The global UV Stabilizers Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (HALS, UV Absorbers, Quenchers), By Application (Packaging, Automotive, Building & Construction, Agricultural Films, Adhesives & Sealants, Others).

UV stabilizers play a critical role in protecting polymers, coatings, and other materials from degradation caused by ultraviolet (UV) radiation in 2024. These additives are designed to absorb or scatter UV radiation, preventing it from reaching the polymer chains and causing photochemical reactions that lead to degradation, discoloration, and loss of mechanical properties. UV stabilizers find applications in industries such as plastics, coatings, adhesives, textiles, and automotive, where exposure to sunlight can cause degradation and deterioration. In plastics, UV stabilizers are incorporated into formulations for outdoor applications such as automotive parts, building materials, and outdoor furniture, extending product lifespan and maintaining appearance. Similarly, in coatings and paints, UV stabilizers are added to formulations for exterior surfaces such as architectural coatings, automotive paints, and marine coatings, providing long-term durability and color retention. With increasing awareness of environmental sustainability and regulatory requirements for product performance, UV stabilizers to be essential additives enabling the development of durable and aesthetically pleasing materials across diverse industries.

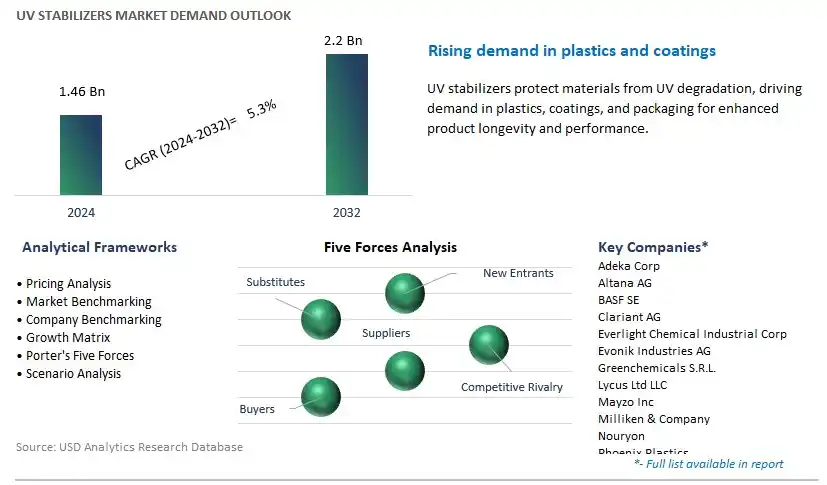

The market report analyses the leading companies in the industry including Adeka Corp, Altana AG, BASF SE, Clariant AG, Everlight Chemical Industrial Corp, Evonik Industries AG, Greenchemicals S.R.L., Lycus Ltd LLC, Mayzo Inc, Milliken & Company, Nouryon, Phoenix Plastics, Rianlon Corp, Sabo S.P.A., Si Group Inc, Solvay S.A., Songwon Industrial Co. Ltd, Unitechem Group, and others.

A significant market trend in the UV stabilizers industry is the growing demand for UV protection in polymer materials. UV stabilizers, additives used to protect polymers from degradation and discoloration caused by ultraviolet radiation, are experiencing increased demand across various industries such as automotive, packaging, construction, and agriculture. This trend is driven by heightened awareness of the damaging effects of UV radiation on polymers, leading to a greater emphasis on extending the lifespan, appearance, and performance of plastic products exposed to sunlight. As industries seek to enhance the durability, weatherability, and UV resistance of polymer materials in outdoor applications, the market for UV stabilizers is witnessing growth and greater adoption as an essential component in polymer formulations.

The driver behind the growth of the UV stabilizers market is stringent regulatory standards and quality requirements. Regulatory agencies worldwide impose restrictions on the use of hazardous substances and require manufacturers to comply with safety, health, and environmental regulations. UV stabilizers play a crucial role in meeting regulatory requirements such as RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) directives, which aim to minimize the environmental impact of polymer products and ensure consumer safety. Additionally, industries such as automotive, packaging, and building materials set stringent quality standards for polymer materials used in outdoor applications, driving the demand for UV stabilizers that offer effective UV protection, thermal stability, and long-term performance. The need to meet regulatory compliance and quality standards thus serves as a key driver for the adoption of UV stabilizers in polymer formulations across diverse industries.

An opportunity for growth and diversification in the UV stabilizers market lies in expansion into emerging applications such as renewable energy and electronics. While UV stabilizers are traditionally used in polymer materials for outdoor applications, there is potential for penetration into new sectors such as photovoltaic modules, electrical insulators, and electronic components. In the renewable energy sector, UV stabilizers can be incorporated into materials used for solar panels, wind turbine blades, and energy storage systems to improve UV resistance, weatherability, and long-term performance in outdoor environments. Similarly, in electronics manufacturing, UV stabilizers can enhance the UV resistance and reliability of polymers used in electronic enclosures, connectors, and printed circuit boards, ensuring product longevity and performance consistency. By exploring new applications and market segments in emerging industries, UV stabilizer manufacturers can diversify their product portfolio, target new customer segments, and capitalize on opportunities for growth and market expansion beyond traditional polymer applications.

Within the UV Stabilizers market, the UV Absorbers segment is the largest and most significant. UV absorbers are essential additives used in various industries to protect materials and products from the harmful effects of ultraviolet (UV) radiation, such as degradation, discoloration, and loss of mechanical properties. UV absorbers function by absorbing UV radiation and converting it into harmless heat, thereby preventing damage to the underlying substrate. The widespread adoption of UV absorbers is driven by their effectiveness in providing long-term UV protection across a wide range of applications, including plastics, coatings, adhesives, and textiles. Moreover, advancements in UV absorber technology have led to the development of highly efficient additives with broad-spectrum UV protection and enhanced stability, further solidifying their position as the preferred choice for UV stabilization. Additionally, the growing awareness of environmental and health concerns associated with UV exposure fuels the demand for UV absorbers as industries strive to produce UV-stabilized products that meet regulatory requirements and consumer expectations for durability and safety. As a result, the UV Absorbers segment maintains its dominance in the UV Stabilizers market, with sustained growth anticipated as industries continue to prioritize UV protection for their materials and products.

Among the various applications in the UV Stabilizers market, the Packaging segment stands out as the fastest-growing. In particular, the packaging industry is witnessing robust growth driven by increasing demand for packaged goods across various sectors such as food and beverage, personal care, and pharmaceuticals. UV stabilizers play a crucial role in packaging materials, such as plastic films, bottles, and containers, by providing protection against UV radiation-induced degradation and extending the shelf life of packaged products. Moreover, the shift towards sustainable packaging solutions, including recyclable and biodegradable materials, drives the adoption of UV stabilizers to enhance the durability and longevity of eco-friendly packaging materials exposed to outdoor environments. Additionally, stringent regulatory requirements regarding food safety and product quality propel the use of UV stabilizers in packaging applications to ensure the integrity and safety of packaged goods. Furthermore, technological advancements in UV stabilizer formulations, such as the development of high-performance additives with enhanced UV protection and compatibility with different polymer matrices, contribute to the rapid growth of UV stabilizers in the packaging industry. As a result, the Packaging Application segment is experiencing significant expansion within the UV Stabilizers market, with sustained growth anticipated as the demand for high-quality and sustainable packaging solutions continues to rise globally.

By Type

HALS

UV Absorbers

Quenchers

By Application

Packaging

Automotive

Building & Construction

Agricultural Films

Adhesives & Sealants

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Adeka Corp

Altana AG

BASF SE

Clariant AG

Everlight Chemical Industrial Corp

Evonik Industries AG

Greenchemicals S.R.L.

Lycus Ltd LLC

Mayzo Inc

Milliken & Company

Nouryon

Phoenix Plastics

Rianlon Corp

Sabo S.P.A.

Si Group Inc

Solvay S.A.

Songwon Industrial Co. Ltd

Unitechem Group

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 UV Stabilizers Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global UV Stabilizers Market Size Outlook, $ Million, 2021 to 2032

3.2 UV Stabilizers Market Outlook by Type, $ Million, 2021 to 2032

3.3 UV Stabilizers Market Outlook by Product, $ Million, 2021 to 2032

3.4 UV Stabilizers Market Outlook by Application, $ Million, 2021 to 2032

3.5 UV Stabilizers Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of UV Stabilizers Industry

4.2 Key Market Trends in UV Stabilizers Industry

4.3 Potential Opportunities in UV Stabilizers Industry

4.4 Key Challenges in UV Stabilizers Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global UV Stabilizers Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global UV Stabilizers Market Outlook by Segments

7.1 UV Stabilizers Market Outlook by Segments, $ Million, 2021- 2032

By Type

HALS

UV Absorbers

Quenchers

By Application

Packaging

Automotive

Building & Construction

Agricultural Films

Adhesives & Sealants

Others

8 North America UV Stabilizers Market Analysis and Outlook To 2032

8.1 Introduction to North America UV Stabilizers Markets in 2024

8.2 North America UV Stabilizers Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America UV Stabilizers Market size Outlook by Segments, 2021-2032

By Type

HALS

UV Absorbers

Quenchers

By Application

Packaging

Automotive

Building & Construction

Agricultural Films

Adhesives & Sealants

Others

9 Europe UV Stabilizers Market Analysis and Outlook To 2032

9.1 Introduction to Europe UV Stabilizers Markets in 2024

9.2 Europe UV Stabilizers Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe UV Stabilizers Market Size Outlook by Segments, 2021-2032

By Type

HALS

UV Absorbers

Quenchers

By Application

Packaging

Automotive

Building & Construction

Agricultural Films

Adhesives & Sealants

Others

10 Asia Pacific UV Stabilizers Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific UV Stabilizers Markets in 2024

10.2 Asia Pacific UV Stabilizers Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific UV Stabilizers Market size Outlook by Segments, 2021-2032

By Type

HALS

UV Absorbers

Quenchers

By Application

Packaging

Automotive

Building & Construction

Agricultural Films

Adhesives & Sealants

Others

11 South America UV Stabilizers Market Analysis and Outlook To 2032

11.1 Introduction to South America UV Stabilizers Markets in 2024

11.2 South America UV Stabilizers Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America UV Stabilizers Market size Outlook by Segments, 2021-2032

By Type

HALS

UV Absorbers

Quenchers

By Application

Packaging

Automotive

Building & Construction

Agricultural Films

Adhesives & Sealants

Others

12 Middle East and Africa UV Stabilizers Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa UV Stabilizers Markets in 2024

12.2 Middle East and Africa UV Stabilizers Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa UV Stabilizers Market size Outlook by Segments, 2021-2032

By Type

HALS

UV Absorbers

Quenchers

By Application

Packaging

Automotive

Building & Construction

Agricultural Films

Adhesives & Sealants

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Adeka Corp

Altana AG

BASF SE

Clariant AG

Everlight Chemical Industrial Corp

Evonik Industries AG

Greenchemicals S.R.L.

Lycus Ltd LLC

Mayzo Inc

Milliken & Company

Nouryon

Phoenix Plastics

Rianlon Corp

Sabo S.P.A.

Si Group Inc

Solvay S.A.

Songwon Industrial Co. Ltd

Unitechem Group

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

HALS

UV Absorbers

Quenchers

By Application

Packaging

Automotive

Building & Construction

Agricultural Films

Adhesives & Sealants

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global UV Stabilizers Market Size is valued at $1.46 Billion in 2024 and is forecast to register a growth rate (CAGR) of 5.3% to reach $2.2 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Adeka Corp, Altana AG, BASF SE, Clariant AG, Everlight Chemical Industrial Corp, Evonik Industries AG, Greenchemicals S.R.L., Lycus Ltd LLC, Mayzo Inc, Milliken & Company, Nouryon, Phoenix Plastics, Rianlon Corp, Sabo S.P.A., Si Group Inc, Solvay S.A., Songwon Industrial Co. Ltd, Unitechem Group

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume