The global Ultrapure Water Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Application (Cleaning, Etching, Ingredient, Others), By End-User (Semiconductor, Pharmaceuticals, Power Generation, Others).

Ultrapure water (UPW) remains indispensable in semiconductor manufacturing, pharmaceutical production, laboratory research, and power generation in 2024. UPW is water that has been purified to stringent quality standards to remove impurities such as dissolved ions, particles, organic compounds, and microorganisms. In semiconductor fabrication, UPW is used for cleaning, rinsing, and etching silicon wafers, ensuring the integrity and reliability of microelectronic devices. In pharmaceutical manufacturing, UPW is employed for formulation, cleaning, and quality control of drug products, meeting regulatory requirements for purity and safety. Further, in laboratory research, UPW is used for analytical and experimental procedures in chemistry, biology, and materials science, providing consistent and reproducible results. Additionally, in power generation, UPW is utilized in steam turbines and boiler systems to prevent scale formation and corrosion, optimizing efficiency and reliability. With advanced water purification technologies such as reverse osmosis, ion exchange, and ultraviolet disinfection, UPW s to play a critical role in enabling advancements in technology, healthcare, and scientific research.

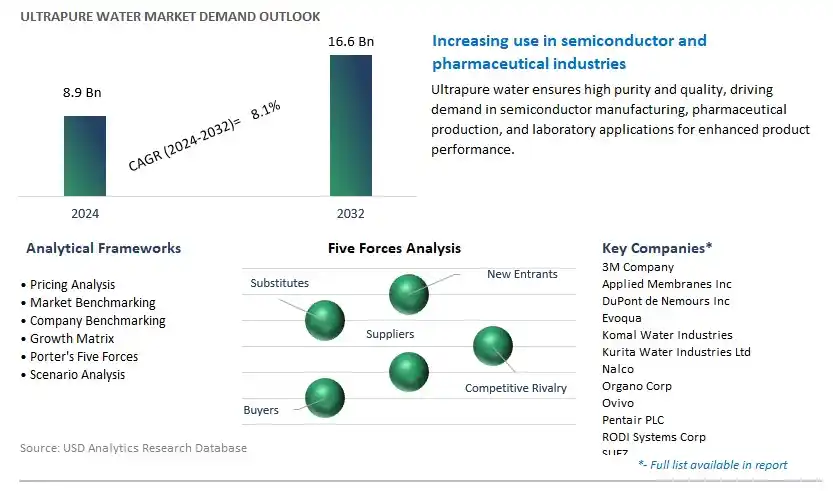

The market report analyses the leading companies in the industry including 3M Company, Applied Membranes Inc, DuPont de Nemours Inc, Evoqua, Komal Water Industries, Kurita Water Industries Ltd, Nalco, Organo Corp, Ovivo, Pentair PLC, RODI Systems Corp, SUEZ, Veolia Environnement SA, and others.

A significant market trend in the ultrapure water industry is the increasing demand in semiconductor and electronics manufacturing. Ultrapure water, with its exceptionally high purity levels and low levels of contaminants, is a critical component in the production of semiconductors, microchips, and electronic components. This trend is driven by the growing complexity and miniaturization of electronic devices, where even trace impurities in water can negatively impact manufacturing processes and product quality. As semiconductor manufacturers strive for higher yields, increased reliability, and tighter tolerances in their fabrication processes, the demand for ultrapure water as a crucial process ingredient continues to rise, shaping the market towards greater adoption in the semiconductor and electronics industry.

The driver behind the growth of the ultrapure water market is stringent quality standards and manufacturing specifications in semiconductor and electronics industries. Semiconductor fabrication requires ultrapure water with extremely low levels of ions, particles, dissolved gases, and organic contaminants to prevent defects, ensure uniformity, and maintain the performance of electronic devices. Manufacturers adhere to strict purity standards such as those outlined by the International Organization for Standardization (ISO) and Semiconductor Equipment and Materials International (SEMI), driving the demand for advanced water treatment technologies such as reverse osmosis, deionization, and filtration to achieve ultrapure water quality. Additionally, advancements in manufacturing processes, device architectures, and material innovations necessitate continuous improvements in water purification technologies to meet evolving industry requirements, further fueling market growth and technological innovation in ultrapure water systems.

An opportunity for growth and diversification in the ultrapure water market lies in expansion into pharmaceutical and biotechnology industries. While ultrapure water is primarily used in semiconductor manufacturing, there is potential for penetration into new sectors such as pharmaceutical manufacturing, bioprocessing, and laboratory research. In pharmaceutical production, ultrapure water is essential for drug formulation, sterile processing, and quality control testing, where it is used in applications such as cleaning, rinsing, and preparation of drug formulations, injectables, and parenteral solutions. Similarly, in biotechnology, ultrapure water is critical for cell culture, media preparation, and purification of biopharmaceuticals, ensuring product safety, consistency, and regulatory compliance. By leveraging their expertise in ultrapure water technology and adapting their solutions to meet the specific requirements of pharmaceutical and biotechnology industries, ultrapure water system manufacturers can diversify their market presence, expand their customer base, and capitalize on opportunities for growth and market expansion beyond semiconductor manufacturing.

Within the Ultrapure Water market, the Cleaning application is the largest and most significant segment. In particular, the cleaning process in various industries such as semiconductor manufacturing, pharmaceutical production, and food and beverage processing requires high-quality water to ensure optimal cleanliness and prevent contamination of critical surfaces and equipment. Ultrapure water, characterized by its exceptionally low levels of impurities and contaminants, is essential for achieving stringent cleanliness standards in cleaning processes. Moreover, the increasing demand for precision cleaning in industries such as electronics and pharmaceuticals, where even minute traces of contaminants can impact product quality and performance, further drives the adoption of ultrapure water. Additionally, advancements in water purification technologies and systems have led to the development of highly efficient ultrapure water production processes, enabling industries to meet their cleaning requirements reliably and cost-effectively. As a result, the Cleaning application maintains its position as the largest and most dominant segment within the Ultrapure Water market, with continued growth anticipated as industries prioritize cleanliness and quality assurance in their manufacturing processes.

Among the various end-user segments in the Ultrapure Water market, the Semiconductor sector stands out as the fastest-growing segment. In particular, the semiconductor manufacturing process requires ultrapure water at multiple stages, including wafer cleaning, chemical mechanical planarization (CMP), and photoresist development. Ultrapure water plays a critical role in ensuring the cleanliness and quality of semiconductor components, as even tiny particles or impurities can adversely affect chip performance and yield. Moreover, the ongoing advancements in semiconductor technology, such as the development of smaller and more complex integrated circuits, increase the demand for ultrapure water to meet stringent cleanliness requirements. Additionally, the expansion of the semiconductor industry, particularly in regions like Asia-Pacific, further drives the growth of the Ultrapure Water market as more fabrication facilities come online. Furthermore, the increasing adoption of advanced water purification technologies, such as ion exchange, reverse osmosis, and ultrafiltration, enhances the efficiency and reliability of ultrapure water production, supporting the semiconductor sector's rapid growth. As a result, the Semiconductor sector is experiencing significant expansion within the Ultrapure Water market, with sustained growth anticipated as semiconductor manufacturing processes continue to evolve and demand for high-quality ultrapure water increases.

By Application

Cleaning

Etching

Ingredient

Others

By End-User

Semiconductor

Pharmaceuticals

Power Generation

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

3M Company

Applied Membranes Inc

DuPont de Nemours Inc

Evoqua

Komal Water Industries

Kurita Water Industries Ltd

Nalco

Organo Corp

Ovivo

Pentair PLC

RODI Systems Corp

SUEZ

Veolia Environnement SA

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Ultrapure Water Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Ultrapure Water Market Size Outlook, $ Million, 2021 to 2032

3.2 Ultrapure Water Market Outlook by Type, $ Million, 2021 to 2032

3.3 Ultrapure Water Market Outlook by Product, $ Million, 2021 to 2032

3.4 Ultrapure Water Market Outlook by Application, $ Million, 2021 to 2032

3.5 Ultrapure Water Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Ultrapure Water Industry

4.2 Key Market Trends in Ultrapure Water Industry

4.3 Potential Opportunities in Ultrapure Water Industry

4.4 Key Challenges in Ultrapure Water Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Ultrapure Water Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Ultrapure Water Market Outlook by Segments

7.1 Ultrapure Water Market Outlook by Segments, $ Million, 2021- 2032

By Application

Cleaning

Etching

Ingredient

Others

By End-User

Semiconductor

Pharmaceuticals

Power Generation

Others

8 North America Ultrapure Water Market Analysis and Outlook To 2032

8.1 Introduction to North America Ultrapure Water Markets in 2024

8.2 North America Ultrapure Water Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Ultrapure Water Market size Outlook by Segments, 2021-2032

By Application

Cleaning

Etching

Ingredient

Others

By End-User

Semiconductor

Pharmaceuticals

Power Generation

Others

9 Europe Ultrapure Water Market Analysis and Outlook To 2032

9.1 Introduction to Europe Ultrapure Water Markets in 2024

9.2 Europe Ultrapure Water Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Ultrapure Water Market Size Outlook by Segments, 2021-2032

By Application

Cleaning

Etching

Ingredient

Others

By End-User

Semiconductor

Pharmaceuticals

Power Generation

Others

10 Asia Pacific Ultrapure Water Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Ultrapure Water Markets in 2024

10.2 Asia Pacific Ultrapure Water Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Ultrapure Water Market size Outlook by Segments, 2021-2032

By Application

Cleaning

Etching

Ingredient

Others

By End-User

Semiconductor

Pharmaceuticals

Power Generation

Others

11 South America Ultrapure Water Market Analysis and Outlook To 2032

11.1 Introduction to South America Ultrapure Water Markets in 2024

11.2 South America Ultrapure Water Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Ultrapure Water Market size Outlook by Segments, 2021-2032

By Application

Cleaning

Etching

Ingredient

Others

By End-User

Semiconductor

Pharmaceuticals

Power Generation

Others

12 Middle East and Africa Ultrapure Water Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Ultrapure Water Markets in 2024

12.2 Middle East and Africa Ultrapure Water Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Ultrapure Water Market size Outlook by Segments, 2021-2032

By Application

Cleaning

Etching

Ingredient

Others

By End-User

Semiconductor

Pharmaceuticals

Power Generation

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

3M Company

Applied Membranes Inc

DuPont de Nemours Inc

Evoqua

Komal Water Industries

Kurita Water Industries Ltd

Nalco

Organo Corp

Ovivo

Pentair PLC

RODI Systems Corp

SUEZ

Veolia Environnement SA

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Application

Cleaning

Etching

Ingredient

Others

By End-User

Semiconductor

Pharmaceuticals

Power Generation

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Ultrapure Water Market Size is valued at $8.9 Billion in 2024 and is forecast to register a growth rate (CAGR) of 8.1% to reach $16.6 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

3M Company, Applied Membranes Inc, DuPont de Nemours Inc, Evoqua, Komal Water Industries, Kurita Water Industries Ltd, Nalco, Organo Corp, Ovivo, Pentair PLC, RODI Systems Corp, SUEZ, Veolia Environnement SA

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume