The global Vanillin Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Synthetic, Bio-based), By Application (Food & Beverage, Fragrances, Pharmaceuticals).

The vanillin market is undergoing significant transformations influenced by factors such as consumer preferences, sustainability initiatives, and regulatory changes. Key trends shaping the future of the industry include the growing demand for natural and sustainable vanillin alternatives derived from sources such as vanilla beans, lignin, and ferulic acid, driven by health-conscious consumers and clean label trends. Moreover, there's a rising emphasis on flavor customization and product differentiation, leading to innovations in vanillin extraction methods, flavor encapsulation, and application technologies to meet diverse customer needs and industry requirements. Additionally, advancements in biotechnology, enzymatic synthesis, and green chemistry are driving innovation and market expansion, enabling manufacturers to offer eco-friendly and cost-effective vanillin solutions for food, beverage, and fragrance applications. However, challenges such as raw material availability, flavor consistency, and price competitiveness also influence the vanillin market's trajectory, necessitating continuous research and development efforts to address technical barriers and capitalize on emerging opportunities in the global vanillin industry.

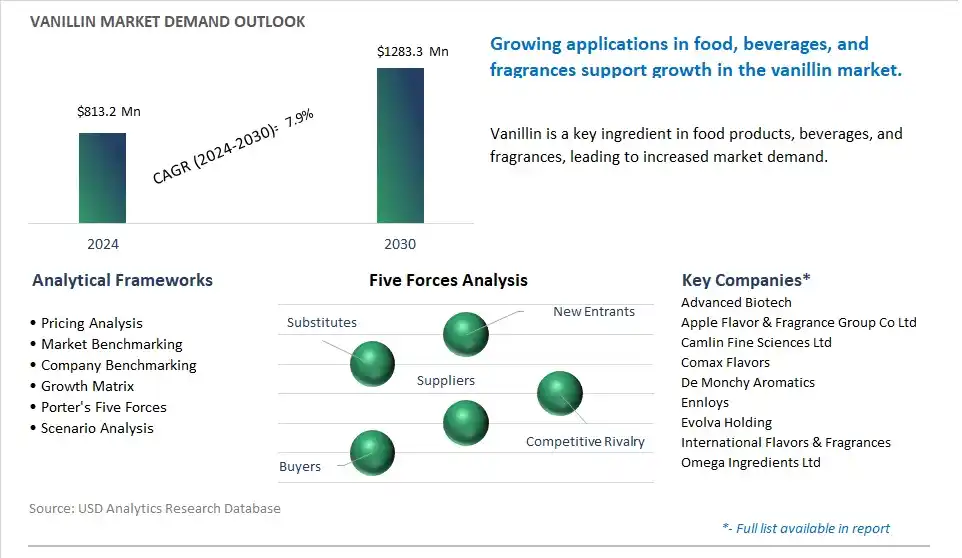

The market report analyses the leading companies in the industry including Advanced Biotech, Apple Flavor & Fragrance Group Co Ltd, Camlin Fine Sciences Ltd, Comax Flavors, De Monchy Aromatics, Ennloys, Evolva Holding, International Flavors & Fragrances, Omega Ingredients Ltd.

The most prominent market trend for vanillin is the shift towards natural and plant-based ingredients in the food and fragrance industries. With increasing consumer awareness of health and sustainability, there is a growing demand for natural flavors and fragrances derived from botanical sources. Vanillin, a primary component of vanilla beans, is favored for its sweet, creamy aroma and flavor profile. This trend is driven by consumer preferences for clean label products, as well as regulatory restrictions on synthetic additives and flavorings. Manufacturers in the food and fragrance industries are increasingly replacing synthetic vanillin with natural alternatives derived from vanilla beans or other natural sources to meet consumer demand for authenticity, purity, and transparency in ingredients.

A key market driver for vanillin is the growth in food and beverage consumption and flavor innovation. Vanillin is widely used as a flavoring agent in various food and beverage products such as baked goods, confectionery, dairy products, and beverages. As global population and disposable income levels rise, there is increasing demand for flavorful and indulgent food experiences. Flavor innovation plays a crucial role in product differentiation and consumer appeal, driving the need for high-quality and versatile flavor ingredients like vanillin. Additionally, vanillin's versatility as a flavor enhancer and masking agent contributes to its widespread use in processed foods and beverages, driving market demand and creating opportunities for manufacturers to innovate and differentiate their products in competitive markets.

An exciting opportunity in the vanillin market lies in the expansion into natural fragrance and personal care products. While vanillin is predominantly known for its use in the food industry, there is growing potential to leverage its aromatic properties in the fragrance and personal care sectors. Natural vanillin offers a warm, comforting scent reminiscent of vanilla, making it a popular choice for perfumes, colognes, body lotions, and skincare products. By tapping into the growing consumer preference for natural and sustainable ingredients in personal care products, vanillin manufacturers can diversify their product offerings and capture market share in the fragrance and cosmetics industries. Strategic partnerships with fragrance houses, cosmetics manufacturers, and retailers offer opportunities to develop innovative formulations and market natural vanillin as a premium ingredient in fragrance and personal care products, catering to the demand for natural, eco-friendly, and ethically sourced ingredients in the beauty and wellness market. This opportunity allows vanillin suppliers to expand their customer base, increase revenue streams, and strengthen their position in the global flavor and fragrance industry.

The largest segment in the Vanillin Market is the Synthetic segment. This dominance can be attributed to diverse factors. The synthetic vanillin has been traditionally used as a flavoring agent in various industries such as food and beverage, cosmetics, and pharmaceuticals for many decades. Its long history of use, coupled with established manufacturing processes and supply chains, has led to widespread acceptance and adoption by manufacturers globally. Additionally, synthetic vanillin offers diverse advantages over bio-based vanillin, including lower production costs, consistent quality, and scalability of production to meet large-scale demand. In addition, synthetic vanillin can be easily synthesized from petrochemical precursors, ensuring a stable and reliable supply even in times of fluctuating raw material prices or availability. While there is a growing trend towards natural and bio-based ingredients in the food and fragrance industries, synthetic vanillin continues to dominate the market due to its affordability, availability, and established track record as a versatile flavoring agent.

The fastest-growing segment in the Vanillin Market is the Food & Beverage segment. This growth is primarily driven by diverse key factors. The the food and beverage industry is experiencing rapid expansion globally, fueled by population growth, urbanization, and changing consumer preferences for convenience and diverse flavor experiences. Vanillin is widely used as a flavoring agent in various food and beverage products, including baked goods, confectionery, beverages, dairy products, and savory snacks, to impart a characteristic vanilla flavor. In addition, as consumers become increasingly health-conscious, there is a growing demand for natural and clean-label ingredients, driving the adoption of natural vanillin derived from sources such as vanilla beans or lignin. Additionally, advancements in food processing technologies and formulations have enabled manufacturers to incorporate vanillin into a broader range of products, including plant-based alternatives and functional foods. With the rising popularity of premium and gourmet food products, coupled with increasing consumer demand for authentic flavors and natural ingredients, the food and beverage segment is poised for significant growth in the vanillin market.

By Product

Synthetic

Bio-based

By Application

Food & Beverage

Fragrances

Pharmaceuticals

Regions Included

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Advanced Biotech

Apple Flavor & Fragrance Group Co Ltd

Camlin Fine Sciences Ltd

Comax Flavors

De Monchy Aromatics

Ennloys

Evolva Holding

International Flavors & Fragrances

Omega Ingredients Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Vanillin Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Vanillin Market Size Outlook, $ Million, 2021 to 2030

3.2 Vanillin Market Outlook by Type, $ Million, 2021 to 2030

3.3 Vanillin Market Outlook by Product, $ Million, 2021 to 2030

3.4 Vanillin Market Outlook by Application, $ Million, 2021 to 2030

3.5 Vanillin Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Vanillin Industry

4.2 Key Market Trends in Vanillin Industry

4.3 Potential Opportunities in Vanillin Industry

4.4 Key Challenges in Vanillin Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Vanillin Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Vanillin Market Outlook by Segments

7.1 Vanillin Market Outlook by Segments, $ Million, 2021- 2030

By Product

Synthetic

Bio-based

By Application

Food & Beverage

Fragrances

Pharmaceuticals

8 North America Vanillin Market Analysis and Outlook To 2030

8.1 Introduction to North America Vanillin Markets in 2024

8.2 North America Vanillin Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Vanillin Market size Outlook by Segments, 2021-2030

By Product

Synthetic

Bio-based

By Application

Food & Beverage

Fragrances

Pharmaceuticals

9 Europe Vanillin Market Analysis and Outlook To 2030

9.1 Introduction to Europe Vanillin Markets in 2024

9.2 Europe Vanillin Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Vanillin Market Size Outlook by Segments, 2021-2030

By Product

Synthetic

Bio-based

By Application

Food & Beverage

Fragrances

Pharmaceuticals

10 Asia Pacific Vanillin Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Vanillin Markets in 2024

10.2 Asia Pacific Vanillin Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Vanillin Market size Outlook by Segments, 2021-2030

By Product

Synthetic

Bio-based

By Application

Food & Beverage

Fragrances

Pharmaceuticals

11 South America Vanillin Market Analysis and Outlook To 2030

11.1 Introduction to South America Vanillin Markets in 2024

11.2 South America Vanillin Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Vanillin Market size Outlook by Segments, 2021-2030

By Product

Synthetic

Bio-based

By Application

Food & Beverage

Fragrances

Pharmaceuticals

12 Middle East and Africa Vanillin Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Vanillin Markets in 2024

12.2 Middle East and Africa Vanillin Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Vanillin Market size Outlook by Segments, 2021-2030

By Product

Synthetic

Bio-based

By Application

Food & Beverage

Fragrances

Pharmaceuticals

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Advanced Biotech

Apple Flavor & Fragrance Group Co Ltd

Camlin Fine Sciences Ltd

Comax Flavors

De Monchy Aromatics

Ennloys

Evolva Holding

International Flavors & Fragrances

Omega Ingredients Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Synthetic

Bio-based

By Application

Food & Beverage

Fragrances

Pharmaceuticals

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Vanillin is forecast to reach $1283.3 Million in 2030 from $813.2 Million in 2024, registering a CAGR of 7.9%

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Advanced Biotech, Apple Flavor & Fragrance Group Co Ltd, Camlin Fine Sciences Ltd, Comax Flavors, De Monchy Aromatics, Ennloys, Evolva Holding, International Flavors & Fragrances, Omega Ingredients Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume