The global UV Curable Coatings Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Composition (Oligomers, Monomers, Photoinitiators, PU Dispersions, Others), By Type (Wood Coatings, Plastic Coatings, Over Print Varnish, Display Coatings, Conformal Coatings, Paper Coatings), By End-User (Industrial Coatings, Electronics, Graphic Arts).

UV curable coatings to gain popularity as environmentally friendly and high-performance surface finishing solutions in 2024, offering rapid curing, exceptional durability, and reduced environmental impact. These coatings are formulated with photoinitiators that initiate polymerization when exposed to ultraviolet (UV) light, resulting in a fast and complete cure without the need for heat or solvents. UV curable coatings find applications in industries such as automotive, wood furniture, electronics, and packaging, where quick turnaround times and superior coating properties are essential. In automotive manufacturing, UV curable coatings are used for automotive refinishing, interior components, and exterior parts, providing scratch resistance, chemical resistance, and gloss retention. Similarly, in wood furniture and flooring, UV curable coatings offer enhanced durability, stain resistance, and color stability, reducing maintenance and improving product lifespan. With growing concerns about volatile organic compounds (VOCs) and environmental regulations, UV curable coatings to be preferred choices for achieving high-quality finishes while minimizing environmental impact and enhancing sustainability in various industries.

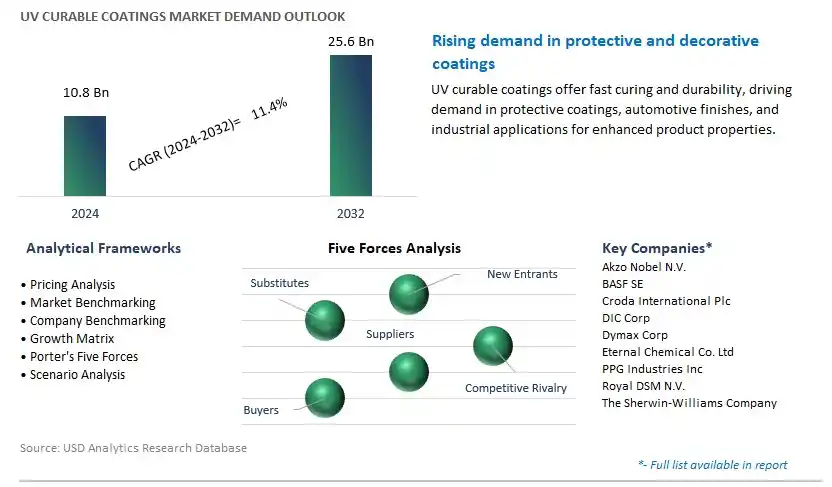

The market report analyses the leading companies in the industry including Akzo Nobel N.V., BASF SE, Croda International Plc, DIC Corp, Dymax Corp, Eternal Chemical Co. Ltd, PPG Industries Inc, Royal DSM N.V., The Sherwin-Williams Company, and others.

A significant market trend in the UV curable coatings industry is the shift towards environmentally friendly coating solutions. UV curable coatings, known for their fast curing times, low volatile organic compound (VOC) emissions, and reduced energy consumption, are gaining popularity as sustainable alternatives to solvent-based coatings. This trend is driven by increasing regulatory pressures, consumer awareness of environmental issues, and the need for eco-friendly manufacturing processes across various industries. Companies are opting for UV curable coatings to meet stringent environmental regulations, reduce carbon footprints, and enhance their corporate sustainability profiles. As industries strive for greener solutions and eco-conscious consumers demand environmentally friendly products, the market for UV curable coatings is experiencing growth and greater adoption in sectors such as automotive, furniture, packaging, and electronics.

The driver behind the growth of the UV curable coatings market is advancements in UV curing technology and performance. Innovations in UV light sources, photoinitiators, and resin formulations have led to improvements in curing speed, coating durability, and adhesion properties of UV curable coatings. UV LED technology, in particular, offers benefits such as energy efficiency, longer service life, and precise control over curing parameters, enabling manufacturers to achieve higher productivity, reduced production times, and enhanced coating performance. Additionally, developments in UV curable coatings with tailored properties such as scratch resistance, chemical resistance, and flexibility expand their applicability in demanding environments such as automotive, electronics, and industrial coatings. As industries seek to improve efficiency, reduce costs, and enhance product quality, the demand for UV curable coatings as a high-performance coating solution driven by technological advancements continues to rise, shaping the market towards greater adoption across diverse industries.

An opportunity for growth and diversification in the UV curable coatings market lies in expansion into high-value specialty coating markets. While UV curable coatings are commonly used in applications such as wood coatings, graphic arts, and packaging, there is potential for penetration into niche markets such as medical devices, optical coatings, and aerospace applications. In the medical device industry, UV curable coatings can be utilized for surface treatments, antimicrobial coatings, and medical device assembly, offering advantages such as biocompatibility, sterilizability, and precision coating thickness control. Similarly, in optical coatings, UV curable coatings provide superior clarity, adhesion, and optical performance for applications such as lenses, displays, and optical filters. By exploring new applications and market segments in specialty coatings, UV curable coatings manufacturers can diversify their product portfolio, target higher-margin markets, and capitalize on opportunities for growth and market expansion beyond traditional coating applications.

Within the UV Curable Coatings market, the Oligomers Composition segment is the largest and most significant. In particular, oligomers play a crucial role in UV curable coatings formulations by providing the backbone structure and determining key properties such as viscosity, flexibility, and adhesion. Oligomers offer a wide range of functionalities, allowing formulators to tailor coating formulations to meet specific performance requirements for various applications. Moreover, oligomers contribute to the overall durability, chemical resistance, and mechanical properties of UV curable coatings, making them indispensable components in coatings for industries such as automotive, aerospace, electronics, and packaging. Additionally, advancements in oligomer chemistry and formulation techniques have led to the development of high-performance coatings with enhanced properties, such as scratch resistance, UV stability, and weatherability, further driving the widespread adoption of oligomer-based UV curable coatings. Furthermore, the versatility and versatility of oligomers enable the formulation of coatings suitable for diverse substrates and application methods, contributing to their dominance in the UV Curable Coatings market.

Among the various types of UV Curable Coatings, the Display Coatings segment stands out as the fastest-growing. In particular, the increasing demand for high-performance coatings in the display industry, driven by advancements in display technologies such as OLED, LCD, and LED, fuels the adoption of UV curable coatings for enhancing optical properties, durability, and scratch resistance of display panels. Display coatings are essential for protecting delicate display surfaces from scratches, fingerprints, and environmental damage while maintaining optical clarity and visibility. Moreover, the growing consumer electronics market, including smartphones, tablets, televisions, and automotive displays, drives the demand for UV curable coatings to meet stringent performance requirements for display panels. Additionally, the shift towards environmentally friendly and sustainable coatings solutions, coupled with the advantages of UV curing technology such as instant curing, low VOC emissions, and energy efficiency, further accelerates the adoption of UV curable display coatings. Furthermore, ongoing research and development efforts aimed at developing novel formulations and application methods continue to drive innovation and growth in the Display Coatings segment of the UV Curable Coatings market. As a result, the Display Coatings segment is experiencing significant expansion, with sustained growth anticipated as display technologies continue to evolve and demand for high-quality display coatings increases.

Within the UV Curable Coatings market, the Industrial Coatings segment is the largest and most significant. In particular, industrial coatings encompass a wide range of applications across industries such as automotive, aerospace, manufacturing, and metal finishing, where UV curable coatings offer numerous advantages, including fast curing times, high durability, and excellent chemical and abrasion resistance. Industrial coatings play a crucial role in protecting substrates from corrosion, wear, and environmental damage, while also enhancing their appearance and performance. Moreover, the shift towards environmentally friendly and sustainable coating solutions, coupled with the increasing demand for high-performance coatings with superior durability and resistance properties, drives the adoption of UV curable coatings in industrial applications. Additionally, the versatility of UV curable coatings allows for customization to meet specific performance requirements for diverse industrial applications, further solidifying their position as the largest segment within the UV Curable Coatings market. Furthermore, ongoing advancements in UV curing technology and formulation techniques continue to drive innovation and growth in the Industrial Coatings segment, with sustained expansion anticipated as industries continue to prioritize efficient and reliable coating solutions for their manufacturing processes.

By Composition

Oligomers

Monomers

Photoinitiators

PU Dispersions

Others

By Type

Wood Coatings

Plastic Coatings

Over Print Varnish

Display Coatings

Conformal Coatings

Paper Coatings

By End-User

Industrial Coatings

Electronics

Graphic ArtsCountries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Akzo Nobel N.V.

BASF SE

Croda International Plc

DIC Corp

Dymax Corp

Eternal Chemical Co. Ltd

PPG Industries Inc

Royal DSM N.V.

The Sherwin-Williams Company

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 UV Curable Coatings Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global UV Curable Coatings Market Size Outlook, $ Million, 2021 to 2032

3.2 UV Curable Coatings Market Outlook by Type, $ Million, 2021 to 2032

3.3 UV Curable Coatings Market Outlook by Product, $ Million, 2021 to 2032

3.4 UV Curable Coatings Market Outlook by Application, $ Million, 2021 to 2032

3.5 UV Curable Coatings Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of UV Curable Coatings Industry

4.2 Key Market Trends in UV Curable Coatings Industry

4.3 Potential Opportunities in UV Curable Coatings Industry

4.4 Key Challenges in UV Curable Coatings Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global UV Curable Coatings Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global UV Curable Coatings Market Outlook by Segments

7.1 UV Curable Coatings Market Outlook by Segments, $ Million, 2021- 2032

By Composition

Oligomers

Monomers

Photoinitiators

PU Dispersions

Others

By Type

Wood Coatings

Plastic Coatings

Over Print Varnish

Display Coatings

Conformal Coatings

Paper Coatings

By End-User

Industrial Coatings

Electronics

Graphic Arts

8 North America UV Curable Coatings Market Analysis and Outlook To 2032

8.1 Introduction to North America UV Curable Coatings Markets in 2024

8.2 North America UV Curable Coatings Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America UV Curable Coatings Market size Outlook by Segments, 2021-2032

By Composition

Oligomers

Monomers

Photoinitiators

PU Dispersions

Others

By Type

Wood Coatings

Plastic Coatings

Over Print Varnish

Display Coatings

Conformal Coatings

Paper Coatings

By End-User

Industrial Coatings

Electronics

Graphic Arts

9 Europe UV Curable Coatings Market Analysis and Outlook To 2032

9.1 Introduction to Europe UV Curable Coatings Markets in 2024

9.2 Europe UV Curable Coatings Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe UV Curable Coatings Market Size Outlook by Segments, 2021-2032

By Composition

Oligomers

Monomers

Photoinitiators

PU Dispersions

Others

By Type

Wood Coatings

Plastic Coatings

Over Print Varnish

Display Coatings

Conformal Coatings

Paper Coatings

By End-User

Industrial Coatings

Electronics

Graphic Arts

10 Asia Pacific UV Curable Coatings Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific UV Curable Coatings Markets in 2024

10.2 Asia Pacific UV Curable Coatings Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific UV Curable Coatings Market size Outlook by Segments, 2021-2032

By Composition

Oligomers

Monomers

Photoinitiators

PU Dispersions

Others

By Type

Wood Coatings

Plastic Coatings

Over Print Varnish

Display Coatings

Conformal Coatings

Paper Coatings

By End-User

Industrial Coatings

Electronics

Graphic Arts

11 South America UV Curable Coatings Market Analysis and Outlook To 2032

11.1 Introduction to South America UV Curable Coatings Markets in 2024

11.2 South America UV Curable Coatings Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America UV Curable Coatings Market size Outlook by Segments, 2021-2032

By Composition

Oligomers

Monomers

Photoinitiators

PU Dispersions

Others

By Type

Wood Coatings

Plastic Coatings

Over Print Varnish

Display Coatings

Conformal Coatings

Paper Coatings

By End-User

Industrial Coatings

Electronics

Graphic Arts

12 Middle East and Africa UV Curable Coatings Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa UV Curable Coatings Markets in 2024

12.2 Middle East and Africa UV Curable Coatings Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa UV Curable Coatings Market size Outlook by Segments, 2021-2032

By Composition

Oligomers

Monomers

Photoinitiators

PU Dispersions

Others

By Type

Wood Coatings

Plastic Coatings

Over Print Varnish

Display Coatings

Conformal Coatings

Paper Coatings

By End-User

Industrial Coatings

Electronics

Graphic Arts

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Akzo Nobel N.V.

BASF SE

Croda International Plc

DIC Corp

Dymax Corp

Eternal Chemical Co. Ltd

PPG Industries Inc

Royal DSM N.V.

The Sherwin-Williams Company

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Composition

Oligomers

Monomers

Photoinitiators

PU Dispersions

Others

By Type

Wood Coatings

Plastic Coatings

Over Print Varnish

Display Coatings

Conformal Coatings

Paper Coatings

By End-User

Industrial Coatings

Electronics

Graphic Arts

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global UV Curable Coatings Market Size is valued at $10.8 Billion in 2024 and is forecast to register a growth rate (CAGR) of 11.4% to reach $25.6 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Akzo Nobel N.V., BASF SE, Croda International Plc, DIC Corp, Dymax Corp, Eternal Chemical Co. Ltd, PPG Industries Inc, Royal DSM N.V., The Sherwin-Williams Company

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume