The global Water Soluble Packaging Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Material (Polymers, Surfactants, Fibers), By Product (Bags, Pouches, Pods & Capsules), By Solubility (Cold Water, Hot Water), By End-User (Household Products, Agriculture, Medical, Retail, Chemicals, Water Treatment, Animal Waste, Fishing, Others).

The water-soluble packaging market is witnessing significant growth and innovation driven by key trends shaping the future of sustainable packaging, waste reduction, and environmental stewardship. One notable trend is the increasing demand for eco-friendly and biodegradable packaging solutions that minimize plastic waste and pollution in the environment. Water-soluble packaging materials, composed of polymers such as polyvinyl alcohol (PVA) or starch-based derivatives, dissolve and disintegrate in water, offering a convenient and environmentally safe alternative to traditional single-use plastics. These materials are used in a wide range of applications, including detergent pods, single-dose food packaging, agricultural films, and personal care products, where they provide containment and protection during use and transportation while eliminating the need for disposal and reducing littering and marine pollution. Additionally, advancements in water-soluble polymer technology, film extrusion, and packaging machinery are driving innovations in packaging design, barrier properties, and processing efficiency, with manufacturers offering customizable solutions tailored to specific product requirements and end-user preferences. Furthermore, the trend towards circular economy initiatives and extended producer responsibility (EPR) programs is driving collaboration between packaging manufacturers, brand owners, and recycling organizations to develop closed-loop systems for collecting, recycling, and repurposing water-soluble packaging materials, ensuring resource recovery and waste diversion from landfills and oceans. Moreover, collaborations between water-soluble packaging suppliers, retailers, and consumer goods companies are driving innovation and market growth by delivering sustainable packaging solutions that meet the performance, safety, and regulatory standards of diverse industries and applications, ensuring continued advancement and adoption of water-soluble packaging as a preferred choice for environmentally conscious consumers and businesses.

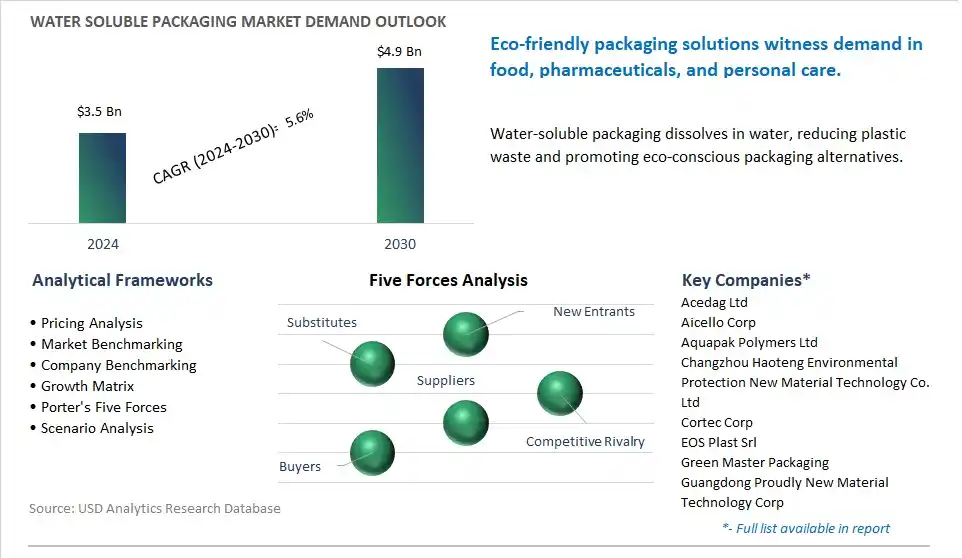

The market report analyses the leading companies in the industry including Acedag Ltd, Aicello Corp, Aquapak Polymers Ltd, Changzhou Haoteng Environmental Protection New Material Technology Co. Ltd, Cortec Corp, EOS Plast Srl, Green Master Packaging, Guangdong Proudly New Material Technology Corp, Invisible Company, Kuraray, Lithey Inc, Medanos Claros HK Ltd, Mitsubishi Chemical Corp, Mondi Group, Rovi Packaging S.A., Sekisui Chemical Co. Ltd, Soltec Development, Solubag, Soluble Technology Ltd, Solupak.

A prominent trend in the water-soluble packaging market is the increasing demand for sustainable packaging solutions. With growing environmental concerns and regulations aimed at reducing plastic waste and pollution, there is a rising preference for eco-friendly packaging alternatives that offer biodegradability and reduced environmental impact. Water-soluble packaging materials dissolve in water, offering a convenient and environmentally friendly solution for single-use packaging applications such as laundry pods, dishwasher tablets, and personal care products. This trend is driven by consumer awareness of plastic pollution, corporate sustainability initiatives, and regulatory pressures to adopt more sustainable packaging practices, driving innovation and adoption of water-soluble packaging solutions across various industries.

The primary driver for the water-soluble packaging market is regulatory restrictions on single-use plastics and packaging waste. Governments worldwide are implementing regulations and bans on single-use plastics such as plastic bags, straws, and packaging materials to reduce plastic pollution and promote sustainable packaging alternatives. Additionally, extended producer responsibility (EPR) regulations and packaging waste directives impose requirements on manufacturers and brand owners to minimize packaging waste and adopt more environmentally friendly packaging materials. The need to comply with regulatory mandates and address consumer preferences for sustainable packaging drives the adoption of water-soluble packaging solutions, which offer biodegradability, compostability, and reduced environmental impact compared to traditional plastic packaging materials.

An opportunity for market expansion in the water-soluble packaging segment lies in the expansion into food and beverage packaging applications. While water-soluble packaging materials are commonly used in household and personal care products, there is potential to penetrate the food and beverage packaging market, particularly for single-serve and portion-controlled products. Water-soluble packaging offers advantages such as portion control, convenience, and reduced food waste by eliminating the need for individual packaging components such as wrappers, sachets, and portion cups. Additionally, water-soluble packaging materials can be formulated to meet food safety standards and regulatory requirements for direct contact with food products, making them suitable for a wide range of food and beverage applications. Collaboration with food manufacturers, packaging converters, and regulatory authorities can facilitate the development and adoption of water-soluble packaging solutions for food and beverage packaging, unlocking new opportunities for growth and sustainability in the packaging industry.

The largest segment in the Water Soluble Packaging Market is the Polymers material category. polymers, particularly synthetic polymers such as polyvinyl alcohol (PVA) and polyvinylpyrrolidone (PVP), are widely used in water-soluble packaging due to their versatility, compatibility with various packaging applications, and ability to dissolve in water at controlled rates. Polymers offer excellent film-forming properties, mechanical strength, and barrier properties, making them suitable for packaging a wide range of products, including detergents, agrochemicals, pharmaceuticals, and personal care products. Additionally, polymers can be easily processed and fabricated into films, bags, pouches, and capsules using conventional packaging equipment, further enhancing their suitability for water-soluble packaging applications. Further, polymers are biodegradable and environmentally friendly, making them a preferred choice for eco-conscious consumers and brands seeking sustainable packaging solutions. Water-soluble polymer films dissolve harmlessly in water without leaving any residues, reducing packaging waste and environmental pollution. Furthermore, advancements in polymer chemistry and processing technologies have led to the development of biodegradable and compostable polymers, further enhancing the sustainability profile of water-soluble packaging materials. Over the forecast period, the Polymers material category maintains its position as the largest in the Water Soluble Packaging Market due to its versatility, performance, sustainability, and widespread use across various industries and applications.

The fastest-growing segment in the Water Soluble Packaging Market is the Pods & Capsules category. pods and capsules offer convenience and ease of use for consumers in various industries, including household cleaning, personal care, and agrochemicals. These single-dose packaging formats are pre-measured and pre-portioned, eliminating the need for measuring and reducing product wastage. Additionally, pods and capsules are highly soluble in water, allowing for easy and mess-free dispensing of their contents. This convenience factor has led to increasing consumer preference for pod and capsule formats, driving demand for water-soluble packaging solutions in this segment. Further, the popularity of concentrated and unit-dose formulations has been growing across multiple product categories, including laundry detergents, dishwashing detergents, and healthcare products. Concentrated formulations offer benefits such as reduced packaging waste, lower transportation costs, and improved product performance. Water-soluble pods and capsules provide a convenient and sustainable packaging solution for delivering concentrated formulations to consumers, further driving their adoption and market growth. Furthermore, advancements in packaging technology, such as improved film properties, enhanced seal strength, and compatibility with various product formulations, have made water-soluble pods and capsules more versatile and reliable for use in diverse applications. Over the forecast period, the Pods & Capsules category is experiencing rapid growth in the Water Soluble Packaging Market due to increasing consumer demand for convenience, sustainability, and concentrated formulations across various industries.

The fastest-growing segment in the Water Soluble Packaging Market is the Cold Water solubility category. cold water-soluble packaging offers convenience and versatility for consumers across various applications, including household cleaning products, personal care items, and agrochemicals. Unlike hot water-soluble packaging, which requires specific temperature conditions for dissolution, cold water-soluble packaging dissolves quickly and completely in cold water, making it suitable for a wider range of use cases and environments. Additionally, cold water-soluble packaging is more energy-efficient than hot water-soluble packaging, as it does not require heating water to dissolve, reducing energy consumption and environmental impact. Further, there is increasing consumer demand for eco-friendly and sustainable packaging solutions, driven by growing awareness of environmental issues and regulatory pressures to reduce plastic waste. Cold water-soluble packaging materials, such as polyvinyl alcohol (PVA) and polyvinylpyrrolidone (PVP), are biodegradable and environmentally friendly, offering a viable alternative to conventional plastics. As consumers seek more sustainable options for packaging and product disposal, cold water-soluble packaging is gaining traction as a preferred choice for brands and manufacturers looking to meet sustainability goals and consumer preferences. Furthermore, advancements in cold water-soluble packaging technology, such as improved film properties, enhanced dissolution rates, and compatibility with different product formulations, are driving innovation and expanding the application scope of cold water-soluble packaging materials. Over the forecast period, the Cold Water solubility category is experiencing rapid growth in the Water Soluble Packaging Market due to its convenience, sustainability, energy efficiency, and expanding application opportunities across various industries.

By Material

Polymers

Surfactants

Fibers

By Product

Bags

Pouches

Pods & Capsules

By Solubility Type

Cold Water

Hot Water

By End-User

Household Products

Agriculture

Medical

Retail

Chemicals

Water Treatment

Animal Waste

Fishing

Others

Regions Included

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Acedag Ltd

Aicello Corp

Aquapak Polymers Ltd

Changzhou Haoteng Environmental Protection New Material Technology Co. Ltd

Cortec Corp

EOS Plast Srl

Green Master Packaging

Guangdong Proudly New Material Technology Corp

Invisible Company

Kuraray

Lithey Inc

Medanos Claros HK Ltd

Mitsubishi Chemical Corp

Mondi Group

Rovi Packaging S.A.

Sekisui Chemical Co. Ltd

Soltec Development

Solubag

Soluble Technology Ltd

Solupak

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Water Soluble Packaging Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Water Soluble Packaging Market Size Outlook, $ Million, 2021 to 2030

3.2 Water Soluble Packaging Market Outlook by Type, $ Million, 2021 to 2030

3.3 Water Soluble Packaging Market Outlook by Product, $ Million, 2021 to 2030

3.4 Water Soluble Packaging Market Outlook by Application, $ Million, 2021 to 2030

3.5 Water Soluble Packaging Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Water Soluble Packaging Industry

4.2 Key Market Trends in Water Soluble Packaging Industry

4.3 Potential Opportunities in Water Soluble Packaging Industry

4.4 Key Challenges in Water Soluble Packaging Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Water Soluble Packaging Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Water Soluble Packaging Market Outlook by Segments

7.1 Water Soluble Packaging Market Outlook by Segments, $ Million, 2021- 2030

By Material

Polymers

Surfactants

Fibers

By Product

Bags

Pouches

Pods & Capsules

By Solubility Type

Cold Water

Hot Water

By End-User

Household Products

Agriculture

Medical

Retail

Chemicals

Water Treatment

Animal Waste

Fishing

Others

8 North America Water Soluble Packaging Market Analysis and Outlook To 2030

8.1 Introduction to North America Water Soluble Packaging Markets in 2024

8.2 North America Water Soluble Packaging Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Water Soluble Packaging Market size Outlook by Segments, 2021-2030

By Material

Polymers

Surfactants

Fibers

By Product

Bags

Pouches

Pods & Capsules

By Solubility Type

Cold Water

Hot Water

By End-User

Household Products

Agriculture

Medical

Retail

Chemicals

Water Treatment

Animal Waste

Fishing

Others

9 Europe Water Soluble Packaging Market Analysis and Outlook To 2030

9.1 Introduction to Europe Water Soluble Packaging Markets in 2024

9.2 Europe Water Soluble Packaging Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Water Soluble Packaging Market Size Outlook by Segments, 2021-2030

By Material

Polymers

Surfactants

Fibers

By Product

Bags

Pouches

Pods & Capsules

By Solubility Type

Cold Water

Hot Water

By End-User

Household Products

Agriculture

Medical

Retail

Chemicals

Water Treatment

Animal Waste

Fishing

Others

10 Asia Pacific Water Soluble Packaging Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Water Soluble Packaging Markets in 2024

10.2 Asia Pacific Water Soluble Packaging Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Water Soluble Packaging Market size Outlook by Segments, 2021-2030

By Material

Polymers

Surfactants

Fibers

By Product

Bags

Pouches

Pods & Capsules

By Solubility Type

Cold Water

Hot Water

By End-User

Household Products

Agriculture

Medical

Retail

Chemicals

Water Treatment

Animal Waste

Fishing

Others

11 South America Water Soluble Packaging Market Analysis and Outlook To 2030

11.1 Introduction to South America Water Soluble Packaging Markets in 2024

11.2 South America Water Soluble Packaging Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Water Soluble Packaging Market size Outlook by Segments, 2021-2030

By Material

Polymers

Surfactants

Fibers

By Product

Bags

Pouches

Pods & Capsules

By Solubility Type

Cold Water

Hot Water

By End-User

Household Products

Agriculture

Medical

Retail

Chemicals

Water Treatment

Animal Waste

Fishing

Others

12 Middle East and Africa Water Soluble Packaging Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Water Soluble Packaging Markets in 2024

12.2 Middle East and Africa Water Soluble Packaging Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Water Soluble Packaging Market size Outlook by Segments, 2021-2030

By Material

Polymers

Surfactants

Fibers

By Product

Bags

Pouches

Pods & Capsules

By Solubility Type

Cold Water

Hot Water

By End-User

Household Products

Agriculture

Medical

Retail

Chemicals

Water Treatment

Animal Waste

Fishing

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Acedag Ltd

Aicello Corp

Aquapak Polymers Ltd

Changzhou Haoteng Environmental Protection New Material Technology Co. Ltd

Cortec Corp

EOS Plast Srl

Green Master Packaging

Guangdong Proudly New Material Technology Corp

Invisible Company

Kuraray

Lithey Inc

Medanos Claros HK Ltd

Mitsubishi Chemical Corp

Mondi Group

Rovi Packaging S.A.

Sekisui Chemical Co. Ltd

Soltec Development

Solubag

Soluble Technology Ltd

Solupak

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Material

Polymers

Surfactants

Fibers

By Product

Bags

Pouches

Pods & Capsules

By Solubility Type

Cold Water

Hot Water

By End-User

Household Products

Agriculture

Medical

Retail

Chemicals

Water Treatment

Animal Waste

Fishing

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Water Soluble Packaging is forecast to reach $4.9 Billion in 2030 from $3.5 Billion in 2024, registering a CAGR of 5.6%

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Acedag Ltd, Aicello Corp, Aquapak Polymers Ltd, Changzhou Haoteng Environmental Protection New Material Technology Co. Ltd, Cortec Corp, EOS Plast Srl, Green Master Packaging, Guangdong Proudly New Material Technology Corp, Invisible Company, Kuraray, Lithey Inc, Medanos Claros HK Ltd, Mitsubishi Chemical Corp, Mondi Group, Rovi Packaging S.A., Sekisui Chemical Co. Ltd, Soltec Development, Solubag, Soluble Technology Ltd, Solupak

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume