The global Water-based Adhesive Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Resin (Acrylic Polymer Emulsion (PAE), Polyvinyl Acetate (PVA) Emulsion, Vinyl Acetate Ethylene (VAE) Emulsion, Styrene Butadiene (SB) Latex, Polyurethane Dispersion (PUD), Others), By Application (Tapes & Labels, Paper & Packaging, Building & Construction, Woodworking, Automotive & Transportation, Others).

Water-based adhesives to gain prominence as environmentally friendly and versatile bonding solutions in various industries in 2024, offering low VOC emissions, fast drying times, and strong adhesion properties. These adhesives are formulated with water as the primary solvent, along with polymers, additives, and crosslinking agents to achieve desired bonding characteristics. Water-based adhesives find applications in industries such as packaging, woodworking, construction, automotive, and textiles, where sustainability, safety, and performance are priorities. In packaging and labeling, water-based adhesives are used for bonding paperboard, cardboard, labels, and flexible packaging materials, providing secure seals and tamper-evident closures. Similarly, in woodworking and furniture manufacturing, water-based adhesives are employed for bonding wood veneers, laminates, and edge banding, offering strong bonds and low formaldehyde emissions. Further, in automotive assembly, water-based adhesives are utilized for bonding interior trim, headliners, and acoustic insulation, contributing to lightweight construction and improved vehicle performance. With increasing regulations on VOC emissions and growing consumer demand for sustainable products, water-based adhesives to be preferred choices for manufacturers seeking environmentally friendly and high-performance bonding solutions.

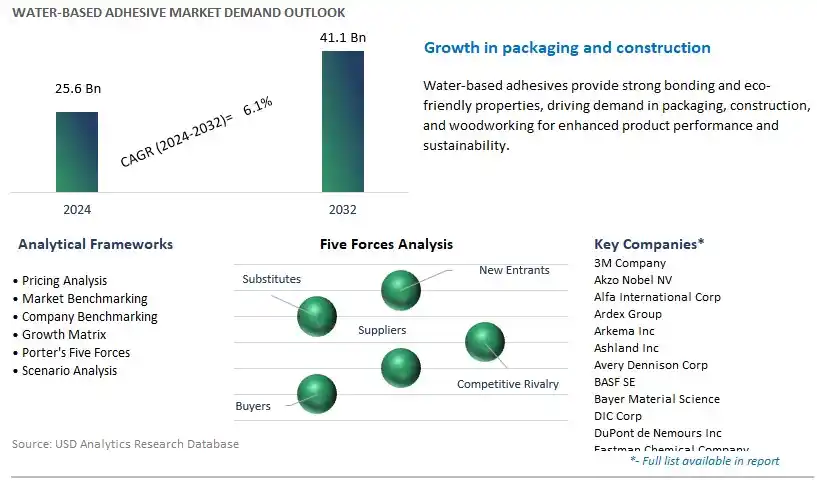

The market report analyses the leading companies in the industry including 3M Company, Akzo Nobel NV, Alfa International Corp, Ardex Group, Arkema Inc, Ashland Inc, Avery Dennison Corp, BASF SE, Bayer Material Science, DIC Corp, DuPont de Nemours Inc, Eastman Chemical Company, Evonik Industries AG, Franklin International Inc, H.B. Fuller Company, Henkel AG & Co. KGaA, Huber Group, Illinois Tool Works Inc, Jowat SE, Lord Corp, Mapei SPA, Momentive Performance Materials Inc, Paramelt BV, Permabond LLC, Pidilite Industries Ltd, PPG Industries Inc, Royal Adhesives & Sealants LLC, RPM International Inc, Sika AG, and others.

A significant market trend in the water-based adhesive industry is the growing preference for eco-friendly and sustainable adhesives. With increasing awareness of environmental issues and regulations, consumers and industries are seeking adhesives that have minimal impact on the environment and human health. This trend is driven by regulatory mandates, consumer demand for greener products, and corporate sustainability initiatives. Water-based adhesives, formulated with water as the primary solvent and free from volatile organic compounds (VOCs) and hazardous chemicals, are gaining popularity as a sustainable alternative to solvent-based adhesives. As businesses and consumers prioritize environmental responsibility and seek to reduce their carbon footprint, the market for water-based adhesives is witnessing growth and greater adoption as a preferred adhesive solution for various applications.

The driver behind the growth of the water-based adhesive market is regulatory restrictions on volatile organic compound (VOC) emissions and hazardous chemicals. Regulatory agencies worldwide impose stringent limits on VOC emissions from adhesives and coatings to protect air quality and human health. Additionally, regulations such as REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and Proposition 65 mandate the use of safer alternatives and require manufacturers to disclose the presence of hazardous substances in products. Water-based adhesives, with low VOC content and non-toxic formulations, offer compliance with regulatory standards and provide a safer working environment for workers and end-users. As industries adapt to evolving regulations and seek to mitigate compliance risks, the demand for water-based adhesives driven by regulatory restrictions on VOC emissions and hazardous chemicals continues to rise, shaping the market towards greater adoption and innovation.

An opportunity for growth and diversification in the water-based adhesive market lies in expansion into high-performance applications and emerging markets. While water-based adhesives are commonly used in industries such as packaging, woodworking, and paper converting, there is potential for penetration into new sectors with specialized requirements such as automotive, electronics, and medical devices. In high-performance applications, water-based adhesives can be engineered to meet stringent performance criteria such as temperature resistance, chemical resistance, and bonding strength, offering opportunities for replacing solvent-based adhesives in challenging environments. Additionally, in emerging markets such as Asia-Pacific and Latin America, where environmental regulations are tightening, and demand for sustainable products is growing, water-based adhesives present opportunities for market expansion and customer acquisition. By investing in research and development, product innovation, and market expansion strategies, water-based adhesive manufacturers can capitalize on opportunities for growth and market diversification in high-performance applications and emerging markets.

In the Water-based Adhesive market, the Polyvinyl Acetate (PVA) Emulsion segment is the largest and most significant. In particular, Polyvinyl Acetate (PVA) emulsion-based adhesives offer a versatile and cost-effective solution for a wide range of bonding applications across various industries. PVA emulsion adhesives exhibit excellent adhesion properties, good tack, and high bond strength, making them suitable for bonding porous substrates such as wood, paper, cardboard, and textiles. Moreover, PVA emulsions are environmentally friendly, as they contain water as a solvent and have low volatile organic compound (VOC) emissions, aligning with increasingly stringent environmental regulations and sustainability requirements. Additionally, the ease of application and clean-up of PVA emulsion adhesives further enhances their appeal to end-users in diverse sectors, including woodworking, packaging, paper converting, textiles, and construction. Furthermore, continuous research and development efforts have led to the development of modified PVA emulsion formulations with enhanced performance characteristics, such as improved water resistance, heat resistance, and adhesion to non-porous substrates, expanding their application scope and driving their widespread adoption. Over the forecast period, the versatility, performance, and eco-friendly nature of Polyvinyl Acetate (PVA) emulsion-based adhesives solidify the segment's position as the largest in the Water-based Adhesive market.

Among the various application segments in the Water-based Adhesive market, the Tapes & Labels segment stands out as the fastest-growing. In particular, the increasing demand for tapes and labels across multiple industries, including packaging, automotive, electronics, and healthcare, is driving the adoption of water-based adhesives due to their superior performance and environmental advantages. Water-based adhesives offer excellent adhesion to a variety of substrates commonly used in tapes and labels, such as paper, cardboard, plastics, and films, ensuring reliable bonding and long-lasting adhesion. Moreover, water-based adhesives are preferred for applications requiring compliance with regulations on volatile organic compound (VOC) emissions and food safety, making them suitable for use in food packaging and medical applications. Additionally, the growing trend towards sustainable and eco-friendly adhesive solutions further boosts the demand for water-based adhesives in the tapes and labels segment. Manufacturers are increasingly investing in research and development to innovate water-based adhesive formulations tailored to the specific requirements of tapes and labels, including improved tack, peel strength, and temperature resistance, driving their adoption in diverse applications. Furthermore, the versatility of water-based adhesives allows for customization to meet the evolving needs of end-users in the tapes and labels segment, contributing to its rapid growth in the Water-based Adhesive market.

By Resin

Acrylic Polymer Emulsion (PAE)

Polyvinyl Acetate (PVA) Emulsion

Vinyl Acetate Ethylene (VAE) Emulsion

Styrene Butadiene (SB) Latex

Polyurethane Dispersion (PUD)

Others

By Application

Tapes & Labels

Paper & Packaging

Building & Construction

Woodworking

Automotive & Transportation

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

3M Company

Akzo Nobel NV

Alfa International Corp

Ardex Group

Arkema Inc

Ashland Inc

Avery Dennison Corp

BASF SE

Bayer Material Science

DIC Corp

DuPont de Nemours Inc

Eastman Chemical Company

Evonik Industries AG

Franklin International Inc

H.B. Fuller Company

Henkel AG & Co. KGaA

Huber Group

Illinois Tool Works Inc

Jowat SE

Lord Corp

Mapei SPA

Momentive Performance Materials Inc

Paramelt BV

Permabond LLC

Pidilite Industries Ltd

PPG Industries Inc

Royal Adhesives & Sealants LLC

RPM International Inc

Sika AG

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Water based Adhesive Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Water based Adhesive Market Size Outlook, $ Million, 2021 to 2032

3.2 Water based Adhesive Market Outlook by Type, $ Million, 2021 to 2032

3.3 Water based Adhesive Market Outlook by Product, $ Million, 2021 to 2032

3.4 Water based Adhesive Market Outlook by Application, $ Million, 2021 to 2032

3.5 Water based Adhesive Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Water based Adhesive Industry

4.2 Key Market Trends in Water based Adhesive Industry

4.3 Potential Opportunities in Water based Adhesive Industry

4.4 Key Challenges in Water based Adhesive Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Water based Adhesive Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Water based Adhesive Market Outlook by Segments

7.1 Water based Adhesive Market Outlook by Segments, $ Million, 2021- 2032

By Resin

Acrylic Polymer Emulsion (PAE)

Polyvinyl Acetate (PVA) Emulsion

Vinyl Acetate Ethylene (VAE) Emulsion

Styrene Butadiene (SB) Latex

Polyurethane Dispersion (PUD)

Others

By Application

Tapes & Labels

Paper & Packaging

Building & Construction

Woodworking

Automotive & Transportation

Others

8 North America Water based Adhesive Market Analysis and Outlook To 2032

8.1 Introduction to North America Water based Adhesive Markets in 2024

8.2 North America Water based Adhesive Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Water based Adhesive Market size Outlook by Segments, 2021-2032

By Resin

Acrylic Polymer Emulsion (PAE)

Polyvinyl Acetate (PVA) Emulsion

Vinyl Acetate Ethylene (VAE) Emulsion

Styrene Butadiene (SB) Latex

Polyurethane Dispersion (PUD)

Others

By Application

Tapes & Labels

Paper & Packaging

Building & Construction

Woodworking

Automotive & Transportation

Others

9 Europe Water based Adhesive Market Analysis and Outlook To 2032

9.1 Introduction to Europe Water based Adhesive Markets in 2024

9.2 Europe Water based Adhesive Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Water based Adhesive Market Size Outlook by Segments, 2021-2032

By Resin

Acrylic Polymer Emulsion (PAE)

Polyvinyl Acetate (PVA) Emulsion

Vinyl Acetate Ethylene (VAE) Emulsion

Styrene Butadiene (SB) Latex

Polyurethane Dispersion (PUD)

Others

By Application

Tapes & Labels

Paper & Packaging

Building & Construction

Woodworking

Automotive & Transportation

Others

10 Asia Pacific Water based Adhesive Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Water based Adhesive Markets in 2024

10.2 Asia Pacific Water based Adhesive Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Water based Adhesive Market size Outlook by Segments, 2021-2032

By Resin

Acrylic Polymer Emulsion (PAE)

Polyvinyl Acetate (PVA) Emulsion

Vinyl Acetate Ethylene (VAE) Emulsion

Styrene Butadiene (SB) Latex

Polyurethane Dispersion (PUD)

Others

By Application

Tapes & Labels

Paper & Packaging

Building & Construction

Woodworking

Automotive & Transportation

Others

11 South America Water based Adhesive Market Analysis and Outlook To 2032

11.1 Introduction to South America Water based Adhesive Markets in 2024

11.2 South America Water based Adhesive Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Water based Adhesive Market size Outlook by Segments, 2021-2032

By Resin

Acrylic Polymer Emulsion (PAE)

Polyvinyl Acetate (PVA) Emulsion

Vinyl Acetate Ethylene (VAE) Emulsion

Styrene Butadiene (SB) Latex

Polyurethane Dispersion (PUD)

Others

By Application

Tapes & Labels

Paper & Packaging

Building & Construction

Woodworking

Automotive & Transportation

Others

12 Middle East and Africa Water based Adhesive Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Water based Adhesive Markets in 2024

12.2 Middle East and Africa Water based Adhesive Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Water based Adhesive Market size Outlook by Segments, 2021-2032

By Resin

Acrylic Polymer Emulsion (PAE)

Polyvinyl Acetate (PVA) Emulsion

Vinyl Acetate Ethylene (VAE) Emulsion

Styrene Butadiene (SB) Latex

Polyurethane Dispersion (PUD)

Others

By Application

Tapes & Labels

Paper & Packaging

Building & Construction

Woodworking

Automotive & Transportation

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

3M Company

Akzo Nobel NV

Alfa International Corp

Ardex Group

Arkema Inc

Ashland Inc

Avery Dennison Corp

BASF SE

Bayer Material Science

DIC Corp

DuPont de Nemours Inc

Eastman Chemical Company

Evonik Industries AG

Franklin International Inc

H.B. Fuller Company

Henkel AG & Co. KGaA

Huber Group

Illinois Tool Works Inc

Jowat SE

Lord Corp

Mapei SPA

Momentive Performance Materials Inc

Paramelt BV

Permabond LLC

Pidilite Industries Ltd

PPG Industries Inc

Royal Adhesives & Sealants LLC

RPM International Inc

Sika AG

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Resin

Acrylic Polymer Emulsion (PAE)

Polyvinyl Acetate (PVA) Emulsion

Vinyl Acetate Ethylene (VAE) Emulsion

Styrene Butadiene (SB) Latex

Polyurethane Dispersion (PUD)

Others

By Application

Tapes & Labels

Paper & Packaging

Building & Construction

Woodworking

Automotive & Transportation

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Water-based Adhesive Market Size is valued at $25.6 Billion in 2024 and is forecast to register a growth rate (CAGR) of 6.1% to reach $41.1 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

3M Company, Akzo Nobel NV, Alfa International Corp, Ardex Group, Arkema Inc, Ashland Inc, Avery Dennison Corp, BASF SE, Bayer Material Science, DIC Corp, DuPont de Nemours Inc, Eastman Chemical Company, Evonik Industries AG, Franklin International Inc, H.B. Fuller Company, Henkel AG & Co. KGaA, Huber Group, Illinois Tool Works Inc, Jowat SE, Lord Corp, Mapei SPA, Momentive Performance Materials Inc, Paramelt BV, Permabond LLC, Pidilite Industries Ltd, PPG Industries Inc, Royal Adhesives & Sealants LLC, RPM International Inc, Sika AG

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume