The global Vapor Recovery Units Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Application (Processing, Storage, Transportation), By End-User (Oil & gas, Chemicals, Others).

Vapor recovery units (VRUs) to play a crucial role in environmental protection and resource conservation by capturing and recycling volatile organic compounds (VOCs) and hazardous air pollutants (HAPs) emitted from industrial processes in 2024. These units are designed to recover vapors from storage tanks, pipelines, and process equipment, preventing their release into the atmosphere and reducing air pollution. Vapor recovery units find applications in industries such as oil and gas production, chemical manufacturing, petrochemical refining, and storage terminals, where VOC emissions must be controlled to comply with environmental regulations and minimize environmental impact. In oil and gas operations, VRUs are installed at wellheads, storage tanks, and loading terminals to capture VOCs emitted during production, storage, and transportation of crude oil and petroleum products. Similarly, in chemical processing plants, VRUs are utilized to recover volatile solvents and gases from various process streams, reducing emissions and improving air quality. With increasing emphasis on environmental sustainability and regulatory requirements for emission control, vapor recovery units to be essential components of industrial operations, helping to mitigate air pollution and conserve valuable resources.

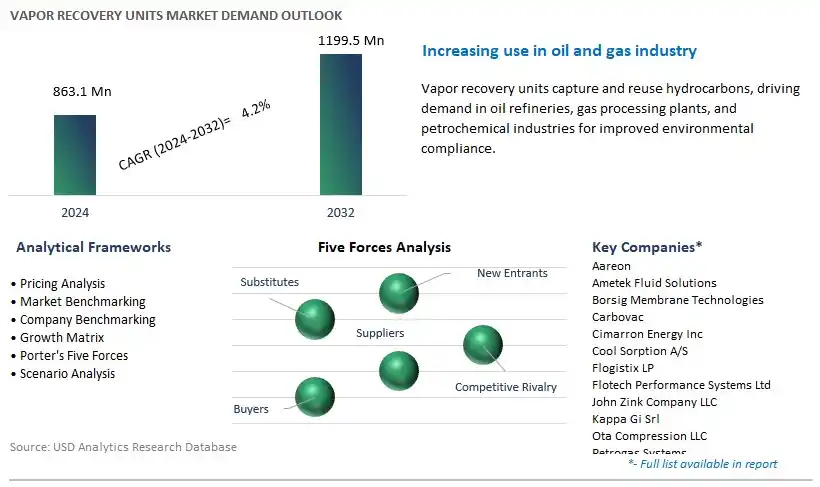

The market report analyses the leading companies in the industry including Aareon, Ametek Fluid Solutions, Borsig Membrane Technologies, Carbovac, Cimarron Energy Inc, Cool Sorption A/S, Flogistix LP, Flotech Performance Systems Ltd, John Zink Company LLC, Kappa Gi Srl, Ota Compression LLC, Petrogas Systems, Platinum Vapor Control, PSG Dover, S&S Technical Services LLC, Symex Technologies, Voczero Ltd, Warner Nicholson Engineering Consultants, Whirlwind Methane Recovery Systems, Zeeco, and others.

A significant market trend in the vapor recovery units industry is the increasing focus on environmental sustainability and emission reduction. Vapor recovery units (VRUs), designed to capture and recover vapors emitted during industrial processes such as oil and gas production, storage, and transportation, are experiencing heightened demand as industries strive to minimize greenhouse gas emissions, comply with regulatory standards, and mitigate environmental impact. This trend is driven by growing concerns over air quality, climate change, and environmental regulations aimed at reducing volatile organic compound (VOC) emissions from industrial operations. As companies across various sectors prioritize sustainability initiatives and invest in emissions control technologies, the market for vapor recovery units is witnessing growth and greater adoption as a key solution for reducing emissions and improving environmental performance.

The driver behind the growth of the vapor recovery units market is regulatory mandates and compliance requirements. Regulatory agencies worldwide impose strict limits on VOC emissions from industrial sources and require companies to implement measures to prevent, control, and mitigate air pollution. Vapor recovery units play a crucial role in meeting regulatory requirements such as the U.S. Environmental Protection Agency's (EPA) New Source Performance Standards (NSPS) for the oil and gas industry and various state and local air quality regulations. Additionally, international agreements such as the Paris Agreement and the Kyoto Protocol further drive the adoption of vapor recovery technologies as part of efforts to reduce greenhouse gas emissions and combat climate change. As industries face increasing pressure to comply with environmental regulations and reduce their carbon footprint, the demand for vapor recovery units as a reliable and cost-effective emissions control solution continues to rise, shaping the market towards greater adoption and deployment.

An opportunity for growth and diversification in the vapor recovery units market lies in expansion into emerging markets such as chemical processing and petrochemicals. While vapor recovery units are commonly used in the oil and gas industry for capturing hydrocarbon vapors from storage tanks, loading terminals, and processing facilities, there is potential for penetration into new sectors with similar emissions challenges. In chemical processing and petrochemical plants, vapor recovery units can be deployed to capture and recover VOC emissions from reactor vents, storage tanks, and solvent handling operations, offering opportunities for emissions reduction, regulatory compliance, and operational efficiency improvements. By targeting emerging markets and applications that require emissions control solutions for volatile organic compounds, vapor recovery unit manufacturers can diversify their product offerings, expand their customer base, and capitalize on opportunities for growth and market expansion beyond traditional oil and gas applications.

Among the various applications in the Vapor Recovery Units market, the Processing segment is the largest and most significant. In particular, the processing industry encompasses a wide range of sectors such as oil refining, chemical processing, and gas processing, all of which generate significant amounts of volatile organic compounds (VOCs) during production and manufacturing processes. Vapor Recovery Units (VRUs) play a crucial role in capturing and recovering these VOC emissions to minimize environmental pollution and comply with regulatory emissions standards. Moreover, the processing sector typically operates large-scale facilities with complex processing units and equipment, requiring robust and efficient vapor recovery systems to handle varying flow rates and compositions of VOC-laden gas streams. Additionally, the increasing focus on sustainability and environmental stewardship drives the adoption of vapor recovery technologies in processing facilities to reduce greenhouse gas emissions and mitigate the environmental impact of industrial operations. Furthermore, advancements in VRU technology, such as the development of high-efficiency compression systems and integrated monitoring and control systems, continue to enhance the performance and reliability of vapor recovery units in processing applications, solidifying the Processing segment as the largest segment in the Vapor Recovery Units market.

Among the various end-user industries in the Vapor Recovery Units market, the Chemicals sector stands out as the fastest-growing. In particular, the chemicals industry encompasses diverse sub-sectors such as petrochemicals, specialty chemicals, and industrial gases, all of which produce volatile organic compounds (VOCs) as by-products or intermediates in manufacturing processes. Vapor Recovery Units (VRUs) play a critical role in capturing and recovering these VOC emissions to comply with stringent environmental regulations and reduce air pollution. Moreover, the chemicals sector often operates complex production facilities with multiple processing units and emission sources, requiring tailored vapor recovery solutions to effectively capture VOCs from various process streams. Additionally, the increasing emphasis on sustainability and corporate responsibility drives the adoption of vapor recovery technologies in the chemicals industry to minimize emissions and improve environmental performance. Furthermore, advancements in VRU technology, such as the integration of advanced monitoring and control systems, enable more efficient and reliable operation, further fuelling the demand for vapor recovery units in the chemicals sector. As a result, the Chemicals segment is experiencing rapid growth in the Vapor Recovery Units market, driven by regulatory compliance, environmental concerns, and the need for sustainable industrial practices within the chemicals industry.

By Application

Processing

Storage

Transportation

By End-User

Oil & gas

Chemicals

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Aareon

Ametek Fluid Solutions

Borsig Membrane Technologies

Carbovac

Cimarron Energy Inc

Cool Sorption A/S

Flogistix LP

Flotech Performance Systems Ltd

John Zink Company LLC

Kappa Gi Srl

Ota Compression LLC

Petrogas Systems

Platinum Vapor Control

PSG Dover

S&S Technical Services LLC

Symex Technologies

Voczero Ltd

Warner Nicholson Engineering Consultants

Whirlwind Methane Recovery Systems

Zeeco

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Vapor Recovery Units Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Vapor Recovery Units Market Size Outlook, $ Million, 2021 to 2032

3.2 Vapor Recovery Units Market Outlook by Type, $ Million, 2021 to 2032

3.3 Vapor Recovery Units Market Outlook by Product, $ Million, 2021 to 2032

3.4 Vapor Recovery Units Market Outlook by Application, $ Million, 2021 to 2032

3.5 Vapor Recovery Units Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Vapor Recovery Units Industry

4.2 Key Market Trends in Vapor Recovery Units Industry

4.3 Potential Opportunities in Vapor Recovery Units Industry

4.4 Key Challenges in Vapor Recovery Units Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Vapor Recovery Units Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Vapor Recovery Units Market Outlook by Segments

7.1 Vapor Recovery Units Market Outlook by Segments, $ Million, 2021- 2032

By Application

Processing

Storage

Transportation

By End-User

Oil & gas

Chemicals

Others

8 North America Vapor Recovery Units Market Analysis and Outlook To 2032

8.1 Introduction to North America Vapor Recovery Units Markets in 2024

8.2 North America Vapor Recovery Units Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Vapor Recovery Units Market size Outlook by Segments, 2021-2032

By Application

Processing

Storage

Transportation

By End-User

Oil & gas

Chemicals

Others

9 Europe Vapor Recovery Units Market Analysis and Outlook To 2032

9.1 Introduction to Europe Vapor Recovery Units Markets in 2024

9.2 Europe Vapor Recovery Units Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Vapor Recovery Units Market Size Outlook by Segments, 2021-2032

By Application

Processing

Storage

Transportation

By End-User

Oil & gas

Chemicals

Others

10 Asia Pacific Vapor Recovery Units Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Vapor Recovery Units Markets in 2024

10.2 Asia Pacific Vapor Recovery Units Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Vapor Recovery Units Market size Outlook by Segments, 2021-2032

By Application

Processing

Storage

Transportation

By End-User

Oil & gas

Chemicals

Others

11 South America Vapor Recovery Units Market Analysis and Outlook To 2032

11.1 Introduction to South America Vapor Recovery Units Markets in 2024

11.2 South America Vapor Recovery Units Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Vapor Recovery Units Market size Outlook by Segments, 2021-2032

By Application

Processing

Storage

Transportation

By End-User

Oil & gas

Chemicals

Others

12 Middle East and Africa Vapor Recovery Units Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Vapor Recovery Units Markets in 2024

12.2 Middle East and Africa Vapor Recovery Units Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Vapor Recovery Units Market size Outlook by Segments, 2021-2032

By Application

Processing

Storage

Transportation

By End-User

Oil & gas

Chemicals

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Aareon

Ametek Fluid Solutions

Borsig Membrane Technologies

Carbovac

Cimarron Energy Inc

Cool Sorption A/S

Flogistix LP

Flotech Performance Systems Ltd

John Zink Company LLC

Kappa Gi Srl

Ota Compression LLC

Petrogas Systems

Platinum Vapor Control

PSG Dover

S&S Technical Services LLC

Symex Technologies

Voczero Ltd

Warner Nicholson Engineering Consultants

Whirlwind Methane Recovery Systems

Zeeco

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Application

Processing

Storage

Transportation

By End-User

Oil & gas

Chemicals

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Vapor Recovery Units Market Size is valued at $863.1 Million in 2024 and is forecast to register a growth rate (CAGR) of 4.2% to reach $1199.5 Million by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Aareon, Ametek Fluid Solutions, Borsig Membrane Technologies, Carbovac, Cimarron Energy Inc, Cool Sorption A/S, Flogistix LP, Flotech Performance Systems Ltd, John Zink Company LLC, Kappa Gi Srl, Ota Compression LLC, Petrogas Systems, Platinum Vapor Control, PSG Dover, S&S Technical Services LLC, Symex Technologies, Voczero Ltd, Warner Nicholson Engineering Consultants, Whirlwind Methane Recovery Systems, Zeeco

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume