The global Vinyl Ester Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Bisphenol A, Novolac, Brominated Fire Retardant, Elastomer Modified, Others), By End-User (Pipes & Tanks, Marine, Wind Energy, Water Pipes, FGD & Precipitators, Building & Construction, Land Transportation, Aerospace & Defense, Others).

Vinyl ester resins to be valued for their exceptional corrosion resistance and mechanical properties in composite materials and coatings in 2024. These thermosetting resins are derived from the reaction between epoxy resins and unsaturated monocarboxylic acids, resulting in a highly crosslinked polymer structure with improved toughness and chemical resistance compared to conventional polyester resins. Vinyl ester resins find applications in industries such as marine, automotive, chemical processing, and infrastructure, where protection against corrosion and harsh environments is essential. In marine applications, vinyl ester composites are used for boat hulls, pipes, and tanks, providing long-lasting protection against saltwater corrosion and abrasion. Similarly, in chemical processing plants and wastewater treatment facilities, vinyl ester coatings and linings offer resistance to corrosive chemicals and acidic environments. With their superior mechanical properties, adhesion, and resistance to moisture and chemicals, vinyl ester resins to be preferred materials for demanding applications requiring durable and corrosion-resistant composite materials and coatings.

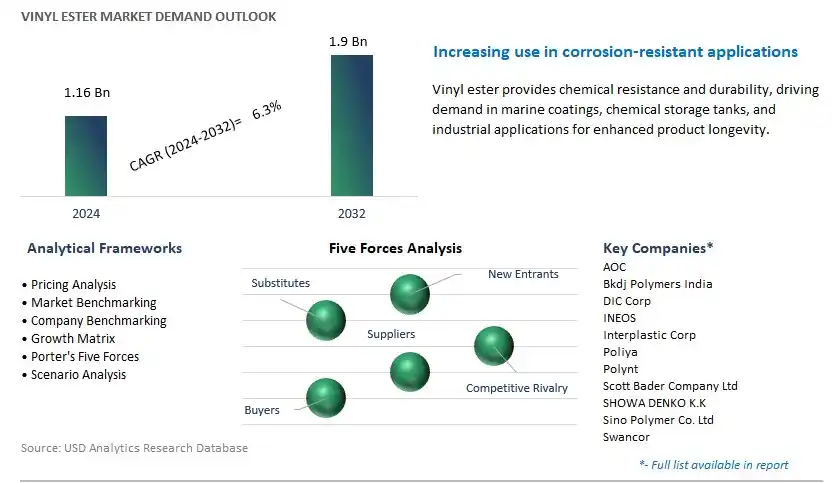

The market report analyses the leading companies in the industry including AOC, Bkdj Polymers India, DIC Corp, INEOS, Interplastic Corp, Poliya, Polynt, Scott Bader Company Ltd, SHOWA DENKO K.K, Sino Polymer Co. Ltd, Swancor, and others.

A significant market trend in the vinyl ester industry is the increasing adoption of vinyl ester resins in corrosion-resistant applications. Vinyl ester resins, known for their excellent corrosion resistance, mechanical properties, and chemical resistance, are experiencing heightened demand across industries such as construction, marine, chemical processing, and infrastructure. This trend is driven by the need to protect structures and equipment from harsh chemical environments, corrosive agents, and extreme weather conditions. As industries prioritize durability, longevity, and maintenance cost reduction, the market for vinyl ester resins is witnessing growth and greater adoption as a preferred material for corrosion-resistant coatings, linings, pipes, tanks, and composite structures.

The driver behind the growth of the vinyl ester market is regulatory compliance and environmental protection. Regulatory agencies worldwide impose strict regulations on the storage, transport, and handling of hazardous chemicals, requiring industries to use corrosion-resistant materials and protective coatings to prevent environmental contamination and ensure workplace safety. Vinyl ester resins offer advantages such as resistance to chemical attack, UV degradation, and thermal shock, making them suitable for compliance with regulatory standards such as OSHA (Occupational Safety and Health Administration), EPA (Environmental Protection Agency), and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals). Additionally, vinyl ester resins are formulated with low VOC (volatile organic compound) content, contributing to environmental sustainability and reducing the impact on air quality. As industries strive to meet regulatory requirements and implement sustainable practices, the demand for vinyl ester resins driven by regulatory compliance and environmental protection continues to rise, shaping the market towards greater adoption and innovation.

An opportunity for growth and diversification in the vinyl ester market lies in expansion into high-performance composite applications. While vinyl ester resins are commonly used in corrosion-resistant coatings and linings, there is potential for penetration into new sectors with demanding performance requirements such as aerospace, automotive, and renewable energy. In aerospace and automotive applications, vinyl ester composites can be utilized for lightweight structures, components, and parts requiring high strength-to-weight ratio, impact resistance, and fatigue resistance. Similarly, in renewable energy applications such as wind turbine blades and solar panels, vinyl ester composites offer advantages such as weatherability, dimensional stability, and resistance to environmental degradation, providing long-term performance in outdoor environments. By targeting emerging markets and applications that demand high-performance materials for lightweight, durable, and sustainable solutions, vinyl ester manufacturers can expand their product offerings, enter new market segments, and capitalize on opportunities for growth and market expansion beyond traditional corrosion-resistant applications.

In the Vinyl Ester market, the Bisphenol A type is the largest and most significant segment. In particular, Bisphenol A (BPA) based vinyl esters are widely used in various industries such as automotive, marine, construction, and chemical processing due to their excellent mechanical properties, chemical resistance, and thermal stability. Vinyl ester resins derived from BPA exhibit high strength-to-weight ratio, corrosion resistance, and dimensional stability, making them suitable for applications requiring superior performance and durability. Moreover, BPA-based vinyl esters are commonly employed in the manufacture of composite materials such as fiberglass reinforced plastics (FRP) and carbon fiber reinforced plastics (CFRP) for applications such as pipes, tanks, wind turbine blades, and automotive components. Additionally, BPA-based vinyl esters offer versatility in processing and formulation, allowing for customization of properties to meet specific application requirements. Furthermore, the widespread availability of BPA as a raw material and established manufacturing processes contribute to the dominance of the Bisphenol A type in the Vinyl Ester market.

Among the various end-user industries in the Vinyl Ester market, the Wind Energy sector stands out as the fastest-growing segment. In particular, vinyl ester resins are extensively used in the manufacturing of composite materials for wind turbine blades due to their excellent mechanical properties, including high strength, stiffness, and fatigue resistance. As the demand for renewable energy sources continues to rise globally, the wind energy sector experiences substantial growth, driving the need for lightweight and durable materials for wind turbine components. Moreover, vinyl ester-based composites offer superior corrosion resistance and weatherability, making them ideal for offshore wind farms subjected to harsh environmental conditions. Additionally, advancements in vinyl ester resin formulations and manufacturing processes have led to the development of high-performance materials tailored specifically for wind energy applications, further fuelling the growth of this segment. Furthermore, government incentives, increasing investments in wind energy projects, and growing environmental awareness contribute to the rapid expansion of the Wind Energy sector in the Vinyl Ester market.

By Type

Bisphenol A

Novolac

Brominated Fire Retardant

Elastomer Modified

Others

By End-User

Pipes & Tanks

Marine

Wind Energy

Water Pipes

FGD & Precipitators

Building & Construction

Land Transportation

Aerospace & Defense

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

AOC

Bkdj Polymers India

DIC Corp

INEOS

Interplastic Corp

Poliya

Polynt

Scott Bader Company Ltd

SHOWA DENKO K.K

Sino Polymer Co. Ltd

Swancor

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Vinyl Ester Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Vinyl Ester Market Size Outlook, $ Million, 2021 to 2032

3.2 Vinyl Ester Market Outlook by Type, $ Million, 2021 to 2032

3.3 Vinyl Ester Market Outlook by Product, $ Million, 2021 to 2032

3.4 Vinyl Ester Market Outlook by Application, $ Million, 2021 to 2032

3.5 Vinyl Ester Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Vinyl Ester Industry

4.2 Key Market Trends in Vinyl Ester Industry

4.3 Potential Opportunities in Vinyl Ester Industry

4.4 Key Challenges in Vinyl Ester Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Vinyl Ester Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Vinyl Ester Market Outlook by Segments

7.1 Vinyl Ester Market Outlook by Segments, $ Million, 2021- 2032

By Type

Bisphenol A

Novolac

Brominated Fire Retardant

Elastomer Modified

Others

By End-User

Pipes & Tanks

Marine

Wind Energy

Water Pipes

FGD & Precipitators

Building & Construction

Land Transportation

Aerospace & Defense

Others

8 North America Vinyl Ester Market Analysis and Outlook To 2032

8.1 Introduction to North America Vinyl Ester Markets in 2024

8.2 North America Vinyl Ester Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Vinyl Ester Market size Outlook by Segments, 2021-2032

By Type

Bisphenol A

Novolac

Brominated Fire Retardant

Elastomer Modified

Others

By End-User

Pipes & Tanks

Marine

Wind Energy

Water Pipes

FGD & Precipitators

Building & Construction

Land Transportation

Aerospace & Defense

Others

9 Europe Vinyl Ester Market Analysis and Outlook To 2032

9.1 Introduction to Europe Vinyl Ester Markets in 2024

9.2 Europe Vinyl Ester Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Vinyl Ester Market Size Outlook by Segments, 2021-2032

By Type

Bisphenol A

Novolac

Brominated Fire Retardant

Elastomer Modified

Others

By End-User

Pipes & Tanks

Marine

Wind Energy

Water Pipes

FGD & Precipitators

Building & Construction

Land Transportation

Aerospace & Defense

Others

10 Asia Pacific Vinyl Ester Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Vinyl Ester Markets in 2024

10.2 Asia Pacific Vinyl Ester Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Vinyl Ester Market size Outlook by Segments, 2021-2032

By Type

Bisphenol A

Novolac

Brominated Fire Retardant

Elastomer Modified

Others

By End-User

Pipes & Tanks

Marine

Wind Energy

Water Pipes

FGD & Precipitators

Building & Construction

Land Transportation

Aerospace & Defense

Others

11 South America Vinyl Ester Market Analysis and Outlook To 2032

11.1 Introduction to South America Vinyl Ester Markets in 2024

11.2 South America Vinyl Ester Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Vinyl Ester Market size Outlook by Segments, 2021-2032

By Type

Bisphenol A

Novolac

Brominated Fire Retardant

Elastomer Modified

Others

By End-User

Pipes & Tanks

Marine

Wind Energy

Water Pipes

FGD & Precipitators

Building & Construction

Land Transportation

Aerospace & Defense

Others

12 Middle East and Africa Vinyl Ester Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Vinyl Ester Markets in 2024

12.2 Middle East and Africa Vinyl Ester Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Vinyl Ester Market size Outlook by Segments, 2021-2032

By Type

Bisphenol A

Novolac

Brominated Fire Retardant

Elastomer Modified

Others

By End-User

Pipes & Tanks

Marine

Wind Energy

Water Pipes

FGD & Precipitators

Building & Construction

Land Transportation

Aerospace & Defense

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

AOC

Bkdj Polymers India

DIC Corp

INEOS

Interplastic Corp

Poliya

Polynt

Scott Bader Company Ltd

SHOWA DENKO K.K

Sino Polymer Co. Ltd

Swancor

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Bisphenol A

Novolac

Brominated Fire Retardant

Elastomer Modified

Others

By End-User

Pipes & Tanks

Marine

Wind Energy

Water Pipes

FGD & Precipitators

Building & Construction

Land Transportation

Aerospace & Defense

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Vinyl Ester Market Size is valued at $1.16 Billion in 2024 and is forecast to register a growth rate (CAGR) of 6.3% to reach $1.9 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

AOC, Bkdj Polymers India, DIC Corp, INEOS, Interplastic Corp, Poliya, Polynt, Scott Bader Company Ltd, SHOWA DENKO K.K, Sino Polymer Co. Ltd, Swancor

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume