The global Terpene Resins Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Solid, Liquid), By Grade (Technical, Industrial), By Application (Inks & coatings, Adhesives & sealants, Chewing gums, Pulp & paper, Plastic & rubber, Leather processing, Others).

Terpene resins, derived from natural terpenes found in plant sources such as conifers and citrus fruits, to serve as valuable materials in various industries in 2024. These resins are known for their excellent tackiness, solvency, and compatibility with other polymers, making them ideal for use in adhesives, coatings, inks, and rubber compounding. In the adhesive industry, terpene resins are utilized as tackifiers to improve adhesion and cohesion properties in formulations such as hot melt adhesives and pressure-sensitive adhesives. Similarly, in coatings and inks, terpene resins act as binders and film formers, providing enhanced durability, gloss, and adhesion to substrates. With growing interest in bio-based and sustainable materials, terpene resins offer a renewable and environmentally friendly alternative to petroleum-based resins, driving their adoption in various applications and contributing to the transition to greener chemistry practices.

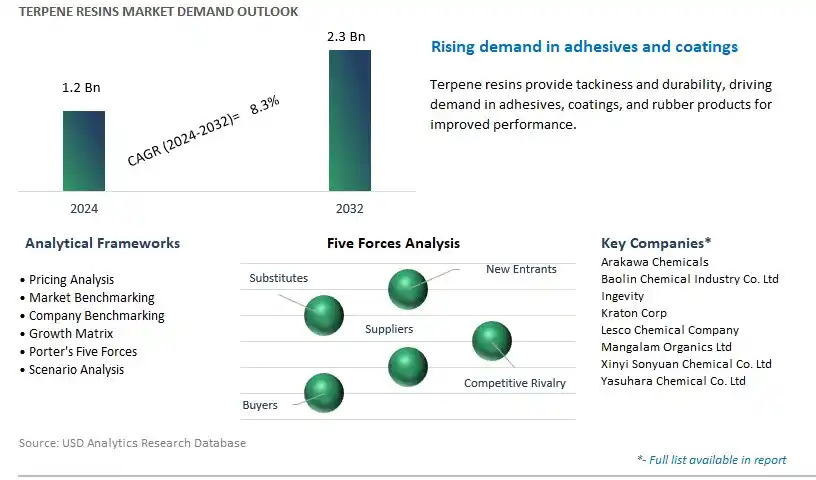

The market report analyses the leading companies in the industry including Arakawa Chemicals, Baolin Chemical Industry Co. Ltd, Ingevity, Kraton Corp, Lesco Chemical Company, Mangalam Organics Ltd, Xinyi Sonyuan Chemical Co. Ltd, Yasuhara Chemical Co. Ltd, and others.

A significant trend in the terpene resins market is the increasing demand for natural and renewable raw materials in various industries. Terpene resins, derived from natural sources such as pine trees, conifers, and citrus fruits, are gaining popularity as sustainable alternatives to synthetic resins derived from petroleum-based feedstocks. With growing environmental concerns and a shift towards green chemistry and sustainable manufacturing practices, there is a rising preference for terpene-based resins that offer biodegradability, low toxicity, and renewable sourcing. Industries such as adhesives, coatings, printing inks, and fragrance formulations are increasingly incorporating terpene resins into their formulations to meet consumer demand for eco-friendly products with reduced environmental impact. As companies seek to align with sustainability goals, comply with regulatory requirements, and differentiate their products in competitive markets, the demand for terpene resins as natural and renewable raw materials is expected to continue growing, driven by the need for sustainable solutions that offer performance and environmental benefits.

The primary driver for the terpene resins market is the shift towards bio-based and green chemistry solutions across industries. With increasing awareness of the environmental impact of traditional chemical manufacturing processes and the need to reduce reliance on fossil fuels, there is a growing emphasis on developing bio-based alternatives derived from renewable resources. Terpene resins, which can be extracted from natural sources or produced through sustainable methods such as biotechnology and enzymatic processes, align with the principles of green chemistry by offering a more sustainable and environmentally friendly alternative to petrochemical-based resins. As industries seek to reduce carbon footprint, minimize waste generation, and enhance product sustainability, terpene resins emerge as viable options for formulators looking to replace synthetic ingredients with bio-based alternatives. Additionally, the availability of terpene-rich by-products from industries such as paper and pulp, essential oil extraction, and citrus processing presents opportunities for valorization and conversion into value-added terpene resin products. As companies prioritize sustainability and seek to improve the environmental profile of their products, the demand for terpene resins as bio-based and green chemistry solutions is expected to grow, driven by the need for environmentally friendly alternatives that offer performance and compatibility with existing formulations.

A significant opportunity for the terpene resins market lies in the development of high-performance formulations leveraging the unique properties of terpene resins. Terpene resins offer a diverse range of properties such as tackiness, adhesion, solubility, and compatibility with other materials, making them versatile ingredients for formulating a wide range of products across industries. Manufacturers have an opportunity to innovate and develop customized formulations using terpene resins as key ingredients in adhesives, sealants, coatings, inks, flavors, fragrances, and pharmaceuticals. By optimizing resin blends, modifying chemical structures, and enhancing processing techniques, companies can tailor terpene-based formulations to meet specific application requirements such as adhesion strength, drying time, film formation, and chemical resistance. Additionally, there is an opportunity to explore novel applications and niche markets where terpene resins offer unique performance advantages over traditional resins. By collaborating with customers, research institutions, and industry partners, terpene resin manufacturers can identify unmet needs, address market gaps, and develop innovative solutions that drive adoption and create value for end-users. As industries seek sustainable and high-performance alternatives, the demand for terpene-based formulations is expected to grow, presenting opportunities for differentiation, market expansion, and value creation in the terpene resins market.

In the terpene resins market, the Solid segment is the largest and most dominant player. This leadership position can be attributed to solid terpene resins offer a wide range of applications across industries such as adhesives, coatings, printing inks, and rubber compounding. Solid terpene resins are typically in the form of flakes, granules, or powders, and they exhibit excellent compatibility with various solvents and polymers, making them highly versatile for formulation purposes. Moreover, solid terpene resins provide desirable properties such as tackiness, adhesion, and flexibility, enhancing the performance of end products in adhesive and coating applications. Additionally, solid terpene resins are preferred for their ease of handling, storage, and transportation compared to liquid counterparts. With their widespread use and advantageous properties, the Solid segment maintains its dominance in the terpene resins market and is poised to drive continued growth across diverse industrial sectors.

The Industrial Grade segment stands out as the fastest-growing segment in the terpene resins market. Industrial-grade terpene resins are gaining momentum due to their increasing applications in a wide range of industries such as adhesives, sealants, printing inks, and rubber compounding. These resins offer desirable properties such as tackiness, adhesion, and viscosity control, making them indispensable in formulating high-performance industrial products. Moreover, the growing demand for eco-friendly and sustainable alternatives to synthetic resins fuels the adoption of terpene resins derived from renewable sources such as pine trees and other plant-derived materials. Additionally, advancements in extraction and purification technologies enable the production of high-quality industrial-grade terpene resins with consistent performance characteristics, driving their acceptance in various industrial applications. With the rising awareness of environmental concerns and the shift towards green chemistry solutions, the Industrial Grade segment is poised to witness sustained growth and expand its market presence in the terpene resins industry.

Within the terpene resins market, the Inks & Coatings segment is the largest and most dominant player. In particular, terpene resins find extensive use in the formulation of inks and coatings due to their excellent adhesive properties, solubility in various solvents, and compatibility with a wide range of polymers. In the printing and coating industries, terpene resins serve as essential binders and modifiers, enhancing the performance and durability of printed materials and coated surfaces. Additionally, the growing demand for eco-friendly and sustainable alternatives to synthetic resins drives the adoption of terpene-based formulations in inks and coatings, aligning with the increasing focus on environmental sustainability and green chemistry initiatives. Moreover, terpene resins offer advantages such as low odor, low toxicity, and renewable sourcing, making them attractive for use in food packaging, labels, and other sensitive applications. With their versatility, performance benefits, and environmental advantages, the Inks & Coatings segment maintains its dominance in the terpene resins market and is poised to drive continued growth across diverse industrial applications.

By Product

Solid

Liquid

By Grade

Technical

Industrial

By Application

Inks & coatings

Adhesives & sealants

Chewing gums

Pulp & paper

Plastic & rubber

Leather processing

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Arakawa Chemicals

Baolin Chemical Industry Co. Ltd

Ingevity

Kraton Corp

Lesco Chemical Company

Mangalam Organics Ltd

Xinyi Sonyuan Chemical Co. Ltd

Yasuhara Chemical Co. Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Terpene Resins Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Terpene Resins Market Size Outlook, $ Million, 2021 to 2032

3.2 Terpene Resins Market Outlook by Type, $ Million, 2021 to 2032

3.3 Terpene Resins Market Outlook by Product, $ Million, 2021 to 2032

3.4 Terpene Resins Market Outlook by Application, $ Million, 2021 to 2032

3.5 Terpene Resins Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Terpene Resins Industry

4.2 Key Market Trends in Terpene Resins Industry

4.3 Potential Opportunities in Terpene Resins Industry

4.4 Key Challenges in Terpene Resins Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Terpene Resins Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Terpene Resins Market Outlook by Segments

7.1 Terpene Resins Market Outlook by Segments, $ Million, 2021- 2032

By Product

Solid

Liquid

By Grade

Technical

Industrial

By Application

Inks & coatings

Adhesives & sealants

Chewing gums

Pulp & paper

Plastic & rubber

Leather processing

Others

8 North America Terpene Resins Market Analysis and Outlook To 2032

8.1 Introduction to North America Terpene Resins Markets in 2024

8.2 North America Terpene Resins Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Terpene Resins Market size Outlook by Segments, 2021-2032

By Product

Solid

Liquid

By Grade

Technical

Industrial

By Application

Inks & coatings

Adhesives & sealants

Chewing gums

Pulp & paper

Plastic & rubber

Leather processing

Others

9 Europe Terpene Resins Market Analysis and Outlook To 2032

9.1 Introduction to Europe Terpene Resins Markets in 2024

9.2 Europe Terpene Resins Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Terpene Resins Market Size Outlook by Segments, 2021-2032

By Product

Solid

Liquid

By Grade

Technical

Industrial

By Application

Inks & coatings

Adhesives & sealants

Chewing gums

Pulp & paper

Plastic & rubber

Leather processing

Others

10 Asia Pacific Terpene Resins Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Terpene Resins Markets in 2024

10.2 Asia Pacific Terpene Resins Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Terpene Resins Market size Outlook by Segments, 2021-2032

By Product

Solid

Liquid

By Grade

Technical

Industrial

By Application

Inks & coatings

Adhesives & sealants

Chewing gums

Pulp & paper

Plastic & rubber

Leather processing

Others

11 South America Terpene Resins Market Analysis and Outlook To 2032

11.1 Introduction to South America Terpene Resins Markets in 2024

11.2 South America Terpene Resins Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Terpene Resins Market size Outlook by Segments, 2021-2032

By Product

Solid

Liquid

By Grade

Technical

Industrial

By Application

Inks & coatings

Adhesives & sealants

Chewing gums

Pulp & paper

Plastic & rubber

Leather processing

Others

12 Middle East and Africa Terpene Resins Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Terpene Resins Markets in 2024

12.2 Middle East and Africa Terpene Resins Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Terpene Resins Market size Outlook by Segments, 2021-2032

By Product

Solid

Liquid

By Grade

Technical

Industrial

By Application

Inks & coatings

Adhesives & sealants

Chewing gums

Pulp & paper

Plastic & rubber

Leather processing

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Arakawa Chemicals

Baolin Chemical Industry Co. Ltd

Ingevity

Kraton Corp

Lesco Chemical Company

Mangalam Organics Ltd

Xinyi Sonyuan Chemical Co. Ltd

Yasuhara Chemical Co. Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Solid

Liquid

By Grade

Technical

Industrial

By Application

Inks & coatings

Adhesives & sealants

Chewing gums

Pulp & paper

Plastic & rubber

Leather processing

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Terpene Resins Market Size is valued at $1.2 Billion in 2024 and is forecast to register a growth rate (CAGR) of 8.3% to reach $2.3 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Arakawa Chemicals, Baolin Chemical Industry Co. Ltd, Ingevity, Kraton Corp, Lesco Chemical Company, Mangalam Organics Ltd, Xinyi Sonyuan Chemical Co. Ltd, Yasuhara Chemical Co. Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume