The global Thermally Conductive Plastics Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Polyamide, Polycarbonate, PPS, PBT, PEI, Polysulfones, Others), By End-User (Electrical & electronics, Automotive, Industrial, Healthcare, Aerospace, Telecommunications, Others).

Thermally conductive plastics, engineered polymers infused with thermally conductive fillers, to revolutionize heat management solutions across industries in 2024. These advanced materials offer the combined benefits of traditional plastics and efficient heat transfer, making them ideal for applications such as electronic enclosures, LED lighting, automotive components, and consumer electronics. By incorporating fillers like ceramics, metals, or carbon fibers into polymer matrices, thermally conductive plastics enable effective heat dissipation, reducing the risk of overheating and enhancing the performance and reliability of devices. With their lightweight nature, design flexibility, and ability to replace metal heatsinks and other bulky cooling components, thermally conductive plastics are driving innovations in thermal management, contributing to the development of more compact, energy-efficient, and high-performance products.

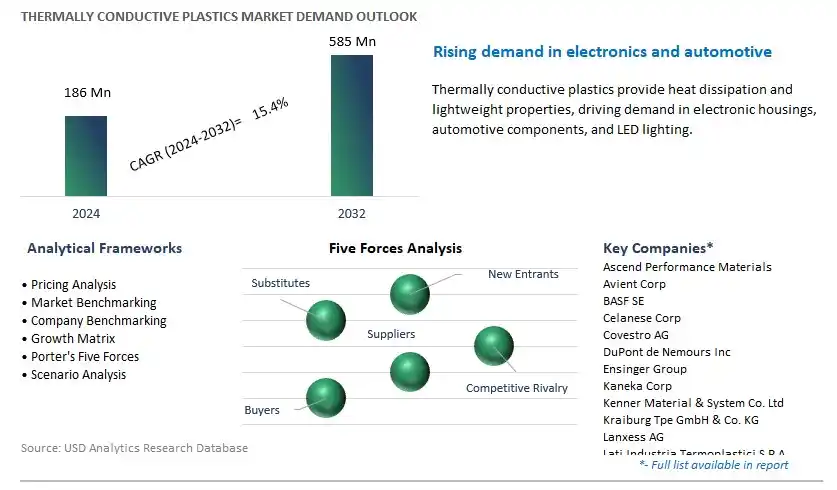

The market report analyses the leading companies in the industry including Ascend Performance Materials, Avient Corp, BASF SE, Celanese Corp, Covestro AG, DuPont de Nemours Inc, Ensinger Group, Kaneka Corp, Kenner Material & System Co. Ltd, Kraiburg Tpe GmbH & Co. KG, Lanxess AG, Lati Industria Termoplastici S.P.A., Lehmann&Voss&Co., Lotte Chemical, Mitsubishi Engineering-Plastics Corp, ROYAL DSM N.V., SABIC, Sumitomo Bakelite Co. Ltd, Toray Industries Inc, Ugent Tech Sdn Bhd., Witcom Engineering Plastics BV, Xiamen Keyuan Plastic Co. Ltd, and others.

A significant trend in the thermally conductive plastics market is the increased demand for lightweight and heat-resistant materials across various industries. As industries such as automotive, aerospace, electronics, and consumer goods seek to reduce weight, improve energy efficiency, and enhance thermal management capabilities, there is a growing preference for thermally conductive plastics. These materials offer the advantage of being lightweight, easy to mold into complex shapes, and capable of efficiently dissipating heat from electronic components and power systems. With the rising demand for electric vehicles, high-performance electronics, and advanced manufacturing technologies, thermally conductive plastics are increasingly being used in applications such as heat sinks, LED lighting, automotive under-the-hood components, and industrial machinery. As industries continue to prioritize lightweighting and thermal management, the demand for thermally conductive plastics is expected to increase, driving market growth and innovation.

The primary driver for the thermally conductive plastics market is technological advancements in material science and manufacturing processes. With ongoing research and development efforts, manufacturers are continuously improving the thermal conductivity, mechanical properties, and processability of thermally conductive plastics. Advancements in polymer chemistry, nano-additive technologies, and compounding techniques have led to the development of plastics with enhanced thermal conductivity while maintaining other desirable properties such as electrical insulation, flame retardancy, and chemical resistance. Additionally, innovations in injection molding, extrusion, and additive manufacturing processes have enabled the production of thermally conductive plastic components with complex geometries and tight tolerances, allowing for greater design flexibility and cost-effectiveness. As industries demand materials that can meet stringent thermal management requirements without compromising on performance or manufacturability, the development of high-performance thermally conductive plastics presents opportunities for manufacturers to gain a competitive edge in the market.

A significant opportunity for the thermally conductive plastics market lies in the expansion into emerging applications and industries. While thermally conductive plastics are already widely used in automotive, electronics, and industrial sectors, there are opportunities to explore new applications and market segments where thermal management is a critical requirement. This includes emerging technologies such as 5G telecommunications, Internet of Things (IoT) devices, renewable energy systems, and medical devices, where efficient thermal management is essential for maintaining device performance, reliability, and longevity. Additionally, there are opportunities to expand into industries such as aerospace, defense, and consumer goods, where lightweighting and thermal management are key considerations in product design. By leveraging their expertise in material science, engineering, and application development, manufacturers of thermally conductive plastics can identify unmet needs, develop innovative solutions, and capitalize on opportunities to penetrate new markets and gain market share. As industries continue to evolve and innovate, the expansion into emerging applications presents opportunities for growth, diversification, and market expansion in the thermally conductive plastics market.

Polycarbonate is the largest segment within thermally Conductive Plastics market. polycarbonate possesses remarkable thermal conductivity properties, making it an ideal choice for applications requiring efficient heat dissipation. Its ability to maintain structural integrity at high temperatures further enhances its suitability for demanding environments, such as automotive electronics and electrical enclosures. Moreover, the widespread use of polycarbonate in industries such as electronics, automotive, and aerospace has significantly contributed to its market growth. Its versatility, impact resistance, and flame-retardant properties make it a preferred material for various applications. Additionally, ongoing research and development efforts aimed at enhancing thermal conductivity of polycarbonate are expected to further propel its market growth in the foreseeable future. Thus, the combination of its intrinsic properties, broad application spectrum, and ongoing innovations solidifies polycarbonate's position as the largest segment in thermally Conductive Plastics market.

The Automotive segment stands out as the fastest-growing segment within thermally Conductive Plastics market. This accelerated growth can be attributed to the automotive industry is undergoing a significant transformation driven by the increasing adoption of electric vehicles (EVs) and the integration of advanced electronic systems for safety, connectivity, and autonomous driving features. These technological advancements have led to higher power densities and increased heat generation within automotive components, necessitating efficient thermal management solutions. Thermally conductive plastics offer a compelling alternative to traditional materials in automotive applications due to their lightweight nature, design flexibility, and superior thermal conductivity properties. Additionally, stringent regulatory requirements regarding emissions and fuel efficiency are pushing automakers to adopt lightweight materials that contribute to overall vehicle efficiency. As automotive manufacturers strive to enhance vehicle performance, range, and reliability, the demand for thermally conductive plastics in the automotive sector is expected to witness significant growth in the coming years. Moreover, ongoing innovations aimed at improving thermal conductivity and mechanical properties of these materials are to further fuel their adoption in automotive applications. Hence, the convergence of technological advancements, regulatory pressures, and the pursuit of automotive efficiency positions the Automotive segment as the fastest-growing segment within thermally Conductive Plastics market.

By Type

Polyamide

Polycarbonate

PPS

PBT

PEI

Polysulfones

Others

By End-User

Electrical & electronics

Automotive

Industrial

Healthcare

Aerospace

Telecommunications

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Ascend Performance Materials

Avient Corp

BASF SE

Celanese Corp

Covestro AG

DuPont de Nemours Inc

Ensinger Group

Kaneka Corp

Kenner Material & System Co. Ltd

Kraiburg Tpe GmbH & Co. KG

Lanxess AG

Lati Industria Termoplastici S.P.A.

Lehmann&Voss&Co.

Lotte Chemical

Mitsubishi Engineering-Plastics Corp

ROYAL DSM N.V.

SABIC

Sumitomo Bakelite Co. Ltd

Toray Industries Inc

Ugent Tech Sdn Bhd.

Witcom Engineering Plastics BV

Xiamen Keyuan Plastic Co. Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Thermally Conductive Plastics Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Thermally Conductive Plastics Market Size Outlook, $ Million, 2021 to 2032

3.2 Thermally Conductive Plastics Market Outlook by Type, $ Million, 2021 to 2032

3.3 Thermally Conductive Plastics Market Outlook by Product, $ Million, 2021 to 2032

3.4 Thermally Conductive Plastics Market Outlook by Application, $ Million, 2021 to 2032

3.5 Thermally Conductive Plastics Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Thermally Conductive Plastics Industry

4.2 Key Market Trends in Thermally Conductive Plastics Industry

4.3 Potential Opportunities in Thermally Conductive Plastics Industry

4.4 Key Challenges in Thermally Conductive Plastics Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Thermally Conductive Plastics Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Thermally Conductive Plastics Market Outlook by Segments

7.1 Thermally Conductive Plastics Market Outlook by Segments, $ Million, 2021- 2032

By Type

Polyamide

Polycarbonate

PPS

PBT

PEI

Polysulfones

Others

By End-User

Electrical & electronics

Automotive

Industrial

Healthcare

Aerospace

Telecommunications

Others

8 North America Thermally Conductive Plastics Market Analysis and Outlook To 2032

8.1 Introduction to North America Thermally Conductive Plastics Markets in 2024

8.2 North America Thermally Conductive Plastics Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Thermally Conductive Plastics Market size Outlook by Segments, 2021-2032

By Type

Polyamide

Polycarbonate

PPS

PBT

PEI

Polysulfones

Others

By End-User

Electrical & electronics

Automotive

Industrial

Healthcare

Aerospace

Telecommunications

Others

9 Europe Thermally Conductive Plastics Market Analysis and Outlook To 2032

9.1 Introduction to Europe Thermally Conductive Plastics Markets in 2024

9.2 Europe Thermally Conductive Plastics Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Thermally Conductive Plastics Market Size Outlook by Segments, 2021-2032

By Type

Polyamide

Polycarbonate

PPS

PBT

PEI

Polysulfones

Others

By End-User

Electrical & electronics

Automotive

Industrial

Healthcare

Aerospace

Telecommunications

Others

10 Asia Pacific Thermally Conductive Plastics Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Thermally Conductive Plastics Markets in 2024

10.2 Asia Pacific Thermally Conductive Plastics Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Thermally Conductive Plastics Market size Outlook by Segments, 2021-2032

By Type

Polyamide

Polycarbonate

PPS

PBT

PEI

Polysulfones

Others

By End-User

Electrical & electronics

Automotive

Industrial

Healthcare

Aerospace

Telecommunications

Others

11 South America Thermally Conductive Plastics Market Analysis and Outlook To 2032

11.1 Introduction to South America Thermally Conductive Plastics Markets in 2024

11.2 South America Thermally Conductive Plastics Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Thermally Conductive Plastics Market size Outlook by Segments, 2021-2032

By Type

Polyamide

Polycarbonate

PPS

PBT

PEI

Polysulfones

Others

By End-User

Electrical & electronics

Automotive

Industrial

Healthcare

Aerospace

Telecommunications

Others

12 Middle East and Africa Thermally Conductive Plastics Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Thermally Conductive Plastics Markets in 2024

12.2 Middle East and Africa Thermally Conductive Plastics Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Thermally Conductive Plastics Market size Outlook by Segments, 2021-2032

By Type

Polyamide

Polycarbonate

PPS

PBT

PEI

Polysulfones

Others

By End-User

Electrical & electronics

Automotive

Industrial

Healthcare

Aerospace

Telecommunications

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Ascend Performance Materials

Avient Corp

BASF SE

Celanese Corp

Covestro AG

DuPont de Nemours Inc

Ensinger Group

Kaneka Corp

Kenner Material & System Co. Ltd

Kraiburg Tpe GmbH & Co. KG

Lanxess AG

Lati Industria Termoplastici S.P.A.

Lehmann&Voss&Co.

Lotte Chemical

Mitsubishi Engineering-Plastics Corp

ROYAL DSM N.V.

SABIC

Sumitomo Bakelite Co. Ltd

Toray Industries Inc

Ugent Tech Sdn Bhd.

Witcom Engineering Plastics BV

Xiamen Keyuan Plastic Co. Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Polyamide

Polycarbonate

PPS

PBT

PEI

Polysulfones

Others

By End-User

Electrical & electronics

Automotive

Industrial

Healthcare

Aerospace

Telecommunications

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Thermally Conductive Plastics Market Size is valued at $186 Million in 2024 and is forecast to register a growth rate (CAGR) of 15.4% to reach $585 Million by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Ascend Performance Materials, Avient Corp, BASF SE, Celanese Corp, Covestro AG, DuPont de Nemours Inc, Ensinger Group, Kaneka Corp, Kenner Material & System Co. Ltd, Kraiburg Tpe GmbH & Co. KG, Lanxess AG, Lati Industria Termoplastici S.P.A., Lehmann&Voss&Co., Lotte Chemical, Mitsubishi Engineering-Plastics Corp, ROYAL DSM N.V., SABIC, Sumitomo Bakelite Co. Ltd, Toray Industries Inc, Ugent Tech Sdn Bhd., Witcom Engineering Plastics BV, Xiamen Keyuan Plastic Co. Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume