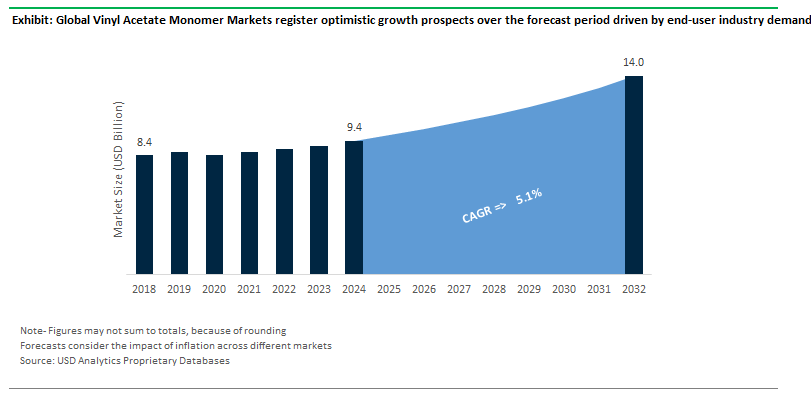

USD Analytics forecasts the Vinyl Acetate Monomer Market Size to increase at a 5.1% CAGR over the forecast period from $9.4 Billion in 2024 to $14 Billion in 2032

Vinyl Acetate Monomer (VAM) is a clear, colorless liquid organic compound with a pungent odor as a precursor to a wide variety of industrial and consumer products, particularly polyvinyl acetate homopolymers and copolymers to produce polyvinyl alcohol and ethylene–vinyl alcohol. Robust demand for Polyvinyl acetate (PVAc) and polyvinyl alcohol (PVOH) from packaging, automotive, construction, and other industries drive the demand for Vinyl Acetate Monomers. It is also used to make polyvinyl butyral (PVB), ethylene-vinyl acetate (EVA) copolymers, and ethylene vinyl alcohol (EVOH) resins. Strong adhesion properties across paper, films, and metals drive the industry size over the forecast period.

Celanese VAM Technology, DuPont VAM Technology, and LyondellBasell VAM Technology are among the widely used technologies. Innovations in polymerization techniques for stronger adhesion and durability in applications drive long-term market prospects. End-user demand for polymer emulsions as base resins in paints, adhesives, and coatings supports the VAM sales volume. In particular, Paints and Coatings (low VOC emissions), Adhesives (toughness and clarity), RDP (barrier to aroma and oxygen), glass (brightness and contamination resistance), and packaging (adhesion and quick drying) drive the market demand.

The global production capacity of VAM stood at 10 MTPA in 2024 and the industry is characterized by volatile prices driven by feedstock prices, varying end-user demand, and plant utilization rates. The price softened over the past year around $1,000/MT but as VAM makers in the US and Europe tighten supplies, the prices are set to fluctuate. Celanese has declared force majeure on acetic acid and vinyl acetate monomer in the Americas and the EMEA regions in 2024.

VAM’s application in water-based paints and coatings is driving demand, particularly in Asia-Pacific. Similarly, Sekisui is expanding its VAM production, aiming to increase PVOH capacity by 20% by 2025, primarily to serve the rising demand for photovoltaic panels and electronics while Asian Paints is building a new 100 KT production plant. Further, INEOS & LOTTE plans to add 250 KT VAM capacity by 2025 and ShengHong Holding Group Lianyungang VAM Plant to add 300 KT capacity.

Bio-based Acetic acid is being used for the production of VAM for use in paints, coatings, inks, adhesives, and sealants in textiles. Godavari Biorefineries Ltd., LENZING AG, Airedale Group, Novozymes A/S, Sekab, and others continue to invest in bio-acetic acid production. Further, bio-based crotonic acid is researched for producing VAM, VAM-based adhesive from bioethanol, and others are widely invested. The use of fermentation technologies, conversion of bio-based ethanol into acetic acid, and others are widely observed for the production of the building block in water-based polymers.

For instance, WACKER uses biobased acetic acid and ethylene to produce vinyl acetate monomer, which is copolymerized with ethylene to produce VAE. LyondellBasell and Neste agree on a long-term commercial relationship to market polymers and chemicals from renewable feedstock. Fossil-fuel-based VAM has moderate toxicity and is biodegraded by anaerobic and aerobic mechanisms. Emerging technologies to deploy eco-friendly production processes drive the market outlook. European countries aim to reduce greenhouse gas emissions by 55% by 2030, as per the European Green Deal, encouraging bio-based VAMs. As consumers increasingly prefer textiles, paints, and coatings sources from bio-based alternatives, the demand for bio-based VAM is increasing.

VAM-based polymers including EVA are gaining significant demand from battery encapsulation, sealing, and thermal insulation for lithium-ion batteries in electric vehicles. Driven by superior electrical insulation and the ability to manage thermal runaway risks, VAM-based adhesives and coatings offer high strength-to-weight ratios, driving bonding, and sealing applications in critical EV components. Further, ethylene-vinyl acetate (EVA) and polyvinyl acetate (PVA) integrate into the battery assembly process, ensuring protection against thermal and mechanical stress. Dow’s EVA-based films, Wacker Chemie AG’s silicone-VAM hybrid adhesives, Arkema’s high-performance VAM-based encapsulant, EV Guard® Coatings by AkzoNobel, Elvax® Resins by DuPont, and others continue to witness robust market demand with the increasing Electric Vehicle sales.

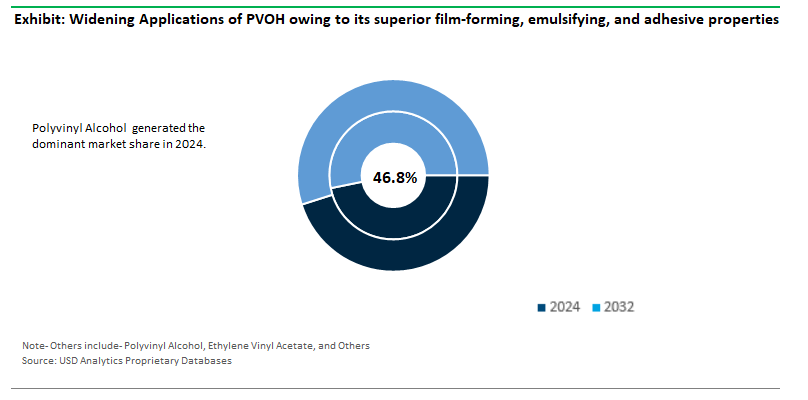

Polyvinyl Alcohol (PVOH), a key derivative of Vinyl Acetate Monomer (VAM), generated an estimated $4.4 billion in revenue. PVOH is widely used across diverse industries due to its superior film-forming, emulsifying, and adhesive properties, making it essential in the production of adhesives, textiles, and packaging materials. In particular, the textile industry heavily relies on PVOH for warp sizing and finishing, encouraging Kuraray and Sekisui Chemical to boost their PVOH capacities. Further, PVOH’s strong adhesive properties fuel its use in the construction industry for wood adhesives, paints, and coatings. Celanese and Chang Chun Group are major players supplying PVOH to adhesive manufacturers. In addition, the biocompatibility of PVOH has expanded its use in pharmaceutical formulations and biomedical devices.

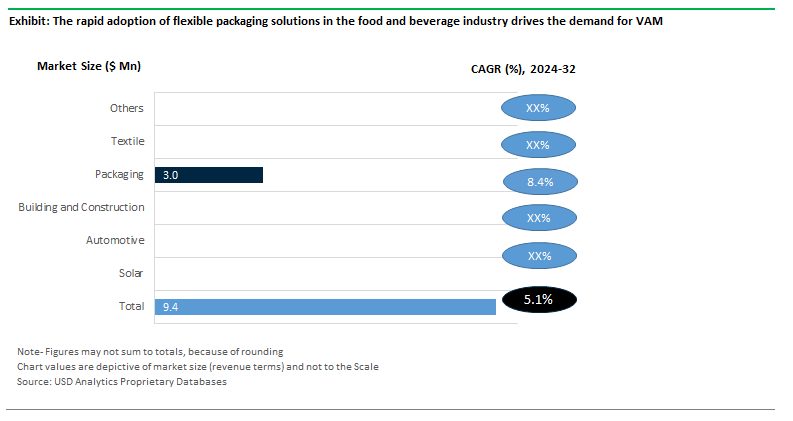

The packaging industry is rapidly adopting VAM-derived polymers to cater to the rising demand for environmentally friendly and high-performance packaging solutions with a 31.8% market share. The rapid adoption of flexible packaging solutions in the food and beverage industry drives the demand for VAM. In particular, VAM-derived ethylene-vinyl acetate (EVA) copolymers are widely used in food-safe films, pouches, and cling wraps due to their excellent clarity, flexibility, and adhesive properties.

Further, the demand for sterile, moisture-resistant packaging for pharmaceuticals is driving the VAM sales revenue from the packaging industry. VAM-based copolymers, especially ethylene-vinyl alcohol (EVOH), are marketed for their superior barrier properties, which help protect sensitive products from oxygen and moisture. Kuraray’s Advanced EVOH for Oxygen Barrier Packaging, Celanese’s Renewable VAM and Biodegradable Packaging Films, Sekisui Specialty Packaging Films for Pharma, Amcor partnerships with Circular Economy groups and chemical recycling companies, and others are gaining significant business growth. In addition, Recent innovations in PVOH-based water-soluble films are revolutionizing packaging, particularly in detergents, agrichemicals, and personal care. Kuraray’s Poval™ series, for example, is seeing rapid adoption for unit-dose packaging solutions that dissolve completely in water, reducing plastic waste.

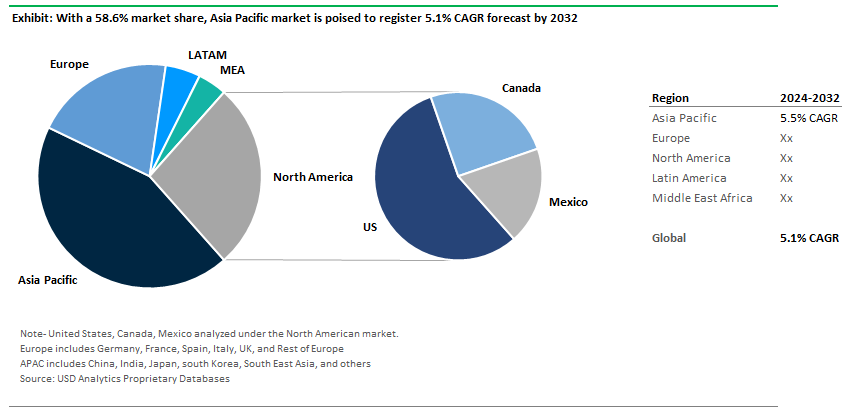

With a 58.6% market share, Asia Pacific is the largest and the fastest growing market for Vinyl Acetate monomers worldwide. In particular, China accounted for the majority of the demand with 22% of revenue in the world. The packaging industry in Asia-Pacific is witnessing exponential growth. China, India, and Southeast Asia are major drivers. In addition, according to the China Association of Automobile Manufacturers (CAAM), China is set to maintain dominance in the electric vehicle (EV) sector, with production slated to surpass 10 million EVs by 2025. Further, the textile industry in countries like China, India, and Vietnam heavily utilizes VAM in polyvinyl acetate (PVAc) adhesives, which are used in fabric finishing and binding. In addition, to meet growing demand, major manufacturers are expanding their production capacity in Asia Pacific, driving the long-term outlook.

The Vinyl Acetate Monomer market is partially consolidated with local players posing stiff competition to global majors. Companies are investing in capacity expansions, technological innovations, and sustainable production to maintain their competitive edge. Capacity expansion in Asia, innovation in bio-based VAM products, long-term supply agreements with key customers, enhancing operational efficiency in production plants, focusing on high-growth markets like automotive and renewable energy, innovating in packaging and adhesives applications, integrating VAM production with downstream applications like adhesives and coatings, and others drive the market outlook. Leading companies included in the study are Arkema S.A., Celanese Corp, China Petrochemical Corp (Sinopec), Clariant AG, DCC plc, Exxon Mobil Corp, INEOS Group Holdings S.A., Innospec Inc, Kemipex FZE, LyondellBasell Industries Holdings B.V., Nippon Chemical Industrial CO. Ltd, Sipchem Company, Wacker Chemie AG, and others.

The Vinyl Acetate Monomer (VAM) market ecosystem encompasses well-established industry stakeholders, including raw material suppliers, VAM producers, end-use industries, and regulatory bodies.

|

Parameter |

Details |

|

Market Size (2024) |

$9.4 Billion |

|

Market Size (2032) |

$14 Billion |

|

Market Growth Rate |

5.1% |

|

Largest Segment- Application |

PVOH ($4.4 Billion) |

|

Fastest Growing Market- Region |

Asia Pacific (5.5% CAGR) |

|

Largest End-User Industry |

Packaging (31.8% Market Share) |

|

Segments |

Types, Applications |

|

Study Period |

2018- 2023 and 2024-2032 |

|

Units |

Revenue (USD) |

|

Qualitative Analysis |

Porter’s Five Forces, SWOT Profile, Market Share, Scenario Forecasts, Market Ecosystem, Company Ranking, Market Dynamics, Industry Benchmarking |

|

Companies |

Arkema S.A., Celanese Corp, China Petrochemical Corp (Sinopec), Clariant AG, DCC plc, Exxon Mobil Corp, INEOS Group Holdings S.A., Innospec Inc, Kemipex FZE, LyondellBasell Industries Holdings B.V., Nippon Chemical Industrial CO. Ltd, Sipchem Company, Wacker Chemie AG |

|

Countries |

US, Canada, Mexico, Germany, France, Spain, Italy, UK, Russia, China, India, Japan, South Korea, Australia, South East Asia, Brazil, Argentina, Middle East, Africa |

Applications

End-Users

Geography

Companies

*- List Not Exhaustive

About USD Analytics

Table of Contents

1. Executive Summary

What’s New in 2024?

Top 10 Takeaways from the industry

Potential Opportunities for Industry Stakeholders

Strategic Imperatives

Company Market Positioning

Industry Benchmarking Matrix

2. Research Scope and Methodology

Market Definition

Market Segments

Companies Profiled

Research Methodology

Data Sources

Conversion Rates for USD

Abbreviations

3. Strategic Landscape: Key Insights and Implications

Spotlight: Key Strategies opted by Business Leaders

Competitive Landscape

SWOT Analysis

Porter’s Five Force Analysis

Macro-Environmental Analysis

5. Growth Opportunity Analysis

Trends at a Glance

Market Dynamics

Key Industry Stakeholders

Regulatory Landscape

6. Market Size Outlook to 2032

Global Vinyl Acetate Monomer Market Size Forecast, USD Million, 2018- 2032

Scenario Analysis

Pricing Analysis and Outlook

7. Historical Vinyl Acetate Monomer Market Size by Segments, 2018- 2023

Key Statistics, 2024

Vinyl Acetate Monomer Market Size Outlook by Type, USD Million, 2018-2023

Growth Comparison (y-o-y) across Vinyl Acetate Monomer Types, 2018-2023

Vinyl Acetate Monomer Market Size Outlook by Application, USD Million, 2018-2023

Growth Comparison (y-o-y) across Vinyl Acetate Monomer Applications, 2018-2023

8. Vinyl Acetate Monomer Market Size Outlook by Segments, 2024- 2032

Vinyl Acetate Monomer Market Size Outlook by Type, USD Million, 2024-2032

Growth Comparison (y-o-y) across Vinyl Acetate Monomer Types, 2024-2032

Vinyl Acetate Monomer Market Size Outlook by Application, USD Million, 2024-2032

Growth Comparison (y-o-y) across Vinyl Acetate Monomer Applications, 2024-2032

9. Vinyl Acetate Monomer Market Size Outlook by Region

North America

Europe

Asia Pacific

South America

Middle East and Africa

10. United States Vinyl Acetate Monomer Market Analysis and Outlook, 2021- 2032

Key Statistics

United States Vinyl Acetate Monomer Market Size Outlook by Type, 2021- 2032

United States Vinyl Acetate Monomer Market Size Outlook by Application, 2021- 2032

United States Vinyl Acetate Monomer Market Size Outlook by End-User, 2021- 2032

11. Canada Vinyl Acetate Monomer Market Analysis and Outlook, 2021- 2032

Key Statistics

Canada Vinyl Acetate Monomer Market Size Outlook by Type, 2021- 2032

Canada Vinyl Acetate Monomer Market Size Outlook by Application, 2021- 2032

Canada Vinyl Acetate Monomer Market Size Outlook by End-User, 2021- 2032

12. Mexico Vinyl Acetate Monomer Market Analysis and Outlook, 2021- 2032

Key Statistics

Mexico Vinyl Acetate Monomer Market Size Outlook by Type, 2021- 2032

Mexico Vinyl Acetate Monomer Market Size Outlook by Application, 2021- 2032

Mexico Vinyl Acetate Monomer Market Size Outlook by End-User, 2021- 2032

13. Germany Vinyl Acetate Monomer Market Analysis and Outlook, 2021- 2032

Key Statistics

Germany Vinyl Acetate Monomer Market Size Outlook by Type, 2021- 2032

Germany Vinyl Acetate Monomer Market Size Outlook by Application, 2021- 2032

Germany Vinyl Acetate Monomer Market Size Outlook by End-User, 2021- 2032

14. France Vinyl Acetate Monomer Market Analysis and Outlook, 2021- 2032

Key Statistics

France Vinyl Acetate Monomer Market Size Outlook by Type, 2021- 2032

France Vinyl Acetate Monomer Market Size Outlook by Application, 2021- 2032

France Vinyl Acetate Monomer Market Size Outlook by End-User, 2021- 2032

15. United Kingdom Vinyl Acetate Monomer Market Analysis and Outlook, 2021- 2032

Key Statistics

United Kingdom Vinyl Acetate Monomer Market Size Outlook by Type, 2021- 2032

United Kingdom Vinyl Acetate Monomer Market Size Outlook by Application, 2021- 2032

United Kingdom Vinyl Acetate Monomer Market Size Outlook by End-User, 2021- 2032

10. Spain Vinyl Acetate Monomer Market Analysis and Outlook, 2021- 2032

Key Statistics

Spain Vinyl Acetate Monomer Market Size Outlook by Type, 2021- 2032

Spain Vinyl Acetate Monomer Market Size Outlook by Application, 2021- 2032

Spain Vinyl Acetate Monomer Market Size Outlook by End-User, 2021- 2032

16. Italy Vinyl Acetate Monomer Market Analysis and Outlook, 2021- 2032

Key Statistics

Italy Vinyl Acetate Monomer Market Size Outlook by Type, 2021- 2032

Italy Vinyl Acetate Monomer Market Size Outlook by Application, 2021- 2032

Italy Vinyl Acetate Monomer Market Size Outlook by End-User, 2021- 2032

17. Benelux Vinyl Acetate Monomer Market Analysis and Outlook, 2021- 2032

Key Statistics

Benelux Vinyl Acetate Monomer Market Size Outlook by Type, 2021- 2032

Benelux Vinyl Acetate Monomer Market Size Outlook by Application, 2021- 2032

Benelux Vinyl Acetate Monomer Market Size Outlook by End-User, 2021- 2032

18. Nordic Vinyl Acetate Monomer Market Analysis and Outlook, 2021- 2032

Key Statistics

Nordic Vinyl Acetate Monomer Market Size Outlook by Type, 2021- 2032

Nordic Vinyl Acetate Monomer Market Size Outlook by Application, 2021- 2032

Nordic Vinyl Acetate Monomer Market Size Outlook by End-User, 2021- 2032

19. Rest of Europe Vinyl Acetate Monomer Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Europe Vinyl Acetate Monomer Market Size Outlook by Type, 2021- 2032

Rest of Europe Vinyl Acetate Monomer Market Size Outlook by Application, 2021- 2032

Rest of Europe Vinyl Acetate Monomer Market Size Outlook by End-User, 2021- 2032

20. China Vinyl Acetate Monomer Market Analysis and Outlook, 2021- 2032

Key Statistics

China Vinyl Acetate Monomer Market Size Outlook by Type, 2021- 2032

China Vinyl Acetate Monomer Market Size Outlook by Application, 2021- 2032

China Vinyl Acetate Monomer Market Size Outlook by End-User, 2021- 2032

21. India Vinyl Acetate Monomer Market Analysis and Outlook, 2021- 2032

Key Statistics

India Vinyl Acetate Monomer Market Size Outlook by Type, 2021- 2032

India Vinyl Acetate Monomer Market Size Outlook by Application, 2021- 2032

India Vinyl Acetate Monomer Market Size Outlook by End-User, 2021- 2032

22. Japan Vinyl Acetate Monomer Market Analysis and Outlook, 2021- 2032

Key Statistics

Japan Vinyl Acetate Monomer Market Size Outlook by Type, 2021- 2032

Japan Vinyl Acetate Monomer Market Size Outlook by Application, 2021- 2032

Japan Vinyl Acetate Monomer Market Size Outlook by End-User, 2021- 2032

23. South Korea Vinyl Acetate Monomer Market Analysis and Outlook, 2021- 2032

Key Statistics

South Korea Vinyl Acetate Monomer Market Size Outlook by Type, 2021- 2032

South Korea Vinyl Acetate Monomer Market Size Outlook by Application, 2021- 2032

South Korea Vinyl Acetate Monomer Market Size Outlook by End-User, 2021- 2032

24. Australia Vinyl Acetate Monomer Market Analysis and Outlook, 2021- 2032

Key Statistics

Australia Vinyl Acetate Monomer Market Size Outlook by Type, 2021- 2032

Australia Vinyl Acetate Monomer Market Size Outlook by Application, 2021- 2032

Australia Vinyl Acetate Monomer Market Size Outlook by End-User, 2021- 2032

25. South East Asia Vinyl Acetate Monomer Market Analysis and Outlook, 2021- 2032

Key Statistics

South East Asia Vinyl Acetate Monomer Market Size Outlook by Type, 2021- 2032

South East Asia Vinyl Acetate Monomer Market Size Outlook by Application, 2021- 2032

South East Asia Vinyl Acetate Monomer Market Size Outlook by End-User, 2021- 2032

26. Rest of Asia Pacific Vinyl Acetate Monomer Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Asia Pacific Vinyl Acetate Monomer Market Size Outlook by Type, 2021- 2032

Rest of Asia Pacific Vinyl Acetate Monomer Market Size Outlook by Application, 2021- 2032

Rest of Asia Pacific Vinyl Acetate Monomer Market Size Outlook by End-User, 2021- 2032

27. Brazil Vinyl Acetate Monomer Market Analysis and Outlook, 2021- 2032

Key Statistics

Brazil Vinyl Acetate Monomer Market Size Outlook by Type, 2021- 2032

Brazil Vinyl Acetate Monomer Market Size Outlook by Application, 2021- 2032

Brazil Vinyl Acetate Monomer Market Size Outlook by End-User, 2021- 2032

28. Argentina Vinyl Acetate Monomer Market Analysis and Outlook, 2021- 2032

Key Statistics

Argentina Vinyl Acetate Monomer Market Size Outlook by Type, 2021- 2032

Argentina Vinyl Acetate Monomer Market Size Outlook by Application, 2021- 2032

Argentina Vinyl Acetate Monomer Market Size Outlook by End-User, 2021- 2032

29. Rest of South America Vinyl Acetate Monomer Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of South America Vinyl Acetate Monomer Market Size Outlook by Type, 2021- 2032

Rest of South America Vinyl Acetate Monomer Market Size Outlook by Application, 2021- 2032

Rest of South America Vinyl Acetate Monomer Market Size Outlook by End-User, 2021- 2032

30. United Arab Emirates Vinyl Acetate Monomer Market Analysis and Outlook, 2021- 2032

Key Statistics

United Arab Emirates Vinyl Acetate Monomer Market Size Outlook by Type, 2021- 2032

United Arab Emirates Vinyl Acetate Monomer Market Size Outlook by Application, 2021- 2032

United Arab Emirates Vinyl Acetate Monomer Market Size Outlook by End-User, 2021- 2032

31. Saudi Arabia Vinyl Acetate Monomer Market Analysis and Outlook, 2021- 2032

Key Statistics

Saudi Arabia Vinyl Acetate Monomer Market Size Outlook by Type, 2021- 2032

Saudi Arabia Vinyl Acetate Monomer Market Size Outlook by Application, 2021- 2032

Saudi Arabia Vinyl Acetate Monomer Market Size Outlook by End-User, 2021- 2032

32. Rest of Middle East Vinyl Acetate Monomer Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Middle East Vinyl Acetate Monomer Market Size Outlook by Type, 2021- 2032

Rest of Middle East Vinyl Acetate Monomer Market Size Outlook by Application, 2021- 2032

Rest of Middle East Vinyl Acetate Monomer Market Size Outlook by End-User, 2021- 2032

33. South Africa Vinyl Acetate Monomer Market Analysis and Outlook, 2021- 2032

Key Statistics

South Africa Vinyl Acetate Monomer Market Size Outlook by Type, 2021- 2032

South Africa Vinyl Acetate Monomer Market Size Outlook by Application, 2021- 2032

South Africa Vinyl Acetate Monomer Market Size Outlook by End-User, 2021- 2032

34. Rest of Africa Vinyl Acetate Monomer Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Africa Vinyl Acetate Monomer Market Size Outlook by Type, 2021- 2032

Rest of Africa Vinyl Acetate Monomer Market Size Outlook by Application, 2021- 2032

Rest of Africa Vinyl Acetate Monomer Market Size Outlook by End-User, 2021- 2032

35. Key Companies

Market Share Analysis

Company Benchmarking

Financial Analysis

36. Recent Market Developments

37. Appendix

Looking Ahead

Research Methodology

Legal Disclaimer

By Application

Polyvinyl Acetate

Polyvinyl Alcohol

Ethylene Vinyl Acetate

Others

By End-User

Solar

Automotive

Building and Construction

Packaging

Textile

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Vinyl Acetate Monomer Market Size to increase at a 5.1% CAGR over the forecast period from $9.4 Billion in 2024 to $14 Billion in 2032

Polyvinyl Alcohol (PVOH) generated an estimated $4.4 billion in revenue, Packaging is projected to be the largest revenue generator with a 31.8% revenue share

Arkema S.A., Celanese Corp, China Petrochemical Corp (Sinopec), Clariant AG, DCC plc, Exxon Mobil Corp, INEOS Group Holdings S.A., Innospec Inc, Kemipex FZE, LyondellBasell Industries Holdings B.V., Nippon Chemical Industrial CO. Ltd, Sipchem Company, Wacker Chemie AG

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume

Asia Pacific (5.5% CAGR)