The global Tire Bead Wire Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Grade (High Tensile Strength, Regular Tensile Strength), By Type (Radial tires, Bias tires), By Application (Automotive tires, Motorcycle tires, Truck tires, Others).

Tire bead wire serves as a critical component in the construction of pneumatic tires, providing structural integrity and ensuring proper fitment to the wheel rim. Typically made from high-strength steel wire, tire bead wire undergoes stringent manufacturing processes to meet precise dimensional tolerances and mechanical properties required for tire performance and safety. With the automotive industry witnessing continuous advancements in tire design, materials, and manufacturing techniques, tire bead wire remains a focal point for innovation, aimed at enhancing tire durability, stability, and fuel efficiency. As demand for high-performance tires grows alongside trends such as electric vehicles and autonomous driving, tire bead wire manufacturers are investing in research and development to meet evolving industry requirements for safer, more sustainable mobility solutions.

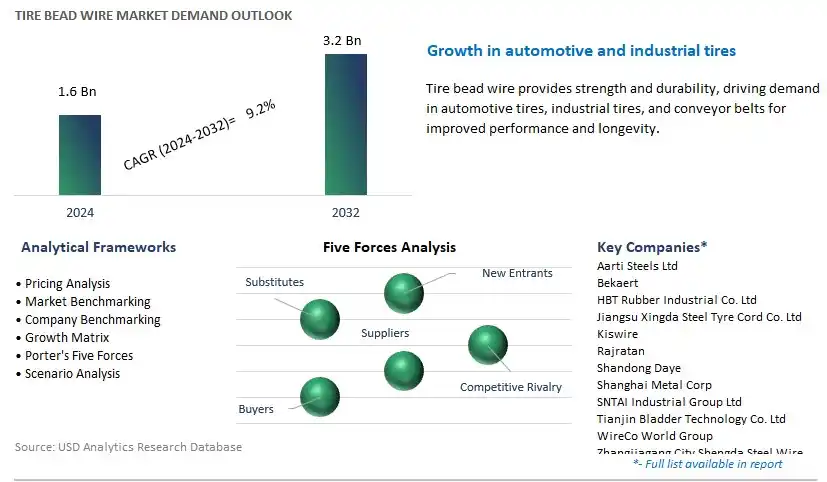

The market report analyses the leading companies in the industry including Aarti Steels Ltd, Bekaert, HBT Rubber Industrial Co. Ltd, Jiangsu Xingda Steel Tyre Cord Co. Ltd, Kiswire, Rajratan, Shandong Daye, Shanghai Metal Corp, SNTAI Industrial Group Ltd, Tianjin Bladder Technology Co. Ltd, WireCo World Group, Zhangjiagang City Shengda Steel Wire Rope Co. Ltd, and others.

A prominent trend in the tire bead wire market is the increasing demand for high-performance tire materials driven by the automotive industry. As the automotive sector continues to innovate and evolve, there is a growing emphasis on tire performance, durability, and safety. Tire bead wire plays a crucial role in ensuring the structural integrity and stability of tires, particularly in high-speed and heavy-duty applications. With advancements in vehicle design, engineering, and technology, there is a rising demand for tire bead wire with enhanced strength, flexibility, and fatigue resistance to meet the stringent performance requirements of modern vehicles. This trend is driving the development and adoption of advanced materials and manufacturing processes in the tire bead wire market to address the evolving needs of the automotive industry and consumer preferences for safer and more efficient vehicles.

The primary driver behind the tire bead wire market's growth is the increasing automotive production and the replacement tire market. As the global population grows, urbanization expands, and disposable income rises, there is a higher demand for passenger cars, commercial vehicles, and off-road vehicles worldwide. This growth in vehicle ownership and usage fuels the demand for tires, both in original equipment manufacturing (OEM) for new vehicles and in the aftermarket for replacement tires. Tire bead wire is a critical component in tire construction, and its demand is directly correlated with tire production and replacement cycles. With the automotive industry witnessing steady growth in emerging markets and increasing vehicle fleet sizes globally, the demand for tire bead wire is expected to remain robust, driving market expansion and investment in production capacity to meet growing requirements.

An opportunity for the tire bead wire market lies in the development of high-strength and lightweight wire materials to address the automotive industry's evolving needs for fuel efficiency and sustainability. With the push towards vehicle electrification, lightweighting, and environmental sustainability, automakers are seeking tire solutions that contribute to improved fuel economy, reduced emissions, and enhanced vehicle performance. Innovations in materials science, such as the use of advanced alloys, composite materials, and nanotechnology, present opportunities to develop tire bead wires with higher tensile strength, reduced weight, and improved corrosion resistance. By collaborating with tire manufacturers and automotive OEMs, wire producers can capitalize on this opportunity to develop tailored solutions that meet the stringent performance, safety, and sustainability requirements of next-generation vehicles. Additionally, by focusing on lightweighting and eco-friendly materials, the tire bead wire market can position itself as a key enabler of automotive innovation and sustainability, fostering long-term growth and competitiveness in the industry.

Within the tire bead wire market segmented by grade, high tensile strength is the largest segment, commanding a significant share due to its superior performance characteristics and widespread application in tire manufacturing. High tensile strength tire bead wire is engineered to withstand the extreme forces and stresses experienced by tires during operation, providing enhanced durability, stability, and resistance to deformation. This grade of bead wire is typically manufactured using advanced steel alloys and undergoes stringent quality control measures to ensure consistent mechanical properties and reliability. The demand for high tensile strength tire bead wire is driven by the growing automotive industry, increasing demand for passenger and commercial vehicles, and the rising focus on tire performance, safety, and fuel efficiency. As tire manufacturers continue to prioritize high-quality materials to meet stringent regulatory standards and consumer expectations, the demand for high tensile strength tire bead wire is expected to remain robust, solidifying its position as the largest segment in the tire bead wire market.

Among the segments delineated within the tire bead wire market by type, radial tires emerge as the fastest-growing segment, fuelling significant advancements in tire technology and automotive performance. Radial tires have gained widespread popularity and adoption due to their superior performance characteristics, including better traction, fuel efficiency, and durability compared to bias tires. The construction of radial tires involves layers of cords, including steel bead wire, arranged perpendicular to the direction of travel, providing greater stability and responsiveness on the road. The increasing demand for radial tires is driven by the growing automotive industry, rising consumer preferences for high-performance tires, and the adoption of radial tire technology in commercial vehicles, passenger cars, and trucks. Additionally, stringent regulatory standards for vehicle safety and fuel efficiency are further driving the shift towards radial tires, driving the demand for tire bead wire used in their construction. As automotive manufacturers continue to innovate and improve tire performance to meet evolving market demands, the demand for radial tires and associated tire bead wire is expected to witness rapid growth, solidifying the radial tires segment as the fastest-growing segment in the tire bead wire market.

Within the tire bead wire market segmented by application, automotive tires emerge as the largest segment, commanding a significant share due to the extensive use of tires in the automotive industry. Automotive tires are essential components of vehicles, providing traction, stability, and safety on various road surfaces. The demand for tire bead wire in automotive tires is driven by the growing automotive industry, increasing vehicle production, and replacement tire market. Passenger cars, SUVs, and light trucks, among others, rely on tire bead wire for the construction of tires, ensuring proper bead retention and tire performance. Additionally, the automotive sector's emphasis on tire performance, safety, and fuel efficiency further drives the demand for high-quality tire bead wire. As the automotive industry continues to grow and evolve, driven by factors such as urbanization, economic development, and technological advancements, the demand for tire bead wire in automotive tires is expected to remain robust, solidifying its position as the largest segment in the tire bead wire market.

By Grade

High Tensile Strength

Regular Tensile Strength

By Type

Radial tires

Bias tires

By Application

Automotive tires

Motorcycle tires

Truck tires

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Aarti Steels Ltd

Bekaert

HBT Rubber Industrial Co. Ltd

Jiangsu Xingda Steel Tyre Cord Co. Ltd

Kiswire

Rajratan

Shandong Daye

Shanghai Metal Corp

SNTAI Industrial Group Ltd

Tianjin Bladder Technology Co. Ltd

WireCo World Group

Zhangjiagang City Shengda Steel Wire Rope Co. Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Tire Bead Wire Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Tire Bead Wire Market Size Outlook, $ Million, 2021 to 2032

3.2 Tire Bead Wire Market Outlook by Type, $ Million, 2021 to 2032

3.3 Tire Bead Wire Market Outlook by Product, $ Million, 2021 to 2032

3.4 Tire Bead Wire Market Outlook by Application, $ Million, 2021 to 2032

3.5 Tire Bead Wire Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Tire Bead Wire Industry

4.2 Key Market Trends in Tire Bead Wire Industry

4.3 Potential Opportunities in Tire Bead Wire Industry

4.4 Key Challenges in Tire Bead Wire Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Tire Bead Wire Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Tire Bead Wire Market Outlook by Segments

7.1 Tire Bead Wire Market Outlook by Segments, $ Million, 2021- 2032

By Grade

High Tensile Strength

Regular Tensile Strength

By Type

Radial tires

Bias tires

By Application

Automotive tires

Motorcycle tires

Truck tires

Others

8 North America Tire Bead Wire Market Analysis and Outlook To 2032

8.1 Introduction to North America Tire Bead Wire Markets in 2024

8.2 North America Tire Bead Wire Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Tire Bead Wire Market size Outlook by Segments, 2021-2032

By Grade

High Tensile Strength

Regular Tensile Strength

By Type

Radial tires

Bias tires

By Application

Automotive tires

Motorcycle tires

Truck tires

Others

9 Europe Tire Bead Wire Market Analysis and Outlook To 2032

9.1 Introduction to Europe Tire Bead Wire Markets in 2024

9.2 Europe Tire Bead Wire Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Tire Bead Wire Market Size Outlook by Segments, 2021-2032

By Grade

High Tensile Strength

Regular Tensile Strength

By Type

Radial tires

Bias tires

By Application

Automotive tires

Motorcycle tires

Truck tires

Others

10 Asia Pacific Tire Bead Wire Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Tire Bead Wire Markets in 2024

10.2 Asia Pacific Tire Bead Wire Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Tire Bead Wire Market size Outlook by Segments, 2021-2032

By Grade

High Tensile Strength

Regular Tensile Strength

By Type

Radial tires

Bias tires

By Application

Automotive tires

Motorcycle tires

Truck tires

Others

11 South America Tire Bead Wire Market Analysis and Outlook To 2032

11.1 Introduction to South America Tire Bead Wire Markets in 2024

11.2 South America Tire Bead Wire Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Tire Bead Wire Market size Outlook by Segments, 2021-2032

By Grade

High Tensile Strength

Regular Tensile Strength

By Type

Radial tires

Bias tires

By Application

Automotive tires

Motorcycle tires

Truck tires

Others

12 Middle East and Africa Tire Bead Wire Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Tire Bead Wire Markets in 2024

12.2 Middle East and Africa Tire Bead Wire Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Tire Bead Wire Market size Outlook by Segments, 2021-2032

By Grade

High Tensile Strength

Regular Tensile Strength

By Type

Radial tires

Bias tires

By Application

Automotive tires

Motorcycle tires

Truck tires

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Aarti Steels Ltd

Bekaert

HBT Rubber Industrial Co. Ltd

Jiangsu Xingda Steel Tyre Cord Co. Ltd

Kiswire

Rajratan

Shandong Daye

Shanghai Metal Corp

SNTAI Industrial Group Ltd

Tianjin Bladder Technology Co. Ltd

WireCo World Group

Zhangjiagang City Shengda Steel Wire Rope Co. Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Grade

High Tensile Strength

Regular Tensile Strength

By Type

Radial tires

Bias tires

By Application

Automotive tires

Motorcycle tires

Truck tires

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Tire Bead Wire Market Size is valued at $1.6 Billion in 2024 and is forecast to register a growth rate (CAGR) of 9.2% to reach $3.2 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Aarti Steels Ltd, Bekaert, HBT Rubber Industrial Co. Ltd, Jiangsu Xingda Steel Tyre Cord Co. Ltd, Kiswire, Rajratan, Shandong Daye, Shanghai Metal Corp, SNTAI Industrial Group Ltd, Tianjin Bladder Technology Co. Ltd, WireCo World Group, Zhangjiagang City Shengda Steel Wire Rope Co. Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume