Technical ceramics are emerging as a popular choice in industrial applications owing to superior properties including excellent material hardness, resilience towards high temperatures, superior tensile attributes, and low toxicity. Ongoing R&D investments focused on developing new materials and composites with improved mechanical strength, thermal conductivity, and electrical properties further strengthen the market outlook. Further, the increased use of additive manufacturing strengthens the demand for technical ceramics. In addition, bioceramics are being developed for implants, dental applications, and drug delivery systems. R&D is focused on improving the biocompatibility and durability of these materials.

Asia-Pacific dominates the technical ceramics industry, owing to robust demand from automotive and electronics in China, India, South East Asia, and other countries. The main markets include electrical equipment, industrial machinery, automotive, oil, gas, and chemicals, energy industry, and medical devices & implants. Technical ceramics with exceptional electrical and thermal properties are increasingly being integrated into electronic components, enabling the sector to meet the demands of miniaturization, high-performance applications, and evolving technologies.

The healthcare industry is increasingly opting for technical ceramics due to their exceptional properties and versatility. Alumina and zirconia are biocompatible and are well-tolerated by the human body. Further, ceramics are widely used for exceptional wear resistance of medical devices and implants. Technical ceramics are gaining wide applications in medical treatments including substituting chemotherapy with radioactive glass microspheres for liver cancer patients. Bioceramics are a key segment of technical ceramics and are specifically designed for medical use. The increasing use in applications like dental implants, orthopedic implants, and bone regeneration materials fuels the market outlook.

Innovations in coatings and surface treatments for technical ceramics remain key for widening applications and enhancing the performance of these materials in diverse industries. Advancements including the launch of a wide range of specialized coatings from protective layers that shield against harsh environments to biocompatible coatings for medical implants, tribological coatings that reduce friction, and thermal barrier coatings for extreme temperatures drive the market outlook. Further, nanostructured coatings and multi-layered compositions that cater to specific needs, enhancing adhesion, electrical conductivity, and corrosion resistance are set to gain rapid market penetration.

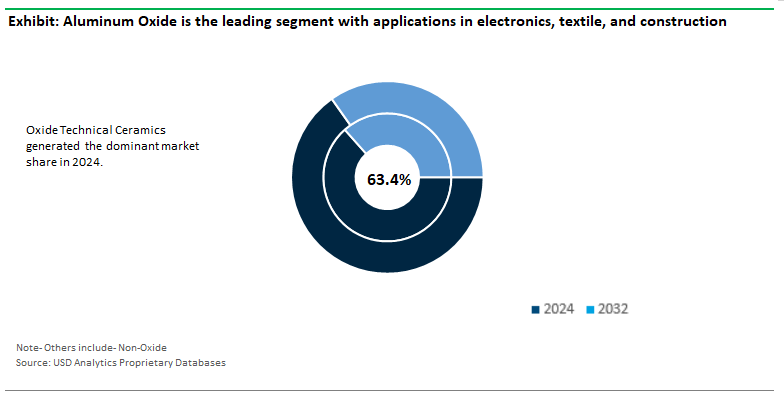

In 2024, Oxide Technical Ceramics accounted for the dominant 63.4% market share. Aluminum Oxide, Aluminum Titanate, Mixed/Dispersion Ceramics, Piezoceramics, Silicate Ceramics, Zirconium Oxide, and others are among the leading Oxide types. In particular, Aluminum Oxide is among the leading segments with wide applications including Heavy-duty forming tools, substrates and resistor cores in the electronics industry, tiles for wear protection, thread guides in textile engineering, seal and regulator discs for water taps and valves, heat-sinks, protection tubes in thermal processes or catalyst carriers for the chemicals industry. In addition, Aluminum Titanate exhibits excellent thermal shock resistance.

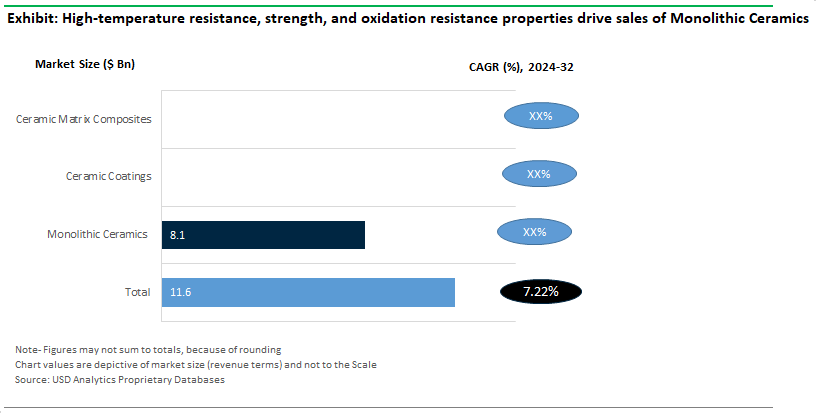

Monolithic Ceramics accounted for 69.5% market share in 2024. High-temperature resistance, strength, and oxidation resistance properties with 24OO °F TO 3OOO °F operating temperature range support the demand for monolithic ceramics. Advanced Ceramics for Electronics, Ceramic Coatings for Aerospace, Bioceramics, Cutting Tool Materials, and Nuclear and Energy Applications are among the emerging applications of monolithic ceramics. Further, in medical and dental applications, ceramics are increasingly used due to their biocompatibility and resistance to bodily fluids.

The Asia Pacific region is poised to remain the fastest-growing market for Technical Ceramics vendors, projected to expand at a CAGR of 7.53% during the forecast period. In particular, the Chinese market has the largest Technical Ceramics market revenue in the region, driven by a robust production and sales of consumer electronics. In 2024, the country produced around 29 million vehicles, supporting the demand for technical ceramics.

Continuous capacity expansions coupled with the demand growth from domestic and international markets support the market outlook. Similarly, the Indian government plans to promote domestic manufacturing and export in the entire value chain of Electronics System Design and Manufacturing (ESDM) further fuels the demand for technical ceramics. In addition, the regional emphasis on the machinery production industry further augments the demand for technical ceramics. Technological advancements 5G, IoT, and AI are expected to drive the demand from end-user industries.

The global Technical Ceramics market is fragmented with the presence of both local and global players. Leading companies in the Technical Ceramics industry include- 3M Company, CeramTec GmbH, Compagnie de Saint-Gobain S.A., CoorsTek, DuPont de Nemours Inc, Elan Technology, General Electric Company, Honeywell International Inc, Kyocera Industrial Ceramics Corp, Momentive Performance Materials Inc, Morgan Technical Raw Materials PLC, Murata Manufacturing Co. Ltd, Oerlikon Surface Solutions AG, Ortech Inc, Pall Corp.

|

Parameter |

Details |

|

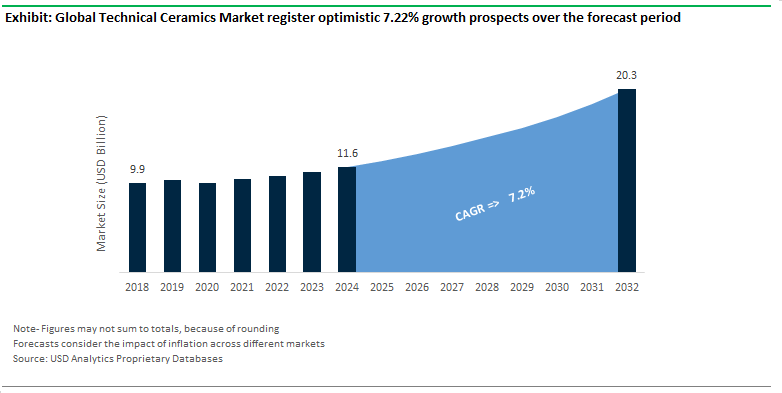

Market Size (2024) |

$11.6 Billion |

|

Market Size (2032) |

$20.3 Billion |

|

Market Growth Rate |

7.22% |

|

Largest Segment- Type |

Oxide (63.4% Market Share) |

|

Fastest Growing Market- Region |

Asia Pacific (7.53% CAGR) |

|

Largest Segment- Product |

Monolithic Ceramics (69.5% Market Share) |

|

Largest Segment- Application |

Electrical and Electronics |

|

Segments |

Types, Forms, Applications, Sales Channels |

|

Study Period |

2018- 2023 and 2024-2032 |

|

Units |

Revenue (USD) |

|

Qualitative Analysis |

Porter’s Five Forces, SWOT Profile, Market Share, Scenario Forecasts, Market Ecosystem, Company Ranking, Market Dynamics, Industry Benchmarking |

|

Companies |

3M Company, CeramTec GmbH, Compagnie de Saint-Gobain S.A., CoorsTek, DuPont de Nemours Inc, Elan Technology, General Electric Company, Honeywell International Inc, Kyocera Industrial Ceramics Corp, Momentive Performance Materials Inc, Morgan Technical Raw Materials PLC, Murata Manufacturing Co. Ltd, Oerlikon Surface Solutions AG, Ortech Inc, Pall Corp |

|

Countries |

US, Canada, Mexico, Germany, France, Spain, Italy, UK, Russia, China, India, Japan, South Korea, Australia, South East Asia, Brazil, Argentina, Middle East, Africa |

Raw Material

Product

Application

End-User

Countries Analyzed

Technical Ceramics Companies Profiled in the Study

*- List Not Exhaustive

About USD Analytics

Table of Contents

1. Executive Summary

What’s New in 2024?

Top 10 Takeaways from the Industry

Potential Opportunities for Industry Stakeholders

Strategic Imperatives

Company Market Positioning

Industry Benchmarking Matrix

2. Research Scope and Methodology

Market Definition

Market Segments

Companies Profiled

Research Methodology

Data Sources

Conversion Rates for USD

Abbreviations

3. Strategic Landscape: Key Insights and Implications

Spotlight: Key Strategies Opted by Business Leaders

Competitive Landscape

SWOT Analysis

Porter’s Five Force Analysis

Macro-Environmental Analysis

4. Growth Opportunity Analysis

Trends at a Glance

Market Dynamics

Key Industry Stakeholders

Regulatory Landscape

5. Market Size Outlook to 2032

Global Technical Ceramics Market Size Forecast, USD Million, 2018- 2032

Scenario Analysis

Pricing Analysis and Outlook

6. Historical Technical Ceramics Market Size by Segments, 2018- 2023

Key Statistics, 2024

Technical Ceramics Market Size Outlook by Type, USD Million, 2018-2023

Growth Comparison (y-o-y) across Technical Ceramics Types, 2018-2023

Technical Ceramics Market Size Outlook by Application, USD Million, 2018-2023

Growth Comparison (y-o-y) across Technical Ceramics Applications, 2018-2023

7. Technical Ceramics Market Size Outlook by Segments, 2024- 2032

Technical Ceramics Market Size Outlook by Raw Material, USD Million, 2024-2032

Growth Comparison (y-o-y) across Technical Ceramics Raw Materials, 2024-2032

Technical Ceramics Market Size Outlook by Type, USD Million, 2024-2032

Growth Comparison (y-o-y) across Technical Ceramics Types, 2024-2032

Technical Ceramics Market Size Outlook by Application, USD Million, 2024-2032

Growth Comparison (y-o-y) across Technical Ceramics Applications, 2024-2032

Technical Ceramics Market Size Outlook by End-User, USD Million, 2024-2032

Growth Comparison (y-o-y) across Technical Ceramics End-Users, 2024-2032

8. Technical Ceramics Market Size Outlook by Region

North America

Europe

Asia Pacific

South America

Middle East and Africa

9. United States Technical Ceramics Market Analysis and Outlook, 2021- 2032

Key Statistics

United States Technical Ceramics Market Size Outlook by Type, 2021- 2032

United States Technical Ceramics Market Size Outlook by Application, 2021- 2032

United States Technical Ceramics Market Size Outlook by End-User, 2021- 2032

10. Canada Technical Ceramics Market Analysis and Outlook, 2021- 2032

Key Statistics

Canada Technical Ceramics Market Size Outlook by Type, 2021- 2032

Canada Technical Ceramics Market Size Outlook by Application, 2021- 2032

Canada Technical Ceramics Market Size Outlook by End-User, 2021- 2032

11. Mexico Technical Ceramics Market Analysis and Outlook, 2021- 2032

Key Statistics

Mexico Technical Ceramics Market Size Outlook by Type, 2021- 2032

Mexico Technical Ceramics Market Size Outlook by Application, 2021- 2032

Mexico Technical Ceramics Market Size Outlook by End-User, 2021- 2032

12. Germany Technical Ceramics Market Analysis and Outlook, 2021- 2032

Key Statistics

Germany Technical Ceramics Market Size Outlook by Type, 2021- 2032

Germany Technical Ceramics Market Size Outlook by Application, 2021- 2032

Germany Technical Ceramics Market Size Outlook by End-User, 2021- 2032

13. France Technical Ceramics Market Analysis and Outlook, 2021- 2032

Key Statistics

France Technical Ceramics Market Size Outlook by Type, 2021- 2032

France Technical Ceramics Market Size Outlook by Application, 2021- 2032

France Technical Ceramics Market Size Outlook by End-User, 2021- 2032

14. United Kingdom Technical Ceramics Market Analysis and Outlook, 2021- 2032

Key Statistics

United Kingdom Technical Ceramics Market Size Outlook by Type, 2021- 2032

United Kingdom Technical Ceramics Market Size Outlook by Application, 2021- 2032

United Kingdom Technical Ceramics Market Size Outlook by End-User, 2021- 2032

15. Spain Technical Ceramics Market Analysis and Outlook, 2021- 2032

Key Statistics

Spain Technical Ceramics Market Size Outlook by Type, 2021- 2032

Spain Technical Ceramics Market Size Outlook by Application, 2021- 2032

Spain Technical Ceramics Market Size Outlook by End-User, 2021- 2032

16. Italy Technical Ceramics Market Analysis and Outlook, 2021- 2032

Key Statistics

Italy Technical Ceramics Market Size Outlook by Type, 2021- 2032

Italy Technical Ceramics Market Size Outlook by Application, 2021- 2032

Italy Technical Ceramics Market Size Outlook by End-User, 2021- 2032

17. Benelux Technical Ceramics Market Analysis and Outlook, 2021- 2032

Key Statistics

Benelux Technical Ceramics Market Size Outlook by Type, 2021- 2032

Benelux Technical Ceramics Market Size Outlook by Application, 2021- 2032

Benelux Technical Ceramics Market Size Outlook by End-User, 2021- 2032

18. Nordic Technical Ceramics Market Analysis and Outlook, 2021- 2032

Key Statistics

Nordic Technical Ceramics Market Size Outlook by Type, 2021- 2032

Nordic Technical Ceramics Market Size Outlook by Application, 2021- 2032

Nordic Technical Ceramics Market Size Outlook by End-User, 2021- 2032

19. Rest of Europe Technical Ceramics Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Europe Technical Ceramics Market Size Outlook by Type, 2021- 2032

Rest of Europe Technical Ceramics Market Size Outlook by Application, 2021- 2032

Rest of Europe Technical Ceramics Market Size Outlook by End-User, 2021- 2032

20. China Technical Ceramics Market Analysis and Outlook, 2021- 2032

Key Statistics

China Technical Ceramics Market Size Outlook by Type, 2021- 2032

China Technical Ceramics Market Size Outlook by Application, 2021- 2032

China Technical Ceramics Market Size Outlook by End-User, 2021- 2032

21. India Technical Ceramics Market Analysis and Outlook, 2021- 2032

Key Statistics

India Technical Ceramics Market Size Outlook by Type, 2021- 2032

India Technical Ceramics Market Size Outlook by Application, 2021- 2032

India Technical Ceramics Market Size Outlook by End-User, 2021- 2032

22. Japan Technical Ceramics Market Analysis and Outlook, 2021- 2032

Key Statistics

Japan Technical Ceramics Market Size Outlook by Type, 2021- 2032

Japan Technical Ceramics Market Size Outlook by Application, 2021- 2032

Japan Technical Ceramics Market Size Outlook by End-User, 2021- 2032

23. South Korea Technical Ceramics Market Analysis and Outlook, 2021- 2032

Key Statistics

South Korea Technical Ceramics Market Size Outlook by Type, 2021- 2032

South Korea Technical Ceramics Market Size Outlook by Application, 2021- 2032

South Korea Technical Ceramics Market Size Outlook by End-User, 2021- 2032

24. Australia Technical Ceramics Market Analysis and Outlook, 2021- 2032

Key Statistics

Australia Technical Ceramics Market Size Outlook by Type, 2021- 2032

Australia Technical Ceramics Market Size Outlook by Application, 2021- 2032

Australia Technical Ceramics Market Size Outlook by End-User, 2021- 2032

25. South East Asia Technical Ceramics Market Analysis and Outlook, 2021- 2032

Key Statistics

South East Asia Technical Ceramics Market Size Outlook by Type, 2021- 2032

South East Asia Technical Ceramics Market Size Outlook by Application, 2021- 2032

South East Asia Technical Ceramics Market Size Outlook by End-User, 2021- 2032

26. Rest of Asia Pacific Technical Ceramics Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Asia Pacific Technical Ceramics Market Size Outlook by Type, 2021- 2032

Rest of Asia Pacific Technical Ceramics Market Size Outlook by Application, 2021- 2032

Rest of Asia Pacific Technical Ceramics Market Size Outlook by End-User, 2021- 2032

27. Brazil Technical Ceramics Market Analysis and Outlook, 2021- 2032

Key Statistics

Brazil Technical Ceramics Market Size Outlook by Type, 2021- 2032

Brazil Technical Ceramics Market Size Outlook by Application, 2021- 2032

Brazil Technical Ceramics Market Size Outlook by End-User, 2021- 2032

28. Argentina Technical Ceramics Market Analysis and Outlook, 2021- 2032

Key Statistics

Argentina Technical Ceramics Market Size Outlook by Type, 2021- 2032

Argentina Technical Ceramics Market Size Outlook by Application, 2021- 2032

Argentina Technical Ceramics Market Size Outlook by End-User, 2021- 2032

29. Rest of South America Technical Ceramics Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of South America Technical Ceramics Market Size Outlook by Type, 2021- 2032

Rest of South America Technical Ceramics Market Size Outlook by Application, 2021- 2032

Rest of South America Technical Ceramics Market Size Outlook by End-User, 2021- 2032

30. United Arab Emirates Technical Ceramics Market Analysis and Outlook, 2021- 2032

Key Statistics

United Arab Emirates Technical Ceramics Market Size Outlook by Type, 2021- 2032

United Arab Emirates Technical Ceramics Market Size Outlook by Application, 2021- 2032

United Arab Emirates Technical Ceramics Market Size Outlook by End-User, 2021- 2032

31. Saudi Arabia Technical Ceramics Market Analysis and Outlook, 2021- 2032

Key Statistics

Saudi Arabia Technical Ceramics Market Size Outlook by Type, 2021- 2032

Saudi Arabia Technical Ceramics Market Size Outlook by Application, 2021- 2032

Saudi Arabia Technical Ceramics Market Size Outlook by End-User, 2021- 2032

32. Rest of Middle East Technical Ceramics Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Middle East Technical Ceramics Market Size Outlook by Type, 2021- 2032

Rest of Middle East Technical Ceramics Market Size Outlook by Application, 2021- 2032

Rest of Middle East Technical Ceramics Market Size Outlook by End-User, 2021- 2032

33. South Africa Technical Ceramics Market Analysis and Outlook, 2021- 2032

Key Statistics

South Africa Technical Ceramics Market Size Outlook by Type, 2021- 2032

South Africa Technical Ceramics Market Size Outlook by Application, 2021- 2032

South Africa Technical Ceramics Market Size Outlook by End-User, 2021- 2032

34. Rest of Africa Technical Ceramics Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Africa Technical Ceramics Market Size Outlook by Type, 2021- 2032

Rest of Africa Technical Ceramics Market Size Outlook by Application, 2021- 2032

Rest of Africa Technical Ceramics Market Size Outlook by End-User, 2021- 2032

35. Key Companies

Market Share Analysis

Company Benchmarking

SWOT Analysis

36. Recent Market Developments

Appendix

Looking Ahead

Research Methodology

Legal Disclaimer

Raw Material

Product

Application

End-User

Countries Analyzed

USD Analytics forecasts the global Technical Ceramics market size to increase from $11.6 Billion in 2024 to $20.3 Billion in 2032, registering a CAGR of 7.22% during the forecast period

Largest Segment by Type is Oxide (63.4% Market Share), Largest Segment by Product is Monolithic Ceramics (69.5% Market Share), Largest Segment by Application is Electrical and Electronics

3M Company, CeramTec GmbH, Compagnie de Saint-Gobain S.A., CoorsTek, DuPont de Nemours Inc, Elan Technology, General Electric Company, Honeywell International Inc, Kyocera Industrial Ceramics Corp, Momentive Performance Materials Inc, Morgan Technical Raw Materials PLC, Murata Manufacturing Co. Ltd, Oerlikon Surface Solutions AG, Ortech Inc, Pall Corp

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume

Asia Pacific (7.53% CAGR)