The global Thermal Management Solutions Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Form (Aqueous Form, Non-Aqueous form, Gaseous Form), By Type (Alkyl Benzenes, Mineral Oils, Synthetic Fluids, Silicon Polymer, Glycol, Water, Steam, Molten Salts, Others), By Temperature (High Temperature, Low Temperature), By Package (Drums, Bulk Containers), By End-User (Energy & Power, Chemical & Petrochemical, Plastic & Fiber, Oil & Gas, HVAC, Pharmaceuticals, Automotive, Food & Beverage, Data Center, Others).

Thermal management solutions remain critical for optimizing the performance, reliability, and longevity of electronic devices, power systems, and industrial equipment in 2024. These solutions encompass a range of techniques and technologies aimed at controlling temperature levels, dissipating heat, and preventing thermal-induced failures. Thermal management solutions include passive cooling methods such as heat sinks, thermal pads, and natural convection, as well as active cooling methods such as fans, liquid cooling systems, and thermoelectric coolers. Additionally, advanced thermal management techniques such as phase change materials, vapor chambers, and microfluidic cooling enable precise temperature control and thermal stability in demanding applications. With the proliferation of high-power electronics, electric vehicles, and data centers, effective thermal management solutions are essential for mitigating thermal challenges, improving energy efficiency, and ensuring the reliability of critical systems and components.

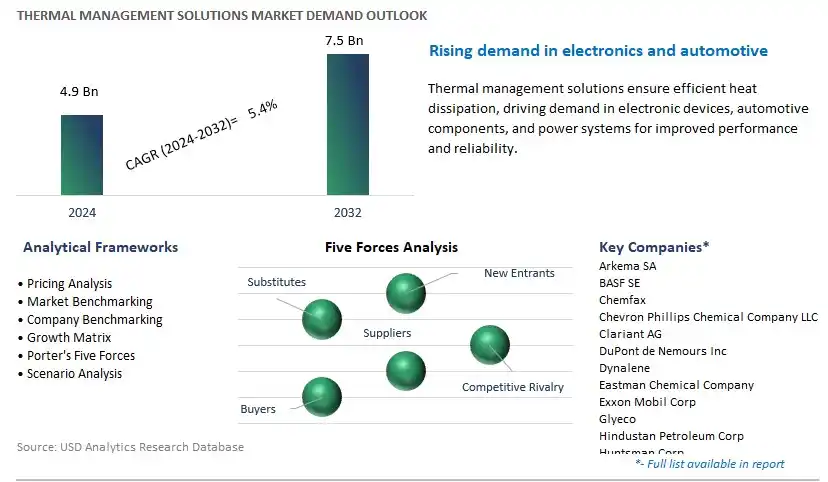

The market report analyses the leading companies in the industry including Arkema SA, BASF SE, Chemfax, Chevron Phillips Chemical Company LLC, Clariant AG, DuPont de Nemours Inc, Dynalene, Eastman Chemical Company, Exxon Mobil Corp, Glyeco, Hindustan Petroleum Corp, Huntsman Corp, Lanxess AG, Paratherm, Petro-Canada, Phillips 66 Company, Radco Industries, Royal Dutch Shell plc, The Dow Chemical Company, Wacker Chemie AG, and others.

A significant trend in the thermal management solutions market is the rising demand for electric vehicles (EVs) and renewable energy systems. As the world transitions towards sustainable transportation and energy sources, there is a growing need for effective thermal management solutions to optimize the performance and longevity of EV batteries, power electronics, and charging infrastructure. Additionally, renewable energy systems such as solar panels and wind turbines require efficient thermal management to enhance energy conversion efficiency and reliability. The increasing adoption of EVs and renewable energy systems is driving the demand for thermal management solutions that offer superior heat dissipation, thermal insulation, and temperature control capabilities, positioning the market for significant growth and innovation.

The primary driver for the thermal management solutions market is technological advancements in the electronics and semiconductor industries. With the proliferation of high-performance computing, 5G telecommunications, artificial intelligence (AI), and Internet of Things (IoT) devices, there is a growing need for thermal management solutions that can effectively dissipate heat generated by densely packed electronic components. Technological advancements such as miniaturization, increased power density, and higher operating frequencies have intensified thermal management challenges, driving the demand for innovative solutions. Additionally, advancements in materials science, nanotechnology, and manufacturing processes have enabled the development of thermal management solutions with higher thermal conductivity, lower thermal resistance, and improved reliability. As industries continue to push the boundaries of electronic performance, the demand for advanced thermal management solutions is expected to grow, creating opportunities for manufacturers and suppliers in the market.

A significant opportunity for the thermal management solutions market lies in the integration of thermal management technologies in smart buildings and smart cities. With the advent of smart building automation systems, energy management platforms, and IoT-enabled devices, there is an opportunity to deploy thermal management solutions that enhance energy efficiency, occupant comfort, and building performance. Thermal management technologies such as phase change materials (PCMs), thermoelectric coolers, and active cooling systems can be integrated into building HVAC (heating, ventilation, and air conditioning) systems, data center infrastructure, and urban infrastructure to optimize temperature control, reduce energy consumption, and mitigate the urban heat island effect. Additionally, thermal management solutions can play a crucial role in enabling smart city initiatives such as intelligent transportation systems, energy-efficient lighting, and environmental monitoring by ensuring the reliability and performance of critical infrastructure components. By collaborating with building developers, city planners, and technology integrators, thermal management solution providers can capitalize on opportunities to deploy innovative solutions that contribute to the sustainability, resilience, and livability of smart buildings and smart cities. As cities and buildings become increasingly interconnected and digitally enabled, the integration of thermal management solutions presents opportunities for growth, differentiation, and market leadership in the thermal management solutions industry.

In thermal Management Solutions Market, the Non-Aqueous Form segment is the largest and most significant player. Non-aqueous forms of thermal management solutions, such as thermal greases, pastes, and phase change materials, offer efficient heat transfer capabilities and excellent thermal conductivity properties. They are widely used in electronic devices, automotive applications, and industrial equipment to dissipate heat generated by electronic components and machinery. Non-aqueous thermal management solutions are preferred for their stability across a wide range of operating temperatures, ensuring consistent performance in diverse environments. Additionally, these solutions provide reliable thermal interface materials for applications where water ingress or moisture sensitivity is a concern. The Non-Aqueous Form segment continues to witness steady growth due to the increasing demand for high-performance thermal management solutions in electronics, automotive, aerospace, and other industries. With ongoing advancements in material science and manufacturing technologies, the Non-Aqueous Form segment is expected to maintain its leadership position in thermal Management Solutions Market.

Among the diverse types of thermal management solutions, the Silicon Polymer segment stands out as the fastest-growing player in the market. Silicon polymers offer exceptional thermal conductivity, stability, and versatility, making them ideal for a wide range of applications in various industries. They are widely used in electronic devices, automotive cooling systems, LED lighting, and power electronics for efficient heat dissipation and thermal management. Silicon polymers exhibit excellent thermal stability over a broad temperature range, ensuring reliable performance in demanding environments. Moreover, they possess good chemical resistance, electrical insulation properties, and compatibility with diverse materials, further enhancing their suitability for thermal management applications. With the increasing demand for high-performance thermal management solutions to address the heat dissipation challenges in modern electronics and industrial systems, the Silicon Polymer segment is experiencing rapid growth. As industries continue to prioritize energy efficiency, reliability, and miniaturization of electronic devices, the demand for silicon polymer-based thermal management solutions is expected to surge, driving the growth of this segment in thermal Management Solutions Market.

In thermal Management Solutions Market, the Low Temperature segment is the largest player, primarily due to its wide-ranging applications and extensive adoption across various industries. This segment encompasses solutions designed to manage heat in systems operating at relatively lower temperatures, typically below 100°C. Low-temperature thermal management solutions find extensive usage in industries such as electronics, automotive, aerospace, and HVAC, where efficient heat dissipation is critical for optimal performance and longevity of components. These solutions include a diverse range of materials and technologies, such as heat sinks, thermal interface materials, phase change materials, and liquid cooling systems, tailored to meet the specific requirements of different applications. With the growing demand for electronics miniaturization, energy efficiency, and thermal reliability, the need for effective low-temperature thermal management solutions continues to rise across industries. As a result, the Low Temperature segment maintains its dominance in thermal Management Solutions Market, driven by its indispensable role in addressing heat dissipation challenges and enhancing the performance of various systems and devices.

Within thermal Management Solutions Market, the Bulk Containers segment is the fastest-growing player. Bulk containers offer significant advantages in terms of cost-effectiveness, efficiency, and sustainability, making them increasingly preferred across industries for thermal management applications. These containers are typically designed to store and transport large volumes of thermal management solutions, such as coolants, heat transfer fluids, and thermal oils, in a safe and convenient manner. The growing demand for bulk containers can be attributed to the expanding adoption of thermal management solutions in diverse sectors, including manufacturing, chemical processing, automotive, and energy. Moreover, the emphasis on sustainability and environmental stewardship has led to a shift towards bulk packaging solutions, as they minimize packaging waste and reduce the carbon footprint associated with transportation and disposal. As industries strive for operational efficiency and cost savings, the Bulk Containers segment is witnessing rapid growth, fuelled by its ability to meet the evolving needs of the market while ensuring reliability, scalability, and sustainability in thermal management practices.

By Form

Aqueous Form

Non-Aqueous form

Gaseous Form

By Type

Alkyl Benzenes

Mineral Oils

Synthetic Fluids

Silicon Polymer

Glycol

Water

Steam

Molten Salts

Others

By Temperature

High Temperature

Low Temperature

By Package

Drums

Bulk Containers

By End-User

Energy & Power

-Non-Renewable Energy

-Renewable Energy

Chemical & Petrochemical

Plastic & Fiber

Oil & Gas

HVAC

Pharmaceuticals

Automotive

Food & Beverage

Data Center

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Arkema SA

BASF SE

Chemfax

Chevron Phillips Chemical Company LLC

Clariant AG

DuPont de Nemours Inc

Dynalene

Eastman Chemical Company

Exxon Mobil Corp

Glyeco

Hindustan Petroleum Corp

Huntsman Corp

Lanxess AG

Paratherm

Petro-Canada

Phillips 66 Company

Radco Industries

Royal Dutch Shell plc

The Dow Chemical Company

Wacker Chemie AG

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Thermal Management Solutions Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Thermal Management Solutions Market Size Outlook, $ Million, 2021 to 2032

3.2 Thermal Management Solutions Market Outlook by Type, $ Million, 2021 to 2032

3.3 Thermal Management Solutions Market Outlook by Product, $ Million, 2021 to 2032

3.4 Thermal Management Solutions Market Outlook by Application, $ Million, 2021 to 2032

3.5 Thermal Management Solutions Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Thermal Management Solutions Industry

4.2 Key Market Trends in Thermal Management Solutions Industry

4.3 Potential Opportunities in Thermal Management Solutions Industry

4.4 Key Challenges in Thermal Management Solutions Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Thermal Management Solutions Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Thermal Management Solutions Market Outlook by Segments

7.1 Thermal Management Solutions Market Outlook by Segments, $ Million, 2021- 2032

By Form

Aqueous Form

Non-Aqueous form

Gaseous Form

By Type

Alkyl Benzenes

Mineral Oils

Synthetic Fluids

Silicon Polymer

Glycol

Water

Steam

Molten Salts

Others

By Temperature

High Temperature

Low Temperature

By Package

Drums

Bulk Containers

By End-User

Energy & Power

-Non-Renewable Energy

-Renewable Energy

Chemical & Petrochemical

Plastic & Fiber

Oil & Gas

HVAC

Pharmaceuticals

Automotive

Food & Beverage

Data Center

Others

8 North America Thermal Management Solutions Market Analysis and Outlook To 2032

8.1 Introduction to North America Thermal Management Solutions Markets in 2024

8.2 North America Thermal Management Solutions Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Thermal Management Solutions Market size Outlook by Segments, 2021-2032

By Form

Aqueous Form

Non-Aqueous form

Gaseous Form

By Type

Alkyl Benzenes

Mineral Oils

Synthetic Fluids

Silicon Polymer

Glycol

Water

Steam

Molten Salts

Others

By Temperature

High Temperature

Low Temperature

By Package

Drums

Bulk Containers

By End-User

Energy & Power

-Non-Renewable Energy

-Renewable Energy

Chemical & Petrochemical

Plastic & Fiber

Oil & Gas

HVAC

Pharmaceuticals

Automotive

Food & Beverage

Data Center

Others

9 Europe Thermal Management Solutions Market Analysis and Outlook To 2032

9.1 Introduction to Europe Thermal Management Solutions Markets in 2024

9.2 Europe Thermal Management Solutions Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Thermal Management Solutions Market Size Outlook by Segments, 2021-2032

By Form

Aqueous Form

Non-Aqueous form

Gaseous Form

By Type

Alkyl Benzenes

Mineral Oils

Synthetic Fluids

Silicon Polymer

Glycol

Water

Steam

Molten Salts

Others

By Temperature

High Temperature

Low Temperature

By Package

Drums

Bulk Containers

By End-User

Energy & Power

-Non-Renewable Energy

-Renewable Energy

Chemical & Petrochemical

Plastic & Fiber

Oil & Gas

HVAC

Pharmaceuticals

Automotive

Food & Beverage

Data Center

Others

10 Asia Pacific Thermal Management Solutions Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Thermal Management Solutions Markets in 2024

10.2 Asia Pacific Thermal Management Solutions Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Thermal Management Solutions Market size Outlook by Segments, 2021-2032

By Form

Aqueous Form

Non-Aqueous form

Gaseous Form

By Type

Alkyl Benzenes

Mineral Oils

Synthetic Fluids

Silicon Polymer

Glycol

Water

Steam

Molten Salts

Others

By Temperature

High Temperature

Low Temperature

By Package

Drums

Bulk Containers

By End-User

Energy & Power

-Non-Renewable Energy

-Renewable Energy

Chemical & Petrochemical

Plastic & Fiber

Oil & Gas

HVAC

Pharmaceuticals

Automotive

Food & Beverage

Data Center

Others

11 South America Thermal Management Solutions Market Analysis and Outlook To 2032

11.1 Introduction to South America Thermal Management Solutions Markets in 2024

11.2 South America Thermal Management Solutions Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Thermal Management Solutions Market size Outlook by Segments, 2021-2032

By Form

Aqueous Form

Non-Aqueous form

Gaseous Form

By Type

Alkyl Benzenes

Mineral Oils

Synthetic Fluids

Silicon Polymer

Glycol

Water

Steam

Molten Salts

Others

By Temperature

High Temperature

Low Temperature

By Package

Drums

Bulk Containers

By End-User

Energy & Power

-Non-Renewable Energy

-Renewable Energy

Chemical & Petrochemical

Plastic & Fiber

Oil & Gas

HVAC

Pharmaceuticals

Automotive

Food & Beverage

Data Center

Others

12 Middle East and Africa Thermal Management Solutions Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Thermal Management Solutions Markets in 2024

12.2 Middle East and Africa Thermal Management Solutions Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Thermal Management Solutions Market size Outlook by Segments, 2021-2032

By Form

Aqueous Form

Non-Aqueous form

Gaseous Form

By Type

Alkyl Benzenes

Mineral Oils

Synthetic Fluids

Silicon Polymer

Glycol

Water

Steam

Molten Salts

Others

By Temperature

High Temperature

Low Temperature

By Package

Drums

Bulk Containers

By End-User

Energy & Power

-Non-Renewable Energy

-Renewable Energy

Chemical & Petrochemical

Plastic & Fiber

Oil & Gas

HVAC

Pharmaceuticals

Automotive

Food & Beverage

Data Center

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Arkema SA

BASF SE

Chemfax

Chevron Phillips Chemical Company LLC

Clariant AG

DuPont de Nemours Inc

Dynalene

Eastman Chemical Company

Exxon Mobil Corp

Glyeco

Hindustan Petroleum Corp

Huntsman Corp

Lanxess AG

Paratherm

Petro-Canada

Phillips 66 Company

Radco Industries

Royal Dutch Shell plc

The Dow Chemical Company

Wacker Chemie AG

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Form

Aqueous Form

Non-Aqueous form

Gaseous Form

By Type

Alkyl Benzenes

Mineral Oils

Synthetic Fluids

Silicon Polymer

Glycol

Water

Steam

Molten Salts

Others

By Temperature

High Temperature

Low Temperature

By Package

Drums

Bulk Containers

By End-User

Energy & Power

-Non-Renewable Energy

-Renewable Energy

Chemical & Petrochemical

Plastic & Fiber

Oil & Gas

HVAC

Pharmaceuticals

Automotive

Food & Beverage

Data Center

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Thermal Management Solutions Market Size is valued at $4.9 Billion in 2024 and is forecast to register a growth rate (CAGR) of 5.4% to reach $7.5 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Arkema SA, BASF SE, Chemfax, Chevron Phillips Chemical Company LLC, Clariant AG, DuPont de Nemours Inc, Dynalene, Eastman Chemical Company, Exxon Mobil Corp, Glyeco, Hindustan Petroleum Corp, Huntsman Corp, Lanxess AG, Paratherm, Petro-Canada, Phillips 66 Company, Radco Industries, Royal Dutch Shell plc, The Dow Chemical Company, Wacker Chemie AG

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume