The global Tourettes Syndrome Drugs Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Product (Antipsychotics, Non-antipsychotics), By Distribution Channel (Offline, Online).

The Tourette's Syndrome Drugs Market comprises pharmaceuticals, neuroleptics, antipsychotics, and dopamine receptor antagonists used in the management of Tourette's syndrome, a neurodevelopmental disorder characterized by involuntary tics, motor movements, and vocalizations. Tourette's syndrome drugs aim to reduce tic frequency, suppress motor tics, and improve tic control, alleviating symptoms and improving quality of life in patients with Tourette's syndrome and tic disorders. Market dynamics include Tourette's syndrome treatment guidelines, neuropsychiatric medications, behavioral therapies, and emerging drug therapies targeting tic suppression and neuropsychiatric symptom management.

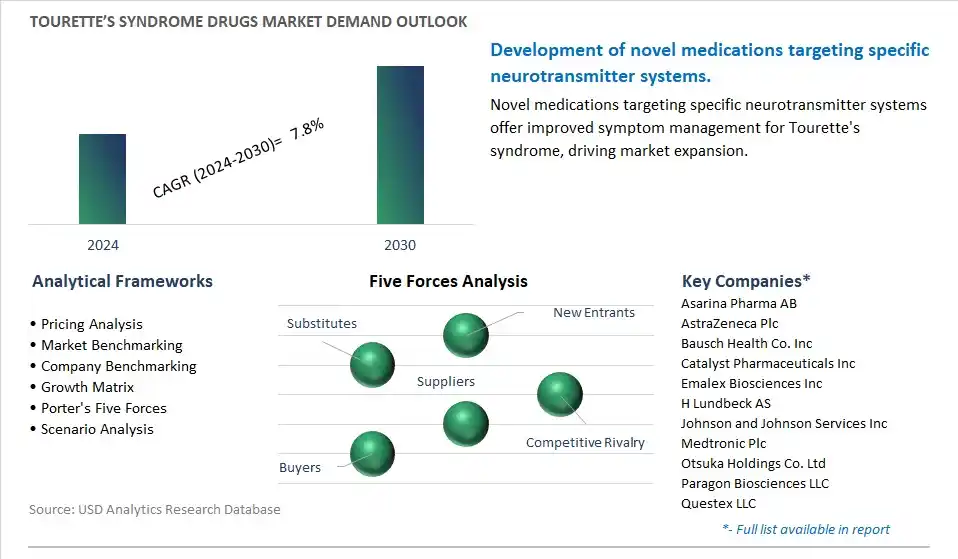

The global Tourettes Syndrome Drugs Industry is highly competitive with a large number of companies focusing on niche market segments. Amidst intense competitive conditions, Tourettes Syndrome Drugs Companies are investing in new product launches and strengthening distribution channels. Key companies operating in the Tourettes Syndrome Drugs Industry include- Asarina Pharma AB, AstraZeneca Plc, Bausch Health Co. Inc, Catalyst Pharmaceuticals Inc, Emalex Biosciences Inc, H Lundbeck AS, Johnson and Johnson Services Inc, Medtronic Plc, Otsuka Holdings Co. Ltd, Paragon Biosciences LLC, Questex LLC, Reviva Pharmaceuticals Holdings Inc, Sun Pharmaceutical Industries Ltd, Teva Pharmaceutical Industries Ltd.

Tourette's syndrome drugs market observes a trend towards advancements in drug development. With the aim of addressing the complex neurobiological mechanisms underlying Tourette's syndrome, there's increasing interest in developing novel pharmacotherapies targeting neurotransmitter systems, neuronal circuits, and neuroinflammatory pathways. Additionally, innovations in clinical trial design, biomarker identification, and patient stratification enable more precise evaluation of drug efficacy and safety profiles in Tourette's syndrome populations, driving the progress of drug discovery and development efforts.

The primary driver for the Tourette's syndrome drugs market is the growing awareness and diagnosis rates of Tourette's syndrome worldwide. As awareness of Tourette's syndrome increases among healthcare professionals, educators, and the general public, there's greater recognition of the need for effective pharmacological interventions to manage tics and associated behavioral symptoms. Tourette's syndrome drugs play a crucial role in symptom management, improving patient quality of life, and reducing functional impairment, thereby driving the demand for pharmacotherapies in the treatment of Tourette's syndrome.

An opportunity exists in the development of targeted therapies for comorbid conditions associated with Tourette's syndrome. Given the high prevalence of psychiatric comorbidities such as attention-deficit/hyperactivity disorder (ADHD), obsessive-compulsive disorder (OCD), anxiety disorders, and mood disorders in Tourette's syndrome patients, companies investing in the development of multimodal treatment approaches can address unmet medical needs and improve overall patient outcomes. By targeting shared neurobiological pathways and symptom clusters, targeted therapies for comorbid conditions offer potential benefits such as symptom reduction, functional improvement, and enhanced treatment response, ultimately driving market growth and innovation in the Tourette's syndrome drugs segment.

The segment experiencing the most rapid growth within Tourette's syndrome drugs is non-antipsychotics, particularly distributed through online channels. Non-antipsychotic medications offer alternative treatment options for Tourette's syndrome, targeting specific symptoms such as tics and associated behavioral issues. These medications include alpha-2 adrenergic agonists, dopamine-depleting agents, and selective serotonin reuptake inhibitors (SSRIs), which have shown efficacy in managing Tourette's symptoms with potentially fewer side effects compared to antipsychotics. Online distribution channels provide convenience and accessibility for individuals seeking Tourette's syndrome medications, allowing them to obtain their prescriptions and refills from the comfort of their homes. Moreover, the online platform offers a wealth of information and support resources for patients and caregivers, enhancing their overall treatment experience. As awareness of Tourette's syndrome grows and the demand for alternative treatment options increases, the market for non-antipsychotic drugs distributed through online channels is expected to continue its rapid expansion, providing valuable therapeutic solutions for individuals living with Tourette's syndrome.

By Product

Antipsychotics

Non-antipsychotics

By Distribution Channel

Offline

Online

Geographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Asarina Pharma AB

AstraZeneca Plc

Bausch Health Co. Inc

Catalyst Pharmaceuticals Inc

Emalex Biosciences Inc

H Lundbeck AS

Johnson and Johnson Services Inc

Medtronic Plc

Otsuka Holdings Co. Ltd

Paragon Biosciences LLC

Questex LLC

Reviva Pharmaceuticals Holdings Inc

Sun Pharmaceutical Industries Ltd

Teva Pharmaceutical Industries Ltd

* List not Exhaustive

• Deepen your industry insights and navigate uncertainties for strategy formulation, CAPEX, and Operational decisions

• Gain access to detailed insights on the Tourettes Syndrome Drugs Market, encompassing current market size, growth trends, and forecasts till 2030.

• Access detailed competitor analysis, enabling competitive advantage through a thorough understanding of market players, strategies, and potential differentiation opportunities

• Stay ahead of the curve with insights on technological advancements, innovations, and upcoming trends

• Identify lucrative investment avenues and expansion opportunities within the Tourettes Syndrome Drugs Industry, guided by robust, data-backed analysis.

• Understand regional and global markets through country-wise analysis, regional market potential, regulatory nuances, and dynamics

• Execute strategies with confidence and speed through information, analytics, and insights on the industry value chain

• Corporate leaders, strategists, financial experts, shareholders, asset managers, and governmental representatives can make long-term planning scenarios and build an integrated and timely understanding of market dynamics

• Benefit from tailored solutions and expert consultation based on report insights, providing personalized strategies aligned with specific business needs.

TABLE OF CONTENTS

1 Introduction to 2024 Tourettes Syndrome Drugs Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Tourettes Syndrome Drugs Market Size Outlook, $ Million, 2021 to 2030

3.2 Tourettes Syndrome Drugs Market Outlook by Type, $ Million, 2021 to 2030

3.3 Tourettes Syndrome Drugs Market Outlook by Product, $ Million, 2021 to 2030

3.4 Tourettes Syndrome Drugs Market Outlook by Application, $ Million, 2021 to 2030

3.5 Tourettes Syndrome Drugs Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Tourettes Syndrome Drugs Industry

4.2 Key Market Trends in Tourettes Syndrome Drugs Industry

4.3 Potential Opportunities in Tourettes Syndrome Drugs Industry

4.4 Key Challenges in Tourettes Syndrome Drugs Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Tourettes Syndrome Drugs Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Tourettes Syndrome Drugs Market Outlook by Segments

7.1 Tourettes Syndrome Drugs Market Outlook by Segments, $ Million, 2021- 2030

By Product

Antipsychotics

Non-antipsychotics

By Distribution Channel

Offline

Online

8 North America Tourettes Syndrome Drugs Market Analysis and Outlook To 2030

8.1 Introduction to North America Tourettes Syndrome Drugs Markets in 2024

8.2 North America Tourettes Syndrome Drugs Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Tourettes Syndrome Drugs Market size Outlook by Segments, 2021-2030

By Product

Antipsychotics

Non-antipsychotics

By Distribution Channel

Offline

Online

9 Europe Tourettes Syndrome Drugs Market Analysis and Outlook To 2030

9.1 Introduction to Europe Tourettes Syndrome Drugs Markets in 2024

9.2 Europe Tourettes Syndrome Drugs Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Tourettes Syndrome Drugs Market Size Outlook by Segments, 2021-2030

By Product

Antipsychotics

Non-antipsychotics

By Distribution Channel

Offline

Online

10 Asia Pacific Tourettes Syndrome Drugs Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Tourettes Syndrome Drugs Markets in 2024

10.2 Asia Pacific Tourettes Syndrome Drugs Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Tourettes Syndrome Drugs Market size Outlook by Segments, 2021-2030

By Product

Antipsychotics

Non-antipsychotics

By Distribution Channel

Offline

Online

11 South America Tourettes Syndrome Drugs Market Analysis and Outlook To 2030

11.1 Introduction to South America Tourettes Syndrome Drugs Markets in 2024

11.2 South America Tourettes Syndrome Drugs Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Tourettes Syndrome Drugs Market size Outlook by Segments, 2021-2030

By Product

Antipsychotics

Non-antipsychotics

By Distribution Channel

Offline

Online

12 Middle East and Africa Tourettes Syndrome Drugs Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Tourettes Syndrome Drugs Markets in 2024

12.2 Middle East and Africa Tourettes Syndrome Drugs Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Tourettes Syndrome Drugs Market size Outlook by Segments, 2021-2030

By Product

Antipsychotics

Non-antipsychotics

By Distribution Channel

Offline

Online

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

Asarina Pharma AB

AstraZeneca Plc

Bausch Health Co. Inc

Catalyst Pharmaceuticals Inc

Emalex Biosciences Inc

H Lundbeck AS

Johnson and Johnson Services Inc

Medtronic Plc

Otsuka Holdings Co. Ltd

Paragon Biosciences LLC

Questex LLC

Reviva Pharmaceuticals Holdings Inc

Sun Pharmaceutical Industries Ltd

Teva Pharmaceutical Industries Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Antipsychotics

Non-antipsychotics

By Distribution Channel

Offline

Online

The global Tourettes Syndrome Drugs Market is one of the lucrative growth markets, poised to register a 6.8% growth (CAGR) between 2024 and 2030.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Asarina Pharma AB, AstraZeneca Plc, Bausch Health Co. Inc, Catalyst Pharmaceuticals Inc, Emalex Biosciences Inc, H Lundbeck AS, Johnson and Johnson Services Inc, Medtronic Plc, Otsuka Holdings Co. Ltd, Paragon Biosciences LLC, Questex LLC, Reviva Pharmaceuticals Holdings Inc, Sun Pharmaceutical Industries Ltd, Teva Pharmaceutical Industries Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume