The global Tackifier Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Feedstock (Rosin Resins, Petroleum Resins, Terepene Resins), By Form (Solid, Liquid, Resin Dispersion), By Type (Synthetic, Natural), By Application (Tapes and Labels, Assembly, Bookbinding, Footwear, Leather, and Rubber Articles, Others), By End-User (Automotive, Building and Construction, Non-Wovens, Packaging, Footwear, Others).

Tackifiers, additives designed to impart adhesion and cohesion properties to adhesives and sealants, are integral to a wide range of industries in 2024. These versatile compounds enhance the tack, peel, and shear strength of adhesive formulations, enabling bonding to various substrates and surfaces. In sectors such as packaging, construction, automotive, and electronics, tackifiers play a crucial role in ensuring the performance and durability of adhesive products under diverse operating conditions. Further, the development of bio-based tackifiers derived from renewable feedstocks aligns with the growing emphasis on sustainability and reduced environmental impact. As manufacturers seek to improve the performance and environmental profile of adhesives and sealants, the demand for innovative tackifiers is expected to escalate. d research and development efforts aimed at optimizing tackifier formulations and expanding their applicability will further drive the growth of the tackifiers market in the foreseeable future.

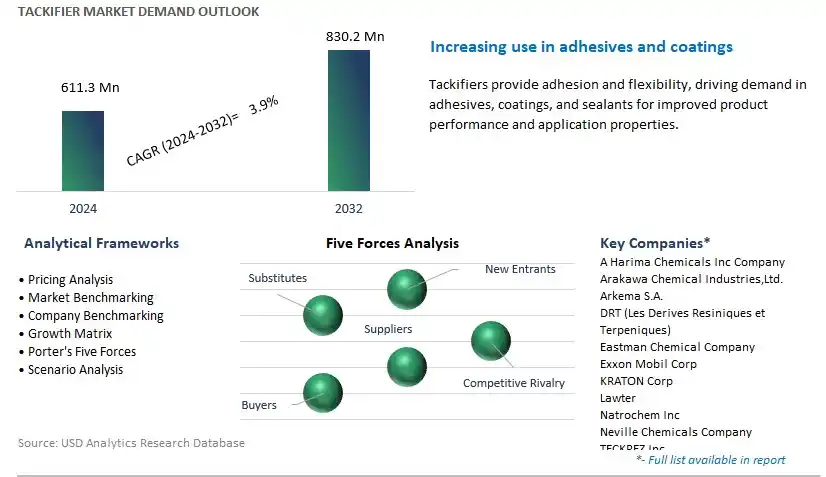

The market report analyses the leading companies in the industry including A Harima Chemicals Inc Company, Arakawa Chemical Industries,Ltd., Arkema S.A., DRT (Les Derives Resiniques et Terpeniques), Eastman Chemical Company, Exxon Mobil Corp, KRATON Corp, Lawter, Natrochem Inc, Neville Chemicals Company, TECKREZ Inc, TWC Group, and others.

A significant trend in the tackifiers market is the growing demand for bio-based and environmentally friendly formulations. Tackifiers are additives used in adhesives, sealants, and coatings to improve tack, adhesion, and cohesion properties. With increasing environmental awareness and regulatory pressures to reduce the use of petroleum-based chemicals and volatile organic compounds (VOCs), there is a shift towards bio-based tackifiers derived from renewable sources such as rosin, terpenes, and plant-based resins. Bio-based tackifiers offer advantages such as biodegradability, low toxicity, and reduced carbon footprint, making them attractive options for industries seeking sustainable adhesive solutions. As consumers and manufacturers prioritize eco-friendly products and green technologies, the demand for bio-based tackifiers is expected to continue to rise, driving market growth and innovation in environmentally friendly adhesive formulations.

The primary driver behind the growth of the tackifiers market is the expansion of packaging, construction, and automotive industries worldwide. Tackifiers play a vital role in various applications such as packaging tapes, labels, hot-melt adhesives, roofing membranes, and automotive interior trims. With the increasing demand for packaged goods, infrastructure development, and vehicle production, there is a parallel increase in the demand for tackifiers to meet the adhesive requirements of these industries. Packaging manufacturers utilize tackifiers to ensure secure and reliable sealing of packages, while construction companies use tackifiers in sealants and adhesives for bonding building materials. Additionally, automotive manufacturers rely on tackifiers to improve the performance and durability of interior and exterior components. As these industries continue to expand and innovate, the demand for tackifiers as essential additives in adhesive formulations is expected to grow, fueling market growth and investment in tackifier technologies.

An opportunity for the tackifiers market lies in the development of high-performance and specialty formulations to meet evolving customer needs and application requirements. While traditional tackifiers offer general-purpose adhesion properties, there is a growing demand for specialized tackifiers tailored for specific applications and performance criteria. For example, there is an opportunity to develop tackifiers with enhanced heat resistance, UV stability, or low-temperature flexibility to meet the requirements of niche industries such as electronics, aerospace, and medical devices. Additionally, there is potential to innovate in tackifiers for sustainable packaging materials, bio-based polymers, and recyclable substrates, aligning with circular economy principles and sustainable packaging trends. By investing in research and development initiatives focused on novel raw materials, formulation techniques, and additive technologies, tackifier manufacturers can create value-added products that address emerging market needs, differentiate their offerings, and capture opportunities in specialized applications. Expanding into high-performance and specialty tackifiers presents an opportunity for the market to diversify its product portfolio, penetrate new market segments, and sustain growth in a competitive landscape.

Within the tackifiers market segmented by feedstock, rosin resins emerge as the largest segment, commanding a significant share due to their versatility and widespread application across various industries. Rosin resins, derived from natural sources such as pine trees, offer excellent adhesive properties, tackiness, and compatibility with a wide range of polymers and substrates. They find extensive use in adhesives, sealants, coatings, and inks, where they serve as crucial ingredients to improve adhesion, cohesion, and tack strength. Moreover, the growing demand for eco-friendly and sustainable materials has further propelled the adoption of rosin resins, as they are renewable and biodegradable alternatives to petroleum-based tackifiers. Additionally, the versatility of rosin resins allows for customization to meet specific performance requirements, making them indispensable in various end-use applications. As industries continue to prioritize sustainability and seek high-performance adhesive solutions, the dominance of rosin resins in the tackifiers market is expected to persist and expand further.

Among the segments delineated within the tackifiers market by form, liquid tackifiers emerge as the fastest-growing segment, driving significant advancements in adhesive formulations and application techniques. Liquid tackifiers offer potential advantages, including ease of handling, uniform dispersion, and compatibility with various solvents and polymers. They are extensively used in industries such as packaging, construction, automotive, and textiles, where they serve as essential additives to enhance the tackiness, peel strength, and adhesion properties of adhesives and sealants. Moreover, the growing preference for solvent-free and water-based adhesive formulations, coupled with stringent regulatory norms governing volatile organic compound (VOC) emissions, has propelled the demand for liquid tackifiers. Additionally, the versatility of liquid tackifiers allows for precise control over adhesive performance characteristics, facilitating the development of customized solutions for specific application requirements. As industries continue to seek sustainable and high-performance adhesive solutions, the liquid tackifiers segment is poised to witness sustained growth, driving innovation and reshaping the landscape of the tackifiers market.

Within the tackifiers market segmented by type, synthetic tackifiers emerge as the largest segment, commanding a significant share due to their diverse applications and superior performance characteristics. Synthetic tackifiers are chemically engineered additives that offer precise control over adhesive properties such as tack, peel strength, and viscosity. They are widely used in various industries, including packaging, automotive, construction, and textiles, where they serve as essential components in adhesive formulations. Synthetic tackifiers offer potential advantages over their natural counterparts, including consistent quality, enhanced durability, and broader compatibility with a wide range of polymers and substrates. Moreover, the growing demand for high-performance adhesives with superior bonding strength and resistance to environmental factors has propelled the adoption of synthetic tackifiers. Additionally, the versatility of synthetic tackifiers allows for customization to meet specific application requirements, further bolstering their prominence in the tackifiers market. As industries continue to prioritize performance, efficiency, and sustainability in adhesive formulations, the dominance of synthetic tackifiers is expected to persist and drive the growth of the overall market.

Among the segments delineated within the tackifiers market by application, tapes and labels emerge as the fastest-growing segment, catalyzing significant advancements in adhesive technology and consumer packaging solutions. Tapes and labels are ubiquitous in various industries, including packaging, automotive, healthcare, and consumer goods, where they serve essential functions such as sealing, bonding, and product identification. The increasing demand for convenience, durability, and aesthetics in consumer packaging has fuelled the growth of the tapes and labels market, consequently driving the demand for tackifiers. Tackifiers play a crucial role in enhancing the adhesion and cohesion properties of pressure-sensitive adhesives used in tapes and labels, ensuring reliable bonding and performance under diverse conditions. Moreover, technological innovations such as the development of low-VOC and solvent-free adhesive formulations have further propelled the adoption of tapes and labels in eco-friendly packaging solutions. As industries continue to prioritize sustainability and consumer satisfaction, the tapes and labels segment is poised to witness sustained growth, driving innovation and reshaping the landscape of the tackifiers market.

By Feedstock

Rosin Resins

Petroleum Resins

Terepene Resins

By Form

Solid

Liquid

Resin Dispersion

By Type

Synthetic

Natural

By Application

Tapes and Labels

Assembly

Bookbinding

Footwear

Leather

and Rubber Articles

Others

By End-User

Automotive

Building and Construction

Non-Wovens

Packaging

Footwear

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

A Harima Chemicals Inc Company

Arakawa Chemical Industries,Ltd.

Arkema S.A.

DRT (Les Derives Resiniques et Terpeniques)

Eastman Chemical Company

Exxon Mobil Corp

KRATON Corp

Lawter

Natrochem Inc

Neville Chemicals Company

TECKREZ Inc

TWC Group

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Tackifier Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Tackifier Market Size Outlook, $ Million, 2021 to 2032

3.2 Tackifier Market Outlook by Type, $ Million, 2021 to 2032

3.3 Tackifier Market Outlook by Product, $ Million, 2021 to 2032

3.4 Tackifier Market Outlook by Application, $ Million, 2021 to 2032

3.5 Tackifier Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Tackifier Industry

4.2 Key Market Trends in Tackifier Industry

4.3 Potential Opportunities in Tackifier Industry

4.4 Key Challenges in Tackifier Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Tackifier Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Tackifier Market Outlook by Segments

7.1 Tackifier Market Outlook by Segments, $ Million, 2021- 2032

By Feedstock

Rosin Resins

Petroleum Resins

Terepene Resins

By Form

Solid

Liquid

Resin Dispersion

By Type

Synthetic

Natural

By Application

Tapes and Labels

Assembly

Bookbinding

Footwear

Leather

and Rubber Articles

Others

By End-User

Automotive

Building and Construction

Non-Wovens

Packaging

Footwear

Others

8 North America Tackifier Market Analysis and Outlook To 2032

8.1 Introduction to North America Tackifier Markets in 2024

8.2 North America Tackifier Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Tackifier Market size Outlook by Segments, 2021-2032

By Feedstock

Rosin Resins

Petroleum Resins

Terepene Resins

By Form

Solid

Liquid

Resin Dispersion

By Type

Synthetic

Natural

By Application

Tapes and Labels

Assembly

Bookbinding

Footwear

Leather

and Rubber Articles

Others

By End-User

Automotive

Building and Construction

Non-Wovens

Packaging

Footwear

Others

9 Europe Tackifier Market Analysis and Outlook To 2032

9.1 Introduction to Europe Tackifier Markets in 2024

9.2 Europe Tackifier Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Tackifier Market Size Outlook by Segments, 2021-2032

By Feedstock

Rosin Resins

Petroleum Resins

Terepene Resins

By Form

Solid

Liquid

Resin Dispersion

By Type

Synthetic

Natural

By Application

Tapes and Labels

Assembly

Bookbinding

Footwear

Leather

and Rubber Articles

Others

By End-User

Automotive

Building and Construction

Non-Wovens

Packaging

Footwear

Others

10 Asia Pacific Tackifier Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Tackifier Markets in 2024

10.2 Asia Pacific Tackifier Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Tackifier Market size Outlook by Segments, 2021-2032

By Feedstock

Rosin Resins

Petroleum Resins

Terepene Resins

By Form

Solid

Liquid

Resin Dispersion

By Type

Synthetic

Natural

By Application

Tapes and Labels

Assembly

Bookbinding

Footwear

Leather

and Rubber Articles

Others

By End-User

Automotive

Building and Construction

Non-Wovens

Packaging

Footwear

Others

11 South America Tackifier Market Analysis and Outlook To 2032

11.1 Introduction to South America Tackifier Markets in 2024

11.2 South America Tackifier Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Tackifier Market size Outlook by Segments, 2021-2032

By Feedstock

Rosin Resins

Petroleum Resins

Terepene Resins

By Form

Solid

Liquid

Resin Dispersion

By Type

Synthetic

Natural

By Application

Tapes and Labels

Assembly

Bookbinding

Footwear

Leather

and Rubber Articles

Others

By End-User

Automotive

Building and Construction

Non-Wovens

Packaging

Footwear

Others

12 Middle East and Africa Tackifier Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Tackifier Markets in 2024

12.2 Middle East and Africa Tackifier Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Tackifier Market size Outlook by Segments, 2021-2032

By Feedstock

Rosin Resins

Petroleum Resins

Terepene Resins

By Form

Solid

Liquid

Resin Dispersion

By Type

Synthetic

Natural

By Application

Tapes and Labels

Assembly

Bookbinding

Footwear

Leather

and Rubber Articles

Others

By End-User

Automotive

Building and Construction

Non-Wovens

Packaging

Footwear

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

A Harima Chemicals Inc Company

Arakawa Chemical Industries,Ltd.

Arkema S.A.

DRT (Les Derives Resiniques et Terpeniques)

Eastman Chemical Company

Exxon Mobil Corp

KRATON Corp

Lawter

Natrochem Inc

Neville Chemicals Company

TECKREZ Inc

TWC Group

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Feedstock

Rosin Resins

Petroleum Resins

Terepene Resins

By Form

Solid

Liquid

Resin Dispersion

By Type

Synthetic

Natural

By Application

Tapes and Labels

Assembly

Bookbinding

Footwear

Leather

and Rubber Articles

Others

By End-User

Automotive

Building and Construction

Non-Wovens

Packaging

Footwear

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Tackifier Market Size is valued at $611.3 Million in 2024 and is forecast to register a growth rate (CAGR) of 3.9% to reach $830.2 Million by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

A Harima Chemicals Inc Company, Arakawa Chemical Industries,Ltd., Arkema S.A., DRT (Les Derives Resiniques et Terpeniques), Eastman Chemical Company, Exxon Mobil Corp, KRATON Corp, Lawter, Natrochem Inc, Neville Chemicals Company, TECKREZ Inc, TWC Group

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume