The global Two Part Adhesive Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Resin (Polyurethane, Epoxy, MMA, Silicone, Others), By Application (Automotive, Construction, Electronics, Aviation, Others).

Two-part adhesives, also known as two-component adhesives or epoxy adhesives, remain essential in various industries for bonding a wide range of substrates in 2024. These adhesives consist of two components – a resin and a hardener – which are mixed together in specific ratios to initiate a chemical reaction that forms a strong and durable bond. Two-part adhesives offer advantages such as high strength, chemical resistance, and versatility in bonding substrates such as metals, plastics, ceramics, and composites. They are widely used in automotive assembly, aerospace manufacturing, construction, electronics, and consumer goods production for applications such as structural bonding, sealing, potting, and encapsulation. With their ability to bond dissimilar materials, withstand harsh environmental conditions, and provide excellent adhesion to substrates, two-part adhesives to be preferred choices for engineers and manufacturers seeking reliable and long-lasting bonding solutions.

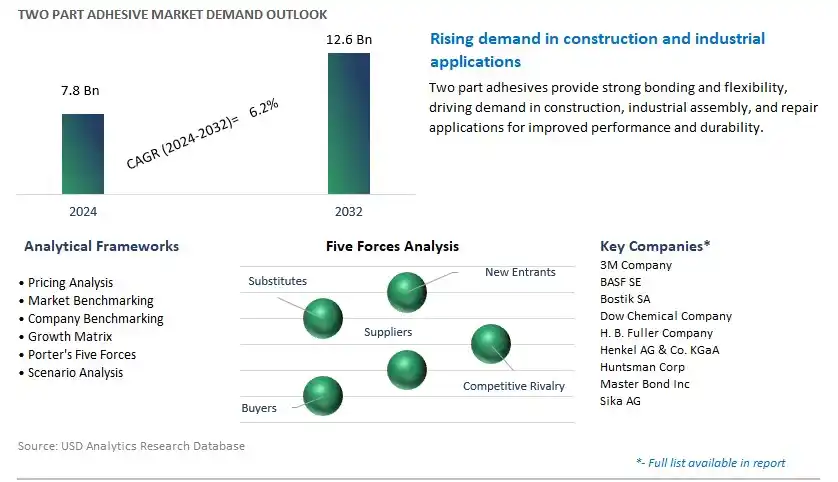

The market report analyses the leading companies in the industry including 3M Company, BASF SE, Bostik SA, Dow Chemical Company, H. B. Fuller Company, Henkel AG & Co. KGaA, Huntsman Corp, Master Bond Inc, Sika AG, and others.

A significant market trend in the two-part adhesive industry is the increased adoption of these adhesives in construction and automotive industries. Two-part adhesives, also known as epoxy adhesives, offer exceptional bonding strength, durability, and versatility, making them suitable for a wide range of applications in both sectors. This trend is driven by the need for reliable bonding solutions that can withstand harsh environmental conditions, temperature fluctuations, and mechanical stresses. In the construction industry, two-part adhesives are used for bonding structural elements, attaching facades, and joining composite materials in building and infrastructure projects. Similarly, in the automotive industry, these adhesives play a vital role in bonding components, panels, and assemblies in vehicle manufacturing, offering lightweight, corrosion-resistant, and vibration-damping properties. As industries seek to improve structural integrity, reduce assembly time, and enhance product performance, the demand for two-part adhesives continues to grow, shaping the market towards increased adoption in construction and automotive applications.

The driver behind the growth of the two-part adhesive market is the emphasis on lightweighting and energy efficiency in manufacturing processes. With increasing concerns over fuel consumption, emissions reduction, and sustainability, industries are turning to lightweight materials and bonding solutions to optimize product designs and improve energy efficiency. Two-part adhesives enable the bonding of dissimilar materials such as metals, plastics, and composites, eliminating the need for mechanical fasteners and reducing overall weight in structures and assemblies. This driver is particularly significant in industries such as aerospace, transportation, and renewable energy, where lightweighting is critical for enhancing fuel economy, performance, and environmental sustainability. The focus on lightweighting and energy efficiency thus serves as a key driver for the adoption of two-part adhesives in various manufacturing sectors.

An opportunity for growth and diversification in the two-part adhesive market lies in expansion into electronics and consumer goods industries. While two-part adhesives are commonly used in construction and automotive applications, there is potential for penetration into new sectors such as electronics assembly, appliances, and consumer electronics. In electronics manufacturing, these adhesives can be utilized for bonding components, sealing housings, and encapsulating sensitive electronic circuits, offering high strength, thermal conductivity, and protection against moisture and environmental contaminants. Similarly, in consumer goods industries, two-part adhesives can be employed for bonding furniture, appliances, sporting goods, and DIY projects, providing strong, durable bonds for a wide range of materials. By exploring new applications and market segments, two-part adhesive manufacturers can diversify their product portfolio, expand their customer base, and capitalize on opportunities for growth and market expansion beyond traditional construction and automotive markets.

Among the various resin types in the Two-Part Adhesive Market, Polyurethane is the largest segment. Polyurethane adhesives offer a wide range of benefits, including high strength, excellent flexibility, good chemical resistance, and durability, making them suitable for diverse applications across industries. In the automotive sector, polyurethane adhesives are extensively used for bonding vehicle components, such as panels, windshields, and structural elements, due to their ability to withstand dynamic loads and harsh environmental conditions. Moreover, in the construction industry, polyurethane adhesives find widespread application in structural bonding, flooring, and insulation applications, where their fast cure times and superior bonding strength contribute to efficient and durable assemblies. Additionally, the versatility of polyurethane adhesives extends to the aerospace, electronics, and woodworking sectors, further driving their demand and establishing Polyurethane as the largest segment in the Two-Part Adhesive Market.

The automotive segment stands out as the fastest-growing segment in the two-part adhesive market. In particular, as automotive manufacturers continue to emphasize lightweight construction for improved fuel efficiency and reduced emissions, the demand for advanced adhesive solutions has surged. Two-part adhesives offer superior bonding strength and durability, making them ideal for joining various lightweight materials such as composites, aluminum, and plastics commonly used in modern vehicle manufacturing. Moreover, the rise of electric vehicles (EVs) has further propelled the demand for two-part adhesives, as these vehicles require specialized bonding techniques due to their unique structural requirements and battery integration. Additionally, stringent regulatory standards regarding vehicle safety and crash performance have also played a pivotal role in driving the adoption of high-performance adhesives in automotive assembly processes. As a result, the automotive segment is witnessing rapid expansion within the two-part adhesive market, with sustained growth projected in the foreseeable future.

By Resin

Polyurethane

Epoxy

MMA

Silicone

Others

By Application

Automotive

Construction

Electronics

Aviation

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

3M Company

BASF SE

Bostik SA

Dow Chemical Company

H. B. Fuller Company

Henkel AG & Co. KGaA

Huntsman Corp

Master Bond Inc

Sika AG

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Two Part Adhesive Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Two Part Adhesive Market Size Outlook, $ Million, 2021 to 2032

3.2 Two Part Adhesive Market Outlook by Type, $ Million, 2021 to 2032

3.3 Two Part Adhesive Market Outlook by Product, $ Million, 2021 to 2032

3.4 Two Part Adhesive Market Outlook by Application, $ Million, 2021 to 2032

3.5 Two Part Adhesive Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Two Part Adhesive Industry

4.2 Key Market Trends in Two Part Adhesive Industry

4.3 Potential Opportunities in Two Part Adhesive Industry

4.4 Key Challenges in Two Part Adhesive Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Two Part Adhesive Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Two Part Adhesive Market Outlook by Segments

7.1 Two Part Adhesive Market Outlook by Segments, $ Million, 2021- 2032

By Resin

Polyurethane

Epoxy

MMA

Silicone

Others

By Application

Automotive

Construction

Electronics

Aviation

Others

8 North America Two Part Adhesive Market Analysis and Outlook To 2032

8.1 Introduction to North America Two Part Adhesive Markets in 2024

8.2 North America Two Part Adhesive Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Two Part Adhesive Market size Outlook by Segments, 2021-2032

By Resin

Polyurethane

Epoxy

MMA

Silicone

Others

By Application

Automotive

Construction

Electronics

Aviation

Others

9 Europe Two Part Adhesive Market Analysis and Outlook To 2032

9.1 Introduction to Europe Two Part Adhesive Markets in 2024

9.2 Europe Two Part Adhesive Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Two Part Adhesive Market Size Outlook by Segments, 2021-2032

By Resin

Polyurethane

Epoxy

MMA

Silicone

Others

By Application

Automotive

Construction

Electronics

Aviation

Others

10 Asia Pacific Two Part Adhesive Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Two Part Adhesive Markets in 2024

10.2 Asia Pacific Two Part Adhesive Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Two Part Adhesive Market size Outlook by Segments, 2021-2032

By Resin

Polyurethane

Epoxy

MMA

Silicone

Others

By Application

Automotive

Construction

Electronics

Aviation

Others

11 South America Two Part Adhesive Market Analysis and Outlook To 2032

11.1 Introduction to South America Two Part Adhesive Markets in 2024

11.2 South America Two Part Adhesive Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Two Part Adhesive Market size Outlook by Segments, 2021-2032

By Resin

Polyurethane

Epoxy

MMA

Silicone

Others

By Application

Automotive

Construction

Electronics

Aviation

Others

12 Middle East and Africa Two Part Adhesive Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Two Part Adhesive Markets in 2024

12.2 Middle East and Africa Two Part Adhesive Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Two Part Adhesive Market size Outlook by Segments, 2021-2032

By Resin

Polyurethane

Epoxy

MMA

Silicone

Others

By Application

Automotive

Construction

Electronics

Aviation

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

3M Company

BASF SE

Bostik SA

Dow Chemical Company

H. B. Fuller Company

Henkel AG & Co. KGaA

Huntsman Corp

Master Bond Inc

Sika AG

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Resin

Polyurethane

Epoxy

MMA

Silicone

Others

By Application

Automotive

Construction

Electronics

Aviation

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Two Part Adhesive Market Size is valued at $7.8 Billion in 2024 and is forecast to register a growth rate (CAGR) of 6.2% to reach $12.6 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

3M Company, BASF SE, Bostik SA, Dow Chemical Company, H. B. Fuller Company, Henkel AG & Co. KGaA, Huntsman Corp, Master Bond Inc, Sika AG

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume