The global Thermal Insulation Material Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Material (Fiberglass, Stone Wool, Foam, Wood Fiber, Others), By Temperature Range (0 to 100 °C, 100 to 500°C, Above 500°C), By End-User (Construction, Automotive, HVAC, Industrial, Others).

Thermal insulation materials remain essential for maintaining temperature control and energy efficiency in buildings, industrial equipment, and transportation systems in 2024. These materials are designed to reduce heat transfer by minimizing conduction, convection, and radiation, thus improving energy efficiency and reducing heating or cooling costs. Thermal insulation materials encompass a wide range of products, including fiberglass, foam insulation, mineral wool, and reflective insulation. These materials are used in applications such as building envelopes, HVAC systems, refrigeration equipment, and pipelines, providing thermal comfort, preventing heat loss or gain, and enhancing environmental sustainability. With increasing awareness of climate change and energy conservation, the demand for high-performance thermal insulation materials s to grow, driving innovations in material science, manufacturing processes, and building design strategies aimed at reducing carbon emissions and improving energy efficiency.

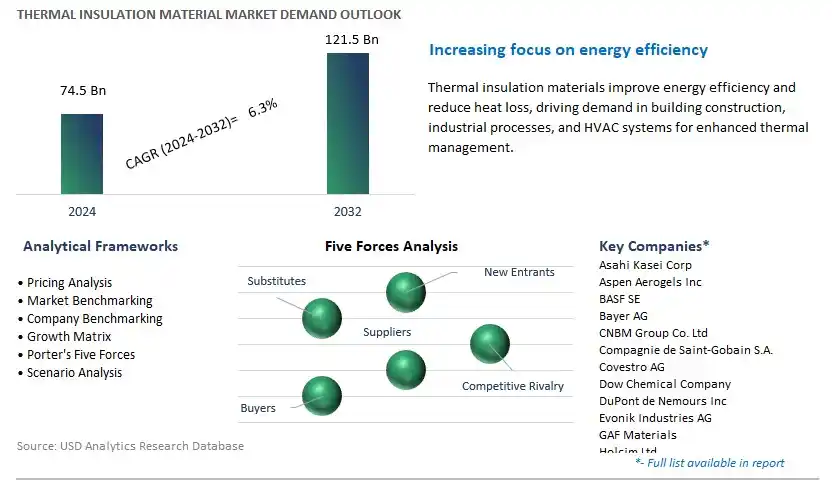

The market report analyses the leading companies in the industry including Asahi Kasei Corp, Aspen Aerogels Inc, BASF SE, Bayer AG, CNBM Group Co. Ltd, Compagnie de Saint-Gobain S.A., Covestro AG, Dow Chemical Company, DuPont de Nemours Inc, Evonik Industries AG, GAF Materials, Holcim Ltd, Huntsman International LLC, Johns Manville, KCC Corp, Kingspan Group, Knauf Insulation, Lloyd Insulations Ltd, Ode Insulation, Owens Corning, Recticel, Rockwool International A/S, Sika AG, and others.

A significant trend in the thermal insulation material market is the growing focus on energy efficiency and sustainability across various industries. With increasing concerns about energy consumption, greenhouse gas emissions, and climate change, there is a rising demand for materials that can effectively reduce heat transfer and improve thermal performance in buildings, industrial processes, and transportation systems. Thermal insulation materials play a crucial role in optimizing energy usage, reducing heat loss or gain, and enhancing indoor comfort, making them essential components in sustainable construction, manufacturing, and infrastructure projects. As governments implement energy efficiency regulations, building codes, and sustainability initiatives, and businesses seek to reduce operational costs and environmental impact, the demand for thermal insulation materials that offer high performance, durability, and environmental responsibility is expected to continue growing.

The primary driver for the thermal insulation material market is regulatory mandates and building energy codes aimed at improving energy efficiency and reducing carbon emissions. Governments around the world are enacting policies and standards that require buildings, industrial facilities, and transportation vehicles to meet minimum thermal insulation requirements to conserve energy and mitigate climate change. Building energy codes specify minimum insulation levels for walls, roofs, floors, and windows, driving demand for thermal insulation materials in new construction and renovation projects. Additionally, regulatory initiatives such as energy efficiency programs, tax incentives, and subsidies incentivize businesses and homeowners to invest in energy-saving measures, including thermal insulation upgrades. As regulatory pressures intensify and stakeholders seek to comply with sustainability goals and mandates, the demand for thermal insulation materials is expected to increase, driven by the need for products that offer compliance, performance, and cost-effectiveness.

A significant opportunity for the thermal insulation material market lies in the development of advanced insulation technologies and solutions that address emerging challenges and requirements. Manufacturers have the opportunity to innovate and invest in research and development to create new insulation materials that offer superior thermal performance, durability, and environmental sustainability. This includes the development of aerogels, vacuum insulation panels (VIPs), phase change materials (PCMs), and other advanced materials that offer high thermal resistance, thin profiles, and compatibility with sustainable building practices. Additionally, there is an opportunity to provide integrated insulation solutions that combine thermal insulation materials with other building components such as structural panels, air barriers, and renewable energy systems to create holistic, energy-efficient building envelopes. By collaborating with architects, engineers, contractors, and building owners, manufacturers can identify market needs, develop innovative products, and capitalize on opportunities to differentiate their offerings in the thermal insulation material market. As industries seek to address energy efficiency challenges and transition towards sustainable practices, the demand for advanced thermal insulation solutions presents opportunities for growth, innovation, and market leadership in the thermal insulation materials industry.

In thermal insulation material market, the Fiberglass Material segment is the largest and most dominant player. Fiberglass insulation is widely recognized for its excellent thermal performance, versatility, and cost-effectiveness. It is composed of fine glass fibers bonded together using a thermosetting resin, creating a lightweight yet durable material that offers superior thermal insulation properties. Fiberglass insulation is highly efficient in reducing heat transfer, providing thermal comfort, and enhancing energy efficiency in buildings, industrial facilities, and transportation vehicles. Additionally, fiberglass insulation is non-combustible, moisture-resistant, and resistant to mold, mildew, and pests, making it suitable for various applications and environments. Moreover, the widespread availability of fiberglass insulation products, coupled with advancements in manufacturing technologies, distribution networks, and installation techniques, further contributes to its dominance in the market. With its proven performance, durability, and widespread use across diverse sectors, the Fiberglass Material segment maintains its leadership position in thermal insulation material market and is expected to continue its strong growth trajectory in the future.

Among the temperature range segments in thermal insulation material market, the Above 500°C Temperature Range segment is the fastest-growing player. Industries such as metallurgy, petrochemical processing, power generation, and aerospace often operate at extremely high temperatures exceeding 500°C, requiring specialized thermal insulation materials capable of withstanding such extreme conditions. The Above 500°C Temperature Range segment encompasses a variety of high-temperature insulation materials such as refractory ceramics, mineral wool, and specialty composites engineered to provide exceptional thermal resistance and stability in extreme heat environments. The increasing demand for energy efficiency, process optimization, and safety regulations drive the adoption of high-temperature insulation materials in these industries to minimize heat loss, improve equipment performance, and ensure operational reliability. Moreover, advancements in material science, manufacturing techniques, and insulation technologies contribute to the development of innovative solutions tailored to the unique requirements of high-temperature applications. With the growing emphasis on industrial efficiency, safety, and sustainability, the Above 500°C Temperature Range segment is expected to continue its rapid growth trajectory and play a significant role in driving the overall expansion of thermal insulation material market.

Within thermal insulation material market, the Construction End-User segment stands out as the largest and most prominent player. In the construction industry, thermal insulation materials play a vital role in enhancing energy efficiency, maintaining indoor comfort, and meeting regulatory requirements for building codes and standards. As energy costs continue to rise and environmental concerns grow, there is a heightened emphasis on constructing energy-efficient buildings with reduced heat loss and improved thermal performance. Thermal insulation materials such as fiberglass, foam, mineral wool, and reflective insulation are extensively utilized in various construction applications, including roofs, walls, floors, and HVAC systems, to minimize heat transfer and optimize energy consumption. Moreover, the increasing trend towards sustainable building practices and green construction further drives the demand for thermal insulation materials in the construction sector. Additionally, government initiatives promoting energy-efficient building practices and offering incentives for green construction projects propel market growth. With its widespread application across residential, commercial, and industrial construction projects, the Construction End-User segment maintains its leadership position in thermal insulation material market and is poised for continued growth in the foreseeable future.

By Material

Fiberglass

Stone Wool

Foam

Wood Fiber

Others

By Temperature Range

0 to 100 °C

100 to 500°C

Above 500°C

By End-User

Construction

Automotive

HVAC

Industrial

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Asahi Kasei Corp

Aspen Aerogels Inc

BASF SE

Bayer AG

CNBM Group Co. Ltd

Compagnie de Saint-Gobain S.A.

Covestro AG

Dow Chemical Company

DuPont de Nemours Inc

Evonik Industries AG

GAF Materials

Holcim Ltd

Huntsman International LLC

Johns Manville

KCC Corp

Kingspan Group

Knauf Insulation

Lloyd Insulations Ltd

Ode Insulation

Owens Corning

Recticel

Rockwool International A/S

Sika AG

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Thermal Insulation Material Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Thermal Insulation Material Market Size Outlook, $ Million, 2021 to 2032

3.2 Thermal Insulation Material Market Outlook by Type, $ Million, 2021 to 2032

3.3 Thermal Insulation Material Market Outlook by Product, $ Million, 2021 to 2032

3.4 Thermal Insulation Material Market Outlook by Application, $ Million, 2021 to 2032

3.5 Thermal Insulation Material Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Thermal Insulation Material Industry

4.2 Key Market Trends in Thermal Insulation Material Industry

4.3 Potential Opportunities in Thermal Insulation Material Industry

4.4 Key Challenges in Thermal Insulation Material Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Thermal Insulation Material Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Thermal Insulation Material Market Outlook by Segments

7.1 Thermal Insulation Material Market Outlook by Segments, $ Million, 2021- 2032

By Material

Fiberglass

Stone Wool

Foam

Wood Fiber

Others

By Temperature Range

0 to 100 °C

100 to 500°C

Above 500°C

By End-User

Construction

Automotive

HVAC

Industrial

Others

8 North America Thermal Insulation Material Market Analysis and Outlook To 2032

8.1 Introduction to North America Thermal Insulation Material Markets in 2024

8.2 North America Thermal Insulation Material Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Thermal Insulation Material Market size Outlook by Segments, 2021-2032

By Material

Fiberglass

Stone Wool

Foam

Wood Fiber

Others

By Temperature Range

0 to 100 °C

100 to 500°C

Above 500°C

By End-User

Construction

Automotive

HVAC

Industrial

Others

9 Europe Thermal Insulation Material Market Analysis and Outlook To 2032

9.1 Introduction to Europe Thermal Insulation Material Markets in 2024

9.2 Europe Thermal Insulation Material Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Thermal Insulation Material Market Size Outlook by Segments, 2021-2032

By Material

Fiberglass

Stone Wool

Foam

Wood Fiber

Others

By Temperature Range

0 to 100 °C

100 to 500°C

Above 500°C

By End-User

Construction

Automotive

HVAC

Industrial

Others

10 Asia Pacific Thermal Insulation Material Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Thermal Insulation Material Markets in 2024

10.2 Asia Pacific Thermal Insulation Material Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Thermal Insulation Material Market size Outlook by Segments, 2021-2032

By Material

Fiberglass

Stone Wool

Foam

Wood Fiber

Others

By Temperature Range

0 to 100 °C

100 to 500°C

Above 500°C

By End-User

Construction

Automotive

HVAC

Industrial

Others

11 South America Thermal Insulation Material Market Analysis and Outlook To 2032

11.1 Introduction to South America Thermal Insulation Material Markets in 2024

11.2 South America Thermal Insulation Material Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Thermal Insulation Material Market size Outlook by Segments, 2021-2032

By Material

Fiberglass

Stone Wool

Foam

Wood Fiber

Others

By Temperature Range

0 to 100 °C

100 to 500°C

Above 500°C

By End-User

Construction

Automotive

HVAC

Industrial

Others

12 Middle East and Africa Thermal Insulation Material Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Thermal Insulation Material Markets in 2024

12.2 Middle East and Africa Thermal Insulation Material Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Thermal Insulation Material Market size Outlook by Segments, 2021-2032

By Material

Fiberglass

Stone Wool

Foam

Wood Fiber

Others

By Temperature Range

0 to 100 °C

100 to 500°C

Above 500°C

By End-User

Construction

Automotive

HVAC

Industrial

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Asahi Kasei Corp

Aspen Aerogels Inc

BASF SE

Bayer AG

CNBM Group Co. Ltd

Compagnie de Saint-Gobain S.A.

Covestro AG

Dow Chemical Company

DuPont de Nemours Inc

Evonik Industries AG

GAF Materials

Holcim Ltd

Huntsman International LLC

Johns Manville

KCC Corp

Kingspan Group

Knauf Insulation

Lloyd Insulations Ltd

Ode Insulation

Owens Corning

Recticel

Rockwool International A/S

Sika AG

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Material

Fiberglass

Stone Wool

Foam

Wood Fiber

Others

By Temperature Range

0 to 100 °C

100 to 500°C

Above 500°C

By End-User

Construction

Automotive

HVAC

Industrial

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Thermal Insulation Material Market Size is valued at $74.5 Billion in 2024 and is forecast to register a growth rate (CAGR) of 6.3% to reach $121.5 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Asahi Kasei Corp, Aspen Aerogels Inc, BASF SE, Bayer AG, CNBM Group Co. Ltd, Compagnie de Saint-Gobain S.A., Covestro AG, Dow Chemical Company, DuPont de Nemours Inc, Evonik Industries AG, GAF Materials, Holcim Ltd, Huntsman International LLC, Johns Manville, KCC Corp, Kingspan Group, Knauf Insulation, Lloyd Insulations Ltd, Ode Insulation, Owens Corning, Recticel, Rockwool International A/S, Sika AG

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume