The global Umami Flavors Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Natural Source (Animal-based, Plant-based, Fermented Products), By Synthetic Source (Monosodium Glutamate (MSG), Disodium Inosinate, Disodium Guanylate), By Form (Granular, Powder, Liquid, Paste), By Application (Food and Beverage, Foodservice, Retail, Others).

The umami flavors market is experiencing significant growth, fueled by the rising demand for savory and complex taste profiles in the food and beverage industry. Umami, often described as the fifth taste, enhances the depth and richness of flavors in a wide range of culinary applications, from snacks and sauces to ready meals and condiments. The market is driven by consumer preferences for authentic and indulgent taste experiences, as well as the increasing popularity of Asian cuisines, which prominently feature umami-rich ingredients such as soy sauce, miso, and seaweed. Innovations in flavor technology and the development of natural and clean-label umami flavor enhancers are expanding the market's reach and appeal. Additionally, the trend towards plant-based and vegetarian diets is boosting demand for umami flavors, as they are used to mimic the savory taste of meat in meatless products. As the food industry continues to explore new taste dimensions and enhance product offerings, the umami flavors market is poised for continued expansion, reflecting broader trends in global cuisine and flavor innovation.

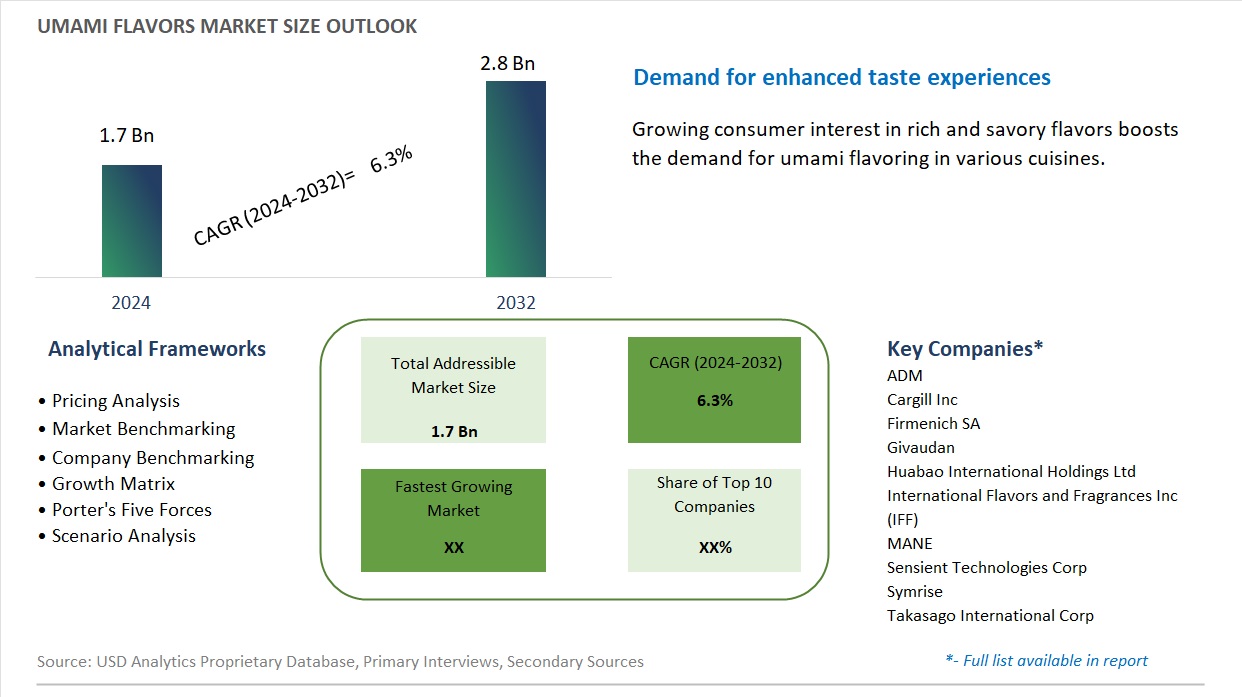

The market report analyses the leading companies in the industry including ADM, Cargill Inc, Firmenich SA, Givaudan, Huabao International Holdings Ltd, International Flavors and Fragrances Inc (IFF), MANE, Sensient Technologies Corp, Symrise, Takasago International Corp, and others.

The Umami Flavors Market is experiencing a prominent trend towards the growing popularity of umami as a key flavor component in a variety of culinary applications. Umami, recognized as the fifth basic taste, is increasingly being incorporated into both traditional and contemporary dishes to enhance flavor profiles and improve overall taste experiences. This trend is driven by a greater understanding and appreciation of umami's role in flavor enhancement, as well as its integration into gourmet cooking and processed foods. The expanding use of umami-rich ingredients, such as MSG, yeast extracts, and fermented products, reflects this broader acceptance and demand.

The increasing demand for flavor enhancement in processed foods is a significant driver for the Umami Flavors Market. As consumers seek more complex and satisfying taste experiences, food manufacturers are turning to umami flavors to boost the overall sensory appeal of their products. This driver is supported by the growing popularity of convenience foods, snacks, and restaurant-quality meals that prioritize rich and appealing flavors. Umami flavors are being used to improve taste profiles, reduce the need for excessive salt, and cater to evolving consumer preferences for flavorful, well-balanced foods.

A notable opportunity for the Umami Flavors Market lies in the development of natural and clean label umami ingredients. With increasing consumer interest in natural and minimally processed foods, there is a growing demand for umami flavor enhancers that meet clean label criteria. Innovations in natural umami sources, such as mushroom extracts, seaweed, and fermented vegetables, can cater to health-conscious and environmentally aware consumers. By focusing on clean label and natural ingredients, companies can differentiate their products and address the needs of a market that values transparency and sustainability in food production.

In the Umami Flavors Market, the granular form segment is the largest. This dominance is due to the versatility and ease of use of granular umami flavors in various culinary applications. Granular umami flavors are preferred by both food manufacturers and restaurants for their ability to blend seamlessly into a wide range of products, from processed foods to seasonings and sauces. They offer convenience in storage and handling, and their long shelf life contributes to their widespread use. Additionally, granular forms are often utilized in bulk processing, making them a preferred choice for large-scale production.

In the Umami Flavors Market, the plant-based segment is the fastest growing over the forecast period to 2032. This rapid growth is driven by increasing consumer demand for plant-based and vegan products, coupled with a rising awareness of sustainability and health benefits associated with plant-based diets. Plant-based umami sources, such as mushrooms and seaweeds, are becoming popular due to their rich umami profiles and alignment with dietary preferences that avoid animal products. Additionally, advancements in plant-based umami flavor technologies and formulations are expanding their applications in various food products, further accelerating their growth in the market.

In the Umami Flavors Market, the food and beverage segment is the largest. This dominance is primarily due to the widespread use of umami flavors in a diverse range of food and beverage products to enhance taste and flavor profiles. Umami, known as the fifth taste, is crucial in various cuisines, including savory dishes, sauces, soups, and snacks. The food and beverage industry benefits from umami flavors as they help in reducing the need for salt and sugar while providing depth and richness to foods, making them a staple in both processed and culinary applications. The extensive integration of umami flavors into numerous food and beverage products ensures this segment remains the largest in the market.

By Natural Source

Animal-based

Plant-based

Fermented Products

By Synthetic Source

Monosodium Glutamate (MSG)

Disodium Inosinate

Disodium Guanylate

By Form

Granular

Powder

Liquid

Paste

By Application

Food and Beverage

Foodservice

Retail

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

ADM

Cargill Inc

Firmenich SA

Givaudan

Huabao International Holdings Ltd

International Flavors and Fragrances Inc (IFF)

MANE

Sensient Technologies Corp

Symrise

Takasago International Corp

*- List Not Exhaustive

By Natural Source

Animal-based

Plant-based

Fermented Products

By Synthetic Source

Monosodium Glutamate (MSG)

Disodium Inosinate

Disodium Guanylate

By Form

Granular

Powder

Liquid

Paste

By Application

Food and Beverage

Foodservice

Retail

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Umami Flavors Market Size is valued at $1.7 Billion in 2024 and is forecast to register a growth rate (CAGR) of 6.3% to reach $2.8 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

ADM, Cargill Inc, Firmenich SA, Givaudan, Huabao International Holdings Ltd, International Flavors and Fragrances Inc (IFF), MANE, Sensient Technologies Corp, Symrise, Takasago International Corp

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume