The global Water Clarifiers Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Coagulant, Flocculant, pH Stabilizers), By End-User (Municipal, Pulp & Paper, Textile, Petrochemicals, Metals & Mining, Others).

Water clarifiers play a crucial role in water treatment processes by removing suspended solids, turbidity, and colloidal particles to clarify water for various applications in 2024. These systems utilize physical and chemical processes to aggregate and settle suspended particles, resulting in clear and visually transparent water suitable for drinking, industrial processes, and environmental discharge. Water clarifiers find applications in municipal water treatment plants, industrial wastewater treatment facilities, and mining operations, where the removal of solids and contaminants is necessary to meet regulatory requirements and ensure water quality standards. In municipal water treatment, clarifiers are typically used after coagulation and flocculation processes to settle out floc particles and produce clarified water for disinfection and distribution to consumers. Similarly, in industrial settings, water clarifiers are employed to treat process water, cooling water, and wastewater streams from manufacturing operations to remove pollutants and improve water quality. With advancements in clarifier design, automation, and monitoring systems, water clarifiers to offer efficient and cost-effective solutions for achieving water clarity and purity in diverse applications, contributing to public health, environmental protection, and sustainable water management.

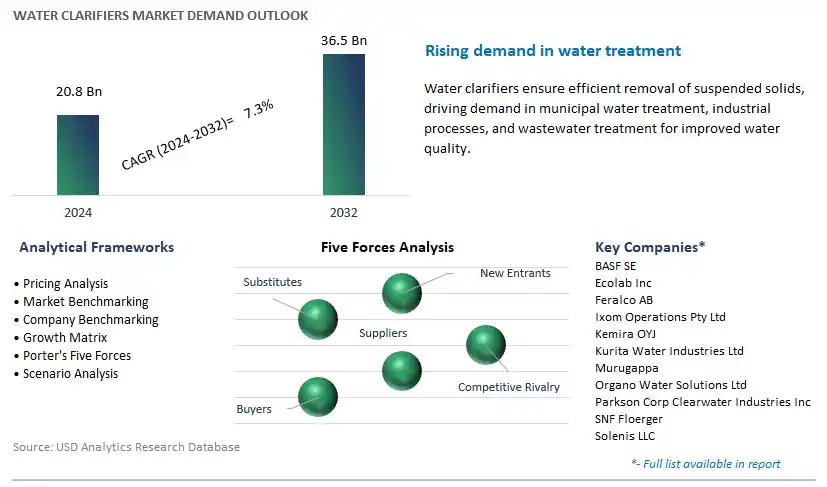

The market report analyses the leading companies in the industry including BASF SE, Ecolab Inc, Feralco AB, Ixom Operations Pty Ltd, Kemira OYJ, Kurita Water Industries Ltd, Murugappa, Organo Water Solutions Ltd, Parkson Corp Clearwater Industries Inc, SNF Floerger, Solenis LLC, and others.

A significant market trend in the water clarifiers industry is the increasing focus on water quality and environmental protection. With growing concerns over pollution, industrial discharge, and contamination of water sources, there is a heightened emphasis on the need for effective water treatment solutions. This trend is driven by regulatory mandates, public awareness campaigns, and corporate sustainability initiatives aimed at preserving natural ecosystems and ensuring safe drinking water supplies. Water clarifiers, designed to remove suspended solids, turbidity, and pollutants from water, are witnessing higher demand as industries, municipalities, and communities seek to improve water quality and comply with regulatory standards. As stakeholders prioritize environmental stewardship and sustainable water management practices, the market for water clarifiers is experiencing growth and greater adoption as a critical component of water treatment infrastructure.

The driver behind the growth of the water clarifiers market is increasing urbanization and industrialization. With rapid population growth, urban expansion, and industrial development, there is a corresponding increase in wastewater generation and pollution loads discharged into water bodies. Municipalities and industries are investing in water clarifiers to treat wastewater from urban sewage systems, industrial processes, and agricultural runoff before discharge into rivers, lakes, and oceans. Additionally, the expansion of manufacturing facilities, chemical plants, and power generation stations further drives the demand for water clarifiers to comply with environmental regulations and minimize the environmental impact of industrial activities. As urban areas expand and industrial sectors grow, the need for efficient water treatment solutions driven by increasing urbanization and industrialization continues to rise, shaping the market towards greater adoption and innovation of water clarifiers.

An opportunity for growth and diversification in the water clarifiers market lies in expansion into emerging markets such as developing countries. While water clarifiers are commonly used in developed nations with established water treatment infrastructure, there is potential for penetration into new regions with growing urban populations and industrial activities. In developing countries, where water pollution levels are high, and access to clean water is limited, there is a pressing need for affordable and scalable water treatment solutions. Water clarifiers can be deployed in municipal water treatment plants, industrial facilities, and agricultural operations to remove contaminants and improve water quality for drinking, sanitation, and irrigation purposes. By targeting emerging markets and partnering with local governments, utilities, and NGOs, water clarifier manufacturers can address the challenges of water pollution, promote public health, and contribute to sustainable development goals. Additionally, by offering cost-effective and customizable solutions tailored to the needs of developing countries, manufacturers can seize opportunities for market expansion and establish a presence in untapped regions with significant growth potential.

In the Water Clarifiers market, the Coagulant segment is the largest and most significant. In particular, coagulants play a fundamental role in the water clarification process by destabilizing suspended particles and colloids, allowing them to aggregate and form larger flocs that can be more easily removed through filtration or sedimentation. This mechanism effectively clears turbidity and improves water clarity, making coagulants essential in various water treatment applications, including drinking water treatment, wastewater treatment, and industrial processes. Moreover, coagulants are versatile chemicals that can effectively treat a wide range of water sources, including surface water, groundwater, and industrial effluents, making them widely applicable across different sectors and industries. Additionally, the availability of various types of coagulants, such as aluminum-based (e.g., aluminum sulfate, alum) and iron-based (e.g., ferric chloride, ferric sulfate), provides flexibility for water treatment plants to select the most suitable coagulant based on water quality parameters and treatment objectives. Furthermore, the growing emphasis on water quality management, regulatory compliance, and environmental sustainability drives the demand for effective water treatment solutions, thereby fuelling the adoption of coagulants in the Water Clarifiers market. Over the forecast period, the essential role, versatility, and widespread applicability of coagulants solidify their position as the largest segment in the Water Clarifiers market.

Among the diverse end-user segments in the Water Clarifiers market, the Municipal segment is the fastest-growing. In particular, rapid urbanization and population growth worldwide have led to an increased demand for clean and potable water in urban areas, driving investments in municipal water treatment infrastructure. Municipalities are continuously striving to enhance their water treatment processes to meet stringent regulatory standards and ensure the supply of safe drinking water to their residents. Additionally, growing environmental concerns, such as pollution and water scarcity, further emphasize the need for efficient water treatment solutions in municipal wastewater treatment plants. Water clarifiers play a vital role in municipal water treatment by facilitating the removal of suspended solids, organic matter, and contaminants from wastewater, thereby improving water quality and safeguarding public health. Moreover, advancements in water clarifier technology, including the development of innovative coagulants, flocculants, and pH stabilizers, enhance the efficiency and performance of municipal water treatment processes, driving adoption in this segment. Furthermore, government initiatives and funding support for upgrading and expanding municipal water infrastructure, along with increasing awareness about the importance of water conservation and sustainability, contribute to the rapid growth of the Municipal segment in the Water Clarifiers market. Over the forecast period, the pressing need for effective wastewater treatment solutions in urban areas and the proactive measures taken by municipalities to address water quality challenges propel the Municipal segment to be the fastest-growing segment in the Water Clarifiers market.

By Type

Coagulant

-Organic Coagulant

-Inorganic Coagulant

Flocculant

- Anionic

-Cationic

-Non-Ionic

-Amphoteric

pH Stabilizers

By End-User

Municipal

Pulp & Paper

Textile

Petrochemicals

Metals & Mining

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

BASF SE

Ecolab Inc

Feralco AB

Ixom Operations Pty Ltd

Kemira OYJ

Kurita Water Industries Ltd

Murugappa

Organo Water Solutions Ltd

Parkson Corp Clearwater Industries Inc

SNF Floerger

Solenis LLC

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Water Clarifiers Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Water Clarifiers Market Size Outlook, $ Million, 2021 to 2032

3.2 Water Clarifiers Market Outlook by Type, $ Million, 2021 to 2032

3.3 Water Clarifiers Market Outlook by Product, $ Million, 2021 to 2032

3.4 Water Clarifiers Market Outlook by Application, $ Million, 2021 to 2032

3.5 Water Clarifiers Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Water Clarifiers Industry

4.2 Key Market Trends in Water Clarifiers Industry

4.3 Potential Opportunities in Water Clarifiers Industry

4.4 Key Challenges in Water Clarifiers Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Water Clarifiers Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Water Clarifiers Market Outlook by Segments

7.1 Water Clarifiers Market Outlook by Segments, $ Million, 2021- 2032

By Type

Coagulant

-Organic Coagulant

-Inorganic Coagulant

Flocculant

- Anionic

-Cationic

-Non-Ionic

-Amphoteric

pH Stabilizers

By End-User

Municipal

Pulp & Paper

Textile

Petrochemicals

Metals & Mining

Others

8 North America Water Clarifiers Market Analysis and Outlook To 2032

8.1 Introduction to North America Water Clarifiers Markets in 2024

8.2 North America Water Clarifiers Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Water Clarifiers Market size Outlook by Segments, 2021-2032

By Type

Coagulant

-Organic Coagulant

-Inorganic Coagulant

Flocculant

- Anionic

-Cationic

-Non-Ionic

-Amphoteric

pH Stabilizers

By End-User

Municipal

Pulp & Paper

Textile

Petrochemicals

Metals & Mining

Others

9 Europe Water Clarifiers Market Analysis and Outlook To 2032

9.1 Introduction to Europe Water Clarifiers Markets in 2024

9.2 Europe Water Clarifiers Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Water Clarifiers Market Size Outlook by Segments, 2021-2032

By Type

Coagulant

-Organic Coagulant

-Inorganic Coagulant

Flocculant

- Anionic

-Cationic

-Non-Ionic

-Amphoteric

pH Stabilizers

By End-User

Municipal

Pulp & Paper

Textile

Petrochemicals

Metals & Mining

Others

10 Asia Pacific Water Clarifiers Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Water Clarifiers Markets in 2024

10.2 Asia Pacific Water Clarifiers Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Water Clarifiers Market size Outlook by Segments, 2021-2032

By Type

Coagulant

-Organic Coagulant

-Inorganic Coagulant

Flocculant

- Anionic

-Cationic

-Non-Ionic

-Amphoteric

pH Stabilizers

By End-User

Municipal

Pulp & Paper

Textile

Petrochemicals

Metals & Mining

Others

11 South America Water Clarifiers Market Analysis and Outlook To 2032

11.1 Introduction to South America Water Clarifiers Markets in 2024

11.2 South America Water Clarifiers Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Water Clarifiers Market size Outlook by Segments, 2021-2032

By Type

Coagulant

-Organic Coagulant

-Inorganic Coagulant

Flocculant

- Anionic

-Cationic

-Non-Ionic

-Amphoteric

pH Stabilizers

By End-User

Municipal

Pulp & Paper

Textile

Petrochemicals

Metals & Mining

Others

12 Middle East and Africa Water Clarifiers Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Water Clarifiers Markets in 2024

12.2 Middle East and Africa Water Clarifiers Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Water Clarifiers Market size Outlook by Segments, 2021-2032

By Type

Coagulant

-Organic Coagulant

-Inorganic Coagulant

Flocculant

- Anionic

-Cationic

-Non-Ionic

-Amphoteric

pH Stabilizers

By End-User

Municipal

Pulp & Paper

Textile

Petrochemicals

Metals & Mining

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

BASF SE

Ecolab Inc

Feralco AB

Ixom Operations Pty Ltd

Kemira OYJ

Kurita Water Industries Ltd

Murugappa

Organo Water Solutions Ltd

Parkson Corp Clearwater Industries Inc

SNF Floerger

Solenis LLC

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Coagulant

-Organic Coagulant

-Inorganic Coagulant

Flocculant

- Anionic

-Cationic

-Non-Ionic

-Amphoteric

pH Stabilizers

By End-User

Municipal

Pulp & Paper

Textile

Petrochemicals

Metals & Mining

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Water Clarifiers Market Size is valued at $20.8 Billion in 2024 and is forecast to register a growth rate (CAGR) of 7.3% to reach $36.5 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

BASF SE, Ecolab Inc, Feralco AB, Ixom Operations Pty Ltd, Kemira OYJ, Kurita Water Industries Ltd, Murugappa, Organo Water Solutions Ltd, Parkson Corp Clearwater Industries Inc, SNF Floerger, Solenis LLC

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume