Innovations in material science, sustainability initiatives, and growing demand from end-user industries like automotive, healthcare, agriculture, protective wear, and fashion are encouraging the textile coatings industry. The market outlook is driven by the shift towards environmentally friendly coatings, spurred by increasing regulatory pressure and consumer demand for sustainable products.

Recent product launches in the textile coatings market including Covestro’s polyurethane-based coatings, BASF enhanced UV protection and weather resistance coatings, Gore-Tex fabric performance enhancing coatings, Huntsman Textile’s Avitera SE range, and others continue to drive the market outlook. Government regulations from the U.S. Environmental Protection Agency (EPA), the European Chemicals Agency (ECHA), China Ministry of Ecology and Environment (MEE), Japan Ministry of Economy, Trade and Industry (METI), India Ministry of Environment, Forest and Climate Change (MoEFCC), and others are encouraging manufacturers to develop alternative, sustainable solutions.

Widening range of coating polymers including PVC, PVDC, PU, Acrylic, EVA, PTFE, SBR, NR, Silicone, Polyolefins, and others present strong prospects for Textile Coating industry. Further, companies across the coating process including substrate providers to coating, drying, and curing process providers are emphasizing advancements in the coating process. Ability to impart diverse properties to the fabrics including Fire retardant, Anti-static, UV resistance, Water repellence, Colour mixtures, food grade coatings, and others at varying gsm weights is encouraging companies across emerging countries to offer products for diverse end-user industries including apparels, home furnishings, automotive and transportation, technical textiles and custom textiles.

Frequent product launch is one of the key strategies opted by leading companies in the industry. Innovations including water-based and bio-based coatings, polyurethane-based coatings with superior elasticity and chemical resistance, long-lasting pathogen protection, graphene-based coatings, deployment of nanotechnology for ultra-thin, highly durable coatings, incorporation of phase-change materials to regulate temperature, providing adaptive insulation in textiles used for outdoor and military applications, and others support the long-term market outlook.

Technical textiles, which are engineered for specific high-performance applications rather than aesthetics, are emerging as essential components in industries such as automotive, construction, healthcare, and defense. The technical textiles market is poised to register 6.2% CAGR between 2024 and 2030. As these advanced textiles require specialized coatings to enhance properties such as durability, resistance to chemicals, water repellency, and flame retardancy, both existing and emerging companies are focusing on product launches for the segment. For instance, in the automotive industry, coatings that provide enhanced abrasion resistance and UV protection to technical textiles are used in seat belts, airbags, and upholstery are gaining significant demand. Similarly, coatings improve the lifespan and performance of geotextiles and others are gaining wide popularity.

Covestro has developed a range of polyurethane-based coatings that provide exceptional elasticity and chemical resistance, BASF introduced UV protection and weather resistance, particularly for outdoor technical textiles, Huntsman Textile Effects launched a series of antimicrobial coatings, Schoeller Textil AG markets functional coatings under ecorepel. the European Union's stringent environmental regulations and initiatives such as the "Circular Economy Action Plan" are encouraging the development of sustainable coatings for technical textiles. Similarly, in India, the government's push for infrastructure development and the promotion of domestic manufacturing through initiatives like "Make in India" have significantly boosted the demand for technical textiles.

Technological advancements in textile coatings are significantly driving product launches across various applications, as companies seek to enhance the functionality, durability, and sustainability of their textile offerings. Integration of nanotechnology into textile coatings for superior water repellency, UV protection, and stain resistance while maintaining breathability and flexibility is gaining popularity. The coatings also impart antifungal and antibacterial properties, encouraging their demand in medical industry such as hospital bed linens, surgical gowns, and patient garments. For instance, Percenta Nano Coating for Textile forms a transparent hydrophobic and oleophobic coating, protecting the surface from contaminations.

Similarly, P2i is launching nanotechnology based self-cleaning coatings that create ultra-thin protective layers on outdoor, sportswear, and military textiles. Further, water-based and bio-based coatings with low volatile organic compounds (VOC) emissions, break down naturally without leaving harmful residues and others are gaining demand from disposable textiles used in hygiene products and packaging. Flame-retardant coatings, energy-efficient coatings, coatings that allow for the embedding of sensors and circuits directly into textiles (by offering flexibility and comfort of the fabric while providing the necessary electrical conductivity for the operation of embedded devices), and others continue to offer significant business prospects for companies across the value chain.

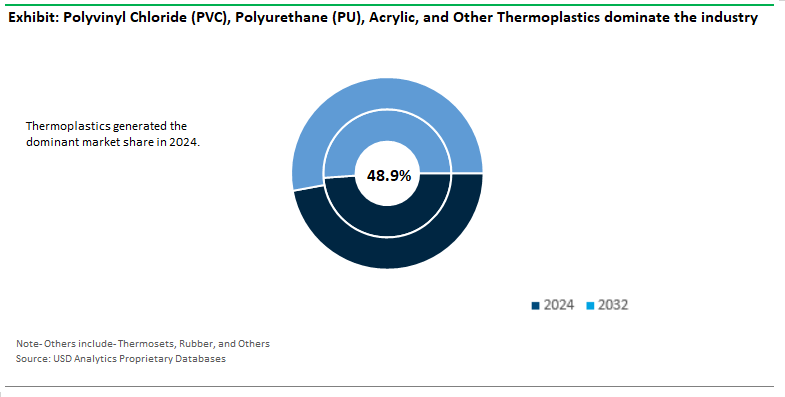

Among Textile Coatings types, Thermoplastics held the largest market share of 48.9% in 2024

Thermoplastics including Polyvinyl Chloride (PVC), Polyurethane (PU), Acrylic, and Others continue to dominate the global Textile coatings market with $2.3 Billion revenue in 2024. The segment accounted for 48.9% of the global Textile coatings market size, driven by versatility, durability, and cost-effectiveness of thermoplastic materials. The ability to be melted and reformed enables recycling, making them environmentally favourable products. In the automotive sector, thermoplastic coatings are extensively used for seating, upholstery, and interior panels due to their excellent abrasion resistance and flexibility. According to the OICA, the sales of new vehicles increased to 92.8 million in 2023 from 82.9 million in 2022.

Further, associations such as Geosynthetic Materials Association (GMA) (part of Advanced Textiles Association (ATA) continue to extend strong support for geosynthetics, thereby driving thermoplastic coatings for erosion control, drainage, and soil stabilization applications. Product innovations drive the long-term outlook. For instance, German Institutes of Textile and Fiber Research Denkendorf (DITF) use thermoplastic processing methods to coat cellulose-based nonwoven fabrics in 2024.

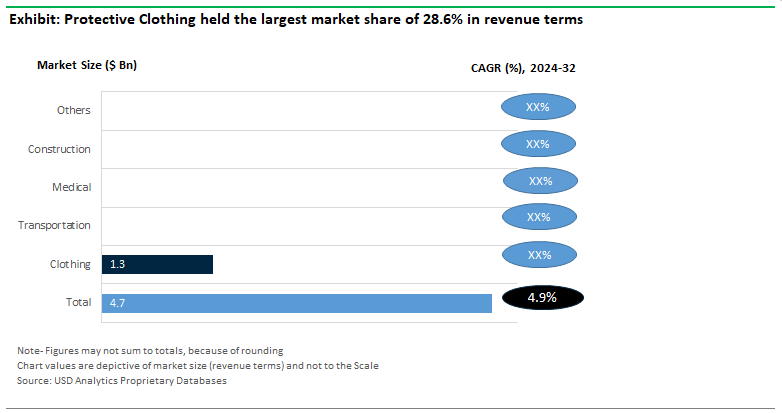

Protective Clothing purpose textile coatings market segment generated $1.36 Billion revenue, accounting for 28.6% of the global market size in 2024. Regulatory bodies like the Occupational Safety and Health Administration (OSHA) in the United States and the European Agency for Safety and Health at Work (EU-OSHA) have set strict guidelines that mandate the use of protective clothing in hazardous work environments. Leading companies in this space are leveraging their expertise to develop cutting-edge coatings. As more countries adopt international safety standards, the need for high-performance protective textiles continues to surge steadily.

For example, DuPont's Nomex® and Kevlar® fabrics are widely used in protective gear for firefighters and military personnel. 3M's Thinsulate™ and Scotchlite™ reflective materials, for example, are used in high-visibility clothing, ensuring that workers are visible in low-light conditions, thereby reducing the risk of accidents. Similarly, Honeywell's chemical-resistant coatings are used in protective suits for workers in industries such as chemical manufacturing and oil and gas, where exposure to hazardous substances is a constant threat.

Textile Coatings Market Forecast

While Asia Pacific generated 40.8% of the global Textile coatings sales revenue in 2024, North America's textile coatings market is set to expand rapidly, supported by strong industrial demand, stringent regulatory frameworks, and continuous innovation in coating technologies. The U.S. Bureau of Economic Analysis (BEA) reported that the U.S.

textile industry contributed approximately $70 billion to the country's GDP in 2023, with significant portions allocated to high-performance textiles, including those used in protective clothing and industrial applications. Further, according to the National Fire Protection Association (NFPA), the North American market for fire-resistant clothing is growing at a rate of 6% annually. The presence of large capital-intensive companies such as Covestro AG and Huntsman International LLC continue to boost R&D activities in the region.

American Association of Textile Chemists and Colorists (AATCC) also identified a surge in research and development activities focused on innovative textile coatings, particularly in areas such as antimicrobial and water-resistant coatings. In Canada, the Textile Human Resources Council (THRC) reported that the country's textile manufacturing sector, which includes coated textiles, experienced a 4% growth in 2023, driven by increasing exports to the U.S. and other international markets.

The textile coatings market is characterized by a competitive landscape where a few key players dominate, driving both innovation and market share consolidation. Leading companies are leveraging extensive R&D capabilities, strategic partnerships, and diversified product portfolios to maintain their market positions. These industry giants invest heavily in the development of advanced coating technologies, such as environmentally friendly water-based and bio-based coatings, responding to the growing demand for sustainable solutions.

The ability to scale production globally to meet the rising demand in high-growth regions like North America and Asia-Pacific remains a key market driver. The focus on sustainability, compliance with stringent environmental regulations, and continuous product innovation are among the key success factors. Leading companies included in the study are Arkema SA, BASF SE, Clariant AG, Covestro AG, Formulated Polymer Products Ltd, Huntsman International LLC, OMNOVA North America Inc, Solvay SA, Sumitomo Chemical Co. Ltd, TANATEX Chemicals B.V., The Lubrizol Corp, and others.

Raw Material Procurement- Companies manufacture base polymers like polyurethanes and acrylics, which serve as the primary component of coatings and Enhancers like flame retardants, UV stabilizers, and colorants are produced and supplied. Further, Production of solvents and carriers that help in the application of coatings on textiles with bio-based and water-based raw materials gaining significant business growth. Covestro AG, BASF SE, Dow Chemical Company, Clariant AG, Wacker Chemie AG, and other companies continue to emphasize sustainable raw material supply.

Formulation and Manufacturing- Development of new formulations to meet specific performance criteria, such as waterproofing, breathability, or antimicrobial properties, Small-scale production runs to test and refine formulations before full-scale manufacturing, quality check, and Formulation of coatings customized for specific industries are included in the stage. Huntsman Textile Effects, Schoeller Textil AG, Archroma, DyStar, and Lubrizol Corporation continue to invest in R&D amidst intense competitive conditions.

Application and Processing- Coating process varies depending on the type of textile and the desired properties, such as using techniques like dip-coating, knife-over-roll, or spray application and involves coating, curing, drying, and surface finishing. APV Engineered Coatings, Trelleborg Coated Systems, Omnova Solutions, Textile Rubber & Chemical Co, Glatfelter, and others are among the key players in the stage.

Distribution and Sales- Logistics and Supply Chain Management, Promoting coated textile products to targeted markets, after-sales support, including product warranties, technical assistance, and customer service, and Retail and E-commerce. VF Corporation, Nike, Inc, Adidas AG, 3M, Textronics, and others opt for aggressive promotion strategies in the intensely competitive market.

|

Parameter |

Details |

|

Market Size (2024) |

$4.7 Billion |

|

Market Size (2032) |

$6.9 Billion |

|

Market Growth Rate |

4.9% |

|

Largest Segment- Product |

Thermoplastics (48.9% Market Share) |

|

Fastest Growing Market- Region |

North America and Asia Pacific |

|

Largest End-User Industry |

Protective Clothing ($1.36 Billion Sales Revenue) |

|

Segments |

Types, Applications |

|

Study Period |

2018- 2023 and 2024-2032 |

|

Units |

Revenue (USD) |

|

Qualitative Analysis |

Porter’s Five Forces, SWOT Profile, Market Share, Scenario Forecasts, Market Ecosystem, Company Ranking, Market Dynamics, Industry Benchmarking |

|

Companies |

Arkema SA, BASF SE, Clariant AG, Covestro AG, Formulated Polymer Products Ltd, Huntsman International LLC, OMNOVA North America Inc, Solvay SA, Sumitomo Chemical Co. Ltd, TANATEX Chemicals B.V., The Lubrizol Corp |

|

Countries |

US, Canada, Mexico, Germany, France, Spain, Italy, UK, Russia, China, India, Japan, South Korea, Australia, South East Asia, Brazil, Argentina, Middle East, Africa |

Polymers

Thermoplastics

Thermosets

Rubber

Others

Applications

Clothing

Transportation

Medical

Construction

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Textile Coatings Companies Profiled in the Study

Arkema SA

BASF SE

Clariant AG

Covestro AG

Formulated Polymer Products Ltd

Huntsman International LLC

OMNOVA North America Inc

Solvay SA

Sumitomo Chemical Co. Ltd

TANATEX Chemicals B.V.

The Lubrizol Corp

*- List Not Exhaustive

About USD Analytics

Table of Contents

1. Executive Summary

What’s New in 2024?

Top 10 Takeaways from the industry

Potential Opportunities for Industry Stakeholders

Strategic Imperatives

Company Market Positioning

Industry Benchmarking Matrix

2. Research Scope and Methodology

Market Definition

Market Segments

Companies Profiled

Research Methodology

Data Sources

Conversion Rates for USD

Abbreviations

3. Strategic Landscape: Key Insights and Implications

Spotlight: Key Strategies opted by Business Leaders

Competitive Landscape

SWOT Analysis

Porter’s Five Force Analysis

Macro-Environmental Analysis

5. Growth Opportunity Analysis

Trends at a Glance

Market Dynamics

Key Industry Stakeholders

Regulatory Landscape

6. Market Size Outlook to 2032

Global Textile Coatings Market Size Forecast, USD Million, 2018- 2032

Scenario Analysis

Pricing Analysis and Outlook

7. Historical Textile Coatings Market Size by Segments, 2018- 2023

Key Statistics, 2024

Textile Coatings Market Size Outlook by Type, USD Million, 2018-2023

Growth Comparison (y-o-y) across Textile Coatings Types, 2018-2023

Textile Coatings Market Size Outlook by Application, USD Million, 2018-2023

Growth Comparison (y-o-y) across Textile Coatings Applications, 2018-2023

8. Textile Coatings Market Size Outlook by Segments, 2024- 2032

Textile Coatings Market Size Outlook by Type, USD Million, 2024-2032

Growth Comparison (y-o-y) across Textile Coatings Types, 2024-2032

Textile Coatings Market Size Outlook by Application, USD Million, 2024-2032

Growth Comparison (y-o-y) across Textile Coatings Applications, 2024-2032

9. Textile Coatings Market Size Outlook by Region

North America

Europe

Asia Pacific

South America

Middle East and Africa

10. United States Textile Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

United States Textile Coatings Market Size Outlook by Type, 2021- 2032

United States Textile Coatings Market Size Outlook by Application, 2021- 2032

United States Textile Coatings Market Size Outlook by End-User, 2021- 2032

11. Canada Textile Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Canada Textile Coatings Market Size Outlook by Type, 2021- 2032

Canada Textile Coatings Market Size Outlook by Application, 2021- 2032

Canada Textile Coatings Market Size Outlook by End-User, 2021- 2032

12. Mexico Textile Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Mexico Textile Coatings Market Size Outlook by Type, 2021- 2032

Mexico Textile Coatings Market Size Outlook by Application, 2021- 2032

Mexico Textile Coatings Market Size Outlook by End-User, 2021- 2032

13. Germany Textile Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Germany Textile Coatings Market Size Outlook by Type, 2021- 2032

Germany Textile Coatings Market Size Outlook by Application, 2021- 2032

Germany Textile Coatings Market Size Outlook by End-User, 2021- 2032

14. France Textile Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

France Textile Coatings Market Size Outlook by Type, 2021- 2032

France Textile Coatings Market Size Outlook by Application, 2021- 2032

France Textile Coatings Market Size Outlook by End-User, 2021- 2032

15. United Kingdom Textile Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

United Kingdom Textile Coatings Market Size Outlook by Type, 2021- 2032

United Kingdom Textile Coatings Market Size Outlook by Application, 2021- 2032

United Kingdom Textile Coatings Market Size Outlook by End-User, 2021- 2032

10. Spain Textile Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Spain Textile Coatings Market Size Outlook by Type, 2021- 2032

Spain Textile Coatings Market Size Outlook by Application, 2021- 2032

Spain Textile Coatings Market Size Outlook by End-User, 2021- 2032

16. Italy Textile Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Italy Textile Coatings Market Size Outlook by Type, 2021- 2032

Italy Textile Coatings Market Size Outlook by Application, 2021- 2032

Italy Textile Coatings Market Size Outlook by End-User, 2021- 2032

17. Benelux Textile Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Benelux Textile Coatings Market Size Outlook by Type, 2021- 2032

Benelux Textile Coatings Market Size Outlook by Application, 2021- 2032

Benelux Textile Coatings Market Size Outlook by End-User, 2021- 2032

18. Nordic Textile Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Nordic Textile Coatings Market Size Outlook by Type, 2021- 2032

Nordic Textile Coatings Market Size Outlook by Application, 2021- 2032

Nordic Textile Coatings Market Size Outlook by End-User, 2021- 2032

19. Rest of Europe Textile Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Europe Textile Coatings Market Size Outlook by Type, 2021- 2032

Rest of Europe Textile Coatings Market Size Outlook by Application, 2021- 2032

Rest of Europe Textile Coatings Market Size Outlook by End-User, 2021- 2032

20. China Textile Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

China Textile Coatings Market Size Outlook by Type, 2021- 2032

China Textile Coatings Market Size Outlook by Application, 2021- 2032

China Textile Coatings Market Size Outlook by End-User, 2021- 2032

21. India Textile Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

India Textile Coatings Market Size Outlook by Type, 2021- 2032

India Textile Coatings Market Size Outlook by Application, 2021- 2032

India Textile Coatings Market Size Outlook by End-User, 2021- 2032

22. Japan Textile Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Japan Textile Coatings Market Size Outlook by Type, 2021- 2032

Japan Textile Coatings Market Size Outlook by Application, 2021- 2032

Japan Textile Coatings Market Size Outlook by End-User, 2021- 2032

23. South Korea Textile Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

South Korea Textile Coatings Market Size Outlook by Type, 2021- 2032

South Korea Textile Coatings Market Size Outlook by Application, 2021- 2032

South Korea Textile Coatings Market Size Outlook by End-User, 2021- 2032

24. Australia Textile Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Australia Textile Coatings Market Size Outlook by Type, 2021- 2032

Australia Textile Coatings Market Size Outlook by Application, 2021- 2032

Australia Textile Coatings Market Size Outlook by End-User, 2021- 2032

25. South East Asia Textile Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

South East Asia Textile Coatings Market Size Outlook by Type, 2021- 2032

South East Asia Textile Coatings Market Size Outlook by Application, 2021- 2032

South East Asia Textile Coatings Market Size Outlook by End-User, 2021- 2032

26. Rest of Asia Pacific Textile Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Asia Pacific Textile Coatings Market Size Outlook by Type, 2021- 2032

Rest of Asia Pacific Textile Coatings Market Size Outlook by Application, 2021- 2032

Rest of Asia Pacific Textile Coatings Market Size Outlook by End-User, 2021- 2032

27. Brazil Textile Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Brazil Textile Coatings Market Size Outlook by Type, 2021- 2032

Brazil Textile Coatings Market Size Outlook by Application, 2021- 2032

Brazil Textile Coatings Market Size Outlook by End-User, 2021- 2032

28. Argentina Textile Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Argentina Textile Coatings Market Size Outlook by Type, 2021- 2032

Argentina Textile Coatings Market Size Outlook by Application, 2021- 2032

Argentina Textile Coatings Market Size Outlook by End-User, 2021- 2032

29. Rest of South America Textile Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of South America Textile Coatings Market Size Outlook by Type, 2021- 2032

Rest of South America Textile Coatings Market Size Outlook by Application, 2021- 2032

Rest of South America Textile Coatings Market Size Outlook by End-User, 2021- 2032

30. United Arab Emirates Textile Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

United Arab Emirates Textile Coatings Market Size Outlook by Type, 2021- 2032

United Arab Emirates Textile Coatings Market Size Outlook by Application, 2021- 2032

United Arab Emirates Textile Coatings Market Size Outlook by End-User, 2021- 2032

31. Saudi Arabia Textile Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Saudi Arabia Textile Coatings Market Size Outlook by Type, 2021- 2032

Saudi Arabia Textile Coatings Market Size Outlook by Application, 2021- 2032

Saudi Arabia Textile Coatings Market Size Outlook by End-User, 2021- 2032

32. Rest of Middle East Textile Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Middle East Textile Coatings Market Size Outlook by Type, 2021- 2032

Rest of Middle East Textile Coatings Market Size Outlook by Application, 2021- 2032

Rest of Middle East Textile Coatings Market Size Outlook by End-User, 2021- 2032

33. South Africa Textile Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

South Africa Textile Coatings Market Size Outlook by Type, 2021- 2032

South Africa Textile Coatings Market Size Outlook by Application, 2021- 2032

South Africa Textile Coatings Market Size Outlook by End-User, 2021- 2032

34. Rest of Africa Textile Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Africa Textile Coatings Market Size Outlook by Type, 2021- 2032

Rest of Africa Textile Coatings Market Size Outlook by Application, 2021- 2032

Rest of Africa Textile Coatings Market Size Outlook by End-User, 2021- 2032

35. Key Companies

Market Share Analysis

Company Benchmarking

Financial Analysis

36. Recent Market Developments

37. Appendix

Looking Ahead

Research Methodology

Legal Disclaimer

By Polymer

Thermoplastics

-Polyvinyl Chloride (PVC)

-Polyurethane (PU)

-Acrylic

-Others

Thermosets

Rubber

-Natural Rubber

-Styrene-Butadiene Rubber

Others

By Application

Clothing

Transportation

Medical

Construction

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

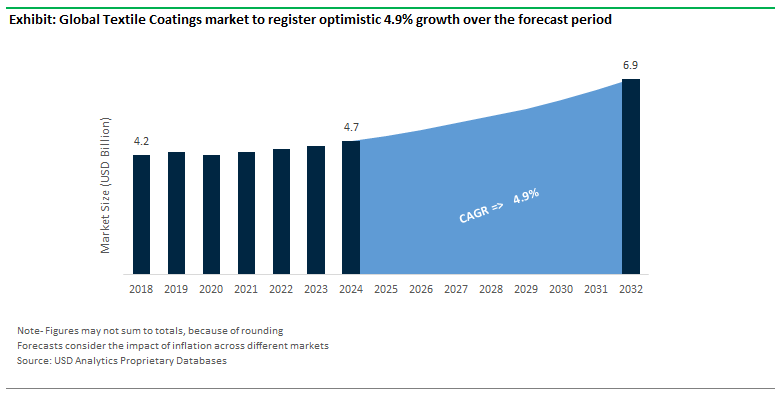

Global Textile Coatings Market Size is valued at $4.7 Billion in 2024 and is forecast to register a growth rate (CAGR) of 4.9% to reach $6.9 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Arkema SA, BASF SE, Clariant AG, Covestro AG, Formulated Polymer Products Ltd, Huntsman International LLC, OMNOVA North America Inc, Solvay SA, Sumitomo Chemical Co. Ltd, TANATEX Chemicals B.V., The Lubrizol Corp

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume