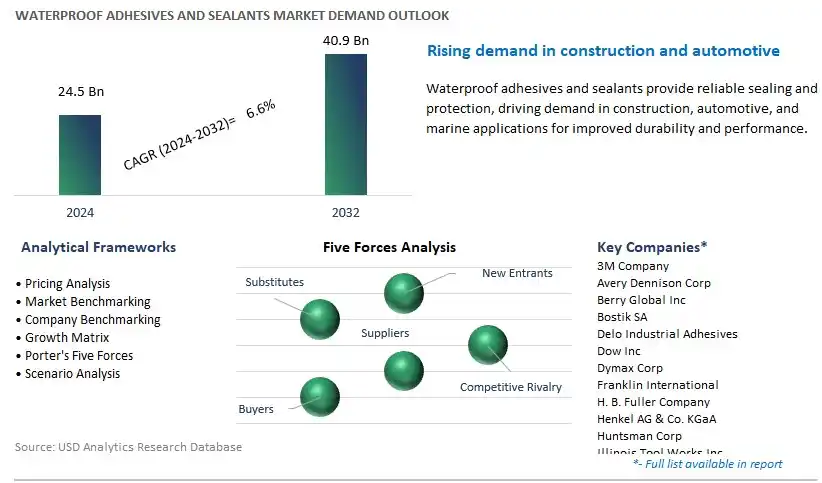

The market report analyses the leading companies in the industry including 3M Company, Avery Dennison Corp, Berry Global Inc, Bostik SA, Delo Industrial Adhesives, Dow Inc, Dymax Corp, Franklin International, H. B. Fuller Company, Henkel AG & Co. KGaA, Huntsman Corp, Illinois Tool Works Inc, Jowat SE, Lord Corp, Mapei Spa, Pidilite Industries Ltd, RPM International Inc, Sika AG, Uniseal Inc, and others.

A significant market trend in the waterproof adhesives and sealants industry is the increasing demand for waterproofing solutions. With growing concerns over water intrusion, moisture damage, and weathering effects, there is a rising need for effective waterproofing products to protect structures, surfaces, and assemblies from water-related damage. This trend is driven by factors such as climate change, urbanization, and infrastructure development, which expose buildings, infrastructure, and equipment to water exposure and moisture ingress. Waterproof adhesives and sealants, which provide durable and reliable sealing against water penetration, are witnessing higher demand across various sectors, including construction, automotive, and manufacturing. As industries prioritize water resistance and durability in their products and applications, the market for waterproof adhesives and sealants is experiencing growth and greater adoption as essential components of waterproofing systems.

The driver behind the growth of the waterproof adhesives and sealants market is the expansion of construction and infrastructure projects. With rapid urbanization, population growth, and infrastructure development worldwide, there is a surge in construction activities, leading to increased demand for waterproofing solutions to protect buildings, roads, bridges, and other structures from water damage. Additionally, renovation and maintenance projects also drive the need for waterproof adhesives and sealants to repair and reinforce existing structures against water intrusion and moisture damage. As governments invest in infrastructure upgrades, green building initiatives, and resilient construction practices, the demand for waterproofing products driven by construction and infrastructure projects continues to rise, shaping the market towards greater innovation and adoption of waterproof adhesives and sealants.

An opportunity for growth and innovation in the waterproof adhesives and sealants market lies in the development of advanced formulations for specialty applications. While waterproof adhesives and sealants are commonly used in building construction, roofing, and automotive assembly, there is potential for penetration into new sectors with specialized requirements for water resistance, adhesion, and durability. In specialty applications such as marine, aerospace, and electronics, where exposure to harsh environments and water immersion is common, there is growing demand for high-performance waterproofing solutions. By developing advanced formulations with enhanced properties such as saltwater resistance, UV stability, and thermal conductivity, waterproof adhesives and sealant manufacturers can cater to the needs of niche markets and capitalize on opportunities for growth and market diversification beyond traditional applications. Additionally, targeting emerging sectors such as renewable energy, medical devices, and outdoor equipment with tailored waterproofing solutions can further expand market reach and drive revenue growth in the waterproof adhesives and sealants industry.

The largest segment in the Waterproof Adhesives & Sealants Market by chemistry is Polyurethanes. This segment's leading position is due to the exceptional properties of polyurethane adhesives and sealants, which make them highly versatile and effective in a wide range of applications. Polyurethane-based products are known for their excellent flexibility, strong adhesion to diverse substrates, and superior durability, which are critical for both industrial and residential uses. These characteristics are particularly valuable in construction, automotive, and marine industries, where materials are frequently exposed to harsh environmental conditions and require robust, waterproof solutions. The ability of polyurethane adhesives and sealants to cure at ambient temperatures without the need for additional catalysts or curing agents further enhances their appeal, simplifying application processes and reducing costs. Additionally, advancements in polyurethane chemistry have led to the development of eco-friendly formulations with low volatile organic compound (VOC) emissions, aligning with the growing global emphasis on sustainability and regulatory compliance. As the demand for durable, long-lasting, and environmentally friendly waterproof adhesives and sealants continues to rise across various industries, polyurethanes are expected to maintain their dominant market share, driven by their performance advantages and broad applicability.

The Electrical & Electronics segment within the Waterproof Adhesives & Sealants market is experiencing remarkable growth. In particular, with the rapid advancements in technology, particularly in areas like consumer electronics, automotive electronics, and renewable energy systems, there's an increasing demand for specialized adhesives and sealants that can withstand harsh environmental conditions such as moisture, heat, and chemicals. This segment is witnessing a surge in demand for waterproof adhesives and sealants used in the manufacturing and assembly of electronic components, circuit boards, sensors, and connectors to ensure reliability and longevity of these devices. Additionally, the proliferation of smart devices, IoT (Internet of Things) technologies, and the transition towards electric vehicles are driving the need for more robust and durable sealing solutions in the electrical and electronics industry. As a result, manufacturers are investing heavily in research and development to innovate new formulations and technologies to cater to this growing demand, further fuelling the expansion of the Electrical & Electronics segment within the Waterproof Adhesives & Sealants market.

By Chemistry

Silicones

Polyurethanes

Acrylics

Epoxy

Polysulfide

Others

By End-User

Building & Construction

Transportation

Electrical & Electronics

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

3M Company

Avery Dennison Corp

Berry Global Inc

Bostik SA

Delo Industrial Adhesives

Dow Inc

Dymax Corp

Franklin International

H. B. Fuller Company

Henkel AG & Co. KGaA

Huntsman Corp

Illinois Tool Works Inc

Jowat SE

Lord Corp

Mapei Spa

Pidilite Industries Ltd

RPM International Inc

Sika AG

Uniseal Inc

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Waterproof Adhesives and Sealants Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Waterproof Adhesives and Sealants Market Size Outlook, $ Million, 2021 to 2032

3.2 Waterproof Adhesives and Sealants Market Outlook by Type, $ Million, 2021 to 2032

3.3 Waterproof Adhesives and Sealants Market Outlook by Product, $ Million, 2021 to 2032

3.4 Waterproof Adhesives and Sealants Market Outlook by Application, $ Million, 2021 to 2032

3.5 Waterproof Adhesives and Sealants Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Waterproof Adhesives and Sealants Industry

4.2 Key Market Trends in Waterproof Adhesives and Sealants Industry

4.3 Potential Opportunities in Waterproof Adhesives and Sealants Industry

4.4 Key Challenges in Waterproof Adhesives and Sealants Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Waterproof Adhesives and Sealants Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Waterproof Adhesives and Sealants Market Outlook by Segments

7.1 Waterproof Adhesives and Sealants Market Outlook by Segments, $ Million, 2021- 2032

By Chemistry

Silicones

Polyurethanes

Acrylics

Epoxy

Polysulfide

Others

By End-User

Building & Construction

Transportation

Electrical & Electronics

Others

8 North America Waterproof Adhesives and Sealants Market Analysis and Outlook To 2032

8.1 Introduction to North America Waterproof Adhesives and Sealants Markets in 2024

8.2 North America Waterproof Adhesives and Sealants Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Waterproof Adhesives and Sealants Market size Outlook by Segments, 2021-2032

By Chemistry

Silicones

Polyurethanes

Acrylics

Epoxy

Polysulfide

Others

By End-User

Building & Construction

Transportation

Electrical & Electronics

Others

9 Europe Waterproof Adhesives and Sealants Market Analysis and Outlook To 2032

9.1 Introduction to Europe Waterproof Adhesives and Sealants Markets in 2024

9.2 Europe Waterproof Adhesives and Sealants Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Waterproof Adhesives and Sealants Market Size Outlook by Segments, 2021-2032

By Chemistry

Silicones

Polyurethanes

Acrylics

Epoxy

Polysulfide

Others

By End-User

Building & Construction

Transportation

Electrical & Electronics

Others

10 Asia Pacific Waterproof Adhesives and Sealants Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Waterproof Adhesives and Sealants Markets in 2024

10.2 Asia Pacific Waterproof Adhesives and Sealants Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Waterproof Adhesives and Sealants Market size Outlook by Segments, 2021-2032

By Chemistry

Silicones

Polyurethanes

Acrylics

Epoxy

Polysulfide

Others

By End-User

Building & Construction

Transportation

Electrical & Electronics

Others

11 South America Waterproof Adhesives and Sealants Market Analysis and Outlook To 2032

11.1 Introduction to South America Waterproof Adhesives and Sealants Markets in 2024

11.2 South America Waterproof Adhesives and Sealants Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Waterproof Adhesives and Sealants Market size Outlook by Segments, 2021-2032

By Chemistry

Silicones

Polyurethanes

Acrylics

Epoxy

Polysulfide

Others

By End-User

Building & Construction

Transportation

Electrical & Electronics

Others

12 Middle East and Africa Waterproof Adhesives and Sealants Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Waterproof Adhesives and Sealants Markets in 2024

12.2 Middle East and Africa Waterproof Adhesives and Sealants Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Waterproof Adhesives and Sealants Market size Outlook by Segments, 2021-2032

By Chemistry

Silicones

Polyurethanes

Acrylics

Epoxy

Polysulfide

Others

By End-User

Building & Construction

Transportation

Electrical & Electronics

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

3M Company

Avery Dennison Corp

Berry Global Inc

Bostik SA

Delo Industrial Adhesives

Dow Inc

Dymax Corp

Franklin International

H. B. Fuller Company

Henkel AG & Co. KGaA

Huntsman Corp

Illinois Tool Works Inc

Jowat SE

Lord Corp

Mapei Spa

Pidilite Industries Ltd

RPM International Inc

Sika AG

Uniseal Inc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Chemistry

Silicones

Polyurethanes

Acrylics

Epoxy

Polysulfide

Others

By End-User

Building & Construction

Transportation

Electrical & Electronics

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Waterproof Adhesives and Sealants Market Size is valued at $24.5 Billion in 2024 and is forecast to register a growth rate (CAGR) of 6.6% to reach $40.9 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

3M Company, Avery Dennison Corp, Berry Global Inc, Bostik SA, Delo Industrial Adhesives, Dow Inc, Dymax Corp, Franklin International, H. B. Fuller Company, Henkel AG & Co. KGaA, Huntsman Corp, Illinois Tool Works Inc, Jowat SE, Lord Corp, Mapei Spa, Pidilite Industries Ltd, RPM International Inc, Sika AG, Uniseal Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume