The global Timber Laminating Adhesives Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Resin (Melamine (Urea) Formaldehyde Adhesives- MF & MUF, Phenol Resorcinol Formaldehyde (PRF) Adhesives, Polyurethane, Emulsion Polymer Isocyanate (EPI) Adhesives, Others), By Application (Floor Beam, Roof Beam, Window & Door Header, Trusses & Supporting Column, Others), By End-User (Residential, Non residential).

Timber laminating adhesives play a crucial role in the manufacturing of engineered wood products such as laminated veneer lumber (LVL), glued laminated timber (glulam), and cross-laminated timber (CLT) in 2024. These adhesives are specially formulated to bond timber layers or veneers together, creating strong and durable structural components for construction and building applications. Timber laminating adhesives provide high bond strength, dimensional stability, and resistance to moisture, ensuring the integrity and performance of engineered wood products in various environmental conditions. In construction, engineered wood products offer advantages such as design flexibility, sustainability, and cost-effectiveness, making them popular choices for structural beams, columns, and panels in residential, commercial, and industrial buildings. With advancements in adhesive technology, curing methods, and quality control processes, timber laminating adhesives to meet stringent performance standards and regulatory requirements, driving innovation and growth in the engineered wood products industry.

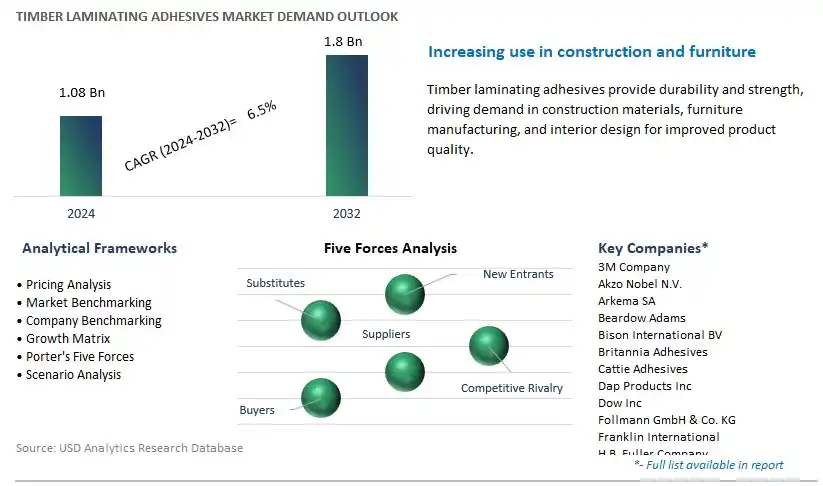

The market report analyses the leading companies in the industry including 3M Company, Akzo Nobel N.V., Arkema SA, Beardow Adams, Bison International BV, Britannia Adhesives, Cattie Adhesives, Dap Products Inc, Dow Inc, Follmann GmbH & Co. KG, Franklin International, H.B. Fuller Company, Henkel AG & Co. KGaA, Ifs Industries Inc, Illinois Tool Works Inc, Jowat SE, Jubilant Industries, Mapei Spa, Pidilite Industries Ltd, Sika AG, and others.

Timber laminating adhesives are witnessing a significant market trend driven by the growing demand for sustainable and eco-friendly products. Consumers and industries alike are increasingly prioritizing environmentally conscious options, leading to a surge in the adoption of adhesives made from renewable sources and with reduced environmental impact. This trend is further fueled by regulatory measures aimed at promoting sustainability and reducing carbon footprints across various sectors. As a result, manufacturers of timber laminating adhesives are investing in research and development to innovate greener solutions, thereby reshaping the market landscape towards more sustainable practices.

The expansion of construction and infrastructure projects globally serves as a major market driver for timber laminating adhesives. With urbanization on the rise and the need for modern infrastructure escalating, there's a growing demand for timber-based materials in construction applications such as beams, columns, and flooring. Timber laminating adhesives play a crucial role in enhancing the structural integrity and durability of these components, making them indispensable in construction projects. Moreover, the increasing focus on green building practices and the preference for timber as a sustainable building material further amplify the demand for high-performance adhesives, driving the growth of the market.

An emerging opportunity in the timber laminating adhesives market lies in the innovation and adoption of bio-based adhesives. As sustainability becomes a key priority for consumers and industries, there's a growing interest in adhesive formulations derived from renewable resources such as plant-based materials and agricultural by-products. Manufacturers can capitalize on this trend by investing in research and development to create bio-based adhesives that offer comparable or superior performance to traditional synthetic adhesives. By leveraging the potential of bio-based technologies, companies can not only meet the evolving demands of environmentally conscious consumers but also carve out a competitive edge in the market while contributing to a more sustainable future.

Melamine (Urea) Formaldehyde Adhesives (MF & MUF) is the largest segment within the Timber Laminating Adhesives Market. In particular, MF and MUF adhesives are widely used in the timber industry for bonding veneers and laminates due to their excellent bonding strength, moisture resistance, and affordability. These adhesives offer reliable performance in various applications such as plywood production, laminated timber beams, and engineered wood products. Moreover, MF and MUF adhesives comply with stringent regulatory requirements for formaldehyde emissions, making them suitable for use in indoor applications such as furniture, cabinets, and flooring. Additionally, the availability of a wide range of formulations tailored for specific timber species and processing conditions enhances the versatility and applicability of MF and MUF adhesives in the timber laminating industry. Furthermore, the growing demand for sustainable and eco-friendly adhesive solutions further drives the adoption of MF and MUF adhesives, solidifying their position as the largest segment within the Timber Laminating Adhesives Market.

The Trusses & Supporting Column segment is the fastest-growing segment within the Timber Laminating Adhesives Market. In particular, trusses and supporting columns play a crucial role in structural applications such as residential and commercial building construction, where they provide load-bearing support and structural stability. Timber laminating adhesives are essential components in the fabrication of laminated timber trusses and columns, as they bond multiple layers of timber to form strong and durable structural elements. Moreover, the increasing adoption of timber as a sustainable building material drives the demand for engineered timber products such as glued laminated timber (glulam) trusses and columns, which require timber laminating adhesives for assembly. Additionally, advancements in adhesive technology, including fast-curing formulations and enhanced bonding performance, enable efficient and cost-effective production of laminated timber components for trusses and columns. Furthermore, the growing trend towards green building practices and eco-friendly construction materials further accelerates the adoption of timber laminating adhesives in structural applications, solidifying the Trusses & Supporting Column segment as the fastest-growing within the Timber Laminating Adhesives Market.

The Residential segment is the largest segment within the Timber Laminating Adhesives Market. In particular, residential construction represents a significant portion of the overall construction industry, driven by population growth, urbanization, and increasing homeownership rates. Timber laminating adhesives play a crucial role in residential construction projects, particularly in the fabrication of engineered wood products such as glued laminated timber (glulam) beams, columns, and trusses. These structural elements are widely used in residential buildings for floor beams, roof beams, window and door headers, and other load-bearing applications. Moreover, the growing trend towards sustainable and eco-friendly building materials encourages the use of timber as a renewable resource in residential construction, further driving the demand for timber laminating adhesives. Additionally, advancements in adhesive technology have led to the development of high-performance formulations tailored for residential applications, meeting stringent regulatory requirements for indoor air quality and structural integrity. Furthermore, the increasing preference for timber-based construction solutions in residential buildings, coupled with the rising demand for affordable and energy-efficient housing, solidifies the Residential segment as the largest within the Timber Laminating Adhesives Market.

By Resin

Melamine (Urea) Formaldehyde Adhesives- MF & MUF

Phenol Resorcinol Formaldehyde (PRF) Adhesives

Polyurethane

Emulsion Polymer Isocyanate (EPI) Adhesives

Others

By Application

Floor Beam

Roof Beam

Window & Door Header

Trusses & Supporting Column

Others

By End-User

Residential

Non residentialCountries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

3M Company

Akzo Nobel N.V.

Arkema SA

Beardow Adams

Bison International BV

Britannia Adhesives

Cattie Adhesives

Dap Products Inc

Dow Inc

Follmann GmbH & Co. KG

Franklin International

H.B. Fuller Company

Henkel AG & Co. KGaA

Ifs Industries Inc

Illinois Tool Works Inc

Jowat SE

Jubilant Industries

Mapei Spa

Pidilite Industries Ltd

Sika AG

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Timber Laminating Adhesives Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Timber Laminating Adhesives Market Size Outlook, $ Million, 2021 to 2032

3.2 Timber Laminating Adhesives Market Outlook by Type, $ Million, 2021 to 2032

3.3 Timber Laminating Adhesives Market Outlook by Product, $ Million, 2021 to 2032

3.4 Timber Laminating Adhesives Market Outlook by Application, $ Million, 2021 to 2032

3.5 Timber Laminating Adhesives Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Timber Laminating Adhesives Industry

4.2 Key Market Trends in Timber Laminating Adhesives Industry

4.3 Potential Opportunities in Timber Laminating Adhesives Industry

4.4 Key Challenges in Timber Laminating Adhesives Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Timber Laminating Adhesives Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Timber Laminating Adhesives Market Outlook by Segments

7.1 Timber Laminating Adhesives Market Outlook by Segments, $ Million, 2021- 2032

By Resin

Melamine (Urea) Formaldehyde Adhesives- MF & MUF

Phenol Resorcinol Formaldehyde (PRF) Adhesives

Polyurethane

Emulsion Polymer Isocyanate (EPI) Adhesives

Others

By Application

Floor Beam

Roof Beam

Window & Door Header

Trusses & Supporting Column

Others

By End-User

Residential

Non residential

8 North America Timber Laminating Adhesives Market Analysis and Outlook To 2032

8.1 Introduction to North America Timber Laminating Adhesives Markets in 2024

8.2 North America Timber Laminating Adhesives Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Timber Laminating Adhesives Market size Outlook by Segments, 2021-2032

By Resin

Melamine (Urea) Formaldehyde Adhesives- MF & MUF

Phenol Resorcinol Formaldehyde (PRF) Adhesives

Polyurethane

Emulsion Polymer Isocyanate (EPI) Adhesives

Others

By Application

Floor Beam

Roof Beam

Window & Door Header

Trusses & Supporting Column

Others

By End-User

Residential

Non residential

9 Europe Timber Laminating Adhesives Market Analysis and Outlook To 2032

9.1 Introduction to Europe Timber Laminating Adhesives Markets in 2024

9.2 Europe Timber Laminating Adhesives Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Timber Laminating Adhesives Market Size Outlook by Segments, 2021-2032

By Resin

Melamine (Urea) Formaldehyde Adhesives- MF & MUF

Phenol Resorcinol Formaldehyde (PRF) Adhesives

Polyurethane

Emulsion Polymer Isocyanate (EPI) Adhesives

Others

By Application

Floor Beam

Roof Beam

Window & Door Header

Trusses & Supporting Column

Others

By End-User

Residential

Non residential

10 Asia Pacific Timber Laminating Adhesives Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Timber Laminating Adhesives Markets in 2024

10.2 Asia Pacific Timber Laminating Adhesives Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Timber Laminating Adhesives Market size Outlook by Segments, 2021-2032

By Resin

Melamine (Urea) Formaldehyde Adhesives- MF & MUF

Phenol Resorcinol Formaldehyde (PRF) Adhesives

Polyurethane

Emulsion Polymer Isocyanate (EPI) Adhesives

Others

By Application

Floor Beam

Roof Beam

Window & Door Header

Trusses & Supporting Column

Others

By End-User

Residential

Non residential

11 South America Timber Laminating Adhesives Market Analysis and Outlook To 2032

11.1 Introduction to South America Timber Laminating Adhesives Markets in 2024

11.2 South America Timber Laminating Adhesives Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Timber Laminating Adhesives Market size Outlook by Segments, 2021-2032

By Resin

Melamine (Urea) Formaldehyde Adhesives- MF & MUF

Phenol Resorcinol Formaldehyde (PRF) Adhesives

Polyurethane

Emulsion Polymer Isocyanate (EPI) Adhesives

Others

By Application

Floor Beam

Roof Beam

Window & Door Header

Trusses & Supporting Column

Others

By End-User

Residential

Non residential

12 Middle East and Africa Timber Laminating Adhesives Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Timber Laminating Adhesives Markets in 2024

12.2 Middle East and Africa Timber Laminating Adhesives Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Timber Laminating Adhesives Market size Outlook by Segments, 2021-2032

By Resin

Melamine (Urea) Formaldehyde Adhesives- MF & MUF

Phenol Resorcinol Formaldehyde (PRF) Adhesives

Polyurethane

Emulsion Polymer Isocyanate (EPI) Adhesives

Others

By Application

Floor Beam

Roof Beam

Window & Door Header

Trusses & Supporting Column

Others

By End-User

Residential

Non residential

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

3M Company

Akzo Nobel N.V.

Arkema SA

Beardow Adams

Bison International BV

Britannia Adhesives

Cattie Adhesives

Dap Products Inc

Dow Inc

Follmann GmbH & Co. KG

Franklin International

H.B. Fuller Company

Henkel AG & Co. KGaA

Ifs Industries Inc

Illinois Tool Works Inc

Jowat SE

Jubilant Industries

Mapei Spa

Pidilite Industries Ltd

Sika AG

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Resin

Melamine (Urea) Formaldehyde Adhesives- MF & MUF

Phenol Resorcinol Formaldehyde (PRF) Adhesives

Polyurethane

Emulsion Polymer Isocyanate (EPI) Adhesives

Others

By Application

Floor Beam

Roof Beam

Window & Door Header

Trusses & Supporting Column

Others

By End-User

Residential

Non residential

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Timber Laminating Adhesives Market Size is valued at $1.08 Billion in 2024 and is forecast to register a growth rate (CAGR) of 6.5% to reach $1.8 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

3M Company, Akzo Nobel N.V., Arkema SA, Beardow Adams, Bison International BV, Britannia Adhesives, Cattie Adhesives, Dap Products Inc, Dow Inc, Follmann GmbH & Co. KG, Franklin International, H.B. Fuller Company, Henkel AG & Co. KGaA, Ifs Industries Inc, Illinois Tool Works Inc, Jowat SE, Jubilant Industries, Mapei Spa, Pidilite Industries Ltd, Sika AG

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume