The global Vapor Deposition Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Technology (Physical Vapor Deposition, Chemical Vapor Deposition), By End-User (Electronics & Semiconductor, Automotive, Aerospace & Defense, Energy & Power, Medical & Healthcare, Packaging, Optic & Optoelectronics, Cutting Tools & Wear Parts, Others).

Vapor deposition processes remain fundamental in thin-film coating and material deposition applications in 2024, offering precise control over film thickness, composition, and properties. Vapor deposition techniques, including physical vapor deposition (PVD) and chemical vapor deposition (CVD), involve the deposition of atoms or molecules from a vapor phase onto a substrate surface to form thin films or coatings. These processes find applications in industries such as semiconductor manufacturing, optics, electronics, and aerospace, where precise thin-film coatings are required for functional or decorative purposes. In semiconductor fabrication, vapor deposition techniques are used to deposit thin films of materials such as silicon, metal oxides, and metals onto silicon wafers to create integrated circuits and electronic devices. Similarly, in optics and thin-film coatings, vapor deposition processes are employed to produce anti-reflective coatings, optical filters, and reflective mirrors with precise optical properties. With advancements in deposition technology, substrate preparation, and process control, vapor deposition s to be a versatile and indispensable technique for producing high-quality thin films and coatings for a wide range of industrial and scientific applications.

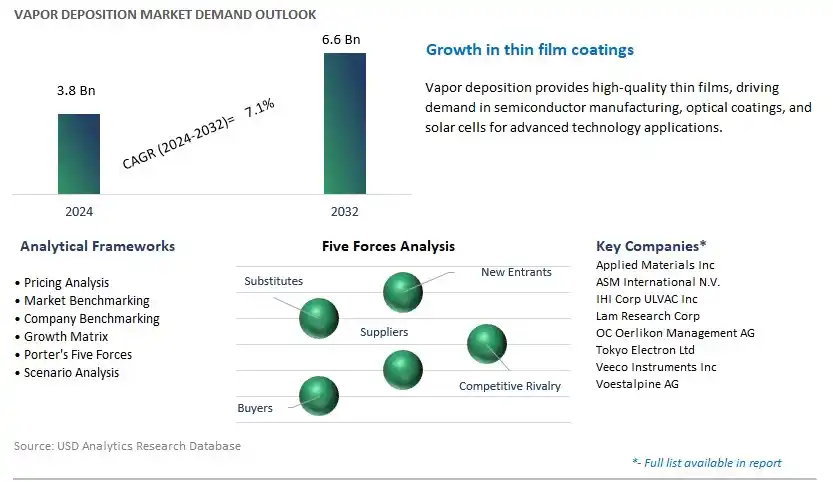

The market report analyses the leading companies in the industry including Applied Materials Inc, ASM International N.V., IHI Corp ULVAC Inc, Lam Research Corp, OC Oerlikon Management AG, Tokyo Electron Ltd, Veeco Instruments Inc, Voestalpine AG, and others.

A significant market trend in the vapor deposition industry is the increasing demand for thin film deposition in semiconductor and electronics industries. Vapor deposition processes, such as chemical vapor deposition (CVD) and physical vapor deposition (PVD), are experiencing heightened demand as semiconductor manufacturers and electronics companies strive to enhance device performance, miniaturize components, and develop advanced materials for next-generation electronic devices. This trend is driven by the relentless pursuit of higher integration densities, improved functionality, and reduced power consumption in electronic products such as microchips, sensors, displays, and photovoltaic cells. As industries continue to innovate and develop cutting-edge technologies for consumer electronics, automotive electronics, and communication devices, the market for vapor deposition techniques is witnessing growth and greater adoption as a critical manufacturing process for thin film coatings and functional layers.

The driver behind the growth of the vapor deposition market is technological advancements in deposition equipment and materials. Innovations in deposition technologies, vacuum systems, and precursor materials have led to improvements in deposition rates, film uniformity, and control over film properties, enabling manufacturers to produce thin films with precise thickness, composition, and performance characteristics. Advanced deposition techniques such as atomic layer deposition (ALD) and molecular beam epitaxy (MBE) offer unparalleled control over film growth at the atomic level, making them indispensable tools for the fabrication of nanoscale electronic devices and emerging technologies such as quantum computing and optoelectronics. Additionally, developments in materials science and chemistry have expanded the range of materials that can be deposited using vapor deposition techniques, opening up new possibilities for functional coatings, optical films, and electronic materials. As industries leverage these advancements to push the boundaries of device performance and functionality, the demand for vapor deposition technologies driven by technological innovation continues to rise, shaping the market towards greater adoption and advancement.

An opportunity for growth and diversification in the vapor deposition market lies in expansion into emerging applications such as energy storage and wearable electronics. While vapor deposition techniques are traditionally used in semiconductor manufacturing, optics, and surface coating industries, there is potential for penetration into new sectors with growing demand for advanced materials and functional coatings. In the energy storage sector, vapor deposition can be utilized for the fabrication of thin film batteries, supercapacitors, and solid-state electrolytes, offering advantages such as high energy density, fast charging, and long cycle life. Similarly, in wearable electronics applications such as flexible displays, sensors, and smart textiles, vapor deposition plays a crucial role in depositing thin film coatings onto flexible substrates, enabling the integration of electronic functionality into wearable and portable devices. By targeting emerging markets and applications that require advanced materials and deposition techniques for innovative products, vapor deposition equipment manufacturers and materials suppliers can diversify their offerings, expand their market presence, and capitalize on opportunities for growth and market expansion beyond traditional semiconductor and electronics industries.

Within the Vapor Deposition market, the Physical Vapor Deposition (PVD) technology segment is the largest and most significant. In particular, PVD technology offers a versatile and efficient method for depositing thin films of materials onto substrates, making it widely used in various industries such as electronics, automotive, aerospace, and medical devices. PVD processes, such as sputtering and evaporation, allow for precise control over film thickness, composition, and properties, enabling the deposition of coatings with desired characteristics such as hardness, wear resistance, and optical properties. Moreover, PVD coatings exhibit excellent adhesion to substrates and uniform coverage, resulting in enhanced surface properties and performance of coated components. Additionally, the environmentally friendly nature of PVD processes, which typically involve low or no hazardous chemicals and minimal waste generation, aligns with sustainability goals and regulatory requirements in many industries. Furthermore, ongoing advancements in PVD technology, including the development of new coating materials and deposition techniques, continue to expand the applicability and market reach of PVD in diverse industrial sectors, solidifying its position as the largest segment within the Vapor Deposition market.

Among the various end-user industries in the Vapor Deposition market, the Electronics & Semiconductor sector stands out as the fastest-growing. In particular, the electronics and semiconductor industries are at the forefront of technological advancements, driving the demand for advanced materials and manufacturing processes to meet the requirements of next-generation devices and components. Vapor deposition techniques, such as Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD), play a crucial role in the fabrication of microelectronics, integrated circuits, and thin-film devices by depositing precise and uniform layers of materials onto semiconductor substrates. Moreover, the increasing adoption of advanced electronic devices, including smartphones, tablets, wearable devices, and IoT sensors, fuels the demand for high-performance coatings and thin films with enhanced functionalities such as conductivity, insulation, and optical properties. Additionally, the growing trend towards miniaturization and integration of electronic components drives the need for thinner and more complex coatings, further boosting the demand for vapor deposition technologies in the electronics and semiconductor industry. Furthermore, ongoing developments in semiconductor manufacturing processes, such as the transition to advanced nodes and emerging technologies like 3D packaging and flexible electronics, continue to drive the growth of vapor deposition technologies in the Electronics & Semiconductor sector, making it the fastest-growing segment in the Vapor Deposition market.

By Technology

Physical Vapor Deposition

-Magnetron Sputtering

-Electron Beam Evaporation

-Cathodic Arc Deposition

-Others

Chemical Vapor Deposition

-Low Pressure CVD

-Atmospheric Pressure CVD

-Plasma Enhanced CVD

-Metal Organic CVD

-Others

By End-User

Electronics & Semiconductor

Automotive

Aerospace & Defense

Energy & Power

Medical & Healthcare

Packaging

Optic & Optoelectronics

Cutting Tools & Wear Parts

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Applied Materials Inc

ASM International N.V.

IHI Corp ULVAC Inc

Lam Research Corp

OC Oerlikon Management AG

Tokyo Electron Ltd

Veeco Instruments Inc

Voestalpine AG

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Vapor Deposition Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Vapor Deposition Market Size Outlook, $ Million, 2021 to 2032

3.2 Vapor Deposition Market Outlook by Type, $ Million, 2021 to 2032

3.3 Vapor Deposition Market Outlook by Product, $ Million, 2021 to 2032

3.4 Vapor Deposition Market Outlook by Application, $ Million, 2021 to 2032

3.5 Vapor Deposition Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Vapor Deposition Industry

4.2 Key Market Trends in Vapor Deposition Industry

4.3 Potential Opportunities in Vapor Deposition Industry

4.4 Key Challenges in Vapor Deposition Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Vapor Deposition Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Vapor Deposition Market Outlook by Segments

7.1 Vapor Deposition Market Outlook by Segments, $ Million, 2021- 2032

By Technology

Physical Vapor Deposition

-Magnetron Sputtering

-Electron Beam Evaporation

-Cathodic Arc Deposition

-Others

Chemical Vapor Deposition

-Low Pressure CVD

-Atmospheric Pressure CVD

-Plasma Enhanced CVD

-Metal Organic CVD

-Others

By End-User

Electronics & Semiconductor

Automotive

Aerospace & Defense

Energy & Power

Medical & Healthcare

Packaging

Optic & Optoelectronics

Cutting Tools & Wear Parts

Others

8 North America Vapor Deposition Market Analysis and Outlook To 2032

8.1 Introduction to North America Vapor Deposition Markets in 2024

8.2 North America Vapor Deposition Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Vapor Deposition Market size Outlook by Segments, 2021-2032

By Technology

Physical Vapor Deposition

-Magnetron Sputtering

-Electron Beam Evaporation

-Cathodic Arc Deposition

-Others

Chemical Vapor Deposition

-Low Pressure CVD

-Atmospheric Pressure CVD

-Plasma Enhanced CVD

-Metal Organic CVD

-Others

By End-User

Electronics & Semiconductor

Automotive

Aerospace & Defense

Energy & Power

Medical & Healthcare

Packaging

Optic & Optoelectronics

Cutting Tools & Wear Parts

Others

9 Europe Vapor Deposition Market Analysis and Outlook To 2032

9.1 Introduction to Europe Vapor Deposition Markets in 2024

9.2 Europe Vapor Deposition Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Vapor Deposition Market Size Outlook by Segments, 2021-2032

By Technology

Physical Vapor Deposition

-Magnetron Sputtering

-Electron Beam Evaporation

-Cathodic Arc Deposition

-Others

Chemical Vapor Deposition

-Low Pressure CVD

-Atmospheric Pressure CVD

-Plasma Enhanced CVD

-Metal Organic CVD

-Others

By End-User

Electronics & Semiconductor

Automotive

Aerospace & Defense

Energy & Power

Medical & Healthcare

Packaging

Optic & Optoelectronics

Cutting Tools & Wear Parts

Others

10 Asia Pacific Vapor Deposition Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Vapor Deposition Markets in 2024

10.2 Asia Pacific Vapor Deposition Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Vapor Deposition Market size Outlook by Segments, 2021-2032

By Technology

Physical Vapor Deposition

-Magnetron Sputtering

-Electron Beam Evaporation

-Cathodic Arc Deposition

-Others

Chemical Vapor Deposition

-Low Pressure CVD

-Atmospheric Pressure CVD

-Plasma Enhanced CVD

-Metal Organic CVD

-Others

By End-User

Electronics & Semiconductor

Automotive

Aerospace & Defense

Energy & Power

Medical & Healthcare

Packaging

Optic & Optoelectronics

Cutting Tools & Wear Parts

Others

11 South America Vapor Deposition Market Analysis and Outlook To 2032

11.1 Introduction to South America Vapor Deposition Markets in 2024

11.2 South America Vapor Deposition Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Vapor Deposition Market size Outlook by Segments, 2021-2032

By Technology

Physical Vapor Deposition

-Magnetron Sputtering

-Electron Beam Evaporation

-Cathodic Arc Deposition

-Others

Chemical Vapor Deposition

-Low Pressure CVD

-Atmospheric Pressure CVD

-Plasma Enhanced CVD

-Metal Organic CVD

-Others

By End-User

Electronics & Semiconductor

Automotive

Aerospace & Defense

Energy & Power

Medical & Healthcare

Packaging

Optic & Optoelectronics

Cutting Tools & Wear Parts

Others

12 Middle East and Africa Vapor Deposition Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Vapor Deposition Markets in 2024

12.2 Middle East and Africa Vapor Deposition Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Vapor Deposition Market size Outlook by Segments, 2021-2032

By Technology

Physical Vapor Deposition

-Magnetron Sputtering

-Electron Beam Evaporation

-Cathodic Arc Deposition

-Others

Chemical Vapor Deposition

-Low Pressure CVD

-Atmospheric Pressure CVD

-Plasma Enhanced CVD

-Metal Organic CVD

-Others

By End-User

Electronics & Semiconductor

Automotive

Aerospace & Defense

Energy & Power

Medical & Healthcare

Packaging

Optic & Optoelectronics

Cutting Tools & Wear Parts

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Applied Materials Inc

ASM International N.V.

IHI Corp ULVAC Inc

Lam Research Corp

OC Oerlikon Management AG

Tokyo Electron Ltd

Veeco Instruments Inc

Voestalpine AG

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Technology

Physical Vapor Deposition

-Magnetron Sputtering

-Electron Beam Evaporation

-Cathodic Arc Deposition

-Others

Chemical Vapor Deposition

-Low Pressure CVD

-Atmospheric Pressure CVD

-Plasma Enhanced CVD

-Metal Organic CVD

-Others

By End-User

Electronics & Semiconductor

Automotive

Aerospace & Defense

Energy & Power

Medical & Healthcare

Packaging

Optic & Optoelectronics

Cutting Tools & Wear Parts

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Vapor Deposition Market Size is valued at $3.8 Billion in 2024 and is forecast to register a growth rate (CAGR) of 7.1% to reach $6.6 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Applied Materials Inc, ASM International N.V., IHI Corp ULVAC Inc, Lam Research Corp, OC Oerlikon Management AG, Tokyo Electron Ltd, Veeco Instruments Inc, Voestalpine AG

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume