The global Ultra-thin Glass Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Thickness (Below 0.1mm, 0.1 to 0.5mm, 0.5 to 1.0mm), By Manufacturing Process (Float, Fusion, Down-Draw), By Application (Semiconductor Substrate, Touch Panel Display, Fingerprint Sensor, Others), By End-User (Consumer Electronics, Automotive & Transportation, Medical & Healthcare, Others).

Ultra-thin glass s to revolutionize various industries in 2024, offering exceptional transparency, strength, and flexibility for diverse applications. This specialized glass, typically less than 0.1 millimeters thick, is manufactured using advanced glass-forming techniques such as float glass processes or chemical vapor deposition (CVD). Ultra-thin glass finds applications in electronics, automotive, architecture, and consumer goods. In electronics, it is used for flexible displays, touchscreens, and wearable devices, where its thin profile and high transmission properties enable innovative designs and improved user experiences. In automotive applications, ultra-thin glass serves as lightweight alternatives for windows, sunroofs, and head-up displays, contributing to vehicle weight reduction and fuel efficiency. Further, in architecture and interior design, ultra-thin glass offers opportunities for aesthetic enhancements such as decorative panels, partitions, and facades, providing natural light transmission and visual openness. With continuous advancements in glass manufacturing technology and coatings, ultra-thin glass s to push the boundaries of design possibilities and functional applications in various industries.

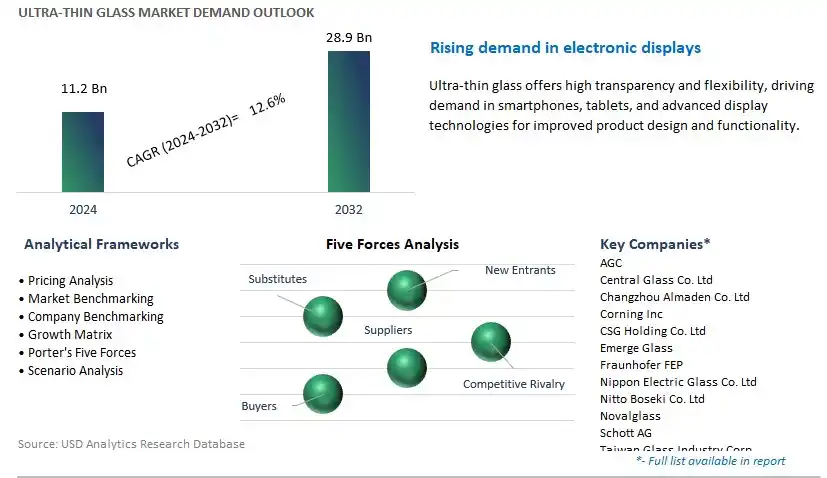

The market report analyses the leading companies in the industry including AGC, Central Glass Co. Ltd, Changzhou Almaden Co. Ltd, Corning Inc, CSG Holding Co. Ltd, Emerge Glass, Fraunhofer FEP, Nippon Electric Glass Co. Ltd, Nitto Boseki Co. Ltd, Novalglass, Schott AG, Taiwan Glass Industry Corp, and others.

A significant market trend in the ultra-thin glass industry is the increasing demand for flexible display technologies. As consumer electronics continue to evolve towards thinner and more lightweight designs, there is a growing need for ultra-thin glass substrates that can withstand bending and folding in flexible displays. This trend is driven by the proliferation of smartphones, tablets, wearables, and foldable devices, where ultra-thin glass enables the production of high-resolution displays with improved durability and optical clarity. Additionally, advancements in OLED and AMOLED display technologies require ultra-thin glass substrates to achieve seamless touch sensitivity and vibrant color reproduction, further fueling the demand for ultra-thin glass in the consumer electronics market.

The driver behind the growth of the ultra-thin glass market is technological advancements in glass manufacturing processes. Innovations in glass forming, thinning, and strengthening techniques have enabled the production of ultra-thin glass sheets with thicknesses as low as a few micrometers. Advanced float glass and fusion draw processes allow for precise control over glass thickness and surface quality, while chemical strengthening methods such as ion exchange and vapor deposition enhance the mechanical strength and scratch resistance of ultra-thin glass substrates. These technological advancements enable manufacturers to produce ultra-thin glass with superior properties, meeting the stringent requirements of flexible display applications and driving market growth in the glass industry.

An opportunity for growth and diversification in the ultra-thin glass market lies in expansion into emerging applications such as wearable electronics and automotive displays. While ultra-thin glass is primarily used in consumer electronics for smartphones and tablets, there is potential for penetration into new sectors such as smartwatches, augmented reality (AR) glasses, and heads-up displays (HUDs) in automobiles. In wearable electronics, ultra-thin glass substrates offer lightweight, shatterproof, and scratch-resistant properties, making them ideal for use in compact and durable wearable devices. Similarly, in automotive displays, ultra-thin glass enables the integration of transparent and curved displays into vehicle interiors, providing drivers with enhanced visibility, safety features, and infotainment options. By exploring new applications and market segments, ultra-thin glass manufacturers can diversify their product portfolio, expand their customer base, and capitalize on opportunities for growth and market expansion beyond traditional consumer electronics markets.

Within the Ultra-Thin Glass market, the Below 0.1mm Thickness segment is the largest and most significant. In particular, ultra-thin glass below 0.1mm thickness finds extensive applications across diverse industries such as electronics, automotive, and construction due to its exceptional properties, including high transparency, flexibility, and lightweight nature. In the electronics industry, ultra-thin glass below 0.1mm thickness is widely utilized in the manufacturing of displays for smartphones, tablets, and wearable devices, where thin and lightweight screens are essential for achieving sleek designs and improved user experiences. Moreover, advancements in display technologies, such as foldable and rollable displays, drive the demand for ultra-thin glass with thickness below 0.1mm, as it enables the fabrication of flexible and durable screens. Additionally, the automotive industry utilizes ultra-thin glass for heads-up displays (HUDs), instrument panels, and panoramic roofs to enhance vehicle aesthetics and safety. Furthermore, the construction sector incorporates ultra-thin glass below 0.1mm thickness in architectural applications such as facades, partitions, and interior decor elements, where transparency and aesthetics are paramount. As a result of these factors, the Below 0.1mm Thickness segment maintains its position as the largest and most lucrative segment within the Ultra-Thin Glass market, with sustained growth expected in the foreseeable future.

Among the various manufacturing processes in the Ultra-Thin Glass market, the Fusion Manufacturing Process stands out as the fastest-growing segment. This accelerated growth can be attributed to the fusion manufacturing process offers distinct advantages over other methods, including superior surface quality, thickness uniformity, and enhanced optical properties. This makes fusion-produced ultra-thin glass particularly suitable for advanced applications in industries such as electronics, optics, and photonics, where precise optical characteristics and surface quality are critical. Moreover, advancements in fusion technology have enabled the production of ultra-thin glass with thicknesses below 0.1mm, meeting the growing demand for thinner and lighter substrates in various high-tech devices. Additionally, the fusion process allows for the fabrication of large-area glass sheets with minimal defects, making it ideal for applications requiring expansive displays or precise optical components. Furthermore, the fusion manufacturing process offers greater flexibility in customizing glass compositions and properties, enabling manufacturers to tailor ultra-thin glass to specific application requirements. As a result, the Fusion Manufacturing Process segment is experiencing rapid growth within the Ultra-Thin Glass market, with continued expansion anticipated as demand for high-performance glass substrates continues to rise.

Within the Ultra-Thin Glass market, the Touch Panel Display application is the largest and most significant segment. In particular, touch panel displays have become ubiquitous in various electronic devices such as smartphones, tablets, laptops, and automotive infotainment systems, driving significant demand for ultra-thin glass substrates. Ultra-thin glass offers potential advantages for touch panel displays, including high transparency, excellent optical clarity, and superior scratch resistance, making it an ideal choice for enhancing display performance and user experience. Moreover, the trend towards sleeker and more lightweight electronic devices further fuels the adoption of ultra-thin glass, as it enables manufacturers to achieve thinner and more aesthetically pleasing designs without compromising on durability or functionality. Additionally, the growing popularity of emerging display technologies such as OLED and foldable displays necessitates the use of ultra-thin glass with precise thickness control and uniformity. As a result of these factors, the Touch Panel Display application maintains its position as the largest and most lucrative segment within the Ultra-Thin Glass market, with sustained growth anticipated in the foreseeable future.

Among the various end-user segments in the Ultra-Thin Glass market, the Automotive & Transportation sector stands out as the fastest-growing segment. In particular, the automotive industry's increasing integration of advanced display technologies, such as heads-up displays (HUDs), infotainment systems, and augmented reality dashboards, drives the demand for ultra-thin glass substrates. These displays require thin and lightweight glass panels that offer high optical clarity, durability, and resistance to vibration and temperature fluctuations, all of which are provided by ultra-thin glass. Moreover, the rise of electric and autonomous vehicles further amplifies the need for innovative interior design solutions, including large touchscreen interfaces and smart glass surfaces, which rely on ultra-thin glass to achieve sleek and futuristic aesthetics. Additionally, the transportation sector's adoption of ultra-thin glass extends beyond automotive applications to include aircraft cabin windows, train displays, and marine navigation screens, further contributing to the segment's rapid growth. As a result of these factors, the Automotive & Transportation sector is experiencing significant growth within the Ultra-Thin Glass market, with sustained expansion expected as automotive and transportation technologies continue to evolve.

By Thickness

<0.1mm

0.1mm-0.5mm

0.5mm-1.0mm

By Manufacturing Process

Float

Fusion

Down-Draw

By Application

Semiconductor Substrate

Touch Panel Display

Fingerprint Sensor

Others

By End-User

Consumer Electronics

Automotive & Transportation

Medical & Healthcare

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

AGC

Central Glass Co. Ltd

Changzhou Almaden Co. Ltd

Corning Inc

CSG Holding Co. Ltd

Emerge Glass

Fraunhofer FEP

Nippon Electric Glass Co. Ltd

Nitto Boseki Co. Ltd

Novalglass

Schott AG

Taiwan Glass Industry Corp

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Ultra thin Glass Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Ultra thin Glass Market Size Outlook, $ Million, 2021 to 2032

3.2 Ultra thin Glass Market Outlook by Type, $ Million, 2021 to 2032

3.3 Ultra thin Glass Market Outlook by Product, $ Million, 2021 to 2032

3.4 Ultra thin Glass Market Outlook by Application, $ Million, 2021 to 2032

3.5 Ultra thin Glass Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Ultra thin Glass Industry

4.2 Key Market Trends in Ultra thin Glass Industry

4.3 Potential Opportunities in Ultra thin Glass Industry

4.4 Key Challenges in Ultra thin Glass Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Ultra thin Glass Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Ultra thin Glass Market Outlook by Segments

7.1 Ultra thin Glass Market Outlook by Segments, $ Million, 2021- 2032

By Thickness

<0.1mm

0.1mm-0.5mm

0.5mm-1.0mm

By Manufacturing Process

Float

Fusion

Down-Draw

By Application

Semiconductor Substrate

Touch Panel Display

Fingerprint Sensor

Others

By End-User

Consumer Electronics

Automotive & Transportation

Medical & Healthcare

Others

8 North America Ultra thin Glass Market Analysis and Outlook To 2032

8.1 Introduction to North America Ultra thin Glass Markets in 2024

8.2 North America Ultra thin Glass Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Ultra thin Glass Market size Outlook by Segments, 2021-2032

By Thickness

<0.1mm

0.1mm-0.5mm

0.5mm-1.0mm

By Manufacturing Process

Float

Fusion

Down-Draw

By Application

Semiconductor Substrate

Touch Panel Display

Fingerprint Sensor

Others

By End-User

Consumer Electronics

Automotive & Transportation

Medical & Healthcare

Others

9 Europe Ultra thin Glass Market Analysis and Outlook To 2032

9.1 Introduction to Europe Ultra thin Glass Markets in 2024

9.2 Europe Ultra thin Glass Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Ultra thin Glass Market Size Outlook by Segments, 2021-2032

By Thickness

<0.1mm

0.1mm-0.5mm

0.5mm-1.0mm

By Manufacturing Process

Float

Fusion

Down-Draw

By Application

Semiconductor Substrate

Touch Panel Display

Fingerprint Sensor

Others

By End-User

Consumer Electronics

Automotive & Transportation

Medical & Healthcare

Others

10 Asia Pacific Ultra thin Glass Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Ultra thin Glass Markets in 2024

10.2 Asia Pacific Ultra thin Glass Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Ultra thin Glass Market size Outlook by Segments, 2021-2032

By Thickness

<0.1mm

0.1mm-0.5mm

0.5mm-1.0mm

By Manufacturing Process

Float

Fusion

Down-Draw

By Application

Semiconductor Substrate

Touch Panel Display

Fingerprint Sensor

Others

By End-User

Consumer Electronics

Automotive & Transportation

Medical & Healthcare

Others

11 South America Ultra thin Glass Market Analysis and Outlook To 2032

11.1 Introduction to South America Ultra thin Glass Markets in 2024

11.2 South America Ultra thin Glass Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Ultra thin Glass Market size Outlook by Segments, 2021-2032

By Thickness

<0.1mm

0.1mm-0.5mm

0.5mm-1.0mm

By Manufacturing Process

Float

Fusion

Down-Draw

By Application

Semiconductor Substrate

Touch Panel Display

Fingerprint Sensor

Others

By End-User

Consumer Electronics

Automotive & Transportation

Medical & Healthcare

Others

12 Middle East and Africa Ultra thin Glass Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Ultra thin Glass Markets in 2024

12.2 Middle East and Africa Ultra thin Glass Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Ultra thin Glass Market size Outlook by Segments, 2021-2032

By Thickness

<0.1mm

0.1mm-0.5mm

0.5mm-1.0mm

By Manufacturing Process

Float

Fusion

Down-Draw

By Application

Semiconductor Substrate

Touch Panel Display

Fingerprint Sensor

Others

By End-User

Consumer Electronics

Automotive & Transportation

Medical & Healthcare

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

AGC

Central Glass Co. Ltd

Changzhou Almaden Co. Ltd

Corning Inc

CSG Holding Co. Ltd

Emerge Glass

Fraunhofer FEP

Nippon Electric Glass Co. Ltd

Nitto Boseki Co. Ltd

Novalglass

Schott AG

Taiwan Glass Industry Corp

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Thickness

<0.1mm

0.1mm-0.5mm

0.5mm-1.0mm

By Manufacturing Process

Float

Fusion

Down-Draw

By Application

Semiconductor Substrate

Touch Panel Display

Fingerprint Sensor

Others

By End-User

Consumer Electronics

Automotive & Transportation

Medical & Healthcare

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Ultra-thin Glass Market Size is valued at $11.2 Billion in 2024 and is forecast to register a growth rate (CAGR) of 12.6% to reach $28.9 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

AGC, Central Glass Co. Ltd, Changzhou Almaden Co. Ltd, Corning Inc, CSG Holding Co. Ltd, Emerge Glass, Fraunhofer FEP, Nippon Electric Glass Co. Ltd, Nitto Boseki Co. Ltd, Novalglass, Schott AG, Taiwan Glass Industry Corp

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume