The global Waterborne Polyurethane Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Application (Coating, Sealant, Adhesive, Elastomer, Others), By End-User (Building & construction, Automotive & transportation, Bedding & furniture, Electronics, Others).

Waterborne polyurethane (PU) dispersions to be favored for their exceptional durability, versatility, and environmental compatibility in coatings and adhesives applications in 2024. These dispersions are aqueous-based formulations containing polyurethane polymer particles dispersed in water, offering properties such as toughness, flexibility, chemical resistance, and adhesion to diverse substrates. Waterborne PU dispersions find applications in industries such as furniture, flooring, automotive, textiles, and packaging, where high-performance coatings and adhesives are required. In furniture manufacturing, waterborne PU coatings are used for wood finishes, upholstery fabrics, and decorative laminates, providing scratch resistance, UV protection, and aesthetic appeal with low VOC emissions. Similarly, in flooring applications, waterborne PU dispersions are employed for sealing, topcoating, and adhesive bonding in hardwood floors, vinyl flooring, and sports surfaces, offering durability and easy maintenance. Additionally, in automotive interiors, waterborne PU coatings and adhesives provide soft-touch finishes, moisture resistance, and bonding of trim components, contributing to interior comfort and aesthetics. With growing emphasis on sustainability, regulatory compliance, and consumer preferences for eco-friendly products, waterborne polyurethane dispersions to be a preferred choice for manufacturers seeking high-performance coatings and adhesives with reduced environmental impact and improved indoor air quality.

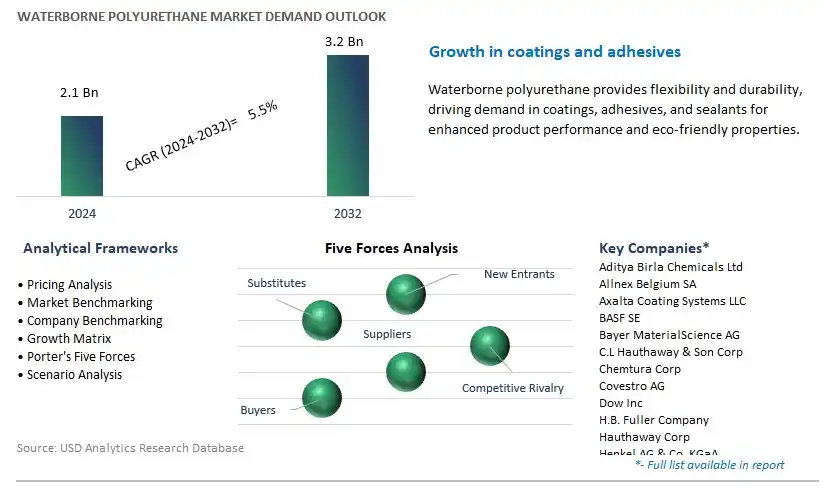

The market report analyses the leading companies in the industry including Aditya Birla Chemicals Ltd, Allnex Belgium SA, Axalta Coating Systems LLC, BASF SE, Bayer MaterialScience AG, C.L Hauthaway & Son Corp, Chemtura Corp, Covestro AG, Dow Inc, H.B. Fuller Company, Hauthaway Corp, Henkel AG & Co. KGaA, Huntsman Corp, Kamsons Chemicals Pvt. Ltd, Koninklijke DSM NV, Lamberti S.p.A., Lanxess AG, Nippon Polyurethane Industry Co. Ltd, Perstorp AB, PPG Industries Inc, R. STAHL GmbH, SNP Inc, Sun Polymers International Inc, The Lubrizol Corp, The Sherwin-Williams Company, Wanhua Chemical Group Co. Ltd, and others.

A significant market trend in the waterborne polyurethane industry is the growing preference for sustainable coating solutions. With increasing environmental awareness and regulations aimed at reducing volatile organic compound (VOC) emissions, there is a rising demand for coatings that offer lower environmental impact without compromising performance. This trend is driven by regulatory mandates, consumer demand for eco-friendly products, and corporate sustainability initiatives. Waterborne polyurethane coatings, which use water as a solvent instead of traditional solvents, are witnessing higher demand as they provide excellent durability, adhesion, and chemical resistance while emitting significantly lower levels of VOCs. As industries prioritize sustainability and seek to reduce their carbon footprint, the market for waterborne polyurethane coatings is experiencing growth and greater adoption as a preferred coating technology.

The driver behind the growth of the waterborne polyurethane market is regulatory compliance and VOC reduction targets. Governments worldwide impose strict limits on VOC emissions from industrial processes, including coating applications, to protect air quality and human health. Regulatory measures such as the Clean Air Act in the United States and the European Union's VOC Directive set maximum allowable VOC levels in coatings, driving the adoption of low-VOC or VOC-free alternatives. Waterborne polyurethane coatings offer a solution to meet regulatory requirements and reduce environmental impact, as they emit significantly lower levels of VOCs compared to solvent-based polyurethane coatings. As industries face pressure to comply with VOC reduction targets and reduce their environmental footprint, the demand for waterborne polyurethane coatings driven by regulatory compliance continues to rise, shaping the market towards greater adoption and innovation of environmentally friendly coating technologies.

An opportunity for growth and diversification in the waterborne polyurethane market lies in expansion into high-performance applications and specialty markets. While waterborne polyurethane coatings are commonly used in architectural paints, wood finishes, and automotive coatings, there is potential for penetration into new sectors with specialized requirements for coating performance and durability. In high-performance applications such as aerospace coatings, marine coatings, and industrial maintenance coatings, waterborne polyurethane formulations can offer advantages such as excellent adhesion, abrasion resistance, and weatherability while meeting stringent VOC regulations. Additionally, in specialty markets such as medical devices, electronic coatings, and sports equipment, there is growing demand for waterborne polyurethane coatings due to their versatility, flexibility, and biocompatibility. By targeting high-performance applications and specialty markets with tailored formulations and value-added services, waterborne polyurethane manufacturers can expand their market presence, address specific industry needs, and capitalize on opportunities for growth and market diversification beyond traditional applications.

The largest segment in the Waterborne Polyurethane Market by application is Coating. The large revenue share is attributed to the extensive use of waterborne polyurethane (PU) coatings in a wide range of industries, including automotive, construction, textiles, and furniture. Waterborne PU coatings are highly valued for their excellent properties such as abrasion resistance, flexibility, and durability, making them ideal for protecting and enhancing surfaces. The push towards eco-friendly and sustainable solutions has also contributed to the growth of this segment, as waterborne PU coatings have lower volatile organic compound (VOC) emissions compared to their solvent-based counterparts. This makes them more compliant with stringent environmental regulations and appealing to environmentally conscious consumers and industries. The versatility of waterborne PU coatings allows them to be used on various substrates, including wood, metal, plastic, and concrete, broadening their applicability and market reach. Technological advancements have further improved the performance and application properties of these coatings, driving their adoption in high-performance and decorative applications. As industries continue to prioritize sustainability and high-quality protective solutions, the demand for waterborne polyurethane coatings is expected to remain strong, solidifying this segment's position as the largest in the market.

The fastest-growing segment in the Waterborne Polyurethane Market by end-user is Automotive & Transportation. This rapid growth is driven by the automotive industry's increasing focus on sustainability and environmental regulations. Waterborne polyurethane (PU) products are favored in this sector due to their low volatile organic compound (VOC) emissions, which help manufacturers meet stringent environmental standards. These materials offer superior performance characteristics such as high abrasion resistance, flexibility, and excellent adhesion, making them ideal for various automotive applications, including coatings, adhesives, and sealants. The shift towards electric vehicles (EVs) is further boosting the demand for advanced materials that contribute to weight reduction and improved energy efficiency, areas where waterborne PUs excel. Additionally, the rising trend of vehicle customization and the need for durable and aesthetically pleasing interior and exterior components are driving the adoption of waterborne PU solutions. As the automotive and transportation industries continue to evolve and prioritize eco-friendly and high-performance materials, the demand for waterborne polyurethane products is expected to accelerate, making this segment the fastest-growing in the market.

By Application

Coating

Sealant

Adhesive

Elastomer

Others

By End-User

Building & construction

Automotive & transportation

Bedding & furniture

Electronics

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Aditya Birla Chemicals Ltd

Allnex Belgium SA

Axalta Coating Systems LLC

BASF SE

Bayer MaterialScience AG

C.L Hauthaway & Son Corp

Chemtura Corp

Covestro AG

Dow Inc

H.B. Fuller Company

Hauthaway Corp

Henkel AG & Co. KGaA

Huntsman Corp

Kamsons Chemicals Pvt. Ltd

Koninklijke DSM NV

Lamberti S.p.A.

Lanxess AG

Nippon Polyurethane Industry Co. Ltd

Perstorp AB

PPG Industries Inc

R. STAHL GmbH

SNP Inc

Sun Polymers International Inc

The Lubrizol Corp

The Sherwin-Williams Company

Wanhua Chemical Group Co. Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Waterborne Polyurethane Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Waterborne Polyurethane Market Size Outlook, $ Million, 2021 to 2032

3.2 Waterborne Polyurethane Market Outlook by Type, $ Million, 2021 to 2032

3.3 Waterborne Polyurethane Market Outlook by Product, $ Million, 2021 to 2032

3.4 Waterborne Polyurethane Market Outlook by Application, $ Million, 2021 to 2032

3.5 Waterborne Polyurethane Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Waterborne Polyurethane Industry

4.2 Key Market Trends in Waterborne Polyurethane Industry

4.3 Potential Opportunities in Waterborne Polyurethane Industry

4.4 Key Challenges in Waterborne Polyurethane Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Waterborne Polyurethane Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Waterborne Polyurethane Market Outlook by Segments

7.1 Waterborne Polyurethane Market Outlook by Segments, $ Million, 2021- 2032

By Application

Coating

Sealant

Adhesive

Elastomer

Others

By End-User

Building & construction

Automotive & transportation

Bedding & furniture

Electronics

Others

8 North America Waterborne Polyurethane Market Analysis and Outlook To 2032

8.1 Introduction to North America Waterborne Polyurethane Markets in 2024

8.2 North America Waterborne Polyurethane Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Waterborne Polyurethane Market size Outlook by Segments, 2021-2032

By Application

Coating

Sealant

Adhesive

Elastomer

Others

By End-User

Building & construction

Automotive & transportation

Bedding & furniture

Electronics

Others

9 Europe Waterborne Polyurethane Market Analysis and Outlook To 2032

9.1 Introduction to Europe Waterborne Polyurethane Markets in 2024

9.2 Europe Waterborne Polyurethane Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Waterborne Polyurethane Market Size Outlook by Segments, 2021-2032

By Application

Coating

Sealant

Adhesive

Elastomer

Others

By End-User

Building & construction

Automotive & transportation

Bedding & furniture

Electronics

Others

10 Asia Pacific Waterborne Polyurethane Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Waterborne Polyurethane Markets in 2024

10.2 Asia Pacific Waterborne Polyurethane Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Waterborne Polyurethane Market size Outlook by Segments, 2021-2032

By Application

Coating

Sealant

Adhesive

Elastomer

Others

By End-User

Building & construction

Automotive & transportation

Bedding & furniture

Electronics

Others

11 South America Waterborne Polyurethane Market Analysis and Outlook To 2032

11.1 Introduction to South America Waterborne Polyurethane Markets in 2024

11.2 South America Waterborne Polyurethane Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Waterborne Polyurethane Market size Outlook by Segments, 2021-2032

By Application

Coating

Sealant

Adhesive

Elastomer

Others

By End-User

Building & construction

Automotive & transportation

Bedding & furniture

Electronics

Others

12 Middle East and Africa Waterborne Polyurethane Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Waterborne Polyurethane Markets in 2024

12.2 Middle East and Africa Waterborne Polyurethane Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Waterborne Polyurethane Market size Outlook by Segments, 2021-2032

By Application

Coating

Sealant

Adhesive

Elastomer

Others

By End-User

Building & construction

Automotive & transportation

Bedding & furniture

Electronics

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Aditya Birla Chemicals Ltd

Allnex Belgium SA

Axalta Coating Systems LLC

BASF SE

Bayer MaterialScience AG

C.L Hauthaway & Son Corp

Chemtura Corp

Covestro AG

Dow Inc

H.B. Fuller Company

Hauthaway Corp

Henkel AG & Co. KGaA

Huntsman Corp

Kamsons Chemicals Pvt. Ltd

Koninklijke DSM NV

Lamberti S.p.A.

Lanxess AG

Nippon Polyurethane Industry Co. Ltd

Perstorp AB

PPG Industries Inc

R. STAHL GmbH

SNP Inc

Sun Polymers International Inc

The Lubrizol Corp

The Sherwin-Williams Company

Wanhua Chemical Group Co. Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Application

Coating

Sealant

Adhesive

Elastomer

Others

By End-User

Building & construction

Automotive & transportation

Bedding & furniture

Electronics

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Waterborne Polyurethane Market Size is valued at $2.1 Billion in 2024 and is forecast to register a growth rate (CAGR) of 5.5% to reach $3.2 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Aditya Birla Chemicals Ltd, Allnex Belgium SA, Axalta Coating Systems LLC, BASF SE, Bayer MaterialScience AG, C.L Hauthaway & Son Corp, Chemtura Corp, Covestro AG, Dow Inc, H.B. Fuller Company, Hauthaway Corp, Henkel AG & Co. KGaA, Huntsman Corp, Kamsons Chemicals Pvt. Ltd, Koninklijke DSM NV, Lamberti S.p.A., Lanxess AG, Nippon Polyurethane Industry Co. Ltd, Perstorp AB, PPG Industries Inc, R. STAHL GmbH, SNP Inc, Sun Polymers International Inc, The Lubrizol Corp, The Sherwin-Williams Company, Wanhua Chemical Group Co. Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume