The global UV Nail Gel Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (UV Nail Gel Polish, UV Nail Gel Basecoat, UV Nail Gel Top Coat), By Distribution Channel (Offline, Online).

UV nail gel remains a popular choice for long-lasting and durable nail enhancements in the beauty and cosmetics industry in 2024. UV nail gel, also known as UV gel polish, is a type of nail enhancement product that is cured under ultraviolet (UV) light to create a hard and glossy finish. It offers advantages such as chip resistance, high gloss shine, and extended wear compared to traditional nail polishes. UV nail gel is applied in multiple layers, including a base coat, color coat, and top coat, each cured under UV light to ensure proper adhesion and durability. With a wide range of colors, finishes, and effects available, UV nail gel allows for creative nail designs and customization according to individual preferences. In addition to aesthetics, UV nail gel provides strength and protection to natural nails, making it a preferred choice for those seeking long-lasting and salon-quality manicures. With advancements in formulation technology and increased consumer demand for at-home nail care solutions, UV nail gel s to be a staple product in the beauty industry, offering professional-quality results and convenience for nail enthusiasts worldwide.

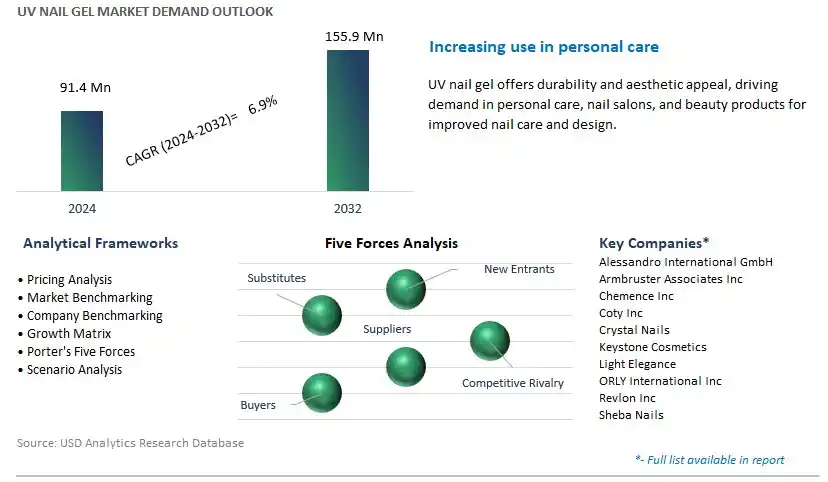

The market report analyses the leading companies in the industry including Alessandro International GmbH, Armbruster Associates Inc, Chemence Inc, Coty Inc, Crystal Nails, Keystone Cosmetics, Light Elegance, ORLY International Inc, Revlon Inc, Sheba Nails, and others.

A significant market trend in the UV nail gel industry is the growing popularity of do-it-yourself (DIY) nail care and beauty trends. UV nail gels, renowned for their long-lasting shine, durability, and ease of application, are experiencing increased demand as consumers seek salon-quality results from the comfort of their homes. This trend is driven by the rise of social media influencers, beauty bloggers, and online tutorials showcasing various nail art techniques and designs. Additionally, the COVID-19 pandemic has accelerated the shift towards at-home beauty routines and self-care practices, leading to a surge in demand for UV nail gel kits and products. As consumers embrace DIY nail care as a form of self-expression and relaxation, the market for UV nail gels is witnessing growth and greater adoption among beauty enthusiasts worldwide.

The driver behind the growth of the UV nail gel market is advancements in formulation technology and nail gel systems. Innovations in UV-curable resin formulations, photoinitiators, and gel polish formulations have led to improvements in product performance, curing speed, and durability of UV nail gels. Manufacturers are developing UV nail gel systems with enhanced adhesion, flexibility, and chip resistance, offering consumers long-lasting manicures with minimal maintenance. Additionally, advancements in LED curing technology and gel nail lamp designs provide faster curing times, reduced heat generation, and improved user experience, further driving the adoption of UV nail gels among both professional nail technicians and DIY enthusiasts. As consumers seek innovative nail care solutions that deliver salon-quality results and long-lasting wear, the demand for UV nail gels as a convenient and durable nail enhancement option continues to rise, shaping the market towards greater innovation and product development.

An opportunity for growth and diversification in the UV nail gel market lies in expansion into specialty nail art and design markets. While UV nail gels are commonly used for traditional manicures and pedicures, there is potential for penetration into new segments such as nail artistry, embellishments, and customization services. In the nail art market, UV nail gels offer advantages such as precise application, compatibility with nail art techniques such as stamping, foiling, and freehand painting, and long-lasting wear, allowing nail technicians and enthusiasts to create intricate designs and personalized looks. Additionally, UV nail gels can be used as a base for embellishments such as rhinestones, charms, and decals, providing a versatile platform for creative expression and customization. By tapping into the growing demand for unique nail art experiences and customization options, UV nail gel manufacturers can expand their product offerings, target new customer segments, and capitalize on opportunities for growth and market expansion beyond traditional gel nail applications.

Within the UV Nail Gel market, the UV Nail Gel Polish segment is the largest and most significant. UV nail gel polish is the primary product used in professional and DIY nail enhancement procedures, offering long-lasting color and durability compared to traditional nail polishes. UV nail gel polish provides a high-gloss finish and superior adhesion to the natural nail, ensuring chip-resistant and smudge-proof manicures for extended periods. Moreover, UV nail gel polish formulations often incorporate ingredients that promote nail health, such as vitamins and nutrients, attracting consumers seeking both aesthetic and functional benefits. Additionally, the versatility of UV nail gel polish allows for a wide range of colors, finishes, and effects, catering to diverse consumer preferences and trends in the beauty industry. Furthermore, the convenience of UV nail gel polish, with its quick curing time under UV or LED lamps, contributes to its widespread adoption among nail technicians and enthusiasts. As a result, the UV Nail Gel Polish segment maintains its position as the largest and most dominant segment within the UV Nail Gel market, with sustained growth anticipated as the demand for long-lasting and professional-quality nail enhancements continues to rise.

Among the various distribution channels in the UV Nail Gel market, the Online segment stands out as the fastest-growing. In particular, the increasing popularity and accessibility of e-commerce platforms have made it easier for consumers to purchase UV nail gel products online, eliminating the need to visit physical stores. The convenience of online shopping allows consumers to browse a wide range of UV nail gel brands, colors, and formulations from the comfort of their homes, leading to increased sales and market penetration for online retailers. Moreover, online platforms often offer competitive pricing, discounts, and promotions, attracting price-conscious consumers seeking value for their purchases. Additionally, the rise of social media influencers and beauty bloggers promoting UV nail gel products online has contributed to heightened consumer interest and awareness, further driving sales through digital channels. Furthermore, the COVID-19 pandemic has accelerated the shift towards online shopping as consumers prioritize safety and social distancing measures, leading to increased online sales of beauty and personal care products, including UV nail gel. As a result, the Online Distribution Channel segment is experiencing significant expansion within the UV Nail Gel market, with sustained growth anticipated as online shopping continues to reshape consumer purchasing habits and preferences.

By Type

UV Nail Gel Polish

UV Nail Gel Basecoat

UV Nail Gel Top Coat

By Distribution Channel

Offline

OnlineCountries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Alessandro International GmbH

Armbruster Associates Inc

Chemence Inc

Coty Inc

Crystal Nails

Keystone Cosmetics

Light Elegance

ORLY International Inc

Revlon Inc

Sheba Nails

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 UV Nail Gel Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global UV Nail Gel Market Size Outlook, $ Million, 2021 to 2032

3.2 UV Nail Gel Market Outlook by Type, $ Million, 2021 to 2032

3.3 UV Nail Gel Market Outlook by Product, $ Million, 2021 to 2032

3.4 UV Nail Gel Market Outlook by Application, $ Million, 2021 to 2032

3.5 UV Nail Gel Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of UV Nail Gel Industry

4.2 Key Market Trends in UV Nail Gel Industry

4.3 Potential Opportunities in UV Nail Gel Industry

4.4 Key Challenges in UV Nail Gel Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global UV Nail Gel Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global UV Nail Gel Market Outlook by Segments

7.1 UV Nail Gel Market Outlook by Segments, $ Million, 2021- 2032

By Type

UV Nail Gel Polish

UV Nail Gel Basecoat

UV Nail Gel Top Coat

By Distribution Channel

Offline

Online

8 North America UV Nail Gel Market Analysis and Outlook To 2032

8.1 Introduction to North America UV Nail Gel Markets in 2024

8.2 North America UV Nail Gel Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America UV Nail Gel Market size Outlook by Segments, 2021-2032

By Type

UV Nail Gel Polish

UV Nail Gel Basecoat

UV Nail Gel Top Coat

By Distribution Channel

Offline

Online

9 Europe UV Nail Gel Market Analysis and Outlook To 2032

9.1 Introduction to Europe UV Nail Gel Markets in 2024

9.2 Europe UV Nail Gel Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe UV Nail Gel Market Size Outlook by Segments, 2021-2032

By Type

UV Nail Gel Polish

UV Nail Gel Basecoat

UV Nail Gel Top Coat

By Distribution Channel

Offline

Online

10 Asia Pacific UV Nail Gel Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific UV Nail Gel Markets in 2024

10.2 Asia Pacific UV Nail Gel Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific UV Nail Gel Market size Outlook by Segments, 2021-2032

By Type

UV Nail Gel Polish

UV Nail Gel Basecoat

UV Nail Gel Top Coat

By Distribution Channel

Offline

Online

11 South America UV Nail Gel Market Analysis and Outlook To 2032

11.1 Introduction to South America UV Nail Gel Markets in 2024

11.2 South America UV Nail Gel Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America UV Nail Gel Market size Outlook by Segments, 2021-2032

By Type

UV Nail Gel Polish

UV Nail Gel Basecoat

UV Nail Gel Top Coat

By Distribution Channel

Offline

Online

12 Middle East and Africa UV Nail Gel Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa UV Nail Gel Markets in 2024

12.2 Middle East and Africa UV Nail Gel Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa UV Nail Gel Market size Outlook by Segments, 2021-2032

By Type

UV Nail Gel Polish

UV Nail Gel Basecoat

UV Nail Gel Top Coat

By Distribution Channel

Offline

Online

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Alessandro International GmbH

Armbruster Associates Inc

Chemence Inc

Coty Inc

Crystal Nails

Keystone Cosmetics

Light Elegance

ORLY International Inc

Revlon Inc

Sheba Nails

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

UV Nail Gel Polish

UV Nail Gel Basecoat

UV Nail Gel Top Coat

By Distribution Channel

Offline

Online

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global UV Nail Gel Market Size is valued at $91.4 Million in 2024 and is forecast to register a growth rate (CAGR) of 6.9% to reach $155.9 Million by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Alessandro International GmbH, Armbruster Associates Inc, Chemence Inc, Coty Inc, Crystal Nails, Keystone Cosmetics, Light Elegance, ORLY International Inc, Revlon Inc, Sheba Nails

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume