The global Tile Adhesives and Stone Adhesives Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Chemistry (Cementitious, Epoxy, Others), By Construction (New Construction, Repairs & Renovation), By End-User (Residential, Commercial, Institutional).

Tile adhesives and stone adhesives play a vital role in the construction and renovation of buildings, infrastructure, and interior spaces in 2024. These adhesives are formulated to bond tiles, natural stones, and other materials to substrates such as concrete, wood, or metal, providing strong and durable adhesion. Tile adhesives are used for installing ceramic tiles, porcelain tiles, and mosaic tiles on floors, walls, and countertops in residential, commercial, and industrial settings. Stone adhesives are specifically designed for bonding natural stone slabs, marble, granite, and quartz surfaces in architectural applications such as facades, cladding, and countertops. With advancements in adhesive chemistry, formulations, and application techniques, tile adhesives and stone adhesives offer improved bonding strength, flexibility, and resistance to moisture, chemicals, and temperature variations. Further, with the growing trend towards sustainable construction practices, tile adhesives and stone adhesives are available in eco-friendly formulations that minimize environmental impact while delivering superior performance.

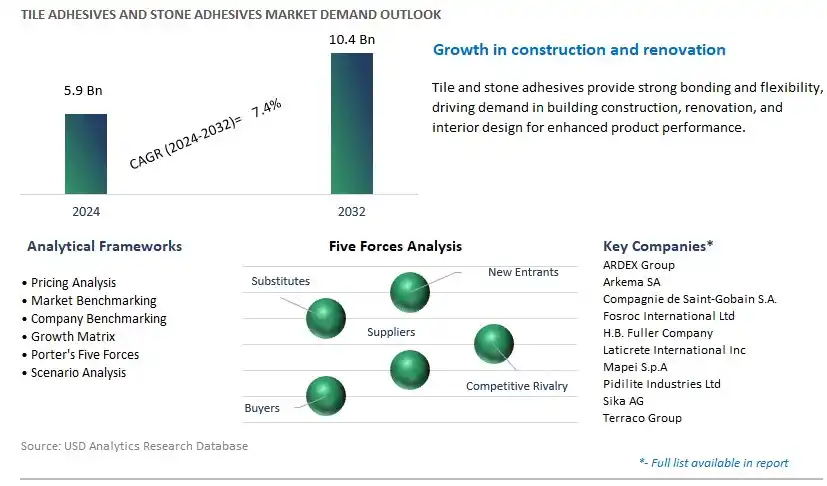

The market report analyses the leading companies in the industry including ARDEX Group, Arkema SA, Compagnie de Saint-Gobain S.A., Fosroc International Ltd, H.B. Fuller Company, Laticrete International Inc, Mapei S.p.A, Pidilite Industries Ltd, Sika AG, Terraco Group, and others.

A prominent trend in the tile adhesives and stone adhesives market is the growing demand for high-performance and sustainable adhesive solutions. As construction projects become more demanding in terms of design flexibility, durability, and environmental considerations, there is a rising need for adhesives that can bond various types of tiles, stones, and veneers effectively while meeting stringent performance and sustainability requirements. Manufacturers are responding to this trend by developing innovative adhesive formulations that offer superior bond strength, water resistance, and chemical resistance, as well as low volatile organic compound (VOC) emissions and environmentally friendly characteristics. Additionally, there is a growing preference for tile adhesives and stone adhesives that contribute to green building certifications such as LEED (Leadership in Energy and Environmental Design), driving the adoption of sustainable adhesive solutions in construction projects worldwide.

The primary driver for the tile adhesives and stone adhesives market is the growth in construction and renovation activities globally. Rapid urbanization, population growth, and infrastructure development are fueling demand for residential, commercial, and industrial construction projects, driving the need for high-quality adhesive products for tile and stone installations. Additionally, renovation and remodeling projects in both residential and commercial sectors contribute to market growth as existing structures undergo upgrades and refurbishments. Tile adhesives and stone adhesives play a critical role in these projects, providing reliable bonding solutions for various surfaces including floors, walls, countertops, and facades. As construction and renovation activities continue to increase, particularly in emerging economies and urban centers, the demand for tile adhesives and stone adhesives is expected to rise, supporting market expansion and innovation.

A significant opportunity for the tile adhesives and stone adhesives market lies in the development of advanced adhesive technologies that address evolving customer needs and market demands. Manufacturers can capitalize on this opportunity by investing in research and development to create adhesive formulations that offer enhanced performance, durability, and ease of use. This includes developing adhesives with rapid curing times, extended open times, and improved flexibility to accommodate various substrates and installation conditions. Furthermore, there is an opportunity to innovate in the area of sustainable adhesive solutions by incorporating recycled materials, bio-based resins, and eco-friendly additives into adhesive formulations. By offering advanced adhesive technologies that meet the diverse requirements of construction projects, manufacturers can gain a competitive edge in the market and position themselves as leaders in the industry. Additionally, partnerships with architects, designers, and construction professionals can help identify emerging trends and unmet needs, guiding the development of tailored adhesive solutions that address specific challenges in tile and stone installations.

Cementitious is the largest segment within the Tile Adhesives & Stone Adhesives Market. In particular, cementitious adhesives are widely used in both residential and commercial construction projects due to their versatility, cost-effectiveness, and ease of application. They provide strong bonding properties suitable for a variety of substrates, including concrete, masonry, and cement backer boards. Moreover, cementitious adhesives offer excellent resistance to moisture and high temperatures, making them ideal for use in wet areas such as bathrooms, kitchens, and swimming pools. Additionally, the availability of a wide range of cementitious adhesive formulations allows for customization to meet specific application requirements, further contributing to their popularity among contractors and DIY enthusiasts. Furthermore, the growing construction industry, particularly in emerging economies, drives the demand for tile and stone adhesives, with cementitious formulations being the preferred choice for many construction projects due to their reliability and cost-effectiveness, solidifying their position as the largest segment within the Tile Adhesives & Stone Adhesives Market.

The Repairs & Renovation segment is the fastest-growing segment within the Tile Adhesives & Stone Adhesives Market. In particular, as urbanization continues to increase globally, there is a growing demand for repairs and renovations of existing buildings and infrastructure. Tile and stone adhesives play a crucial role in these projects, as they are used to repair damaged tiles, replace old flooring, and renovate kitchens and bathrooms. Moreover, the rise in home improvement projects, driven by changing consumer preferences and lifestyle trends, contributes to the increasing demand for tile and stone adhesives in the repairs and renovation segment. Additionally, advancements in adhesive technology have led to the development of innovative products that offer enhanced performance, such as rapid-setting adhesives and flexible formulations, making them ideal for repair and renovation applications. Furthermore, the growing emphasis on sustainability and eco-friendly construction practices encourages the use of tile and stone adhesives that are low in volatile organic compounds (VOCs) and environmentally friendly, further driving the growth of the Repairs & Renovation segment within the Tile Adhesives & Stone Adhesives Market.

The Residential segment is the largest segment within the Tile Adhesives & Stone Adhesives Market. In particular, the residential construction sector represents a significant portion of the overall construction industry, driven by population growth, urbanization, and rising disposable incomes. Tile and stone adhesives are essential components in residential construction projects, used for installing flooring, wall tiles, and decorative stone features in kitchens, bathrooms, and living spaces. Moreover, the increasing trend towards home renovation and remodeling further contributes to the demand for tile and stone adhesives in the residential segment. Additionally, the availability of a wide range of adhesive formulations tailored for residential applications, such as rapid-setting adhesives and waterproof formulations, meets the specific needs of homeowners and contractors. Furthermore, the growing preference for aesthetically pleasing and durable finishes in residential spaces drives the adoption of tile and stone adhesives, solidifying the Residential segment as the largest within the Tile Adhesives & Stone Adhesives Market.

By Chemistry

Cementitious

Epoxy

Others

By Construction

New Construction

Repairs & Renovation

By End-User

Residential

Commercial

InstitutionalCountries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

ARDEX Group

Arkema SA

Compagnie de Saint-Gobain S.A.

Fosroc International Ltd

H.B. Fuller Company

Laticrete International Inc

Mapei S.p.A

Pidilite Industries Ltd

Sika AG

Terraco Group

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Tile Adhesives and Stone Adhesives Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Tile Adhesives and Stone Adhesives Market Size Outlook, $ Million, 2021 to 2032

3.2 Tile Adhesives and Stone Adhesives Market Outlook by Type, $ Million, 2021 to 2032

3.3 Tile Adhesives and Stone Adhesives Market Outlook by Product, $ Million, 2021 to 2032

3.4 Tile Adhesives and Stone Adhesives Market Outlook by Application, $ Million, 2021 to 2032

3.5 Tile Adhesives and Stone Adhesives Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Tile Adhesives and Stone Adhesives Industry

4.2 Key Market Trends in Tile Adhesives and Stone Adhesives Industry

4.3 Potential Opportunities in Tile Adhesives and Stone Adhesives Industry

4.4 Key Challenges in Tile Adhesives and Stone Adhesives Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Tile Adhesives and Stone Adhesives Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Tile Adhesives and Stone Adhesives Market Outlook by Segments

7.1 Tile Adhesives and Stone Adhesives Market Outlook by Segments, $ Million, 2021- 2032

By Chemistry

Cementitious

Epoxy

Others

By Construction

New Construction

Repairs & Renovation

By End-User

Residential

Commercial

Institutional

8 North America Tile Adhesives and Stone Adhesives Market Analysis and Outlook To 2032

8.1 Introduction to North America Tile Adhesives and Stone Adhesives Markets in 2024

8.2 North America Tile Adhesives and Stone Adhesives Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Tile Adhesives and Stone Adhesives Market size Outlook by Segments, 2021-2032

By Chemistry

Cementitious

Epoxy

Others

By Construction

New Construction

Repairs & Renovation

By End-User

Residential

Commercial

Institutional

9 Europe Tile Adhesives and Stone Adhesives Market Analysis and Outlook To 2032

9.1 Introduction to Europe Tile Adhesives and Stone Adhesives Markets in 2024

9.2 Europe Tile Adhesives and Stone Adhesives Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Tile Adhesives and Stone Adhesives Market Size Outlook by Segments, 2021-2032

By Chemistry

Cementitious

Epoxy

Others

By Construction

New Construction

Repairs & Renovation

By End-User

Residential

Commercial

Institutional

10 Asia Pacific Tile Adhesives and Stone Adhesives Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Tile Adhesives and Stone Adhesives Markets in 2024

10.2 Asia Pacific Tile Adhesives and Stone Adhesives Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Tile Adhesives and Stone Adhesives Market size Outlook by Segments, 2021-2032

By Chemistry

Cementitious

Epoxy

Others

By Construction

New Construction

Repairs & Renovation

By End-User

Residential

Commercial

Institutional

11 South America Tile Adhesives and Stone Adhesives Market Analysis and Outlook To 2032

11.1 Introduction to South America Tile Adhesives and Stone Adhesives Markets in 2024

11.2 South America Tile Adhesives and Stone Adhesives Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Tile Adhesives and Stone Adhesives Market size Outlook by Segments, 2021-2032

By Chemistry

Cementitious

Epoxy

Others

By Construction

New Construction

Repairs & Renovation

By End-User

Residential

Commercial

Institutional

12 Middle East and Africa Tile Adhesives and Stone Adhesives Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Tile Adhesives and Stone Adhesives Markets in 2024

12.2 Middle East and Africa Tile Adhesives and Stone Adhesives Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Tile Adhesives and Stone Adhesives Market size Outlook by Segments, 2021-2032

By Chemistry

Cementitious

Epoxy

Others

By Construction

New Construction

Repairs & Renovation

By End-User

Residential

Commercial

Institutional

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

ARDEX Group

Arkema SA

Compagnie de Saint-Gobain S.A.

Fosroc International Ltd

H.B. Fuller Company

Laticrete International Inc

Mapei S.p.A

Pidilite Industries Ltd

Sika AG

Terraco Group

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Chemistry

Cementitious

Epoxy

Others

By Construction

New Construction

Repairs & Renovation

By End-User

Residential

Commercial

Institutional

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Tile Adhesives and Stone Adhesives Market Size is valued at $5.9 Billion in 2024 and is forecast to register a growth rate (CAGR) of 7.4% to reach $10.4 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

ARDEX Group, Arkema SA, Compagnie de Saint-Gobain S.A., Fosroc International Ltd, H.B. Fuller Company, Laticrete International Inc, Mapei S.p.A, Pidilite Industries Ltd, Sika AG, Terraco Group

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume