The global Thermoforming Plastic Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Polymethyl Methacrylate (PMMA), Bio-degradable polymers, Polyethylene (PE), Acrylonitrile Butadiene Styrene (ABS), Poly Vinyl Chloride (PVC), High Impact Polystyrene (HIPS), Polystyrene (PS), Polypropylene (PP)), By Process (Plug assist forming, Thick gauge thermoforming, Thin gauge thermoforming, Vacuum snapback), By Application (Healthcare & medical, Food packaging, Electrical & electronics, Automotive packaging, Construction, Consumer goods & appliances).

Thermoforming plastics, versatile materials capable of taking shape under heat and pressure, remain essential in packaging, automotive, construction, and consumer goods industries in 2024. These plastics, including polystyrene, polyethylene, and polypropylene, are heated to a pliable state and then formed into various shapes using molds or dies. Thermoforming offers advantages such as cost-effectiveness, rapid production cycles, and design flexibility, making it suitable for both prototyping and high-volume manufacturing. In packaging, thermoformed trays, containers, and blister packs provide protection and visibility for products, enhancing shelf appeal and consumer convenience. Similarly, in automotive interiors, thermoformed panels, dashboards, and trim components offer lightweight, durable, and aesthetically pleasing solutions. With advancements in material formulations, processing technologies, and sustainability initiatives, thermoforming plastics to evolve, offering innovative solutions for diverse industrial and consumer applications.

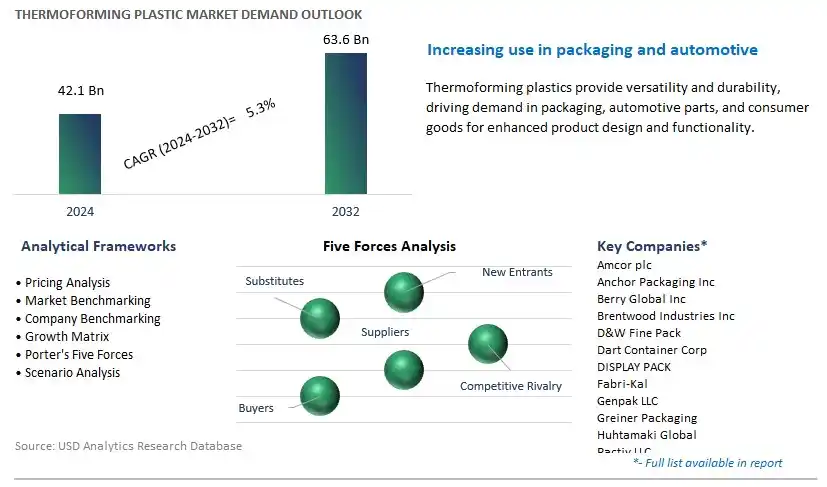

The market report analyses the leading companies in the industry including Amcor plc, Anchor Packaging Inc, Berry Global Inc, Brentwood Industries Inc, D&W Fine Pack, Dart Container Corp, DISPLAY PACK, Fabri-Kal, Genpak LLC, Greiner Packaging, Huhtamaki Global, Pactiv LLC, Penda, Placon, Sabert Corp, SILGAN HOLDINGS Inc, Silgan Plastics, Sonoco Products Company, Spencer Industries Inc, WINPAK Ltd, and others.

A significant trend in the thermoforming plastic market is the increasing demand for sustainable packaging solutions. With growing environmental awareness and regulatory pressures, there is a shift towards eco-friendly packaging materials that reduce waste and carbon footprint. Thermoforming plastics, such as recycled PET (rPET) and bio-based polymers, are gaining popularity as they offer comparable performance to traditional plastics while being more environmentally sustainable. Brands and manufacturers are increasingly adopting thermoforming plastics for various packaging applications, including food containers, clamshells, trays, and blister packs, to meet sustainability goals and consumer preferences for green packaging options. As sustainability continues to drive packaging innovation, the demand for thermoforming plastics is expected to rise, leading to market growth and expansion.

The primary driver for the thermoforming plastic market is advancements in thermoforming technology and material science. Technological innovations in thermoforming equipment, mold design, and process automation have improved production efficiency, cycle times, and product quality, making thermoforming a cost-effective and versatile manufacturing solution for a wide range of applications. Additionally, advancements in material science have led to the development of new thermoforming plastics with enhanced properties such as clarity, barrier performance, and heat resistance, expanding the suitability of thermoforming for demanding packaging requirements. With ongoing research and development efforts focused on improving material formulations and processing techniques, thermoforming plastics are becoming increasingly competitive with other packaging materials such as injection-molded plastics, glass, and aluminum. As manufacturers seek to optimize production processes and enhance product performance, the demand for thermoforming plastics as a preferred packaging solution is expected to grow, driving market expansion and innovation.

A significant opportunity for the thermoforming plastic market lies in the development of customized solutions for niche applications and industries. While thermoforming plastics are widely used in food packaging, consumer goods, and medical packaging, there are opportunities to explore new applications and market segments where thermoforming offers distinct advantages. This includes industries such as automotive, electronics, and aerospace, where thermoforming plastics can be used for interior components, protective covers, and structural parts due to their lightweight, impact resistance, and design flexibility. Additionally, there are opportunities to develop specialized thermoforming plastics tailored to specific performance requirements, regulatory standards, and end-use environments. By collaborating with customers to develop customized solutions, thermoforming plastic manufacturers can address unmet needs, differentiate their offerings, and capture market share in niche applications and industries. As industries continue to seek innovative packaging and manufacturing solutions, the development of customized thermoforming plastic solutions presents opportunities for growth, diversification, and market leadership in the thermoforming plastic market.

Polyethylene (PE) stands out as the largest segment within thermoforming Plastic Market. polyethylene is one of the most widely used plastics globally due to its versatility, affordability, and ease of processing. Its widespread application in packaging, consumer goods, construction, and automotive industries contributes significantly to its market share within thermoforming plastic sector. Moreover, the growing demand for sustainable packaging solutions has propelled the adoption of bio-based and recycled polyethylene, further boosting its market growth. Additionally, advancements in polymer technology have led to the development of enhanced polyethylene grades with improved mechanical properties, chemical resistance, and recyclability, making them even more appealing to manufacturers. Furthermore, the versatility of polyethylene allows for a wide range of thermoforming processes, including vacuum forming, pressure forming, and twin-sheet forming, catering to diverse application requirements. Hence, the combination of its inherent properties, widespread application spectrum, and ongoing innovations solidifies Polyethylene (PE) as the largest segment within thermoforming Plastic Market.

Thin Gauge Thermoforming is the fastest-growing segment within thermoforming Plastic Market. This rapid growth is driven by thin gauge thermoforming offers numerous advantages such as lightweight construction, cost-effectiveness, and high production efficiency, making it increasingly preferred across various industries including packaging, electronics, and medical devices. The demand for thin gauge thermoformed products is propelled by the rising need for lightweight and sustainable packaging solutions, particularly in the food and beverage industry where manufacturers seek to reduce material usage and transportation costs while ensuring product protection and shelf appeal. Additionally, advancements in material technology have led to the development of new thin gauge thermoformable polymers with enhanced properties such as clarity, barrier performance, and recyclability, further expanding the application potential of thin gauge thermoforming. Furthermore, the versatility of thin gauge thermoforming processes allows for the production of intricate and custom-designed parts, catering to the evolving demands of end-users across various sectors. Hence, the convergence of its inherent benefits, technological advancements, and broad application spectrum positions Thin Gauge Thermoforming as the fastest-growing segment within thermoforming Plastic Market.

Food packaging is the largest segment within thermoforming Plastic Market. The large revenue share is attributed to the food packaging industry is driven by the global demand for safe, convenient, and attractive packaging solutions to preserve food freshness, extend shelf life, and ensure hygiene standards. Thermoforming plastics offer a versatile and cost-effective solution for food packaging applications, providing excellent barrier properties against moisture, oxygen, and contaminants while maintaining product integrity. Moreover, the growing trend towards on-the-go consumption and convenience foods has fuelled the demand for single-serve and portion-controlled packaging formats, driving the adoption of thermoformed plastic containers, trays, and cups in the food industry. Additionally, stringent regulations regarding food safety and sustainability have prompted manufacturers to explore recyclable and environmentally friendly packaging materials, further boosting the demand for thermoforming plastics in food packaging applications. Hence, the combination of consumer preferences, regulatory requirements, and the need for innovative packaging solutions solidifies Food Packaging as the largest segment within thermoforming Plastic Market.

By Product

Polymethyl Methacrylate (PMMA)

Bio-degradable polymers

Polyethylene (PE)

Acrylonitrile Butadiene Styrene (ABS)

Poly Vinyl Chloride (PVC)

High Impact Polystyrene (HIPS)

Polystyrene (PS)

Polypropylene (PP)

By Process

Plug assist forming

Thick gauge thermoforming

Thin gauge thermoforming

Vacuum snapback

By Application

Healthcare & medical

Food packaging

Electrical & electronics

Automotive packaging

Construction

Consumer goods & appliancesCountries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Amcor plc

Anchor Packaging Inc

Berry Global Inc

Brentwood Industries Inc

D&W Fine Pack

Dart Container Corp

DISPLAY PACK

Fabri-Kal

Genpak LLC

Greiner Packaging

Huhtamaki Global

Pactiv LLC

Penda

Placon

Sabert Corp

SILGAN HOLDINGS Inc

Silgan Plastics

Sonoco Products Company

Spencer Industries Inc

WINPAK Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Thermoforming Plastic Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Thermoforming Plastic Market Size Outlook, $ Million, 2021 to 2032

3.2 Thermoforming Plastic Market Outlook by Type, $ Million, 2021 to 2032

3.3 Thermoforming Plastic Market Outlook by Product, $ Million, 2021 to 2032

3.4 Thermoforming Plastic Market Outlook by Application, $ Million, 2021 to 2032

3.5 Thermoforming Plastic Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Thermoforming Plastic Industry

4.2 Key Market Trends in Thermoforming Plastic Industry

4.3 Potential Opportunities in Thermoforming Plastic Industry

4.4 Key Challenges in Thermoforming Plastic Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Thermoforming Plastic Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Thermoforming Plastic Market Outlook by Segments

7.1 Thermoforming Plastic Market Outlook by Segments, $ Million, 2021- 2032

By Product

Polymethyl Methacrylate (PMMA)

Bio-degradable polymers

Polyethylene (PE)

Acrylonitrile Butadiene Styrene (ABS)

Poly Vinyl Chloride (PVC)

High Impact Polystyrene (HIPS)

Polystyrene (PS)

Polypropylene (PP)

By Process

Plug assist forming

Thick gauge thermoforming

Thin gauge thermoforming

Vacuum snapback

By Application

Healthcare & medical

Food packaging

Electrical & electronics

Automotive packaging

Construction

Consumer goods & appliances

8 North America Thermoforming Plastic Market Analysis and Outlook To 2032

8.1 Introduction to North America Thermoforming Plastic Markets in 2024

8.2 North America Thermoforming Plastic Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Thermoforming Plastic Market size Outlook by Segments, 2021-2032

By Product

Polymethyl Methacrylate (PMMA)

Bio-degradable polymers

Polyethylene (PE)

Acrylonitrile Butadiene Styrene (ABS)

Poly Vinyl Chloride (PVC)

High Impact Polystyrene (HIPS)

Polystyrene (PS)

Polypropylene (PP)

By Process

Plug assist forming

Thick gauge thermoforming

Thin gauge thermoforming

Vacuum snapback

By Application

Healthcare & medical

Food packaging

Electrical & electronics

Automotive packaging

Construction

Consumer goods & appliances

9 Europe Thermoforming Plastic Market Analysis and Outlook To 2032

9.1 Introduction to Europe Thermoforming Plastic Markets in 2024

9.2 Europe Thermoforming Plastic Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Thermoforming Plastic Market Size Outlook by Segments, 2021-2032

By Product

Polymethyl Methacrylate (PMMA)

Bio-degradable polymers

Polyethylene (PE)

Acrylonitrile Butadiene Styrene (ABS)

Poly Vinyl Chloride (PVC)

High Impact Polystyrene (HIPS)

Polystyrene (PS)

Polypropylene (PP)

By Process

Plug assist forming

Thick gauge thermoforming

Thin gauge thermoforming

Vacuum snapback

By Application

Healthcare & medical

Food packaging

Electrical & electronics

Automotive packaging

Construction

Consumer goods & appliances

10 Asia Pacific Thermoforming Plastic Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Thermoforming Plastic Markets in 2024

10.2 Asia Pacific Thermoforming Plastic Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Thermoforming Plastic Market size Outlook by Segments, 2021-2032

By Product

Polymethyl Methacrylate (PMMA)

Bio-degradable polymers

Polyethylene (PE)

Acrylonitrile Butadiene Styrene (ABS)

Poly Vinyl Chloride (PVC)

High Impact Polystyrene (HIPS)

Polystyrene (PS)

Polypropylene (PP)

By Process

Plug assist forming

Thick gauge thermoforming

Thin gauge thermoforming

Vacuum snapback

By Application

Healthcare & medical

Food packaging

Electrical & electronics

Automotive packaging

Construction

Consumer goods & appliances

11 South America Thermoforming Plastic Market Analysis and Outlook To 2032

11.1 Introduction to South America Thermoforming Plastic Markets in 2024

11.2 South America Thermoforming Plastic Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Thermoforming Plastic Market size Outlook by Segments, 2021-2032

By Product

Polymethyl Methacrylate (PMMA)

Bio-degradable polymers

Polyethylene (PE)

Acrylonitrile Butadiene Styrene (ABS)

Poly Vinyl Chloride (PVC)

High Impact Polystyrene (HIPS)

Polystyrene (PS)

Polypropylene (PP)

By Process

Plug assist forming

Thick gauge thermoforming

Thin gauge thermoforming

Vacuum snapback

By Application

Healthcare & medical

Food packaging

Electrical & electronics

Automotive packaging

Construction

Consumer goods & appliances

12 Middle East and Africa Thermoforming Plastic Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Thermoforming Plastic Markets in 2024

12.2 Middle East and Africa Thermoforming Plastic Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Thermoforming Plastic Market size Outlook by Segments, 2021-2032

By Product

Polymethyl Methacrylate (PMMA)

Bio-degradable polymers

Polyethylene (PE)

Acrylonitrile Butadiene Styrene (ABS)

Poly Vinyl Chloride (PVC)

High Impact Polystyrene (HIPS)

Polystyrene (PS)

Polypropylene (PP)

By Process

Plug assist forming

Thick gauge thermoforming

Thin gauge thermoforming

Vacuum snapback

By Application

Healthcare & medical

Food packaging

Electrical & electronics

Automotive packaging

Construction

Consumer goods & appliances

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Amcor plc

Anchor Packaging Inc

Berry Global Inc

Brentwood Industries Inc

D&W Fine Pack

Dart Container Corp

DISPLAY PACK

Fabri-Kal

Genpak LLC

Greiner Packaging

Huhtamaki Global

Pactiv LLC

Penda

Placon

Sabert Corp

SILGAN HOLDINGS Inc

Silgan Plastics

Sonoco Products Company

Spencer Industries Inc

WINPAK Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Polymethyl Methacrylate (PMMA)

Bio-degradable polymers

Polyethylene (PE)

Acrylonitrile Butadiene Styrene (ABS)

Poly Vinyl Chloride (PVC)

High Impact Polystyrene (HIPS)

Polystyrene (PS)

Polypropylene (PP)

By Process

Plug assist forming

Thick gauge thermoforming

Thin gauge thermoforming

Vacuum snapback

By Application

Healthcare & medical

Food packaging

Electrical & electronics

Automotive packaging

Construction

Consumer goods & appliances

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Thermoforming Plastic Market Size is valued at $42.1 Billion in 2024 and is forecast to register a growth rate (CAGR) of 5.3% to reach $63.6 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Amcor plc, Anchor Packaging Inc, Berry Global Inc, Brentwood Industries Inc, D&W Fine Pack, Dart Container Corp, DISPLAY PACK, Fabri-Kal, Genpak LLC, Greiner Packaging, Huhtamaki Global, Pactiv LLC, Penda, Placon, Sabert Corp, SILGAN HOLDINGS Inc, Silgan Plastics, Sonoco Products Company, Spencer Industries Inc, WINPAK Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume