The global Transportation Composites Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Resin (Thermoset, Thermoplastic), By Manufacturing Process (Compression Molding, Injection Molding, Resin Transfer Molding, Others), By Fiber (Glass, Carbon, Natural, Others), By Application (Interior, Exterior, Others), By Transportation (Airways, Railways, Waterways, Roadways).

Transportation composites, composed of fibers such as carbon fiber, fiberglass, or aramid, embedded in a polymer matrix, to revolutionize the transportation industry in 2024. These lightweight and high-strength materials offer significant advantages in terms of fuel efficiency, performance, and environmental sustainability. In automotive manufacturing, transportation composites are used for body panels, chassis components, and interior parts, contributing to lightweighting and improving vehicle efficiency. Similarly, in aerospace, transportation composites are utilized for aircraft structures, reducing weight and enhancing fuel economy. Further, in marine and rail industries, transportation composites offer corrosion resistance, durability, and design flexibility. With the increasing focus on reducing carbon emissions and improving energy efficiency, transportation composites play a crucial role in enabling the development of next-generation vehicles and transportation systems.

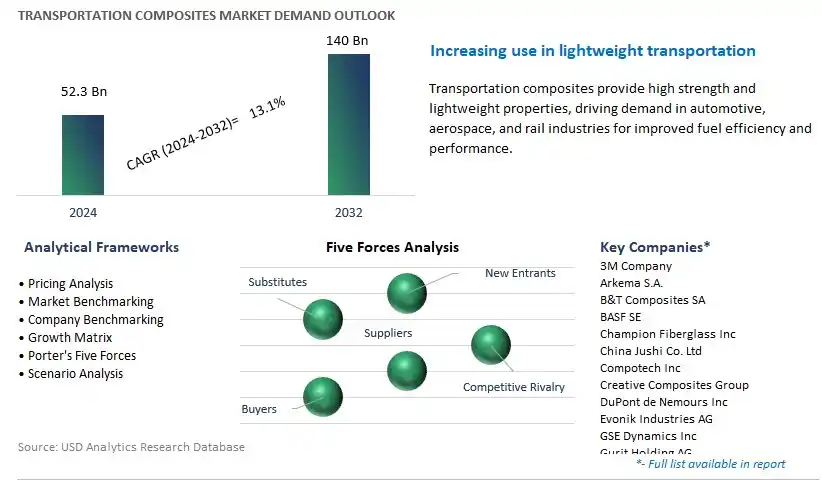

The market report analyses the leading companies in the industry including 3M Company, Arkema S.A., B&T Composites SA, BASF SE, Champion Fiberglass Inc, China Jushi Co. Ltd, Compotech Inc, Creative Composites Group, DuPont de Nemours Inc, Evonik Industries AG, GSE Dynamics Inc, Gurit Holding AG, Henkel AG & Co. KGaA, Hexcel Corp, Huntsman Corp LLC, Jushi Group Co. Ltd, Koninklijke DSM N.V., Middle River Aerostructures Systems, Mitsubishi Chemical Holdings Corp, Momentive Performance Materials Inc, Nammo Composite Solutions LLC, Owens Corning, Saudi Basic Industries Corp, SGL Carbon SE, Shellback Canvas LLC, Solvay S.A., Teijin Ltd, Toray Industries Inc, Veplas Group, Weyerhaeuser Company, and others.

A significant market trend in the transportation composites industry is the shift towards lightweight and fuel-efficient vehicles. With increasing concerns over environmental sustainability and fuel economy, automotive manufacturers are turning to composite materials to reduce vehicle weight and improve fuel efficiency. This trend is driven by regulatory pressures to meet emissions standards, consumer demand for eco-friendly vehicles, and advancements in composite manufacturing technologies. Transportation composites, including carbon fiber reinforced polymers (CFRP) and glass fiber reinforced polymers (GFRP), offer excellent strength-to-weight ratios, corrosion resistance, and design flexibility, making them ideal for applications in automotive, aerospace, rail, and marine sectors. As automotive manufacturers seek to comply with fuel efficiency regulations and enhance vehicle performance, the demand for lightweight composites in transportation continues to grow, shaping the market towards increased adoption of these materials.

The driver behind the growth of the transportation composites market is regulatory mandates and emissions reduction targets. Governments worldwide are implementing stringent regulations to curb greenhouse gas emissions and promote sustainable transportation solutions. Automakers are under pressure to meet fuel efficiency standards, reduce vehicle weight, and transition towards electric and hybrid vehicles to comply with regulatory mandates. Composite materials offer a viable solution to address these challenges by providing lightweight alternatives to traditional metal components, thereby contributing to fuel savings and emissions reductions. Additionally, regulatory incentives and subsidies for electric and fuel-efficient vehicles further drive the adoption of composites in transportation, creating opportunities for growth and innovation in the industry.

An opportunity for growth and diversification in the transportation composites market lies in expansion into emerging applications and market segments. While composites are widely used in automotive manufacturing, there is potential for penetration into new sectors such as aerospace, rail, and marine transportation. In aerospace, composites offer significant weight savings and structural performance advantages, making them essential materials for aircraft fuselages, wings, and interiors. In rail transportation, composites can be used in lightweight train components, interiors, and infrastructure elements to enhance fuel efficiency and reduce maintenance costs. Moreover, in marine transportation, composites provide corrosion resistance, durability, and design flexibility for boat hulls, decks, and components, enabling lighter and more fuel-efficient vessels. By exploring new applications and market segments, transportation composites manufacturers can capitalize on the diverse opportunities available in the transportation sector, driving market expansion, innovation, and revenue growth.

Thermoset segment is the largest segment within the Transportation Composites Market. In particular, thermoset resins, such as epoxy and polyester, offer exceptional mechanical properties, including high strength-to-weight ratio, excellent chemical resistance, and dimensional stability, making them ideal for structural applications in transportation vehicles. Additionally, thermoset composites exhibit superior fatigue resistance and durability, making them well-suited for demanding environments encountered in automotive, aerospace, and marine applications. Moreover, thermoset composites enable manufacturers to achieve complex shapes and designs, optimizing performance while reducing overall weight, which is crucial for enhancing fuel efficiency and reducing emissions in transportation vehicles. Furthermore, the widespread adoption of thermoset composites in critical components such as body panels, engine components, and interior structures underscores their significance in advancing the transportation industry towards lightweight, high-performance solutions.

The Injection Molding segment is the fastest-growing segment within the Transportation Composites Market. Injection molding offers numerous advantages, including high production efficiency, low material waste, and the ability to produce complex geometries with tight tolerances. In the transportation industry, injection molding is increasingly utilized for manufacturing lightweight composite components such as interior panels, dashboard trims, and structural reinforcements in vehicles. The growing demand for lightweight materials to improve fuel efficiency and reduce carbon emissions is driving the adoption of injection molding in transportation composites. Moreover, advancements in injection molding technologies, including multi-material injection molding and rapid tooling techniques, enable manufacturers to achieve cost-effective production of composite parts with enhanced performance properties. Additionally, the versatility of injection molding allows for the integration of functional features such as inserts, ribs, and bosses, further enhancing the value proposition of composite components in transportation applications. Over the forecast period, the Injection Molding segment's rapid growth underscores its pivotal role in revolutionizing the transportation industry through innovative composite solutions.

The Glass Fiber segment is the largest segment within the Transportation Composites Market. Glass fiber composites offer a compelling combination of properties, including high strength, stiffness, impact resistance, and affordability, making them widely favored in transportation applications. Glass fibers are extensively used in automotive, aerospace, marine, and rail industries for manufacturing lightweight yet durable components such as body panels, chassis reinforcements, and interior structures. Moreover, glass fibers exhibit excellent corrosion resistance and thermal stability, making them suitable for harsh operating conditions encountered in transportation vehicles. Additionally, the availability of various glass fiber formulations, including chopped strand mats, woven fabrics, and continuous strands, enables manufacturers to tailor composite properties to specific application requirements. Furthermore, the mature supply chain and established manufacturing processes for glass fiber composites contribute to their widespread adoption and dominance in the transportation composites market. Over the forecast period, the Glass Fiber segment's versatility, performance, and cost-effectiveness make it the preferred choice for a wide range of transportation applications, consolidating its position as the largest segment in the market.

The Exterior segment is the fastest-growing segment within the Transportation Composites Market. The market growth is driven by demand for composite materials in exterior applications. With a growing emphasis on lightweighting, vehicle manufacturers are increasingly turning to composites for exterior components to reduce overall vehicle weight and improve fuel efficiency. Composite materials offer exceptional design flexibility, allowing for the creation of complex shapes and contours while maintaining structural integrity. Additionally, composites provide excellent resistance to corrosion, impacts, and harsh weather conditions, making them ideal for exterior panels, body panels, and aerodynamic components. Moreover, the trend towards electric and autonomous vehicles further accelerates the adoption of composites in exterior applications due to their ability to accommodate advanced sensor systems and battery packs seamlessly. Furthermore, advancements in composite manufacturing technologies, such as automated lay-up processes and resin infusion techniques, contribute to the rapid growth of composites in exterior applications by reducing production costs and cycle times. Over the forecast period, the Exterior segment's fast growth underscores the pivotal role of composites in enhancing vehicle performance, aesthetics, and sustainability in the transportation industry.

By Resin

Thermoset

Thermoplastic

By Manufacturing Process

Compression Molding

Injection Molding

Resin Transfer Molding

Others

By Fiber

Glass

Carbon

Natural

Others

By Application

Interior

Exterior

Others

By Transportation

Airways

Railways

Waterways

RoadwaysCountries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

3M Company

Arkema S.A.

B&T Composites SA

BASF SE

Champion Fiberglass Inc

China Jushi Co. Ltd

Compotech Inc

Creative Composites Group

DuPont de Nemours Inc

Evonik Industries AG

GSE Dynamics Inc

Gurit Holding AG

Henkel AG & Co. KGaA

Hexcel Corp

Huntsman Corp LLC

Jushi Group Co. Ltd

Koninklijke DSM N.V.

Middle River Aerostructures Systems

Mitsubishi Chemical Holdings Corp

Momentive Performance Materials Inc

Nammo Composite Solutions LLC

Owens Corning

Saudi Basic Industries Corp

SGL Carbon SE

Shellback Canvas LLC

Solvay S.A.

Teijin Ltd

Toray Industries Inc

Veplas Group

Weyerhaeuser Company

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Transportation Composites Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Transportation Composites Market Size Outlook, $ Million, 2021 to 2032

3.2 Transportation Composites Market Outlook by Type, $ Million, 2021 to 2032

3.3 Transportation Composites Market Outlook by Product, $ Million, 2021 to 2032

3.4 Transportation Composites Market Outlook by Application, $ Million, 2021 to 2032

3.5 Transportation Composites Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Transportation Composites Industry

4.2 Key Market Trends in Transportation Composites Industry

4.3 Potential Opportunities in Transportation Composites Industry

4.4 Key Challenges in Transportation Composites Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Transportation Composites Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Transportation Composites Market Outlook by Segments

7.1 Transportation Composites Market Outlook by Segments, $ Million, 2021- 2032

By Resin

Thermoset

Thermoplastic

By Manufacturing Process

Compression Molding

Injection Molding

Resin Transfer Molding

Others

By Fiber

Glass

Carbon

Natural

Others

By Application

Interior

Exterior

Others

By Transportation

Airways

Railways

Waterways

Roadways

8 North America Transportation Composites Market Analysis and Outlook To 2032

8.1 Introduction to North America Transportation Composites Markets in 2024

8.2 North America Transportation Composites Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Transportation Composites Market size Outlook by Segments, 2021-2032

By Resin

Thermoset

Thermoplastic

By Manufacturing Process

Compression Molding

Injection Molding

Resin Transfer Molding

Others

By Fiber

Glass

Carbon

Natural

Others

By Application

Interior

Exterior

Others

By Transportation

Airways

Railways

Waterways

Roadways

9 Europe Transportation Composites Market Analysis and Outlook To 2032

9.1 Introduction to Europe Transportation Composites Markets in 2024

9.2 Europe Transportation Composites Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Transportation Composites Market Size Outlook by Segments, 2021-2032

By Resin

Thermoset

Thermoplastic

By Manufacturing Process

Compression Molding

Injection Molding

Resin Transfer Molding

Others

By Fiber

Glass

Carbon

Natural

Others

By Application

Interior

Exterior

Others

By Transportation

Airways

Railways

Waterways

Roadways

10 Asia Pacific Transportation Composites Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Transportation Composites Markets in 2024

10.2 Asia Pacific Transportation Composites Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Transportation Composites Market size Outlook by Segments, 2021-2032

By Resin

Thermoset

Thermoplastic

By Manufacturing Process

Compression Molding

Injection Molding

Resin Transfer Molding

Others

By Fiber

Glass

Carbon

Natural

Others

By Application

Interior

Exterior

Others

By Transportation

Airways

Railways

Waterways

Roadways

11 South America Transportation Composites Market Analysis and Outlook To 2032

11.1 Introduction to South America Transportation Composites Markets in 2024

11.2 South America Transportation Composites Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Transportation Composites Market size Outlook by Segments, 2021-2032

By Resin

Thermoset

Thermoplastic

By Manufacturing Process

Compression Molding

Injection Molding

Resin Transfer Molding

Others

By Fiber

Glass

Carbon

Natural

Others

By Application

Interior

Exterior

Others

By Transportation

Airways

Railways

Waterways

Roadways

12 Middle East and Africa Transportation Composites Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Transportation Composites Markets in 2024

12.2 Middle East and Africa Transportation Composites Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Transportation Composites Market size Outlook by Segments, 2021-2032

By Resin

Thermoset

Thermoplastic

By Manufacturing Process

Compression Molding

Injection Molding

Resin Transfer Molding

Others

By Fiber

Glass

Carbon

Natural

Others

By Application

Interior

Exterior

Others

By Transportation

Airways

Railways

Waterways

Roadways

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

3M Company

Arkema S.A.

B&T Composites SA

BASF SE

Champion Fiberglass Inc

China Jushi Co. Ltd

Compotech Inc

Creative Composites Group

DuPont de Nemours Inc

Evonik Industries AG

GSE Dynamics Inc

Gurit Holding AG

Henkel AG & Co. KGaA

Hexcel Corp

Huntsman Corp LLC

Jushi Group Co. Ltd

Koninklijke DSM N.V.

Middle River Aerostructures Systems

Mitsubishi Chemical Holdings Corp

Momentive Performance Materials Inc

Nammo Composite Solutions LLC

Owens Corning

Saudi Basic Industries Corp

SGL Carbon SE

Shellback Canvas LLC

Solvay S.A.

Teijin Ltd

Toray Industries Inc

Veplas Group

Weyerhaeuser Company

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Resin

Thermoset

Thermoplastic

By Manufacturing Process

Compression Molding

Injection Molding

Resin Transfer Molding

Others

By Fiber

Glass

Carbon

Natural

Others

By Application

Interior

Exterior

Others

By Transportation

Airways

Railways

Waterways

Roadways

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Transportation Composites Market Size is valued at $52.3 Billion in 2024 and is forecast to register a growth rate (CAGR) of 13.1% to reach $140 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

3M Company, Arkema S.A., B&T Composites SA, BASF SE, Champion Fiberglass Inc, China Jushi Co. Ltd, Compotech Inc, Creative Composites Group, DuPont de Nemours Inc, Evonik Industries AG, GSE Dynamics Inc, Gurit Holding AG, Henkel AG & Co. KGaA, Hexcel Corp, Huntsman Corp LLC, Jushi Group Co. Ltd, Koninklijke DSM N.V., Middle River Aerostructures Systems, Mitsubishi Chemical Holdings Corp, Momentive Performance Materials Inc, Nammo Composite Solutions LLC, Owens Corning, Saudi Basic Industries Corp, SGL Carbon SE, Shellback Canvas LLC, Solvay S.A., Teijin Ltd, Toray Industries Inc, Veplas Group, Weyerhaeuser Company

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume