The global Transformer Oil Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Mineral Oil, Silicone Oil, Bio-based Oil), By Application (Transformer, Reactor, Switchgear), By End-User (Transmission and Distribution, Railways & Metros, Power generation, Others).

The transformer oil market is experiencing growth driven by the increasing demand for electricity, infrastructure development, and the expansion of the power sector globally. Key trends shaping the future of the industry include advancements in transformer oil formulations, purification techniques, and insulation materials to enhance dielectric strength, thermal stability, and contaminant resistance. Innovations such as low-viscosity and high-flashpoint transformer oils offer improved performance and safety characteristics, facilitating efficient heat dissipation and reducing the risk of transformer failures. Moreover, the adoption of eco-friendly and biodegradable transformer oils derived from renewable feedstocks addresses environmental concerns and regulatory requirements, promoting sustainable energy infrastructure development. Additionally, the integration of condition monitoring, predictive maintenance, and online monitoring technologies enables proactive asset management and extends the lifespan of transformers by identifying potential failure risks and optimizing maintenance schedules. As utilities and grid operators invest in modernizing and upgrading their transformer fleets to meet growing electricity demand and enhance grid reliability, the transformer oil market is poised for sustained growth and innovation to support the evolving needs of the power industry.

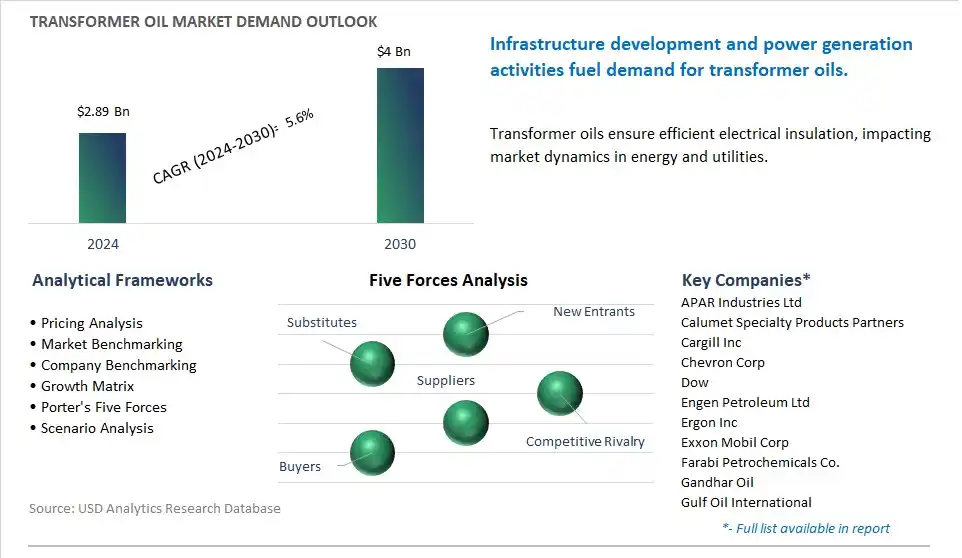

The market report analyses the leading companies in the industry including APAR Industries Ltd, Calumet Specialty Products Partners, Cargill Inc, Chevron Corp, Dow, Engen Petroleum Ltd, Ergon Inc, Exxon Mobil Corp, Farabi Petrochemicals Co., Gandhar Oil, Gulf Oil International, Hydrodec Group plc, Lubrita, M&I Materials Ltd, Nynas AB, Petro-Canada, PetroChina Company Ltd, Phillips 66 Company, Repsol, San Joaquin Refining Co, Sasol, Savita Oil Technologies Ltd, Shell, Sinopec Lubricant Company.

A prominent trend in the transformer oil market is the transition towards environmentally friendly and biodegradable transformer oils. With increasing environmental concerns and regulations aimed at reducing the impact of oil spills and leaks, there is a growing demand for transformer oils that are non-toxic, biodegradable, and environmentally sustainable. Manufacturers are developing new formulations of transformer oils using biodegradable base oils and additives that meet or exceed performance requirements while minimizing environmental impact. This trend reflects a broader shift towards sustainable solutions in the energy industry and drives innovation in transformer oil technology to meet evolving regulatory standards and customer preferences.

A key driver for the transformer oil market is the growth in electricity consumption and grid expansion projects. As populations grow, urbanization increases, and industrialization advances, there is a rising demand for electricity to power homes, businesses, and industries worldwide. This drives investments in power generation, transmission, and distribution infrastructure, including transformers that require transformer oil for insulation and cooling purposes. Additionally, grid modernization initiatives, renewable energy integration, and electrification projects further stimulate the demand for transformer oils. The expansion of electricity infrastructure and grid networks fuels the demand for transformer oils as essential components in electrical equipment and systems.

An opportunity within the transformer oil market lies in the development of high-performance and specialty transformer oil formulations. While traditional mineral-based transformer oils remain prevalent, there is potential to innovate and introduce advanced formulations that offer enhanced performance characteristics such as improved thermal stability, oxidation resistance, and electrical insulation properties. Manufacturers can focus on developing specialty transformer oils tailored for specific applications and operating conditions, such as extreme temperatures, high voltages, and corrosive environments. Additionally, there is an opportunity to introduce transformer oils with advanced features such as self-healing properties or compatibility with new transformer designs and materials. By addressing the evolving needs of transformer manufacturers and utilities, manufacturers of specialty transformer oils can differentiate themselves in the market and capture new opportunities for growth and market share.

The mineral oil segment is the largest segment in the Transformer Oil Market due to its long-standing history, widespread availability, and favorable properties for use in electrical transformers. Mineral oil, derived from petroleum refining processes, has been the traditional choice for transformer oil insulation and cooling due to its excellent electrical insulating properties, high dielectric strength, and thermal stability. These properties make mineral oil an ideal choice for insulating and cooling electrical transformers, where it acts as a dielectric fluid, transferring heat away from the transformer windings and preventing electrical breakdown. Additionally, mineral oil is cost-effective, readily available, and compatible with existing transformer designs and materials, making it the preferred choice for transformer manufacturers and operators worldwide. In addition, mineral oil-based transformer oils have a proven track record of reliability and performance over many decades of service in various electrical power systems and environments. Further, mineral oil-based transformer oils meet international standards and specifications for transformer insulation fluids, ensuring compliance with safety, environmental, and operational requirements. As the demand for electricity continues to grow, driven by urbanization, industrialization, and infrastructure development, the need for reliable and efficient electrical transformers also increases. This drives the demand for mineral oil-based transformer oils, solidifying the mineral oil segment's position as the largest segment in the Transformer Oil Market.

The switchgear segment is the fastest-growing segment in the Transformer Oil Market due to increasing investments in electrical infrastructure modernization and expansion projects worldwide. Switchgear, which includes devices such as circuit breakers, disconnect switches, and fuses, plays a crucial role in controlling, protecting, and isolating electrical circuits in power distribution systems. Transformer oil is used as an insulating and cooling medium in switchgear applications to enhance electrical insulation, dissipate heat, and extinguish electrical arcs during circuit interruption. The switchgear segment experiences rapid growth due to diverse factors. The aging electrical infrastructure and the need for reliable, efficient, and safe switchgear solutions drive the replacement and upgrading of existing switchgear installations. Transformer oil-based switchgear offers cost-effective and proven solutions for electrical system protection and control, attracting investments from utilities, industries, and infrastructure developers. Additionally, the increasing demand for electricity, driven by population growth, urbanization, and industrialization, necessitates the expansion and modernization of electrical grids and substations, further boosting the demand for switchgear. In addition, the growing focus on renewable energy integration, smart grid technologies, and grid resilience drives investments in advanced switchgear solutions with enhanced performance and reliability. Transformer oil-based switchgear meets these requirements by providing effective insulation, cooling, and arc extinguishing capabilities, enabling safe and efficient operation of electrical networks. Further, stringent regulations and standards governing electrical safety, reliability, and environmental protection drive the adoption of transformer oil-based switchgear solutions that comply with industry requirements. As utilities, industries, and infrastructure developers prioritize the upgrade and expansion of electrical infrastructure to meet growing energy demands and ensure grid reliability, the demand for switchgear applications utilizing transformer oil is expected to experience rapid growth, positioning the switchgear segment as the fastest-growing segment in the Transformer Oil Market.

The railways & metros segment is the fastest-growing segment in the Transformer Oil Market due to increasing investments in railway electrification projects and the expansion of urban transit systems worldwide. Transformer oil plays a critical role in the reliable and efficient operation of traction substations, which supply electrical power to electric locomotives, trains, trams, and metro systems. Traction substations contain transformers that step down high-voltage AC power from overhead catenaries or third rails to lower voltages suitable for train propulsion and auxiliary systems. Transformer oil serves as both an electrical insulating fluid and a coolant in traction transformers, ensuring the insulation integrity and thermal stability of transformer windings under varying load conditions. The railways & metros segment experiences rapid growth due to diverse factors. The the increasing demand for urban mass transit solutions and the expansion of metro networks in densely populated cities drive investments in railway electrification and traction infrastructure. Electric traction offers numerous advantages over diesel traction, including lower operating costs, reduced environmental impact, and improved energy efficiency, driving the electrification of existing rail lines and the deployment of electric rolling stock in new railway projects. Additionally, the electrification of railway lines and the transition to electric locomotives and trains create a significant demand for traction transformers and transformer oil. Transformer oil-based insulation solutions offer reliable and cost-effective performance in harsh railway environments, ensuring the safe and efficient operation of traction substations. In addition, the growing emphasis on sustainable mobility and the decarbonization of transportation drive investments in electrified railways and metros as environmentally friendly alternatives to fossil fuel-based transportation modes. As governments, transit agencies, and railway operators prioritize railway electrification projects to meet growing passenger demand and reduce carbon emissions, the demand for transformer oil in the railways & metros segment is expected to experience rapid growth, positioning it as the fastest-growing segment in the Transformer Oil Market.

By Type

Mineral Oil

-Naphthenic Oil

-Paraffinic Oil

Silicone Oil

Bio-based Oil

By Application

Transformer

-Power transformer

-Distribution transformer

Reactor

Switchgear

By End-User

Transmission and Distribution

Railways & Metros

Power generation

Others

Regions Included

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

APAR Industries Ltd

Calumet Specialty Products Partners

Cargill Inc

Chevron Corp

Dow

Engen Petroleum Ltd

Ergon Inc

Exxon Mobil Corp

Farabi Petrochemicals Co.

Gandhar Oil

Gulf Oil International

Hydrodec Group plc

Lubrita

M&I Materials Ltd

Nynas AB

Petro-Canada

PetroChina Company Ltd

Phillips 66 Company

Repsol

San Joaquin Refining Co

Sasol

Savita Oil Technologies Ltd

Shell

Sinopec Lubricant Company

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Transformer Oil Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Transformer Oil Market Size Outlook, $ Million, 2021 to 2030

3.2 Transformer Oil Market Outlook by Type, $ Million, 2021 to 2030

3.3 Transformer Oil Market Outlook by Product, $ Million, 2021 to 2030

3.4 Transformer Oil Market Outlook by Application, $ Million, 2021 to 2030

3.5 Transformer Oil Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Transformer Oil Industry

4.2 Key Market Trends in Transformer Oil Industry

4.3 Potential Opportunities in Transformer Oil Industry

4.4 Key Challenges in Transformer Oil Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Transformer Oil Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Transformer Oil Market Outlook by Segments

7.1 Transformer Oil Market Outlook by Segments, $ Million, 2021- 2030

By Type

Mineral Oil

-Naphthenic Oil

-Paraffinic Oil

Silicone Oil

Bio-based Oil

By Application

Transformer

-Power transformer

-Distribution transformer

Reactor

Switchgear

By End-User

Transmission and Distribution

Railways & Metros

Power generation

Others

8 North America Transformer Oil Market Analysis and Outlook To 2030

8.1 Introduction to North America Transformer Oil Markets in 2024

8.2 North America Transformer Oil Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Transformer Oil Market size Outlook by Segments, 2021-2030

By Type

Mineral Oil

-Naphthenic Oil

-Paraffinic Oil

Silicone Oil

Bio-based Oil

By Application

Transformer

-Power transformer

-Distribution transformer

Reactor

Switchgear

By End-User

Transmission and Distribution

Railways & Metros

Power generation

Others

9 Europe Transformer Oil Market Analysis and Outlook To 2030

9.1 Introduction to Europe Transformer Oil Markets in 2024

9.2 Europe Transformer Oil Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Transformer Oil Market Size Outlook by Segments, 2021-2030

By Type

Mineral Oil

-Naphthenic Oil

-Paraffinic Oil

Silicone Oil

Bio-based Oil

By Application

Transformer

-Power transformer

-Distribution transformer

Reactor

Switchgear

By End-User

Transmission and Distribution

Railways & Metros

Power generation

Others

10 Asia Pacific Transformer Oil Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Transformer Oil Markets in 2024

10.2 Asia Pacific Transformer Oil Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Transformer Oil Market size Outlook by Segments, 2021-2030

By Type

Mineral Oil

-Naphthenic Oil

-Paraffinic Oil

Silicone Oil

Bio-based Oil

By Application

Transformer

-Power transformer

-Distribution transformer

Reactor

Switchgear

By End-User

Transmission and Distribution

Railways & Metros

Power generation

Others

11 South America Transformer Oil Market Analysis and Outlook To 2030

11.1 Introduction to South America Transformer Oil Markets in 2024

11.2 South America Transformer Oil Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Transformer Oil Market size Outlook by Segments, 2021-2030

By Type

Mineral Oil

-Naphthenic Oil

-Paraffinic Oil

Silicone Oil

Bio-based Oil

By Application

Transformer

-Power transformer

-Distribution transformer

Reactor

Switchgear

By End-User

Transmission and Distribution

Railways & Metros

Power generation

Others

12 Middle East and Africa Transformer Oil Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Transformer Oil Markets in 2024

12.2 Middle East and Africa Transformer Oil Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Transformer Oil Market size Outlook by Segments, 2021-2030

By Type

Mineral Oil

-Naphthenic Oil

-Paraffinic Oil

Silicone Oil

Bio-based Oil

By Application

Transformer

-Power transformer

-Distribution transformer

Reactor

Switchgear

By End-User

Transmission and Distribution

Railways & Metros

Power generation

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

APAR Industries Ltd

Calumet Specialty Products Partners

Cargill Inc

Chevron Corp

Dow

Engen Petroleum Ltd

Ergon Inc

Exxon Mobil Corp

Farabi Petrochemicals Co.

Gandhar Oil

Gulf Oil International

Hydrodec Group plc

Lubrita

M&I Materials Ltd

Nynas AB

Petro-Canada

PetroChina Company Ltd

Phillips 66 Company

Repsol

San Joaquin Refining Co

Sasol

Savita Oil Technologies Ltd

Shell

Sinopec Lubricant Company

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Mineral Oil

-Naphthenic Oil

-Paraffinic Oil

Silicone Oil

Bio-based Oil

By Application

Transformer

-Power transformer

-Distribution transformer

Reactor

Switchgear

By End-User

Transmission and Distribution

Railways & Metros

Power generation

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Transformer Oil is forecast to reach $4 Billion in 2030 from $2.89 Billion in 2024, registering a CAGR of 5.6%

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

APAR Industries Ltd, Calumet Specialty Products Partners, Cargill Inc, Chevron Corp, Dow, Engen Petroleum Ltd, Ergon Inc, Exxon Mobil Corp, Farabi Petrochemicals Co., Gandhar Oil, Gulf Oil International, Hydrodec Group plc, Lubrita, M&I Materials Ltd, Nynas AB, Petro-Canada, PetroChina Company Ltd, Phillips 66 Company, Repsol, San Joaquin Refining Co, Sasol, Savita Oil Technologies Ltd, Shell, Sinopec Lubricant Company

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume