The global Thermoplastic Elastomers Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Application (Automotive, Electrical & Electronics, Industrial, Medical, Consumer Goods, Others), By Material (Poly Styrenes, Poly Olefins, Poly Ether Imides, Poly Urethanes, Poly Esters, Poly Amides).

Thermoplastic elastomers (TPEs), versatile materials combining the properties of thermoplastics and elastomers, remain essential in diverse applications in 2024. These elastomeric materials offer advantages such as flexibility, resilience, softness, and ease of processing, making them suitable for applications requiring elastomeric properties with thermoplastic processing capabilities. TPEs encompass a wide range of materials, including styrenic block copolymers, thermoplastic polyurethanes, thermoplastic vulcanizates, and copolyesters. In industries such as automotive, consumer goods, medical devices, and footwear, TPEs are used for applications such as seals, gaskets, grips, soft-touch handles, and medical tubing. Additionally, TPEs find applications in overmolding, coextrusion, and multi-component molding processes, enabling the integration of elastomeric features with rigid components in single-piece designs. With ongoing innovations in material formulations, processing technologies, and sustainability initiatives, TPEs to offer versatile solutions for manufacturers seeking performance, design flexibility, and cost-effectiveness in their products.

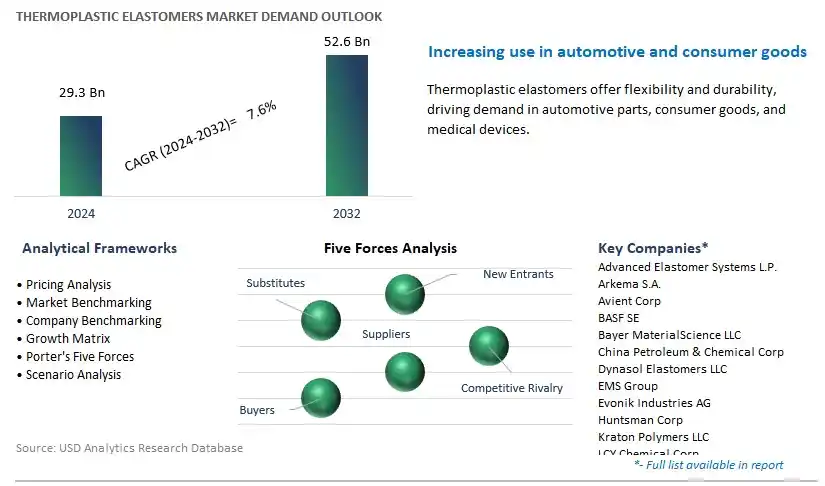

The market report analyses the leading companies in the industry including Advanced Elastomer Systems L.P., Arkema S.A., Avient Corp, BASF SE, Bayer MaterialScience LLC, China Petroleum & Chemical Corp, Dynasol Elastomers LLC, EMS Group, Evonik Industries AG, Huntsman Corp, Kraton Polymers LLC, LCY Chemical Corp, LG Chemicals, LyondellBasell Industries NV, Nippon Polyurethane Industry Company Ltd, Teknor APEX Company, The Dow Chemical Company, The Lubrizol Corp, TSRC Corp, Yantai Wanhua Polyurethane Co. Ltd, and others.

A significant trend in the thermoplastic elastomers (TPE) market is the increasing demand for flexible and versatile materials across various industries. As consumers and manufacturers seek materials that offer both elasticity and processability, there is a growing preference for TPEs due to their unique combination of rubber-like elasticity and thermoplastic processing characteristics. TPEs are widely used in applications such as automotive components, consumer goods, medical devices, and packaging, where flexibility, durability, and ease of molding are essential. The trend towards customization, lightweighting, and sustainability is driving the adoption of TPEs as substitutes for traditional elastomers and thermoset rubbers, leading to market growth and diversification.

The primary driver for the thermoplastic elastomers market is advancements in material formulations and processing technologies. With ongoing research and development efforts, manufacturers are continuously improving the properties and performance of TPEs to meet the evolving needs of end-users and markets. Innovations in polymer chemistry, compounding techniques, and additives have led to the development of TPEs with enhanced properties such as high elasticity, chemical resistance, UV stability, and flame retardancy. Additionally, advancements in processing technologies such as injection molding, extrusion, and blow molding have expanded the range of TPE applications and enabled the production of complex-shaped parts with tight tolerances. As industries demand materials that offer superior performance, design flexibility, and cost-effectiveness, the development of advanced TPE formulations and processing technologies is driving market growth and competitiveness.

A significant opportunity for the thermoplastic elastomers market lies in the penetration into medical and healthcare applications. TPEs are increasingly being used in medical devices, surgical instruments, drug delivery systems, and healthcare equipment due to their biocompatibility, sterilizability, and soft-touch properties. With the growing demand for minimally invasive procedures, wearable medical devices, and disposable healthcare products, there is a need for materials that offer comfort, flexibility, and reliability. TPEs present opportunities for manufacturers to develop customized solutions tailored to the specific requirements of medical and healthcare applications, such as skin-contact materials, tubing, seals, and gaskets. By addressing the stringent regulatory standards, performance criteria, and patient safety requirements of the medical industry, TPE manufacturers can capitalize on opportunities to expand their presence in the medical and healthcare sectors, gain market share, and drive revenue growth. As the medical and healthcare industries continue to innovate and evolve, the penetration into these applications presents significant growth opportunities for the thermoplastic elastomers market.

The Automotive segment stands out as the largest segment within thermoplastic Elastomers Market. the automotive industry is one of the largest consumers of thermoplastic elastomers due to their versatile properties and diverse applications in vehicle components such as seals, gaskets, hoses, and interior trim. Thermoplastic elastomers offer excellent elasticity, durability, and weather resistance, making them well-suited for demanding automotive environments. Moreover, the growing trend towards lightweighting in the automotive sector to improve fuel efficiency and reduce emissions has driven the adoption of thermoplastic elastomers as alternatives to traditional rubber and metal components. Additionally, stringent regulatory standards for vehicle safety and performance have propelled the demand for thermoplastic elastomers in automotive applications, where they contribute to enhanced comfort, noise reduction, and overall vehicle performance. Furthermore, the continuous innovation in material formulations and processing technologies is expanding the application potential of thermoplastic elastomers in the automotive industry, reinforcing their position as the largest segment within thermoplastic Elastomers Market.

Polyurethanes emerge as the fastest-growing segment within thermoplastic Elastomers Market. In particular, polyurethane elastomers offer a unique combination of properties including high elasticity, abrasion resistance, chemical resistance, and durability, making them suitable for a wide range of applications across industries such as automotive, footwear, construction, and consumer goods. The versatility of polyurethane elastomers allows for the formulation of materials with tailored properties to meet specific application requirements, driving their adoption in diverse end-use sectors. Moreover, the growing demand for lightweight, high-performance materials in industries such as automotive and footwear is fuelling the adoption of polyurethane elastomers as alternatives to traditional rubber and thermoset elastomers. Additionally, advancements in material science and manufacturing processes have led to the development of bio-based and recyclable polyurethane elastomers, aligning with the growing emphasis on sustainability and environmental responsibility. Furthermore, the expanding application scope of polyurethane elastomers in emerging sectors such as 3D printing and medical devices further contributes to their rapid market growth, solidifying their position as the fastest-growing segment within thermoplastic Elastomers Market.

By Application

Automotive

Electrical & Electronics

Industrial

Medical

Consumer Goods

Others

By Material

Poly Styrenes

Poly Olefins

Poly Ether Imides

Poly Urethanes

Poly Esters

Poly AmidesCountries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Advanced Elastomer Systems L.P.

Arkema S.A.

Avient Corp

BASF SE

Bayer MaterialScience LLC

China Petroleum & Chemical Corp

Dynasol Elastomers LLC

EMS Group

Evonik Industries AG

Huntsman Corp

Kraton Polymers LLC

LCY Chemical Corp

LG Chemicals

LyondellBasell Industries NV

Nippon Polyurethane Industry Company Ltd

Teknor APEX Company

The Dow Chemical Company

The Lubrizol Corp

TSRC Corp

Yantai Wanhua Polyurethane Co. Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Thermoplastic Elastomers Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Thermoplastic Elastomers Market Size Outlook, $ Million, 2021 to 2032

3.2 Thermoplastic Elastomers Market Outlook by Type, $ Million, 2021 to 2032

3.3 Thermoplastic Elastomers Market Outlook by Product, $ Million, 2021 to 2032

3.4 Thermoplastic Elastomers Market Outlook by Application, $ Million, 2021 to 2032

3.5 Thermoplastic Elastomers Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Thermoplastic Elastomers Industry

4.2 Key Market Trends in Thermoplastic Elastomers Industry

4.3 Potential Opportunities in Thermoplastic Elastomers Industry

4.4 Key Challenges in Thermoplastic Elastomers Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Thermoplastic Elastomers Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Thermoplastic Elastomers Market Outlook by Segments

7.1 Thermoplastic Elastomers Market Outlook by Segments, $ Million, 2021- 2032

By Application

Automotive

Electrical & Electronics

Industrial

Medical

Consumer Goods

Others

By Material

Poly Styrenes

Poly Olefins

Poly Ether Imides

Poly Urethanes

Poly Esters

Poly Amides

8 North America Thermoplastic Elastomers Market Analysis and Outlook To 2032

8.1 Introduction to North America Thermoplastic Elastomers Markets in 2024

8.2 North America Thermoplastic Elastomers Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Thermoplastic Elastomers Market size Outlook by Segments, 2021-2032

By Application

Automotive

Electrical & Electronics

Industrial

Medical

Consumer Goods

Others

By Material

Poly Styrenes

Poly Olefins

Poly Ether Imides

Poly Urethanes

Poly Esters

Poly Amides

9 Europe Thermoplastic Elastomers Market Analysis and Outlook To 2032

9.1 Introduction to Europe Thermoplastic Elastomers Markets in 2024

9.2 Europe Thermoplastic Elastomers Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Thermoplastic Elastomers Market Size Outlook by Segments, 2021-2032

By Application

Automotive

Electrical & Electronics

Industrial

Medical

Consumer Goods

Others

By Material

Poly Styrenes

Poly Olefins

Poly Ether Imides

Poly Urethanes

Poly Esters

Poly Amides

10 Asia Pacific Thermoplastic Elastomers Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Thermoplastic Elastomers Markets in 2024

10.2 Asia Pacific Thermoplastic Elastomers Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Thermoplastic Elastomers Market size Outlook by Segments, 2021-2032

By Application

Automotive

Electrical & Electronics

Industrial

Medical

Consumer Goods

Others

By Material

Poly Styrenes

Poly Olefins

Poly Ether Imides

Poly Urethanes

Poly Esters

Poly Amides

11 South America Thermoplastic Elastomers Market Analysis and Outlook To 2032

11.1 Introduction to South America Thermoplastic Elastomers Markets in 2024

11.2 South America Thermoplastic Elastomers Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Thermoplastic Elastomers Market size Outlook by Segments, 2021-2032

By Application

Automotive

Electrical & Electronics

Industrial

Medical

Consumer Goods

Others

By Material

Poly Styrenes

Poly Olefins

Poly Ether Imides

Poly Urethanes

Poly Esters

Poly Amides

12 Middle East and Africa Thermoplastic Elastomers Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Thermoplastic Elastomers Markets in 2024

12.2 Middle East and Africa Thermoplastic Elastomers Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Thermoplastic Elastomers Market size Outlook by Segments, 2021-2032

By Application

Automotive

Electrical & Electronics

Industrial

Medical

Consumer Goods

Others

By Material

Poly Styrenes

Poly Olefins

Poly Ether Imides

Poly Urethanes

Poly Esters

Poly Amides

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Advanced Elastomer Systems L.P.

Arkema S.A.

Avient Corp

BASF SE

Bayer MaterialScience LLC

China Petroleum & Chemical Corp

Dynasol Elastomers LLC

EMS Group

Evonik Industries AG

Huntsman Corp

Kraton Polymers LLC

LCY Chemical Corp

LG Chemicals

LyondellBasell Industries NV

Nippon Polyurethane Industry Company Ltd

Teknor APEX Company

The Dow Chemical Company

The Lubrizol Corp

TSRC Corp

Yantai Wanhua Polyurethane Co. Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Application

Automotive

Electrical & Electronics

Industrial

Medical

Consumer Goods

Others

By Material

Poly Styrenes

Poly Olefins

Poly Ether Imides

Poly Urethanes

Poly Esters

Poly Amides

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Thermoplastic Elastomers Market Size is valued at $29.3 Billion in 2024 and is forecast to register a growth rate (CAGR) of 7.6% to reach $52.6 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Advanced Elastomer Systems L.P., Arkema S.A., Avient Corp, BASF SE, Bayer MaterialScience LLC, China Petroleum & Chemical Corp, Dynasol Elastomers LLC, EMS Group, Evonik Industries AG, Huntsman Corp, Kraton Polymers LLC, LCY Chemical Corp, LG Chemicals, LyondellBasell Industries NV, Nippon Polyurethane Industry Company Ltd, Teknor APEX Company, The Dow Chemical Company, The Lubrizol Corp, TSRC Corp, Yantai Wanhua Polyurethane Co. Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume