The global Water and Wastewater Treatment Equipment Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Filtration, Disinfection, Desalination, Sludge Treatment, Biological, Testing), By Process (Primary, Secondary, Tertiary), By End-User (Municipal, Industrial).

Water and wastewater treatment equipment remains essential infrastructure for ensuring clean water supply and effective wastewater management in 2024. This equipment encompasses a wide range of technologies and systems used in water treatment plants, wastewater treatment facilities, and industrial processes to remove contaminants, pathogens, and pollutants from water sources. Water treatment equipment includes processes such as filtration, sedimentation, disinfection, and chemical treatment, while wastewater treatment equipment includes processes such as screening, aeration, biological treatment, and sludge dewatering. In municipal water treatment plants, equipment such as clarifiers, filters, disinfection systems, and pumps are used to treat raw water from rivers, lakes, or groundwater sources to meet drinking water quality standards. Similarly, in wastewater treatment facilities, equipment such as screens, grit chambers, biological reactors, and settling tanks are employed to remove solids, organic matter, and nutrients from wastewater before discharge or reuse. Industrial water treatment equipment is utilized in sectors such as manufacturing, food and beverage, pharmaceuticals, and power generation to treat process water, boiler feedwater, and wastewater streams to meet regulatory requirements and operational needs. With increasing population growth, urbanization, and industrialization, the demand for water and wastewater treatment equipment s to rise, driving innovation, investment, and adoption of advanced technologies to address emerging water quality challenges and ensure sustainable water management practices.

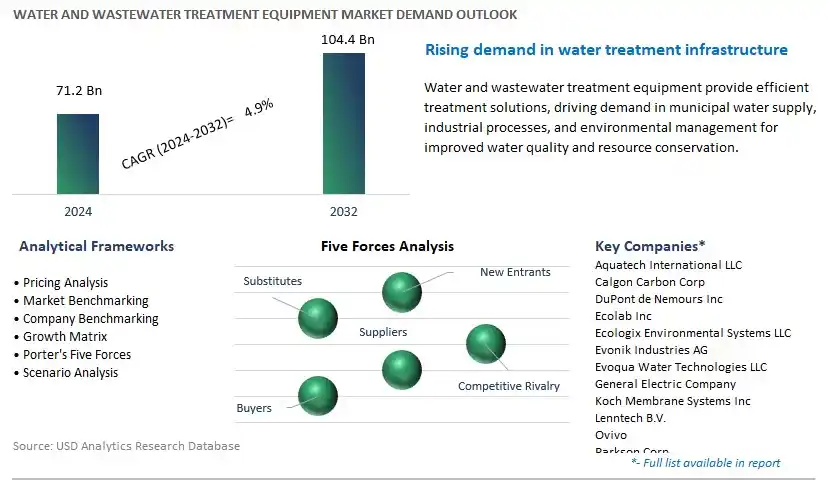

The market report analyses the leading companies in the industry including Aquatech International LLC, Calgon Carbon Corp, DuPont de Nemours Inc, Ecolab Inc, Ecologix Environmental Systems LLC, Evonik Industries AG, Evoqua Water Technologies LLC, General Electric Company, Koch Membrane Systems Inc, Lenntech B.V., Ovivo, Parkson Corp, Pentair plc, Samco Technologies Inc, Toshiba Water Solutions Private Ltd, Veolia Environnement SA, Xylem Inc, and others.

A significant market trend in the water and wastewater treatment equipment industry is the increasing adoption of advanced treatment technologies. With growing concerns over water scarcity, pollution, and the need for sustainable water management, industries, municipalities, and governments are investing in advanced equipment for water and wastewater treatment. This trend is driven by regulatory requirements, population growth, and industrial expansion, leading to higher demand for equipment that can effectively remove contaminants, pathogens, and pollutants from water sources. As stakeholders prioritize water quality, environmental protection, and public health, the market for water and wastewater treatment equipment is witnessing growth and greater adoption of advanced technologies such as membrane filtration, UV disinfection, and advanced oxidation processes.

The driver behind the growth of the water and wastewater treatment equipment market is the demand for clean and safe water supply. With increasing urbanization, industrialization, and agricultural activities, the demand for fresh and potable water is rising, placing pressure on water resources and infrastructure. Water and wastewater treatment equipment play a crucial role in ensuring access to safe drinking water, protecting public health, and meeting regulatory standards for water quality. Additionally, industries rely on water treatment equipment to comply with discharge regulations, minimize environmental impact, and manage wastewater effectively. As communities and industries seek to address water-related challenges and ensure sustainable water management practices, the demand for water and wastewater treatment equipment driven by the need for clean and safe water supply continues to rise, shaping the market towards greater innovation and adoption of advanced treatment technologies.

An opportunity for growth and diversification in the water and wastewater treatment equipment market lies in expansion into emerging markets such as decentralized treatment systems. While centralized treatment plants are commonly used for large-scale water and wastewater treatment, there is potential for penetration into new sectors with decentralized solutions for remote communities, industrial sites, and rural areas. Decentralized treatment systems offer advantages such as scalability, flexibility, and resilience to infrastructure challenges, making them suitable for addressing water treatment needs in underserved regions and off-grid locations. By offering modular and portable treatment equipment such as containerized systems, mobile units, and compact units, equipment manufacturers can cater to the needs of diverse markets and applications requiring decentralized water and wastewater treatment solutions. Additionally, by leveraging innovative technologies such as membrane bioreactors, electrocoagulation, and constructed wetlands, equipment providers can deliver cost-effective and sustainable solutions for decentralized water treatment, supporting access to clean water and sanitation in areas with limited resources and infrastructure.

In the Water & Wastewater Treatment Equipment market, the Filtration segment is the largest and most significant. In particular, filtration plays a fundamental role in water and wastewater treatment processes by removing suspended solids, sediments, and other particulate matter from the water. Filtration systems encompass a wide range of technologies, including sand filtration, membrane filtration (such as microfiltration, ultrafiltration, nanofiltration, and reverse osmosis), cartridge filters, and multimedia filters, among others, providing versatility to address various water quality challenges. Moreover, with the increasing emphasis on water quality standards, regulations, and public health concerns, the demand for reliable and efficient filtration solutions continues to grow across municipal, industrial, and commercial sectors. Additionally, advancements in filtration technologies, such as the development of high-performance membranes and innovative filtration media, enhance the efficiency, capacity, and lifespan of filtration systems, further driving their adoption. Furthermore, the versatility of filtration equipment in addressing diverse water treatment applications, including potable water production, wastewater treatment, process water purification, and groundwater remediation, solidifies the Filtration segment's position as the largest segment in the Water & Wastewater Treatment Equipment market.

Among the various process segments in the Water & Wastewater Treatment Equipment market, the Tertiary Treatment segment stands out as the fastest-growing. In particular, tertiary treatment plays a critical role in enhancing the quality of treated water by further removing contaminants, pathogens, and pollutants that remain after primary and secondary treatment processes. Tertiary treatment typically involves advanced treatment technologies such as filtration, disinfection (e.g., UV disinfection, chlorination), chemical precipitation, and membrane processes (e.g., reverse osmosis, nanofiltration) to achieve stringent water quality standards for reuse or discharge into the environment. Moreover, with increasing water scarcity, regulatory requirements for wastewater reuse, and growing environmental concerns about nutrient pollution and emerging contaminants, there is a rising demand for advanced tertiary treatment solutions to ensure the safety and sustainability of water resources. Additionally, technological advancements and innovations in tertiary treatment equipment, such as the development of more efficient membranes, advanced oxidation processes, and integrated treatment systems, drive the adoption of tertiary treatment solutions in various municipal, industrial, and commercial applications. Furthermore, the versatility of tertiary treatment processes in addressing diverse water quality challenges and the increasing emphasis on sustainable water management practices contribute to the rapid growth of the Tertiary Treatment segment in the Water & Wastewater Treatment Equipment market.

In the Water & Wastewater Treatment Equipment market, the Municipal segment is the largest and most significant. In particular, municipal water and wastewater treatment facilities play a critical role in ensuring public health and environmental protection by treating water for potable use and treating wastewater before discharge into the environment. As urbanization and population growth continue worldwide, the demand for clean drinking water and effective wastewater treatment solutions in municipal areas escalates. Consequently, governments and municipalities invest significantly in upgrading and expanding water and wastewater infrastructure, including the installation of advanced treatment equipment and technologies. Moreover, regulatory requirements and standards for water quality and environmental protection drive municipalities to adopt state-of-the-art treatment equipment to comply with stringent regulations and safeguard public health and the environment. Additionally, the increasing prevalence of waterborne diseases, pollution incidents, and water scarcity challenges necessitates continuous improvements in municipal water and wastewater treatment systems, further driving the demand for treatment equipment. Furthermore, the Municipal segment benefits from economies of scale, as municipal treatment plants typically serve large populations, resulting in substantial investments in water and wastewater treatment equipment, solidifying its position as the largest segment in the Water & Wastewater Treatment Equipment market.

By Product

Filtration

Disinfection

Desalination

Sludge Treatment

Biological

Testing

By Process

Primary

Secondary

Tertiary

By End-User

Municipal

IndustrialCountries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Aquatech International LLC

Calgon Carbon Corp

DuPont de Nemours Inc

Ecolab Inc

Ecologix Environmental Systems LLC

Evonik Industries AG

Evoqua Water Technologies LLC

General Electric Company

Koch Membrane Systems Inc

Lenntech B.V.

Ovivo

Parkson Corp

Pentair plc

Samco Technologies Inc

Toshiba Water Solutions Private Ltd

Veolia Environnement SA

Xylem Inc

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Water and Wastewater Treatment Equipment Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Water and Wastewater Treatment Equipment Market Size Outlook, $ Million, 2021 to 2032

3.2 Water and Wastewater Treatment Equipment Market Outlook by Type, $ Million, 2021 to 2032

3.3 Water and Wastewater Treatment Equipment Market Outlook by Product, $ Million, 2021 to 2032

3.4 Water and Wastewater Treatment Equipment Market Outlook by Application, $ Million, 2021 to 2032

3.5 Water and Wastewater Treatment Equipment Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Water and Wastewater Treatment Equipment Industry

4.2 Key Market Trends in Water and Wastewater Treatment Equipment Industry

4.3 Potential Opportunities in Water and Wastewater Treatment Equipment Industry

4.4 Key Challenges in Water and Wastewater Treatment Equipment Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Water and Wastewater Treatment Equipment Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Water and Wastewater Treatment Equipment Market Outlook by Segments

7.1 Water and Wastewater Treatment Equipment Market Outlook by Segments, $ Million, 2021- 2032

By Product

Filtration

Disinfection

Desalination

Sludge Treatment

Biological

Testing

By Process

Primary

Secondary

Tertiary

By End-User

Municipal

Industrial

8 North America Water and Wastewater Treatment Equipment Market Analysis and Outlook To 2032

8.1 Introduction to North America Water and Wastewater Treatment Equipment Markets in 2024

8.2 North America Water and Wastewater Treatment Equipment Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Water and Wastewater Treatment Equipment Market size Outlook by Segments, 2021-2032

By Product

Filtration

Disinfection

Desalination

Sludge Treatment

Biological

Testing

By Process

Primary

Secondary

Tertiary

By End-User

Municipal

Industrial

9 Europe Water and Wastewater Treatment Equipment Market Analysis and Outlook To 2032

9.1 Introduction to Europe Water and Wastewater Treatment Equipment Markets in 2024

9.2 Europe Water and Wastewater Treatment Equipment Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Water and Wastewater Treatment Equipment Market Size Outlook by Segments, 2021-2032

By Product

Filtration

Disinfection

Desalination

Sludge Treatment

Biological

Testing

By Process

Primary

Secondary

Tertiary

By End-User

Municipal

Industrial

10 Asia Pacific Water and Wastewater Treatment Equipment Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Water and Wastewater Treatment Equipment Markets in 2024

10.2 Asia Pacific Water and Wastewater Treatment Equipment Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Water and Wastewater Treatment Equipment Market size Outlook by Segments, 2021-2032

By Product

Filtration

Disinfection

Desalination

Sludge Treatment

Biological

Testing

By Process

Primary

Secondary

Tertiary

By End-User

Municipal

Industrial

11 South America Water and Wastewater Treatment Equipment Market Analysis and Outlook To 2032

11.1 Introduction to South America Water and Wastewater Treatment Equipment Markets in 2024

11.2 South America Water and Wastewater Treatment Equipment Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Water and Wastewater Treatment Equipment Market size Outlook by Segments, 2021-2032

By Product

Filtration

Disinfection

Desalination

Sludge Treatment

Biological

Testing

By Process

Primary

Secondary

Tertiary

By End-User

Municipal

Industrial

12 Middle East and Africa Water and Wastewater Treatment Equipment Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Water and Wastewater Treatment Equipment Markets in 2024

12.2 Middle East and Africa Water and Wastewater Treatment Equipment Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Water and Wastewater Treatment Equipment Market size Outlook by Segments, 2021-2032

By Product

Filtration

Disinfection

Desalination

Sludge Treatment

Biological

Testing

By Process

Primary

Secondary

Tertiary

By End-User

Municipal

Industrial

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Aquatech International LLC

Calgon Carbon Corp

DuPont de Nemours Inc

Ecolab Inc

Ecologix Environmental Systems LLC

Evonik Industries AG

Evoqua Water Technologies LLC

General Electric Company

Koch Membrane Systems Inc

Lenntech B.V.

Ovivo

Parkson Corp

Pentair plc

Samco Technologies Inc

Toshiba Water Solutions Private Ltd

Veolia Environnement SA

Xylem Inc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Filtration

Disinfection

Desalination

Sludge Treatment

Biological

Testing

By Process

Primary

Secondary

Tertiary

By End-User

Municipal

Industrial

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Water and Wastewater Treatment Equipment Market Size is valued at $71.2 Billion in 2024 and is forecast to register a growth rate (CAGR) of 4.9% to reach $104.4 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Aquatech International LLC, Calgon Carbon Corp, DuPont de Nemours Inc, Ecolab Inc, Ecologix Environmental Systems LLC, Evonik Industries AG, Evoqua Water Technologies LLC, General Electric Company, Koch Membrane Systems Inc, Lenntech B.V., Ovivo, Parkson Corp, Pentair plc, Samco Technologies Inc, Toshiba Water Solutions Private Ltd, Veolia Environnement SA, Xylem Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume