The global Textile Finishing Chemicals Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Softening Finishes, Repellent Finishes, Wrinkle Free Finishes, Coating Finishes, Mothproofing Finishes, Others), By Process (Pad-Dry Cure Process, Exhaust Dyeing Process, Others), By Application (Clothing Textile, Home Textile, Technical Textile, Others).

Textile finishing chemicals play a crucial role in enhancing the performance, aesthetics, and functionality of textiles in 2024. These chemicals are applied to fabrics after weaving or knitting to impart specific properties such as softness, wrinkle resistance, stain repellency, and flame retardancy. In the textile industry, finishing chemicals encompass a wide range of products, including softeners, wrinkle-free agents, water repellents, antimicrobial agents, and UV protectants. These chemicals are applied through various methods such as padding, spraying, or exhaust processes, depending on the desired properties and fabric characteristics. With increasing emphasis on sustainability and regulatory compliance, textile finishing chemicals are being developed with eco-friendly formulations, free from harmful substances such as formaldehyde and heavy metals. Additionally, innovations in finishing technologies enable the creation of functional textiles with advanced properties such as self-cleaning, moisture management, and odor control, meeting the evolving needs of consumers and industries.

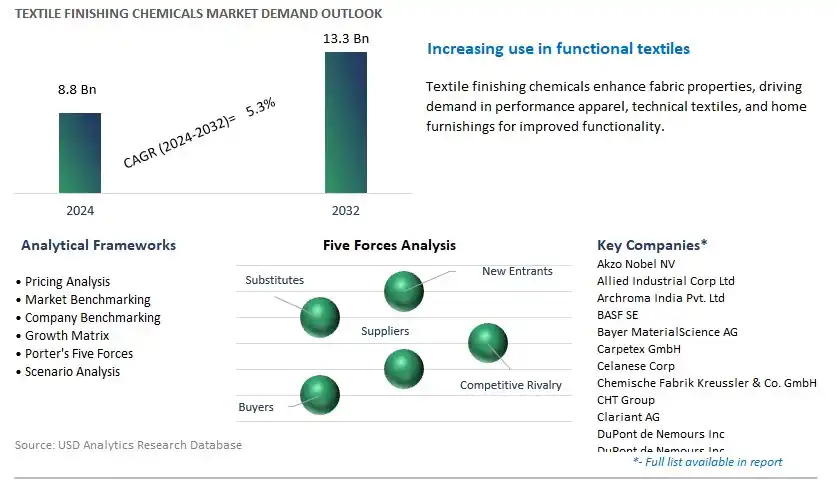

The market report analyses the leading companies in the industry including Akzo Nobel NV, Allied Industrial Corp Ltd, Archroma India Pvt. Ltd, BASF SE, Bayer MaterialScience AG, Carpetex GmbH, Celanese Corp, Chemische Fabrik Kreussler & Co. GmbH, CHT Group, Clariant AG, DuPont de Nemours Inc, DuPont de Nemours Inc, Dystar Singapore Pte. Ltd, Evonik Industries AG, Fineotex Chemical Ltd, Giovanni Bozzetto S.p.A., Hangzhou Chungyo Chem Co. Ltd, Ht Fine Chemicals Co. Ltd, Huntsman Corp, Kemin Industries South Asia Pvt. Ltd, Kiri Industries Ltd, Lanxess AG, Pulcra Chemicals India Pvt. Ltd, Rudolf GmbH, Solvay S.A., Sumitomo Chemical Co. Ltd, TANATEX Chemicals B.V., The Dow Chemical Company, Wacker Chemie AG, Zschimmer & Schwarz Holding GmbH & Co. KG, and others.

A significant trend in the textile finishing chemicals market is the growing demand for functional and sustainable finishing chemicals. With consumers increasingly seeking textiles with enhanced performance properties such as wrinkle resistance, stain repellency, moisture management, and antimicrobial activity, there is a rising demand for finishing chemicals that offer these functionalities while minimizing environmental impact. This trend is driving the development and adoption of eco-friendly finishing chemicals that are free from harmful substances, biodegradable, and compliant with regulatory standards. Additionally, there is a growing interest in multifunctional finishing chemicals that combine multiple properties in a single treatment, reducing the need for multiple processing steps and chemicals. As industries seek to meet consumer demands for performance, comfort, and sustainability, the demand for functional and sustainable textile finishing chemicals is expected to continue growing, driven by the need for chemicals that offer performance, durability, and environmental responsibility.

The primary driver for the textile finishing chemicals market is consumer preferences for performance and comfort in textiles. As consumers become more discerning and value-conscious, they seek textiles that offer not only aesthetic appeal but also functional benefits such as comfort, durability, and ease of care. This drives the demand for finishing chemicals that enhance textile properties and performance, such as softeners for improved hand feel, water repellents for protection against moisture, and UV absorbers for sun protection. Additionally, with increasing awareness of health and hygiene, there is a growing demand for finishing chemicals that provide antimicrobial and odor control properties, particularly in applications such as apparel, home textiles, and healthcare textiles. By addressing consumer preferences for performance and comfort, manufacturers of textile finishing chemicals can capitalize on opportunities to differentiate their products, meet market demand, and drive growth in the industry.

A significant opportunity for the textile finishing chemicals market lies in the development of bio-based and renewable finishing chemicals. With the shift towards sustainable and eco-friendly practices in the textile industry, there is a growing demand for finishing chemicals derived from renewable feedstocks such as plant-based oils, sugars, and cellulose. Bio-based finishing chemicals offer advantages such as reduced environmental impact, biodegradability, and lower carbon footprint compared to conventional petroleum-based chemicals. Additionally, there is an opportunity to develop innovative formulations and processes that utilize bio-based materials to enhance textile properties and functionality while meeting sustainability criteria. By investing in research and development of bio-based finishing chemicals, manufacturers can position themselves as leaders in sustainability, cater to evolving consumer preferences, and tap into new markets for eco-friendly textiles. As industries seek to reduce dependence on fossil fuels and transition towards renewable resources, the demand for bio-based and renewable finishing chemicals presents opportunities for innovation, differentiation, and market growth in the textile finishing chemicals market.

Within the textile finishing chemicals market, the Softening Finishes segment is the largest and most dominant player. Softening finishes are essential additives used in textile manufacturing to impart a soft and smooth feel to fabrics, enhancing their comfort and wearability. These finishes are applied to a wide range of textile products, including apparel, home textiles, and upholstery fabrics. Moreover, softening finishes improve the drape and hand feel of textiles, making them more appealing to consumers. Additionally, advancements in softening finish formulations and application technologies have led to the development of eco-friendly and sustainable options that meet stringent regulatory standards and consumer preferences for environmentally conscious products. Furthermore, the growing demand for soft, luxurious fabrics in the fashion and home furnishing industries drives the adoption of softening finishes, further reinforcing the dominance of the Softening Finishes segment in the textile finishing chemicals market. With their indispensable role in enhancing textile quality and consumer satisfaction, the Softening Finishes segment is expected to maintain its leading position and witness continued growth in the future.

Among the processes in the textile finishing chemicals market, the Exhaust Dyeing Process segment is the fastest-growing player. The exhaust dyeing process involves immersing textile materials in a dye bath containing finishing chemicals, followed by heating and rinsing to fix the dye onto the fabric. This process offers potential advantages, including uniform dye penetration, high color fastness, and the ability to dye large batches of textiles simultaneously. Additionally, the exhaust dyeing process is versatile and can be used with various textile fibers, including cotton, polyester, and blends, making it suitable for a wide range of applications in the apparel, home textiles, and industrial sectors. Moreover, advancements in dyeing machinery and automation technologies have improved process efficiency and reduced water and energy consumption, making exhaust dyeing a cost-effective and environmentally friendly option for textile manufacturers. Furthermore, the growing demand for vibrant and colorfast textiles, coupled with increasing consumer awareness of sustainable dyeing practices, drives the adoption of the exhaust dyeing process and fuels its rapid growth in the textile finishing chemicals market. With its proven performance, versatility, and eco-friendliness, the Exhaust Dyeing Process segment is poised to witness sustained growth and expand its market share in the future.

Within the textile finishing chemicals market, the Clothing Textile segment is the largest and most dominant player. Clothing textiles encompass a wide range of apparel items, including shirts, pants, dresses, and outerwear, which represent a significant portion of the global textile market. Textile finishing chemicals are essential additives used in the manufacturing process of clothing textiles to impart desired properties such as softness, wrinkle resistance, water repellency, and color fastness. Additionally, advancements in textile finishing technologies have led to the development of innovative finishes that enhance the performance, comfort, and aesthetic appeal of clothing textiles. Moreover, the fashion industry's dynamic nature and consumers' ever-changing preferences drive the continuous demand for new and improved textile finishing solutions. Furthermore, the growing global population, urbanization, and rising disposable incomes contribute to the increasing consumption of clothing textiles and, consequently, textile finishing chemicals. With their indispensable role in enhancing textile quality and consumer satisfaction, the Clothing Textile segment is expected to maintain its leading position and witness continued growth in the textile finishing chemicals market.

By Type

Softening Finishes

Repellent Finishes

Wrinkle Free Finishes

Coating Finishes

Mothproofing Finishes

Others

By Process

Pad-Dry Cure Process

Exhaust Dyeing Process

Others

By Application

Clothing Textile

Home Textile

Technical Textile

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Akzo Nobel NV

Allied Industrial Corp Ltd

Archroma India Pvt. Ltd

BASF SE

Bayer MaterialScience AG

Carpetex GmbH

Celanese Corp

Chemische Fabrik Kreussler & Co. GmbH

CHT Group

Clariant AG

DuPont de Nemours Inc

DuPont de Nemours Inc

Dystar Singapore Pte. Ltd

Evonik Industries AG

Fineotex Chemical Ltd

Giovanni Bozzetto S.p.A.

Hangzhou Chungyo Chem Co. Ltd

Ht Fine Chemicals Co. Ltd

Huntsman Corp

Kemin Industries South Asia Pvt. Ltd

Kiri Industries Ltd

Lanxess AG

Pulcra Chemicals India Pvt. Ltd

Rudolf GmbH

Solvay S.A.

Sumitomo Chemical Co. Ltd

TANATEX Chemicals B.V.

The Dow Chemical Company

Wacker Chemie AG

Zschimmer & Schwarz Holding GmbH & Co. KG

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Textile Finishing Chemicals Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Textile Finishing Chemicals Market Size Outlook, $ Million, 2021 to 2032

3.2 Textile Finishing Chemicals Market Outlook by Type, $ Million, 2021 to 2032

3.3 Textile Finishing Chemicals Market Outlook by Product, $ Million, 2021 to 2032

3.4 Textile Finishing Chemicals Market Outlook by Application, $ Million, 2021 to 2032

3.5 Textile Finishing Chemicals Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Textile Finishing Chemicals Industry

4.2 Key Market Trends in Textile Finishing Chemicals Industry

4.3 Potential Opportunities in Textile Finishing Chemicals Industry

4.4 Key Challenges in Textile Finishing Chemicals Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Textile Finishing Chemicals Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Textile Finishing Chemicals Market Outlook by Segments

7.1 Textile Finishing Chemicals Market Outlook by Segments, $ Million, 2021- 2032

By Type

Softening Finishes

Repellent Finishes

Wrinkle Free Finishes

Coating Finishes

Mothproofing Finishes

Others

By Process

Pad-Dry Cure Process

Exhaust Dyeing Process

Others

By Application

Clothing Textile

Home Textile

Technical Textile

Others

8 North America Textile Finishing Chemicals Market Analysis and Outlook To 2032

8.1 Introduction to North America Textile Finishing Chemicals Markets in 2024

8.2 North America Textile Finishing Chemicals Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Textile Finishing Chemicals Market size Outlook by Segments, 2021-2032

By Type

Softening Finishes

Repellent Finishes

Wrinkle Free Finishes

Coating Finishes

Mothproofing Finishes

Others

By Process

Pad-Dry Cure Process

Exhaust Dyeing Process

Others

By Application

Clothing Textile

Home Textile

Technical Textile

Others

9 Europe Textile Finishing Chemicals Market Analysis and Outlook To 2032

9.1 Introduction to Europe Textile Finishing Chemicals Markets in 2024

9.2 Europe Textile Finishing Chemicals Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Textile Finishing Chemicals Market Size Outlook by Segments, 2021-2032

By Type

Softening Finishes

Repellent Finishes

Wrinkle Free Finishes

Coating Finishes

Mothproofing Finishes

Others

By Process

Pad-Dry Cure Process

Exhaust Dyeing Process

Others

By Application

Clothing Textile

Home Textile

Technical Textile

Others

10 Asia Pacific Textile Finishing Chemicals Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Textile Finishing Chemicals Markets in 2024

10.2 Asia Pacific Textile Finishing Chemicals Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Textile Finishing Chemicals Market size Outlook by Segments, 2021-2032

By Type

Softening Finishes

Repellent Finishes

Wrinkle Free Finishes

Coating Finishes

Mothproofing Finishes

Others

By Process

Pad-Dry Cure Process

Exhaust Dyeing Process

Others

By Application

Clothing Textile

Home Textile

Technical Textile

Others

11 South America Textile Finishing Chemicals Market Analysis and Outlook To 2032

11.1 Introduction to South America Textile Finishing Chemicals Markets in 2024

11.2 South America Textile Finishing Chemicals Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Textile Finishing Chemicals Market size Outlook by Segments, 2021-2032

By Type

Softening Finishes

Repellent Finishes

Wrinkle Free Finishes

Coating Finishes

Mothproofing Finishes

Others

By Process

Pad-Dry Cure Process

Exhaust Dyeing Process

Others

By Application

Clothing Textile

Home Textile

Technical Textile

Others

12 Middle East and Africa Textile Finishing Chemicals Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Textile Finishing Chemicals Markets in 2024

12.2 Middle East and Africa Textile Finishing Chemicals Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Textile Finishing Chemicals Market size Outlook by Segments, 2021-2032

By Type

Softening Finishes

Repellent Finishes

Wrinkle Free Finishes

Coating Finishes

Mothproofing Finishes

Others

By Process

Pad-Dry Cure Process

Exhaust Dyeing Process

Others

By Application

Clothing Textile

Home Textile

Technical Textile

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Akzo Nobel NV

Allied Industrial Corp Ltd

Archroma India Pvt. Ltd

BASF SE

Bayer MaterialScience AG

Carpetex GmbH

Celanese Corp

Chemische Fabrik Kreussler & Co. GmbH

CHT Group

Clariant AG

DuPont de Nemours Inc

DuPont de Nemours Inc

Dystar Singapore Pte. Ltd

Evonik Industries AG

Fineotex Chemical Ltd

Giovanni Bozzetto S.p.A.

Hangzhou Chungyo Chem Co. Ltd

Ht Fine Chemicals Co. Ltd

Huntsman Corp

Kemin Industries South Asia Pvt. Ltd

Kiri Industries Ltd

Lanxess AG

Pulcra Chemicals India Pvt. Ltd

Rudolf GmbH

Solvay S.A.

Sumitomo Chemical Co. Ltd

TANATEX Chemicals B.V.

The Dow Chemical Company

Wacker Chemie AG

Zschimmer & Schwarz Holding GmbH & Co. KG

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Softening Finishes

Repellent Finishes

Wrinkle Free Finishes

Coating Finishes

Mothproofing Finishes

Others

By Process

Pad-Dry Cure Process

Exhaust Dyeing Process

Others

By Application

Clothing Textile

Home Textile

Technical Textile

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Textile Finishing Chemicals Market Size is valued at $8.8 Billion in 2024 and is forecast to register a growth rate (CAGR) of 5.3% to reach $13.3 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Akzo Nobel NV, Allied Industrial Corp Ltd, Archroma India Pvt. Ltd, BASF SE, Bayer MaterialScience AG, Carpetex GmbH, Celanese Corp, Chemische Fabrik Kreussler & Co. GmbH, CHT Group, Clariant AG, DuPont de Nemours Inc, DuPont de Nemours Inc, Dystar Singapore Pte. Ltd, Evonik Industries AG, Fineotex Chemical Ltd, Giovanni Bozzetto S.p.A., Hangzhou Chungyo Chem Co. Ltd, Ht Fine Chemicals Co. Ltd, Huntsman Corp, Kemin Industries South Asia Pvt. Ltd, Kiri Industries Ltd, Lanxess AG, Pulcra Chemicals India Pvt. Ltd, Rudolf GmbH, Solvay S.A., Sumitomo Chemical Co. Ltd, TANATEX Chemicals B.V., The Dow Chemical Company, Wacker Chemie AG, Zschimmer & Schwarz Holding GmbH & Co. KG

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume