The global Ultrafiltration Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Polymeric, Ceramic), By Application (Municipal Treatment, Industrial Treatment, Food & Beverage Processing, Chemical & Petrochemical Processing, Pharmaceutical Processing, Others), By Module (Hollow Fiber, Others).

Ultrafiltration (UF) remains a critical process in water and wastewater treatment, food and beverage processing, pharmaceutical manufacturing, and biotechnology in 2024. UF is a membrane filtration process that separates suspended solids, colloids, bacteria, and macromolecules from liquids using semi-permeable membranes with pore sizes typically ranging from 0.01 to 0.1 micrometers. In water treatment, UF is employed for pretreatment, potable water production, and wastewater reuse, providing effective removal of particulate matter, pathogens, and organic compounds. In food and beverage processing, UF is used for concentration, clarification, and fractionation of liquids such as juices, dairy products, and beverages, improving product quality and shelf life. Additionally, UF is utilized in pharmaceutical manufacturing for purification of drug substances, clarification of fermentation broths, and removal of endotoxins and viruses. With advancements in membrane materials, module designs, and system configurations, UF s to offer sustainable and cost-effective solutions for various liquid-solid separation applications, driving efficiency, quality, and compliance in industrial processes.

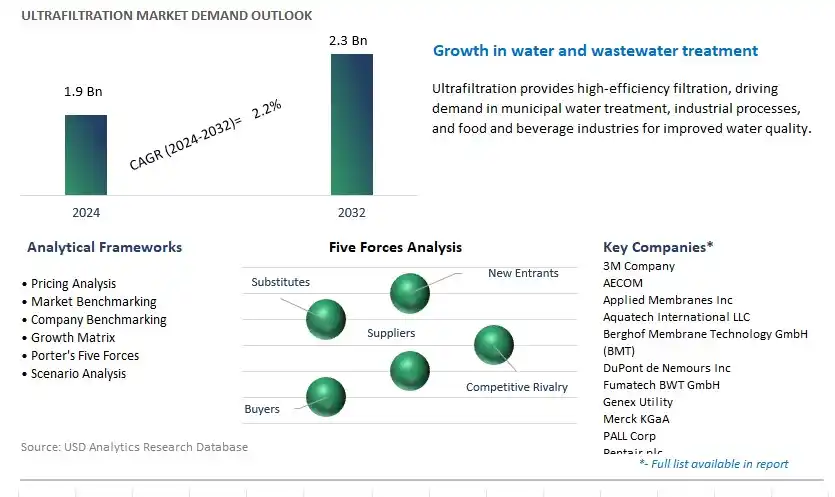

The market report analyses the leading companies in the industry including 3M Company, AECOM, Applied Membranes Inc, Aquatech International LLC, Berghof Membrane Technology GmbH (BMT), DuPont de Nemours Inc, Fumatech BWT GmbH, Genex Utility, Merck KGaA, PALL Corp, Pentair plc, Sterlitech Corp, SUEZ, Synder Filtration Inc, Trucent, and others.

A significant market trend in the ultrafiltration industry is the increasing demand for water and wastewater treatment solutions. Ultrafiltration, a membrane-based separation process, is gaining prominence as an effective method for removing contaminants, particulates, and microorganisms from water sources. This trend is driven by growing concerns over water scarcity, pollution, and the need for sustainable water management practices globally. As industries, municipalities, and communities seek to improve water quality, comply with regulatory standards, and address emerging contaminants such as microplastics and pharmaceuticals, the demand for ultrafiltration systems continues to rise, shaping the market towards greater adoption in water treatment and purification applications.

The driver behind the growth of the ultrafiltration market is stringent environmental regulations and water quality standards. Regulatory agencies worldwide impose strict standards for drinking water quality, wastewater discharge, and environmental protection, driving industries and municipalities to invest in advanced water treatment technologies such as ultrafiltration to meet regulatory requirements. Ultrafiltration systems offer efficient removal of suspended solids, bacteria, viruses, and other contaminants, providing safe and clean water for various applications including drinking water production, industrial processes, and wastewater reuse. Additionally, the need to address emerging contaminants and comply with evolving regulations further fuels the adoption of ultrafiltration systems in water and wastewater treatment, driving market growth and technological innovation in the industry.

An opportunity for growth and diversification in the ultrafiltration market lies in expansion into food and beverage processing industries. While ultrafiltration is commonly used in water treatment and purification, there is potential for penetration into new sectors such as dairy, juice, brewing, and wine production. In the food and beverage industry, ultrafiltration membranes are utilized for concentration, clarification, and fractionation of liquids, enabling the removal of bacteria, enzymes, and undesirable compounds while retaining valuable nutrients, flavors, and aromas. Ultrafiltration also offers advantages such as gentle processing, minimal heat exposure, and preservation of product quality, making it suitable for applications such as milk and whey processing, fruit juice clarification, beer and wine clarification, and protein fractionation. By exploring new applications and market segments, ultrafiltration system manufacturers can diversify their product portfolio, expand their customer base, and capitalize on opportunities for growth and market expansion beyond traditional water treatment markets.

Within the Ultrafiltration market, the Polymeric Type is the largest and most significant segment. In particular, polymeric ultrafiltration membranes offer numerous advantages over ceramic membranes, including lower cost of production, greater flexibility in design and fabrication, and higher resistance to fouling. These characteristics make polymeric membranes highly versatile and well-suited for a wide range of applications, including water and wastewater treatment, food and beverage processing, pharmaceutical manufacturing, and biotechnology. Additionally, advancements in polymer chemistry and membrane technology have led to the development of high-performance polymeric membranes with enhanced selectivity, permeability, and durability, further driving their adoption across various industries. Moreover, the scalability of polymeric membrane manufacturing processes allows for cost-effective production of membranes in large quantities, meeting the growing demand for efficient and reliable filtration solutions. As a result, the Polymeric Type segment maintains its position as the largest and most dominant segment within the Ultrafiltration market, with continued growth expected in the foreseeable future.

Among the various applications in the Ultrafiltration market, the Industrial Treatment sector stands out as the fastest-growing segment. In particular, industries such as manufacturing, textiles, and electronics require efficient and reliable water treatment solutions to meet stringent regulatory standards and ensure environmental compliance. Ultrafiltration offers an effective method for removing contaminants, suspended solids, and microorganisms from industrial wastewater streams, thereby facilitating water reuse and minimizing environmental impact. Additionally, the increasing focus on sustainability and resource conservation drives the adoption of ultrafiltration systems in industrial facilities, as they provide a cost-effective and environmentally friendly alternative to traditional treatment methods such as chemical coagulation and sedimentation. Moreover, advancements in membrane technology and system design have led to the development of customized ultrafiltration solutions tailored to specific industrial processes and wastewater characteristics, further fuelling the segment's growth. As a result, the Industrial Treatment application is experiencing rapid expansion within the Ultrafiltration market, with continued growth anticipated as industries prioritize water stewardship and environmental sustainability.

Within the Ultrafiltration market, the Hollow Fiber Module is the largest and most significant segment. In particular, hollow fiber membranes offer potential advantages over other module types, including high surface area-to-volume ratio, compact design, and efficient fluid dynamics, making them ideal for various filtration applications. These membranes are widely used in industries such as water and wastewater treatment, food and beverage processing, and pharmaceutical manufacturing due to their ability to effectively remove suspended solids, bacteria, and viruses from liquid streams. Moreover, hollow fiber modules are versatile and adaptable to different operating conditions, allowing for the optimization of filtration performance and system efficiency. Additionally, advancements in membrane technology have led to the development of high-performance hollow fiber membranes with enhanced flux rates, fouling resistance, and durability, further driving their widespread adoption in industrial and municipal applications. As a result, the Hollow Fiber Module segment maintains its position as the largest and most dominant segment within the Ultrafiltration market, with continued growth expected in the foreseeable future.

By Type

Polymeric

Ceramic

By Application

Municipal Treatment

Industrial Treatment

Food & Beverage Processing

Chemical & Petrochemical Processing

Pharmaceutical Processing

Others

By Module

Hollow Fiber

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

3M Company

AECOM

Applied Membranes Inc

Aquatech International LLC

Berghof Membrane Technology GmbH (BMT)

DuPont de Nemours Inc

Fumatech BWT GmbH

Genex Utility

Merck KGaA

PALL Corp

Pentair plc

Sterlitech Corp

SUEZ

Synder Filtration Inc

Trucent

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Ultrafiltration Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Ultrafiltration Market Size Outlook, $ Million, 2021 to 2032

3.2 Ultrafiltration Market Outlook by Type, $ Million, 2021 to 2032

3.3 Ultrafiltration Market Outlook by Product, $ Million, 2021 to 2032

3.4 Ultrafiltration Market Outlook by Application, $ Million, 2021 to 2032

3.5 Ultrafiltration Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Ultrafiltration Industry

4.2 Key Market Trends in Ultrafiltration Industry

4.3 Potential Opportunities in Ultrafiltration Industry

4.4 Key Challenges in Ultrafiltration Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Ultrafiltration Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Ultrafiltration Market Outlook by Segments

7.1 Ultrafiltration Market Outlook by Segments, $ Million, 2021- 2032

By Type

Polymeric

Ceramic

By Application

Municipal Treatment

Industrial Treatment

Food & Beverage Processing

Chemical & Petrochemical Processing

Pharmaceutical Processing

Others

By Module

Hollow Fiber

Others

8 North America Ultrafiltration Market Analysis and Outlook To 2032

8.1 Introduction to North America Ultrafiltration Markets in 2024

8.2 North America Ultrafiltration Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Ultrafiltration Market size Outlook by Segments, 2021-2032

By Type

Polymeric

Ceramic

By Application

Municipal Treatment

Industrial Treatment

Food & Beverage Processing

Chemical & Petrochemical Processing

Pharmaceutical Processing

Others

By Module

Hollow Fiber

Others

9 Europe Ultrafiltration Market Analysis and Outlook To 2032

9.1 Introduction to Europe Ultrafiltration Markets in 2024

9.2 Europe Ultrafiltration Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Ultrafiltration Market Size Outlook by Segments, 2021-2032

By Type

Polymeric

Ceramic

By Application

Municipal Treatment

Industrial Treatment

Food & Beverage Processing

Chemical & Petrochemical Processing

Pharmaceutical Processing

Others

By Module

Hollow Fiber

Others

10 Asia Pacific Ultrafiltration Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Ultrafiltration Markets in 2024

10.2 Asia Pacific Ultrafiltration Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Ultrafiltration Market size Outlook by Segments, 2021-2032

By Type

Polymeric

Ceramic

By Application

Municipal Treatment

Industrial Treatment

Food & Beverage Processing

Chemical & Petrochemical Processing

Pharmaceutical Processing

Others

By Module

Hollow Fiber

Others

11 South America Ultrafiltration Market Analysis and Outlook To 2032

11.1 Introduction to South America Ultrafiltration Markets in 2024

11.2 South America Ultrafiltration Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Ultrafiltration Market size Outlook by Segments, 2021-2032

By Type

Polymeric

Ceramic

By Application

Municipal Treatment

Industrial Treatment

Food & Beverage Processing

Chemical & Petrochemical Processing

Pharmaceutical Processing

Others

By Module

Hollow Fiber

Others

12 Middle East and Africa Ultrafiltration Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Ultrafiltration Markets in 2024

12.2 Middle East and Africa Ultrafiltration Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Ultrafiltration Market size Outlook by Segments, 2021-2032

By Type

Polymeric

Ceramic

By Application

Municipal Treatment

Industrial Treatment

Food & Beverage Processing

Chemical & Petrochemical Processing

Pharmaceutical Processing

Others

By Module

Hollow Fiber

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

3M Company

AECOM

Applied Membranes Inc

Aquatech International LLC

Berghof Membrane Technology GmbH (BMT)

DuPont de Nemours Inc

Fumatech BWT GmbH

Genex Utility

Merck KGaA

PALL Corp

Pentair plc

Sterlitech Corp

SUEZ

Synder Filtration Inc

Trucent

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Polymeric

Ceramic

By Application

Municipal Treatment

Industrial Treatment

Food & Beverage Processing

Chemical & Petrochemical Processing

Pharmaceutical Processing

Others

By Module

Hollow Fiber

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Ultrafiltration Market Size is valued at $1.9 Billion in 2024 and is forecast to register a growth rate (CAGR) of 2.2% to reach $2.3 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

3M Company, AECOM, Applied Membranes Inc, Aquatech International LLC, Berghof Membrane Technology GmbH (BMT), DuPont de Nemours Inc, Fumatech BWT GmbH, Genex Utility, Merck KGaA, PALL Corp, Pentair plc, Sterlitech Corp, SUEZ, Synder Filtration Inc, Trucent

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume