The global Synthetic Rope Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Polypropylene, Polyester, Nylon, Polyethylene, Specialty Fiber), By Application (Marine & Fishing Industry, Oil & Gas Industry, Industrial Construction, Others).

Synthetic ropes, made from fibers such as nylon, polyester, polypropylene, or aramid, to offer lightweight, strong, and durable alternatives to traditional natural fiber ropes in 2024. These ropes are widely used in marine, industrial, recreational, and safety applications where high strength-to-weight ratio, abrasion resistance, and chemical resistance are crucial. In marine and offshore industries, synthetic ropes are employed for mooring, towing, and lifting operations, offering superior performance compared to steel wire ropes in terms of handling, buoyancy, and corrosion resistance. Similarly, in construction and rigging, synthetic ropes are used for hoisting, rigging, and safety applications, providing reliable and cost-effective solutions for lifting and securing loads. With ongoing developments in fiber technology and rope construction methods, synthetic ropes to improve in performance, durability, and environmental sustainability, meeting the evolving needs of industries worldwide.

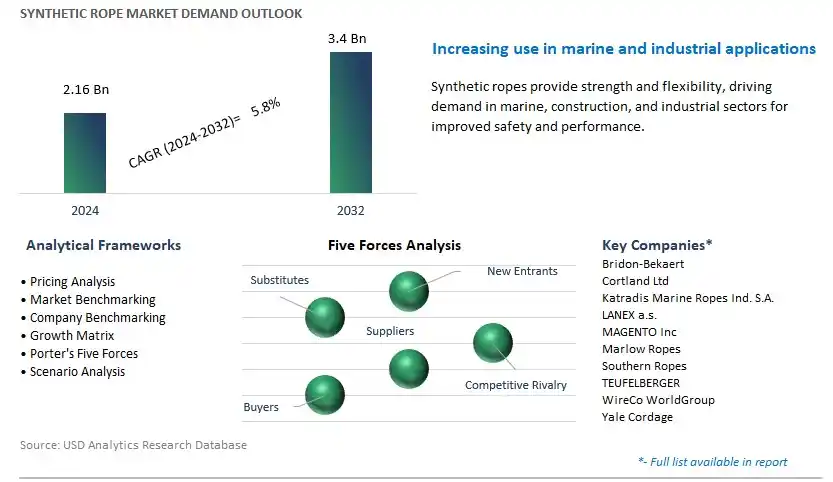

The market report analyses the leading companies in the industry including Bridon-Bekaert, Cortland Ltd, Katradis Marine Ropes Ind. S.A., LANEX a.s., MAGENTO Inc, Marlow Ropes, Southern Ropes, TEUFELBERGER, WireCo WorldGroup, Yale Cordage, and others.

A significant trend in the synthetic rope market is the increasing adoption of synthetic ropes in marine and offshore industries. Synthetic ropes, made from materials such as polypropylene, nylon, polyester, and high-performance fibers like aramid and polyethylene, offer several advantages over traditional natural fiber ropes and steel wire ropes. These advantages include high strength-to-weight ratio, resistance to corrosion, abrasion, and UV degradation, buoyancy, and ease of handling. With the expansion of marine activities such as shipping, fishing, offshore oil and gas exploration, and aquaculture, there is a growing demand for synthetic ropes for mooring, towing, lifting, and anchoring applications. Additionally, synthetic ropes are increasingly replacing steel wire ropes in offshore rigging and lifting operations due to their lighter weight, reduced risk of injury, and lower maintenance requirements. As industries prioritize safety, efficiency, and cost-effectiveness in their operations, the market for synthetic ropes is expected to continue growing, driven by the advantages they offer in marine and offshore environments.

The primary driver for the synthetic rope market is the growth in construction and industrial sectors, which rely on synthetic ropes for a wide range of lifting, rigging, and material handling applications. Synthetic ropes are used in construction projects such as building erection, bridge construction, and infrastructure development for hoisting and securing heavy loads, scaffolding, and temporary structures. Additionally, in industrial settings such as manufacturing plants, warehouses, and logistics facilities, synthetic ropes are utilized for overhead lifting, crane operations, cargo handling, and towing applications. The lightweight, flexible, and non-conductive nature of synthetic ropes makes them ideal for use in confined spaces, hazardous environments, and areas where weight restrictions apply. As construction activities rebound from economic downturns and industrial production levels increase, the demand for synthetic ropes is expected to grow, driven by the need for reliable and versatile lifting and rigging solutions that improve safety, productivity, and operational efficiency.

A significant opportunity for the synthetic rope market lies in innovation in material science and rope design to develop advanced synthetic ropes with enhanced performance characteristics. Manufacturers can invest in research and development to create synthetic ropes with improved strength, durability, flexibility, and resistance to environmental factors such as moisture, chemicals, and extreme temperatures. Additionally, there is an opportunity to explore the use of novel materials such as carbon fiber, aramid composites, and hybrid fibers to develop lightweight yet ultra-strong ropes for specialized applications in industries such as aerospace, defense, and renewable energy. Furthermore, advancements in rope design, construction techniques, and manufacturing processes can lead to the development of customized ropes tailored to specific end-user requirements, such as high-visibility ropes for safety applications, low-stretch ropes for precision lifting, and energy-absorbing ropes for dynamic loading conditions. By leveraging innovation in material science and rope technology, synthetic rope manufacturers can differentiate their products, address niche market needs, and capture new opportunities for growth in diverse industries and applications.

Among the various products in the synthetic rope market, the Polypropylene segment is the largest and most dominant player. This leadership position can be attributed to polypropylene ropes offer a compelling combination of properties such as lightweight, buoyancy, abrasion resistance, and UV stability, making them highly versatile and suitable for a wide range of applications. Their affordability compared to other synthetic ropes like polyester and nylon further contributes to their widespread adoption across industries such as marine, construction, agriculture, and recreational activities. Moreover, polypropylene ropes exhibit excellent chemical resistance and low moisture absorption, making them ideal for use in harsh environments and outdoor applications. Additionally, advancements in manufacturing technologies enable the production of polypropylene ropes with enhanced strength and durability, further solidifying their position as the largest segment in the synthetic rope market. With their versatility, affordability, and performance advantages, the Polypropylene segment is poised to maintain its leadership and drive continued growth in the synthetic rope market.

Among the diverse applications in the synthetic rope market, the Oil & Gas Industry segment is the fastest-growing segment. In particular, the oil and gas industry require robust and reliable lifting and mooring solutions for offshore exploration, drilling, and production activities. Synthetic ropes offer significant advantages over traditional steel wire ropes, including lighter weight, greater flexibility, and resistance to corrosion and fatigue. These properties make synthetic ropes particularly well-suited for use in offshore installations such as drilling rigs, FPSOs (Floating Production Storage and Offloading units), and subsea infrastructure. Moreover, the increasing shift towards deeper water exploration and production activities, where the weight and handling characteristics of lifting and mooring equipment are crucial, further drives the demand for synthetic ropes in the oil and gas sector. Additionally, advancements in synthetic rope technologies, such as the development of high-performance materials and innovative construction techniques, enhance their suitability for demanding offshore applications, consolidating the Oil & Gas Industry segment's position as the fastest-growing segment in the synthetic rope market. With the ongoing expansion of offshore oil and gas activities and continued technological advancements, the demand for synthetic ropes in the oil and gas industry is expected to sustain its rapid growth trajectory.

By Product

Polypropylene

Polyester

Nylon

Polyethylene

Specialty Fiber

By Application

Marine & Fishing Industry

Oil & Gas Industry

Industrial Construction

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Bridon-Bekaert

Cortland Ltd

Katradis Marine Ropes Ind. S.A.

LANEX a.s.

MAGENTO Inc

Marlow Ropes

Southern Ropes

TEUFELBERGER

WireCo WorldGroup

Yale Cordage

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Synthetic Rope Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Synthetic Rope Market Size Outlook, $ Million, 2021 to 2032

3.2 Synthetic Rope Market Outlook by Type, $ Million, 2021 to 2032

3.3 Synthetic Rope Market Outlook by Product, $ Million, 2021 to 2032

3.4 Synthetic Rope Market Outlook by Application, $ Million, 2021 to 2032

3.5 Synthetic Rope Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Synthetic Rope Industry

4.2 Key Market Trends in Synthetic Rope Industry

4.3 Potential Opportunities in Synthetic Rope Industry

4.4 Key Challenges in Synthetic Rope Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Synthetic Rope Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Synthetic Rope Market Outlook by Segments

7.1 Synthetic Rope Market Outlook by Segments, $ Million, 2021- 2032

By Product

Polypropylene

Polyester

Nylon

Polyethylene

Specialty Fiber

By Application

Marine & Fishing Industry

Oil & Gas Industry

Industrial Construction

Others

8 North America Synthetic Rope Market Analysis and Outlook To 2032

8.1 Introduction to North America Synthetic Rope Markets in 2024

8.2 North America Synthetic Rope Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Synthetic Rope Market size Outlook by Segments, 2021-2032

By Product

Polypropylene

Polyester

Nylon

Polyethylene

Specialty Fiber

By Application

Marine & Fishing Industry

Oil & Gas Industry

Industrial Construction

Others

9 Europe Synthetic Rope Market Analysis and Outlook To 2032

9.1 Introduction to Europe Synthetic Rope Markets in 2024

9.2 Europe Synthetic Rope Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Synthetic Rope Market Size Outlook by Segments, 2021-2032

By Product

Polypropylene

Polyester

Nylon

Polyethylene

Specialty Fiber

By Application

Marine & Fishing Industry

Oil & Gas Industry

Industrial Construction

Others

10 Asia Pacific Synthetic Rope Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Synthetic Rope Markets in 2024

10.2 Asia Pacific Synthetic Rope Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Synthetic Rope Market size Outlook by Segments, 2021-2032

By Product

Polypropylene

Polyester

Nylon

Polyethylene

Specialty Fiber

By Application

Marine & Fishing Industry

Oil & Gas Industry

Industrial Construction

Others

11 South America Synthetic Rope Market Analysis and Outlook To 2032

11.1 Introduction to South America Synthetic Rope Markets in 2024

11.2 South America Synthetic Rope Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Synthetic Rope Market size Outlook by Segments, 2021-2032

By Product

Polypropylene

Polyester

Nylon

Polyethylene

Specialty Fiber

By Application

Marine & Fishing Industry

Oil & Gas Industry

Industrial Construction

Others

12 Middle East and Africa Synthetic Rope Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Synthetic Rope Markets in 2024

12.2 Middle East and Africa Synthetic Rope Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Synthetic Rope Market size Outlook by Segments, 2021-2032

By Product

Polypropylene

Polyester

Nylon

Polyethylene

Specialty Fiber

By Application

Marine & Fishing Industry

Oil & Gas Industry

Industrial Construction

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Bridon-Bekaert

Cortland Ltd

Katradis Marine Ropes Ind. S.A.

LANEX a.s.

MAGENTO Inc

Marlow Ropes

Southern Ropes

TEUFELBERGER

WireCo WorldGroup

Yale Cordage

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Polypropylene

Polyester

Nylon

Polyethylene

Specialty Fiber

By Application

Marine & Fishing Industry

Oil & Gas Industry

Industrial Construction

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Synthetic Rope Market Size is valued at $2.16 Billion in 2024 and is forecast to register a growth rate (CAGR) of 5.8% to reach $3.4 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Bridon-Bekaert, Cortland Ltd, Katradis Marine Ropes Ind. S.A., LANEX a.s., MAGENTO Inc, Marlow Ropes, Southern Ropes, TEUFELBERGER, WireCo WorldGroup, Yale Cordage

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume