The global Used Cars Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Vehicle (Hybrid, Conventional, Electric), By Vendor (Organized, Unorganized), By Fuel (Diesel, Petrol, Others), By Size (Compact, Mid-Sized, SUV), By Sales Channel (Offline, Online).

In 2024, the Used Car Market continues to play a significant role in the automotive industry, offering consumers a wide range of pre-owned vehicles that provide affordability, value, and choice. Used cars, also known as second-hand or pre-owned vehicles, appeal to a broad spectrum of buyers, including budget-conscious consumers, first-time car buyers, and those seeking specific models or features at a lower price point. The Used Car Market encompasses various vehicle types, including sedans, SUVs, trucks, and luxury cars, catering to diverse needs, preferences, and budgets. Dealerships, independent sellers, and online platforms provide avenues for buying and selling used cars, offering a wide selection of makes, models, and trim levels to suit individual requirements. Moreover, certified pre-owned (CPO) programs offered by manufacturers and dealerships provide added peace of mind and assurance to buyers, with thorough vehicle inspections, warranties, and maintenance programs. Additionally, technological advancements such as vehicle history reports, online marketplaces, and virtual vehicle inspections facilitate transparency and trust in the used car buying process, enabling consumers to make informed decisions and find the right vehicle for their needs. As economic factors, changing lifestyles, and environmental concerns drive consumer preferences toward used cars, the Used Car Market remains resilient and continues to thrive, providing accessible and sustainable mobility solutions for millions of consumers worldwide.

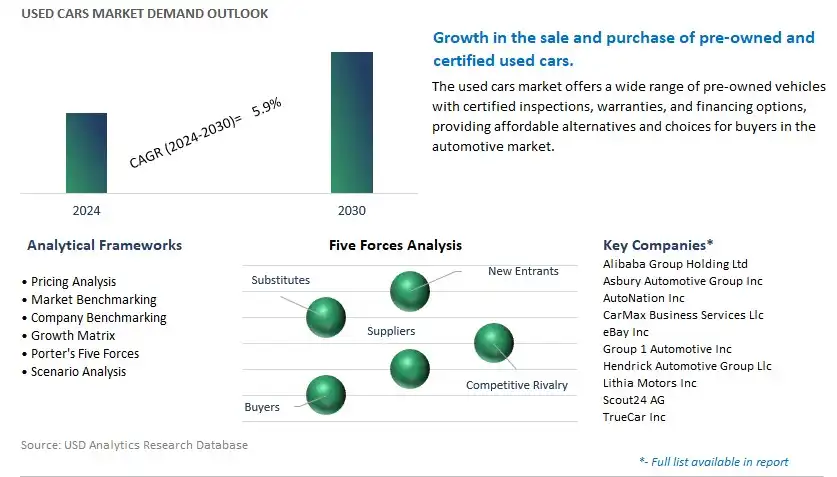

The global Used Cars market is highly competitive with a large number of companies focusing on niche market segments. Amidst intense competitive conditions, Used Cars Companies are investing in new product launches and strengthening distribution channels. Key companies operating in the Used Cars Market Industry include- Alibaba Group Holding Ltd, Asbury Automotive Group Inc, AutoNation Inc, CarMax Business Services Llc, eBay Inc, Group 1 Automotive Inc, Hendrick Automotive Group Llc, Lithia Motors Inc, Scout24 AG, TrueCar Inc.

A significant trend in the Used Car Market is the increased demand for online platforms for buying and selling used vehicles, driven by advancements in technology, changing consumer behavior, and the convenience of digital transactions. Online platforms offer a wide selection of used cars, detailed vehicle information, and transparent pricing, enabling consumers to browse, compare, and purchase vehicles from the comfort of their homes. Additionally, online platforms often provide additional services such as vehicle inspections, financing options, and delivery services, enhancing the overall buying experience for consumers. This trend reflects a broader industry shift towards digitalization in automotive retail, shaping the used car market towards greater reliance on online channels for vehicle transactions and facilitating market growth through increased accessibility and convenience for buyers and sellers alike.

A key driver propelling the Used Car Market is economic factors such as affordability, depreciation, and cost-conscious consumer behavior, particularly during periods of economic uncertainty or downturns. As new car prices continue to rise and vehicle ownership costs increase, consumers are turning to the used car market as a more affordable alternative for purchasing vehicles. Moreover, used cars offer lower depreciation rates compared to new cars, making them attractive options for budget-conscious buyers seeking to maximize their purchasing power and minimize long-term ownership costs. Additionally, the availability of certified pre-owned (CPO) programs from automakers and dealerships provides consumers with added confidence and peace of mind when purchasing used vehicles, further driving market demand for reliable and well-maintained pre-owned cars. This driver underscores the integral role of affordability and economic considerations in shaping consumer preferences and driving market growth in the used car segment.

An opportunity within the Used Car Market lies in the expansion of certified pre-owned (CPO) programs offered by automakers, dealerships, and third-party providers to meet the growing demand for high-quality, certified used vehicles. CPO programs typically involve rigorous vehicle inspections, refurbishment, and warranty coverage, providing consumers with assurance of the vehicle's condition and reliability. By expanding CPO programs and offering incentives such as extended warranties, roadside assistance, and financing options, automotive retailers can attract more buyers to the used car market and differentiate their offerings from traditional used car sales channels. Moreover, CPO programs offer opportunities for dealerships to increase customer loyalty, retention, and profitability by providing value-added services and building long-term relationships with buyers. By embracing opportunities in CPO programs, automotive retailers can capitalize on the growing demand for certified used cars and drive market growth in the competitive used car segment.

By Vehicle

Hybrid

Conventional

Electric

By Vendor

Organized

Unorganized

By Fuel

Diesel

Petrol

Others

By Size

Compact

Mid-Sized

SUV

By Sales Channel

Offline

OnlineGeographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa

Alibaba Group Holding Ltd

Asbury Automotive Group Inc

AutoNation Inc

CarMax Business Services Llc

eBay Inc

Group 1 Automotive Inc

Hendrick Automotive Group Llc

Lithia Motors Inc

Scout24 AG

TrueCar Inc

*- List not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Used Cars Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Used Cars Market Size Outlook, $ Million, 2021 to 2030

3.2 Used Cars Market Outlook by Type, $ Million, 2021 to 2030

3.3 Used Cars Market Outlook by Product, $ Million, 2021 to 2030

3.4 Used Cars Market Outlook by Application, $ Million, 2021 to 2030

3.5 Used Cars Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Used Cars Industry

4.2 Key Market Trends in Used Cars Industry

4.3 Potential Opportunities in Used Cars Industry

4.4 Key Challenges in Used Cars Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Used Cars Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Used Cars Market Outlook by Segments

7.1 Used Cars Market Outlook by Segments, $ Million, 2021- 2030

By Vehicle

Hybrid

Conventional

Electric

By Vendor

Organized

Unorganized

By Fuel

Diesel

Petrol

Others

By Size

Compact

Mid-Sized

SUV

By Sales Channel

Offline

Online

8 North America Used Cars Market Analysis and Outlook To 2030

8.1 Introduction to North America Used Cars Markets in 2024

8.2 North America Used Cars Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Used Cars Market size Outlook by Segments, 2021-2030

By Vehicle

Hybrid

Conventional

Electric

By Vendor

Organized

Unorganized

By Fuel

Diesel

Petrol

Others

By Size

Compact

Mid-Sized

SUV

By Sales Channel

Offline

Online

9 Europe Used Cars Market Analysis and Outlook To 2030

9.1 Introduction to Europe Used Cars Markets in 2024

9.2 Europe Used Cars Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Used Cars Market Size Outlook by Segments, 2021-2030

By Vehicle

Hybrid

Conventional

Electric

By Vendor

Organized

Unorganized

By Fuel

Diesel

Petrol

Others

By Size

Compact

Mid-Sized

SUV

By Sales Channel

Offline

Online

10 Asia Pacific Used Cars Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Used Cars Markets in 2024

10.2 Asia Pacific Used Cars Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Used Cars Market size Outlook by Segments, 2021-2030

By Vehicle

Hybrid

Conventional

Electric

By Vendor

Organized

Unorganized

By Fuel

Diesel

Petrol

Others

By Size

Compact

Mid-Sized

SUV

By Sales Channel

Offline

Online

11 South America Used Cars Market Analysis and Outlook To 2030

11.1 Introduction to South America Used Cars Markets in 2024

11.2 South America Used Cars Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Used Cars Market size Outlook by Segments, 2021-2030

By Vehicle

Hybrid

Conventional

Electric

By Vendor

Organized

Unorganized

By Fuel

Diesel

Petrol

Others

By Size

Compact

Mid-Sized

SUV

By Sales Channel

Offline

Online

12 Middle East and Africa Used Cars Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Used Cars Markets in 2024

12.2 Middle East and Africa Used Cars Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Used Cars Market size Outlook by Segments, 2021-2030

By Vehicle

Hybrid

Conventional

Electric

By Vendor

Organized

Unorganized

By Fuel

Diesel

Petrol

Others

By Size

Compact

Mid-Sized

SUV

By Sales Channel

Offline

Online

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

Alibaba Group Holding Ltd

Asbury Automotive Group Inc

AutoNation Inc

CarMax Business Services Llc

eBay Inc

Group 1 Automotive Inc

Hendrick Automotive Group Llc

Lithia Motors Inc

Scout24 AG

TrueCar Inc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Vehicle

Hybrid

Conventional

Electric

By Vendor

Organized

Unorganized

By Fuel

Diesel

Petrol

Others

By Size

Compact

Mid-Sized

SUV

By Sales Channel

Offline

Online

The global Used Cars Market is one of the lucrative growth markets, poised to register a 5.9% growth (CAGR) between 2024 and 2030.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Alibaba Group Holding Ltd, Asbury Automotive Group Inc, AutoNation Inc, CarMax Business Services Llc, eBay Inc, Group 1 Automotive Inc, Hendrick Automotive Group Llc, Lithia Motors Inc, Scout24 AG, TrueCar Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume