The global Synthetic Rubber Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Styrene butadiene rubber (SBR), Polybutadiene Rubber (BR), Styrene block copolymer (SBC), Ethylene-propylene-diene rubber (EPDM), Butyl rubber (IIR), Acrylonitrile-butadiene rubber (NBR)), By Application (Tire, Footwear, Industrial Goods, Consumer Goods, Textiles, Others).

Synthetic rubber, a versatile elastomer produced through chemical synthesis, remains essential in various industries in 2024. This synthetic material offers properties similar to natural rubber, including elasticity, resilience, and flexibility, making it suitable for a wide range of applications. In the automotive industry, synthetic rubber is utilized for manufacturing tires, seals, hoses, and automotive components due to its excellent durability, wear resistance, and weather resistance. Further, in the construction industry, synthetic rubber is used for roofing membranes, waterproofing materials, and sealants, providing protection against moisture and environmental elements. With ongoing advancements in polymer chemistry and manufacturing processes, synthetic rubber s to evolve, offering improved performance characteristics and environmental sustainability compared to natural rubber, driving its adoption in various industrial sectors.

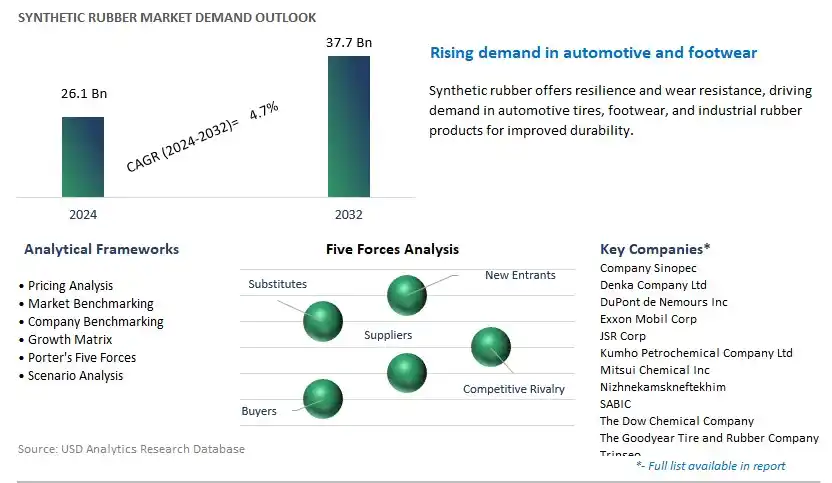

The market report analyses the leading companies in the industry including Company Sinopec, Denka Company Ltd, DuPont de Nemours Inc, Exxon Mobil Corp, JSR Corp, Kumho Petrochemical Company Ltd, Mitsui Chemical Inc, Nizhnekamskneftekhim, SABIC, The Dow Chemical Company, The Goodyear Tire and Rubber Company, Trinseo, Zeon Corp, and others.

A significant trend in the synthetic rubber market is the increasing demand for green and sustainable rubber solutions across various industries. With growing environmental concerns and regulatory pressure to reduce carbon footprint, there is a shift towards the adoption of synthetic rubbers derived from renewable feedstocks and eco-friendly manufacturing processes. Manufacturers are focusing on developing synthetic rubbers with reduced environmental impact, such as bio-based rubbers derived from sources like soybean oil, palm oil, and guayule plants. Additionally, there is a rising preference among consumers for products manufactured using sustainable materials, driving the demand for eco-friendly synthetic rubbers in applications such as automotive tires, footwear, industrial hoses, and consumer goods. As sustainability becomes a key criterion for product selection and brand loyalty, the synthetic rubber market is expected to witness continued growth in green and sustainable rubber solutions.

The primary driver for the synthetic rubber market is the growth in automotive and tire manufacturing industries worldwide, which are the largest end-user segments for synthetic rubbers. As population growth, urbanization, and disposable incomes rise, there is an increasing demand for vehicles, driving the production of automotive tires and rubber components such as hoses, belts, seals, and gaskets. Synthetic rubbers offer advantages such as durability, abrasion resistance, temperature stability, and fuel efficiency, making them the preferred choice for tire tread compounds and other automotive applications. Additionally, advancements in tire technology such as run-flat tires, all-weather tires, and low rolling resistance tires drive the demand for specialized synthetic rubbers with tailored properties to meet performance requirements. As automotive manufacturers strive to meet stringent regulations for fuel efficiency, safety, and emissions reduction, the demand for synthetic rubbers with enhanced performance characteristics is expected to grow, supported by the expansion of the automotive industry globally.

A significant opportunity for the synthetic rubber market lies in the development of high-performance specialty rubbers tailored to specific end-user applications and performance requirements. Manufacturers can invest in research and development to create synthetic rubbers with superior properties such as improved wear resistance, tear strength, aging resistance, and low-temperature flexibility. Specialty rubbers such as butyl rubber, nitrile rubber, and silicone rubber offer unique characteristics that make them suitable for specialized applications in industries such as healthcare, electronics, aerospace, and oil and gas. For example, butyl rubber is used in pharmaceutical stoppers and seals, nitrile rubber is used in oil and chemical-resistant gloves and seals, and silicone rubber is used in high-temperature gaskets, wire insulation, and medical implants. By collaborating with end-users to understand their specific application needs and performance requirements, synthetic rubber manufacturers can develop customized solutions that offer value-added benefits and address niche market demands. Furthermore, there is an opportunity to innovate and differentiate synthetic rubber products through the development of novel formulations, compounding techniques, and processing methods that enhance performance, sustainability, and cost-effectiveness. By seizing these opportunities for product innovation and market diversification, synthetic rubber manufacturers can strengthen their competitive position and capture new growth avenues in the global marketplace.

Among the various types of synthetic rubber, the Styrene Butadiene Rubber (SBR) segment is the largest and most dominant player. This leadership position can be attributed to SBR is one of the most widely used synthetic rubbers, finding extensive applications in tire manufacturing due to its excellent abrasion resistance, good aging properties, and cost-effectiveness compared to natural rubber. The automotive industry, which constitutes a significant portion of the synthetic rubber market, relies heavily on SBR for tire production, as tires represent one of the largest end uses of rubber globally. Moreover, the versatility of SBR extends beyond tires to include various industrial rubber goods such as conveyor belts, hoses, footwear, and automotive parts. Additionally, the increasing demand for environmentally friendly tire formulations, driven by regulatory pressures and sustainability initiatives, further boosts the adoption of SBR, which can be easily blended with natural rubber or recycled rubber to improve tire performance and reduce environmental impact. With its widespread use, versatility, and favorable properties for tire and industrial applications, the SBR segment is poised to maintain its leadership and drive continued growth in the synthetic rubber market.

Among the diverse applications in the synthetic rubber market, the Consumer Goods segment is the fastest-growing segment. In particular, the consumer goods sector encompasses a wide range of products such as electronic devices, appliances, household items, and recreational equipment, all of which require rubber components for various purposes such as seals, gaskets, grips, and insulation. Synthetic rubber offers manufacturers flexibility, durability, and cost-effectiveness compared to natural rubber, driving its increasing adoption in consumer goods manufacturing. Moreover, the rising disposable income levels and changing consumer lifestyles contribute to the growing demand for consumer goods globally, further fuelling the market growth of synthetic rubber. Additionally, advancements in rubber compounding technologies enable the production of specialized synthetic rubber formulations tailored to meet the specific performance requirements of consumer goods applications, enhancing their suitability and driving market expansion. With the continuous innovation in consumer goods design and materials, coupled with the increasing consumer demand for high-quality and long-lasting products, the Consumer Goods segment is poised to sustain its rapid growth trajectory in the synthetic rubber market.

By Type

Styrene butadiene rubber (SBR)

Polybutadiene Rubber (BR)

Styrene block copolymer (SBC)

Ethylene-propylene-diene rubber (EPDM)

Butyl rubber (IIR)

Acrylonitrile-butadiene rubber (NBR)

By Application

Tire

Footwear

Industrial Goods

Consumer Goods

Textiles

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Company Sinopec

Denka Company Ltd

DuPont de Nemours Inc

Exxon Mobil Corp

JSR Corp

Kumho Petrochemical Company Ltd

Mitsui Chemical Inc

Nizhnekamskneftekhim

SABIC

The Dow Chemical Company

The Goodyear Tire and Rubber Company

Trinseo

Zeon Corp

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Synthetic Rubber Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Synthetic Rubber Market Size Outlook, $ Million, 2021 to 2032

3.2 Synthetic Rubber Market Outlook by Type, $ Million, 2021 to 2032

3.3 Synthetic Rubber Market Outlook by Product, $ Million, 2021 to 2032

3.4 Synthetic Rubber Market Outlook by Application, $ Million, 2021 to 2032

3.5 Synthetic Rubber Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Synthetic Rubber Industry

4.2 Key Market Trends in Synthetic Rubber Industry

4.3 Potential Opportunities in Synthetic Rubber Industry

4.4 Key Challenges in Synthetic Rubber Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Synthetic Rubber Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Synthetic Rubber Market Outlook by Segments

7.1 Synthetic Rubber Market Outlook by Segments, $ Million, 2021- 2032

By Type

Styrene butadiene rubber (SBR)

Polybutadiene Rubber (BR)

Styrene block copolymer (SBC)

Ethylene-propylene-diene rubber (EPDM)

Butyl rubber (IIR)

Acrylonitrile-butadiene rubber (NBR)

By Application

Tire

Footwear

Industrial Goods

Consumer Goods

Textiles

Others

8 North America Synthetic Rubber Market Analysis and Outlook To 2032

8.1 Introduction to North America Synthetic Rubber Markets in 2024

8.2 North America Synthetic Rubber Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Synthetic Rubber Market size Outlook by Segments, 2021-2032

By Type

Styrene butadiene rubber (SBR)

Polybutadiene Rubber (BR)

Styrene block copolymer (SBC)

Ethylene-propylene-diene rubber (EPDM)

Butyl rubber (IIR)

Acrylonitrile-butadiene rubber (NBR)

By Application

Tire

Footwear

Industrial Goods

Consumer Goods

Textiles

Others

9 Europe Synthetic Rubber Market Analysis and Outlook To 2032

9.1 Introduction to Europe Synthetic Rubber Markets in 2024

9.2 Europe Synthetic Rubber Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Synthetic Rubber Market Size Outlook by Segments, 2021-2032

By Type

Styrene butadiene rubber (SBR)

Polybutadiene Rubber (BR)

Styrene block copolymer (SBC)

Ethylene-propylene-diene rubber (EPDM)

Butyl rubber (IIR)

Acrylonitrile-butadiene rubber (NBR)

By Application

Tire

Footwear

Industrial Goods

Consumer Goods

Textiles

Others

10 Asia Pacific Synthetic Rubber Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Synthetic Rubber Markets in 2024

10.2 Asia Pacific Synthetic Rubber Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Synthetic Rubber Market size Outlook by Segments, 2021-2032

By Type

Styrene butadiene rubber (SBR)

Polybutadiene Rubber (BR)

Styrene block copolymer (SBC)

Ethylene-propylene-diene rubber (EPDM)

Butyl rubber (IIR)

Acrylonitrile-butadiene rubber (NBR)

By Application

Tire

Footwear

Industrial Goods

Consumer Goods

Textiles

Others

11 South America Synthetic Rubber Market Analysis and Outlook To 2032

11.1 Introduction to South America Synthetic Rubber Markets in 2024

11.2 South America Synthetic Rubber Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Synthetic Rubber Market size Outlook by Segments, 2021-2032

By Type

Styrene butadiene rubber (SBR)

Polybutadiene Rubber (BR)

Styrene block copolymer (SBC)

Ethylene-propylene-diene rubber (EPDM)

Butyl rubber (IIR)

Acrylonitrile-butadiene rubber (NBR)

By Application

Tire

Footwear

Industrial Goods

Consumer Goods

Textiles

Others

12 Middle East and Africa Synthetic Rubber Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Synthetic Rubber Markets in 2024

12.2 Middle East and Africa Synthetic Rubber Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Synthetic Rubber Market size Outlook by Segments, 2021-2032

By Type

Styrene butadiene rubber (SBR)

Polybutadiene Rubber (BR)

Styrene block copolymer (SBC)

Ethylene-propylene-diene rubber (EPDM)

Butyl rubber (IIR)

Acrylonitrile-butadiene rubber (NBR)

By Application

Tire

Footwear

Industrial Goods

Consumer Goods

Textiles

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Company Sinopec

Denka Company Ltd

DuPont de Nemours Inc

Exxon Mobil Corp

JSR Corp

Kumho Petrochemical Company Ltd

Mitsui Chemical Inc

Nizhnekamskneftekhim

SABIC

The Dow Chemical Company

The Goodyear Tire and Rubber Company

Trinseo

Zeon Corp

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Styrene butadiene rubber (SBR)

Polybutadiene Rubber (BR)

Styrene block copolymer (SBC)

Ethylene-propylene-diene rubber (EPDM)

Butyl rubber (IIR)

Acrylonitrile-butadiene rubber (NBR)

By Application

Tire

Footwear

Industrial Goods

Consumer Goods

Textiles

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Synthetic Rubber Market Size is valued at $26.1 Billion in 2024 and is forecast to register a growth rate (CAGR) of 4.7% to reach $37.7 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Company Sinopec, Denka Company Ltd, DuPont de Nemours Inc, Exxon Mobil Corp, JSR Corp, Kumho Petrochemical Company Ltd, Mitsui Chemical Inc, Nizhnekamskneftekhim, SABIC, The Dow Chemical Company, The Goodyear Tire and Rubber Company, Trinseo, Zeon Corp

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume