The global Transparent Conductive Films Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Application (Smartphones, Tablets, Notebooks, LCDs, Wearable Devices, Others), By Material (ITO on Glass, ITO on PET, Silver Nanowires, Metal Mesh, Carbon Nanotubes, Others).

Transparent conductive films, thin and flexible materials with high electrical conductivity and optical transparency, to drive innovations in touchscreens, displays, solar cells, and flexible electronics in 2024. These films are typically composed of transparent conductive oxides such as indium tin oxide (ITO), graphene, or silver nanowires deposited onto flexible substrates such as plastic or glass. Transparent conductive films enable touch-sensitive interfaces, high-resolution displays, and efficient light transmission while maintaining aesthetics and design flexibility. In consumer electronics, transparent conductive films are used in smartphones, tablets, laptops, and wearable devices for touchscreens, fingerprint sensors, and transparent antennas. Further, in photovoltaics, transparent conductive films serve as front electrodes in solar panels, enabling efficient light absorption and electrical current collection. With the increasing demand for flexible, lightweight, and energy-efficient devices, transparent conductive films to play a vital role in enabling next-generation technologies and driving advancements in electronics, renewable energy, and human-machine interfaces.

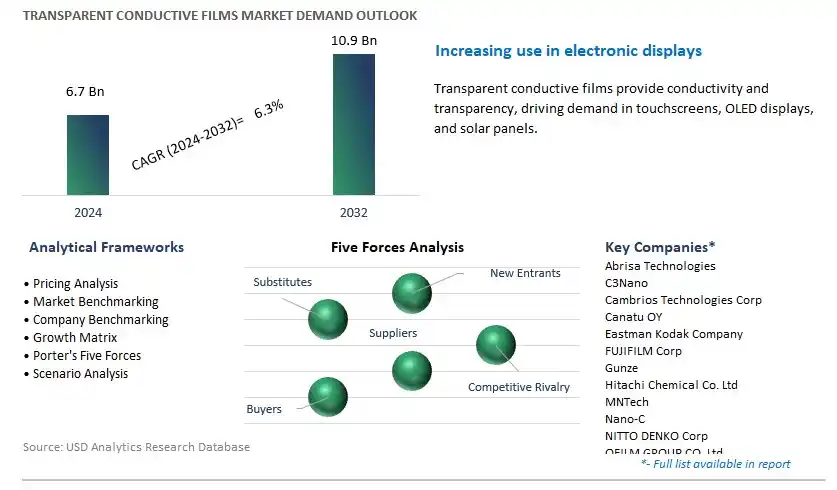

The market report analyses the leading companies in the industry including Abrisa Technologies, C3Nano, Cambrios Technologies Corp, Canatu OY, Eastman Kodak Company, FUJIFILM Corp, Gunze, Hitachi Chemical Co. Ltd, MNTech, Nano-C, NITTO DENKO Corp, OFILM GROUP CO. Ltd, OIKE & Co. Ltd, SEKISUI CHEMICAL CO. LTD, TDK Corp, TEIJIN Ltd, Toray Industries Inc, TOYOBO Co. Ltd, and others.

A significant market trend in the transparent conductive films industry is the surge in demand for touchscreen displays and flexible electronics. Transparent conductive films, typically made of materials like indium tin oxide (ITO), graphene, or silver nanowires, are essential components in the fabrication of touch-sensitive screens, OLED displays, and flexible electronic devices. This trend is driven by the proliferation of smartphones, tablets, wearables, and smart home appliances, all of which rely on touchscreen interfaces for user interaction. Additionally, the growing adoption of flexible and foldable electronic devices necessitates the use of transparent conductive films that can withstand bending and stretching without compromising conductivity or optical clarity. As consumer preferences shift towards sleeker, more interactive, and versatile electronic devices, the demand for transparent conductive films continues to rise, shaping the market towards increased production and innovation in this segment.

The driver behind the growth of the transparent conductive films market is technological advancements in flexible electronics and wearable devices. As manufacturers strive to create thinner, lighter, and more durable electronic products, there is a growing need for transparent conductive films that can conform to curved surfaces, accommodate bending and stretching, and maintain electrical conductivity over repeated flexing cycles. Breakthroughs in materials science, nanotechnology, and manufacturing processes have led to the development of innovative transparent conductive films with improved flexibility, conductivity, and durability. These advancements enable the production of flexible displays, foldable smartphones, smart clothing, and wearable sensors, driving the adoption of transparent conductive films in emerging applications and fueling market growth.

An opportunity for growth and diversification in the transparent conductive films market lies in expansion into emerging markets and industries. While transparent conductive films are widely used in consumer electronics, there is potential for penetration into new sectors such as automotive, healthcare, and energy. In the automotive industry, transparent conductive films are employed in touch-sensitive infotainment systems, heads-up displays, and smart windows, enhancing user experience and vehicle connectivity. In healthcare, these films can be utilized in medical devices, diagnostic tools, and wearable health monitors, enabling real-time monitoring and data collection. Furthermore, transparent conductive films have applications in energy-efficient windows, solar panels, and transparent electrodes for photovoltaic cells, contributing to sustainability and energy conservation efforts. By exploring new markets and industries, transparent conductive film manufacturers can diversify their customer base, drive innovation, and capitalize on emerging opportunities for growth and market expansion.

The Smartphones segment is the largest segment within the Transparent Conductive Films Market. In particular, smartphones have become ubiquitous devices in today's digital era, with billions of units sold annually worldwide. Transparent conductive films are a crucial component in smartphone manufacturing, used primarily for touchscreens and display panels. The proliferation of touchscreen technology in smartphones has significantly boosted the demand for transparent conductive films. Additionally, advancements in smartphone design, such as bezel-less displays and curved screens, require highly transparent and flexible conductive materials, further driving the adoption of transparent conductive films. Moreover, the increasing popularity of features such as fingerprint sensors, face recognition systems, and gesture controls in smartphones necessitates the use of transparent conductive films for efficient operation. Furthermore, the continuous innovation in smartphone technology, coupled with the growing demand for high-performance and durable display solutions, solidifies the Smartphones segment as the largest within the Transparent Conductive Films Market.

The Silver Nanowires segment is the fastest-growing segment within the Transparent Conductive Films Market. In particular, Silver Nanowires offer a compelling alternative to traditional transparent conductive materials like indium tin oxide (ITO) due to their superior flexibility, conductivity, and transparency. Silver Nanowires can be easily deposited onto flexible substrates such as polyethylene terephthalate (PET) films, enabling the production of bendable and foldable electronic devices. Additionally, Silver Nanowires exhibit excellent mechanical properties, making them resistant to cracking and degradation under bending or stretching conditions, which is crucial for wearable devices, flexible displays, and other emerging applications. Moreover, advancements in manufacturing techniques and material synthesis processes have led to significant reductions in production costs, further driving the adoption of Silver Nanowires in the Transparent Conductive Films Market. Furthermore, the increasing demand for lightweight, flexible, and transparent electronic components in sectors such as consumer electronics, automotive, and healthcare fuels the rapid growth of the Silver Nanowires segment.

By Application

Smartphones

Tablets

Notebooks

LCDs

Wearable Devices

Others

By Material

ITO on Glass

ITO on PET

Silver Nanowires

Metal Mesh

Carbon Nanotubes

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Abrisa Technologies

C3Nano

Cambrios Technologies Corp

Canatu OY

Eastman Kodak Company

FUJIFILM Corp

Gunze

Hitachi Chemical Co. Ltd

MNTech

Nano-C

NITTO DENKO Corp

OFILM GROUP CO. Ltd

OIKE & Co. Ltd

SEKISUI CHEMICAL CO. LTD

TDK Corp

TEIJIN Ltd

Toray Industries Inc

TOYOBO Co. Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Transparent Conductive Films Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Transparent Conductive Films Market Size Outlook, $ Million, 2021 to 2032

3.2 Transparent Conductive Films Market Outlook by Type, $ Million, 2021 to 2032

3.3 Transparent Conductive Films Market Outlook by Product, $ Million, 2021 to 2032

3.4 Transparent Conductive Films Market Outlook by Application, $ Million, 2021 to 2032

3.5 Transparent Conductive Films Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Transparent Conductive Films Industry

4.2 Key Market Trends in Transparent Conductive Films Industry

4.3 Potential Opportunities in Transparent Conductive Films Industry

4.4 Key Challenges in Transparent Conductive Films Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Transparent Conductive Films Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Transparent Conductive Films Market Outlook by Segments

7.1 Transparent Conductive Films Market Outlook by Segments, $ Million, 2021- 2032

By Application

Smartphones

Tablets

Notebooks

LCDs

Wearable Devices

Others

By Material

ITO on Glass

ITO on PET

Silver Nanowires

Metal Mesh

Carbon Nanotubes

Others

8 North America Transparent Conductive Films Market Analysis and Outlook To 2032

8.1 Introduction to North America Transparent Conductive Films Markets in 2024

8.2 North America Transparent Conductive Films Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Transparent Conductive Films Market size Outlook by Segments, 2021-2032

By Application

Smartphones

Tablets

Notebooks

LCDs

Wearable Devices

Others

By Material

ITO on Glass

ITO on PET

Silver Nanowires

Metal Mesh

Carbon Nanotubes

Others

9 Europe Transparent Conductive Films Market Analysis and Outlook To 2032

9.1 Introduction to Europe Transparent Conductive Films Markets in 2024

9.2 Europe Transparent Conductive Films Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Transparent Conductive Films Market Size Outlook by Segments, 2021-2032

By Application

Smartphones

Tablets

Notebooks

LCDs

Wearable Devices

Others

By Material

ITO on Glass

ITO on PET

Silver Nanowires

Metal Mesh

Carbon Nanotubes

Others

10 Asia Pacific Transparent Conductive Films Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Transparent Conductive Films Markets in 2024

10.2 Asia Pacific Transparent Conductive Films Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Transparent Conductive Films Market size Outlook by Segments, 2021-2032

By Application

Smartphones

Tablets

Notebooks

LCDs

Wearable Devices

Others

By Material

ITO on Glass

ITO on PET

Silver Nanowires

Metal Mesh

Carbon Nanotubes

Others

11 South America Transparent Conductive Films Market Analysis and Outlook To 2032

11.1 Introduction to South America Transparent Conductive Films Markets in 2024

11.2 South America Transparent Conductive Films Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Transparent Conductive Films Market size Outlook by Segments, 2021-2032

By Application

Smartphones

Tablets

Notebooks

LCDs

Wearable Devices

Others

By Material

ITO on Glass

ITO on PET

Silver Nanowires

Metal Mesh

Carbon Nanotubes

Others

12 Middle East and Africa Transparent Conductive Films Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Transparent Conductive Films Markets in 2024

12.2 Middle East and Africa Transparent Conductive Films Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Transparent Conductive Films Market size Outlook by Segments, 2021-2032

By Application

Smartphones

Tablets

Notebooks

LCDs

Wearable Devices

Others

By Material

ITO on Glass

ITO on PET

Silver Nanowires

Metal Mesh

Carbon Nanotubes

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Abrisa Technologies

C3Nano

Cambrios Technologies Corp

Canatu OY

Eastman Kodak Company

FUJIFILM Corp

Gunze

Hitachi Chemical Co. Ltd

MNTech

Nano-C

NITTO DENKO Corp

OFILM GROUP CO. Ltd

OIKE & Co. Ltd

SEKISUI CHEMICAL CO. LTD

TDK Corp

TEIJIN Ltd

Toray Industries Inc

TOYOBO Co. Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Application

Smartphones

Tablets

Notebooks

LCDs

Wearable Devices

Others

By Material

ITO on Glass

ITO on PET

Silver Nanowires

Metal Mesh

Carbon Nanotubes

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Transparent Conductive Films Market Size is valued at $6.7 Billion in 2024 and is forecast to register a growth rate (CAGR) of 6.3% to reach $10.9 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Abrisa Technologies, C3Nano, Cambrios Technologies Corp, Canatu OY, Eastman Kodak Company, FUJIFILM Corp, Gunze, Hitachi Chemical Co. Ltd, MNTech, Nano-C, NITTO DENKO Corp, OFILM GROUP CO. Ltd, OIKE & Co. Ltd, SEKISUI CHEMICAL CO. LTD, TDK Corp, TEIJIN Ltd, Toray Industries Inc, TOYOBO Co. Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume